An invoice is a document given to the buyer by the seller to collect payment. It includes the cost of the products purchased or services rendered to the buyer. Invoices can also serve as legal records, if they contain the names of the seller and client, description and price of goods or services, and the terms of payment.

Evolution of invoices

Stone invoices

Invoices and records of transactions were made as early as 5000 BC in Mesopotamia. The merchants used to carve details of transactions on clay or stone tablets using the earliest form of math.

Hand-written invoices

Invoicing later evolved to hand-written invoices on animal skin, parchment, or paper. These invoices contained most of the elements of a modern invoice and used signatures or seals.

Electronic invoices

The invention of computers brought about the next big change in invoicing. This revolution was triggered by the desire to reduce traditional costs and labor. Invoicing became cheaper, easier, and faster with electronic invoices.

Online invoices

The advent of the internet led to better, more secure, more green ways to communicate with clients. Online invoices are paperless as the invoices are sent through email, and payments are made online.

Mobile invoices

Invoicing in the modern world has gone mobile. Specialized SaaS (Software as a Service) companies ensure that invoicing is now automated, secure, and instant, so you can invoice on the move.

Functions of invoices

Companies need to deliver invoices in order to demand payments. An invoice is a legally binding agreement showing both parties' consent to the quoted price and payment conditions. However, there are other benefits to using invoices.

-

Maintaining records

The most important benefit of an invoice is the ability to keep a legal record of the sale. This makes it possible to find out when a good was sold, who bought it, and who sold it.

-

Payment tracking

An invoice is an invaluable tool for accounting. It helps both the seller and the buyer to keep track of their payments and amounts owed.

-

Legal protection

A proper invoice is legal proof of an agreement between the buyer and seller on a set price. It protects the merchant from fraudulent lawsuits.

-

Easy tax filing

Recording and maintaining all sale invoices helps the company report its income and ensure that it's paid the proper amount of taxes.

-

Business analytics

Analyzing invoices can help businesses gather information from their customers' buying patterns and identify trends, popular products, peak buying times, and more. This helps to develop effective marketing strategies.

There are several different types of invoices

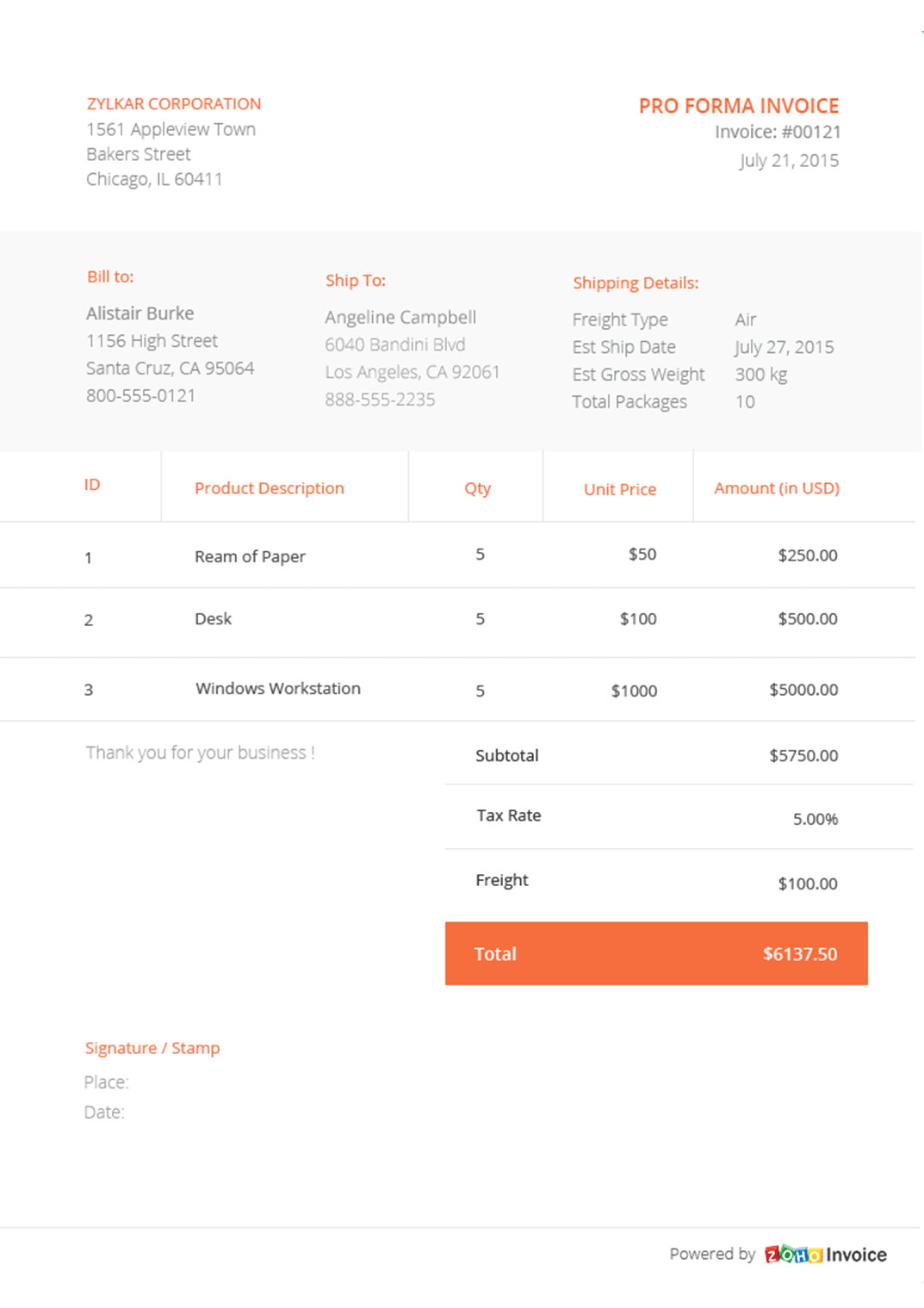

A pro forma invoice is a document that states the commitment of the seller to deliver goods and services to the buyer for an agreed-upon price.

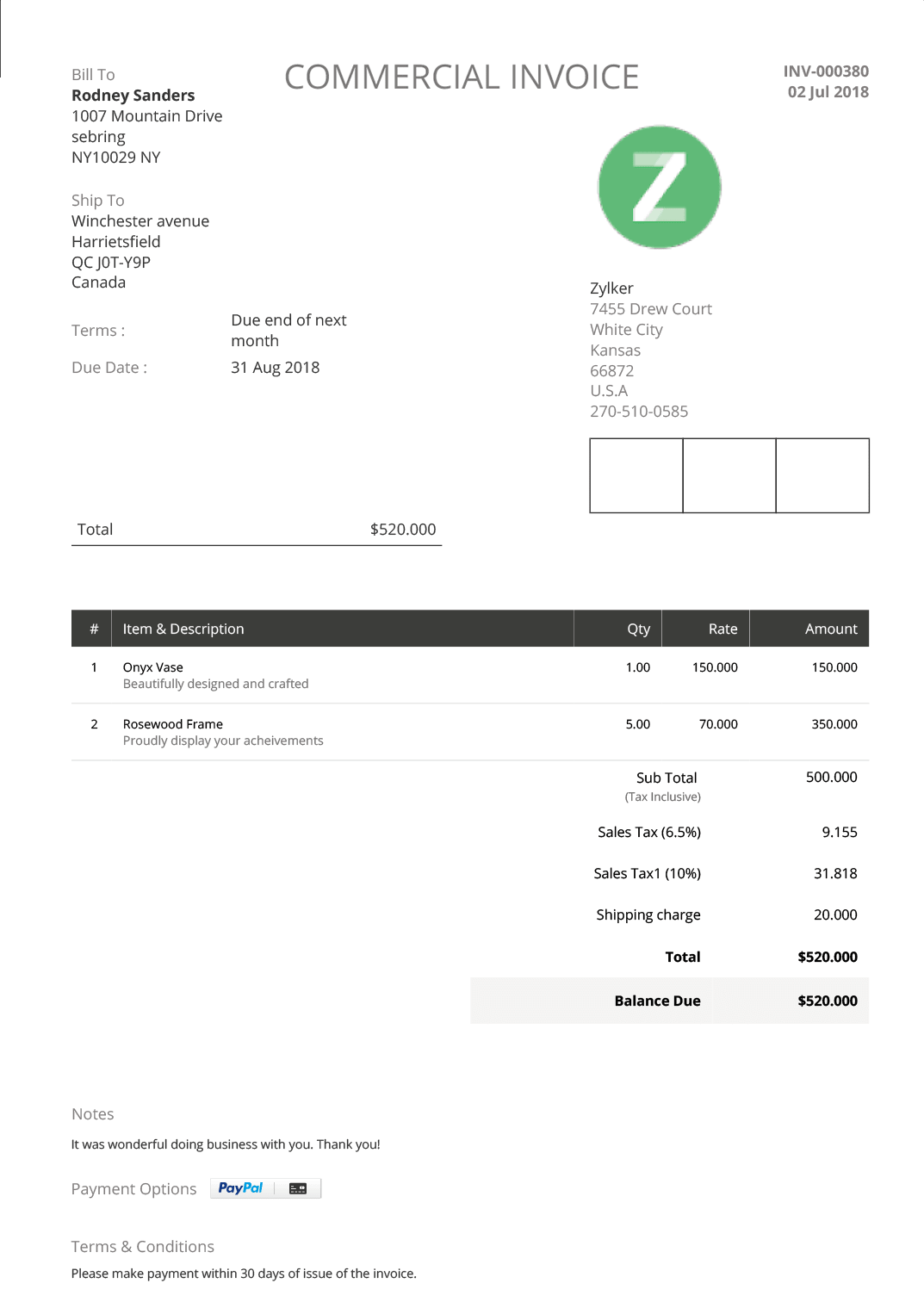

A commercial invoice is a document used for customs declaration in the sale of goods that are exported across international borders.

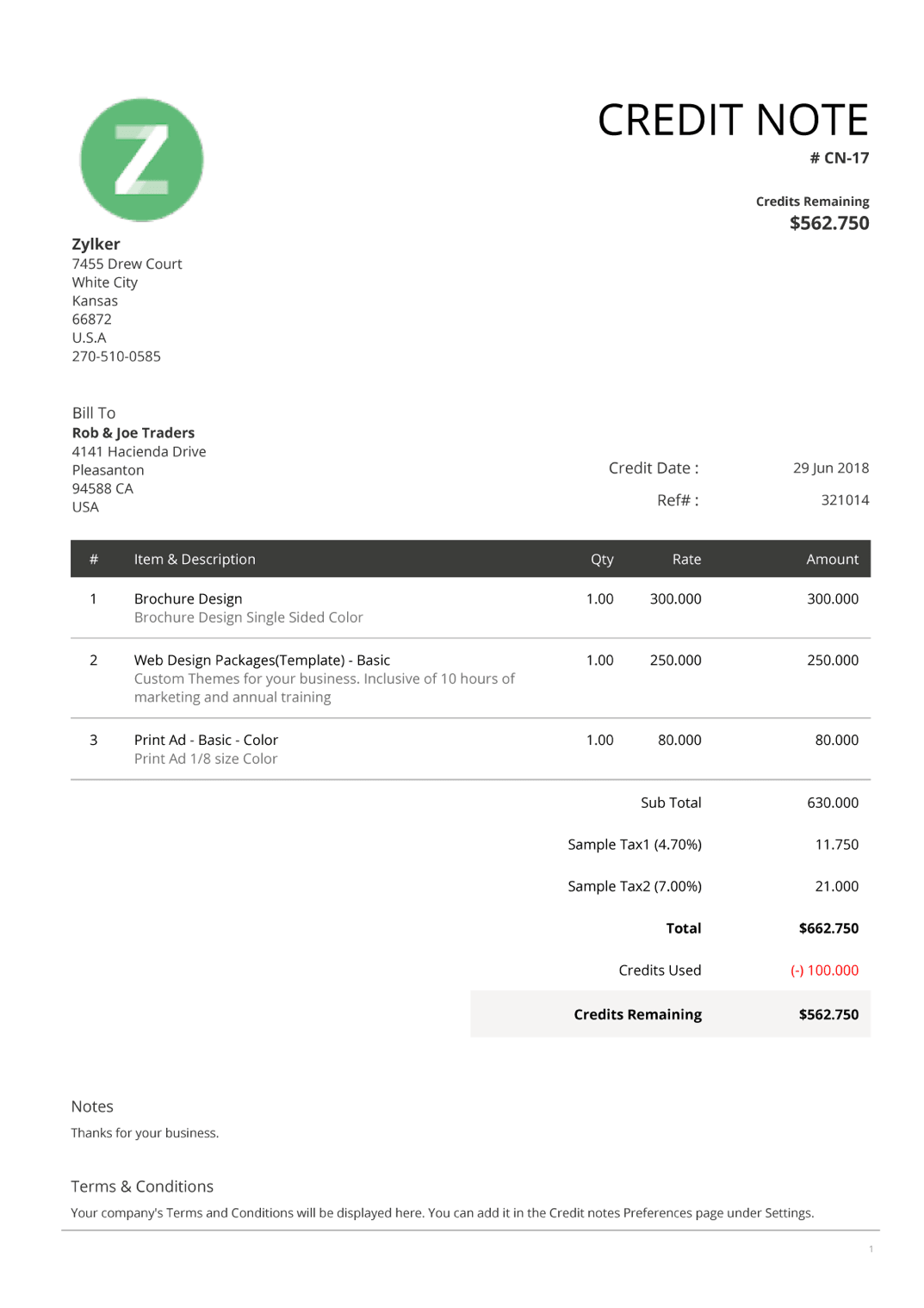

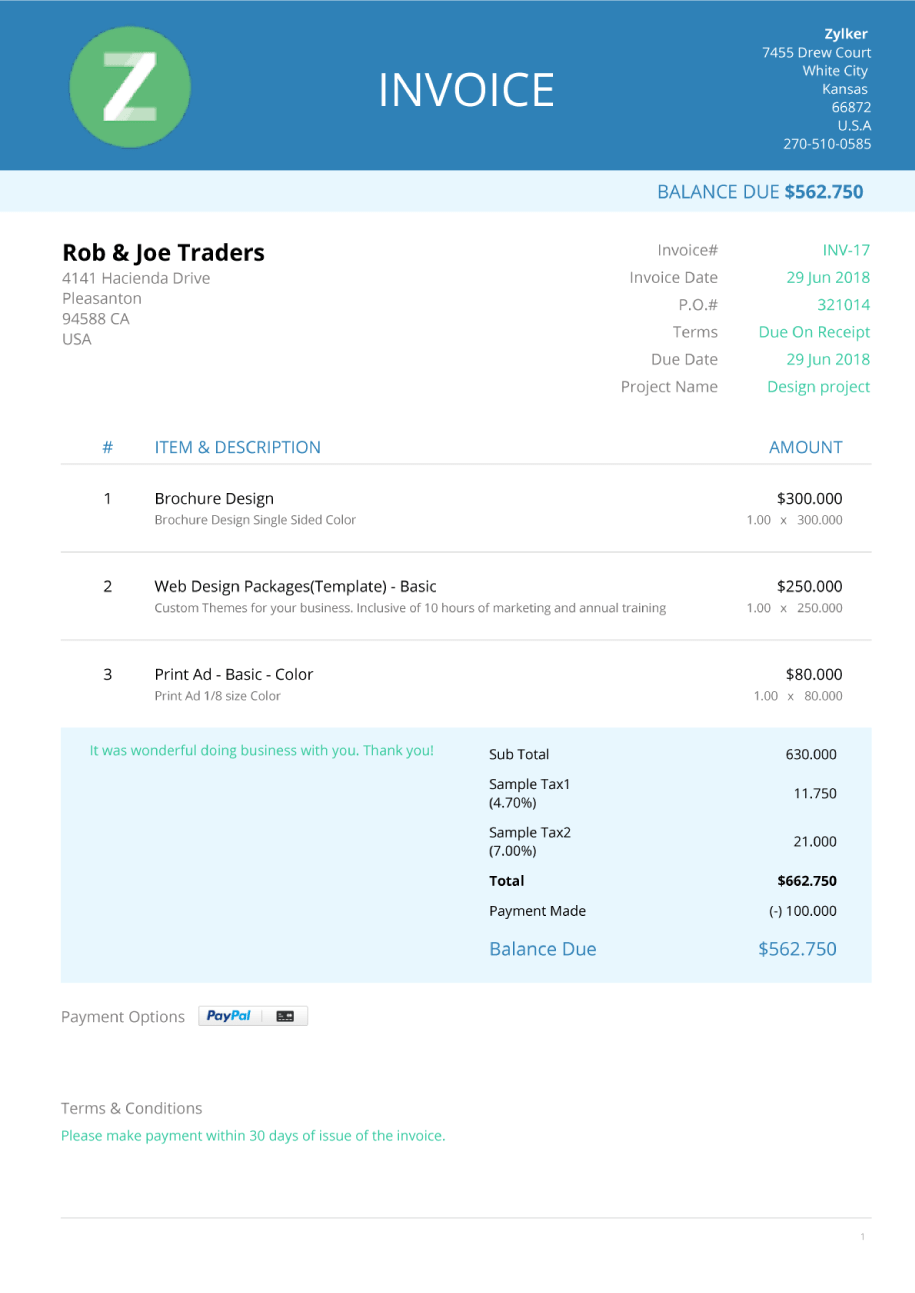

A credit note is a document issued to the buyer if goods are returned due to damage or mistakes.

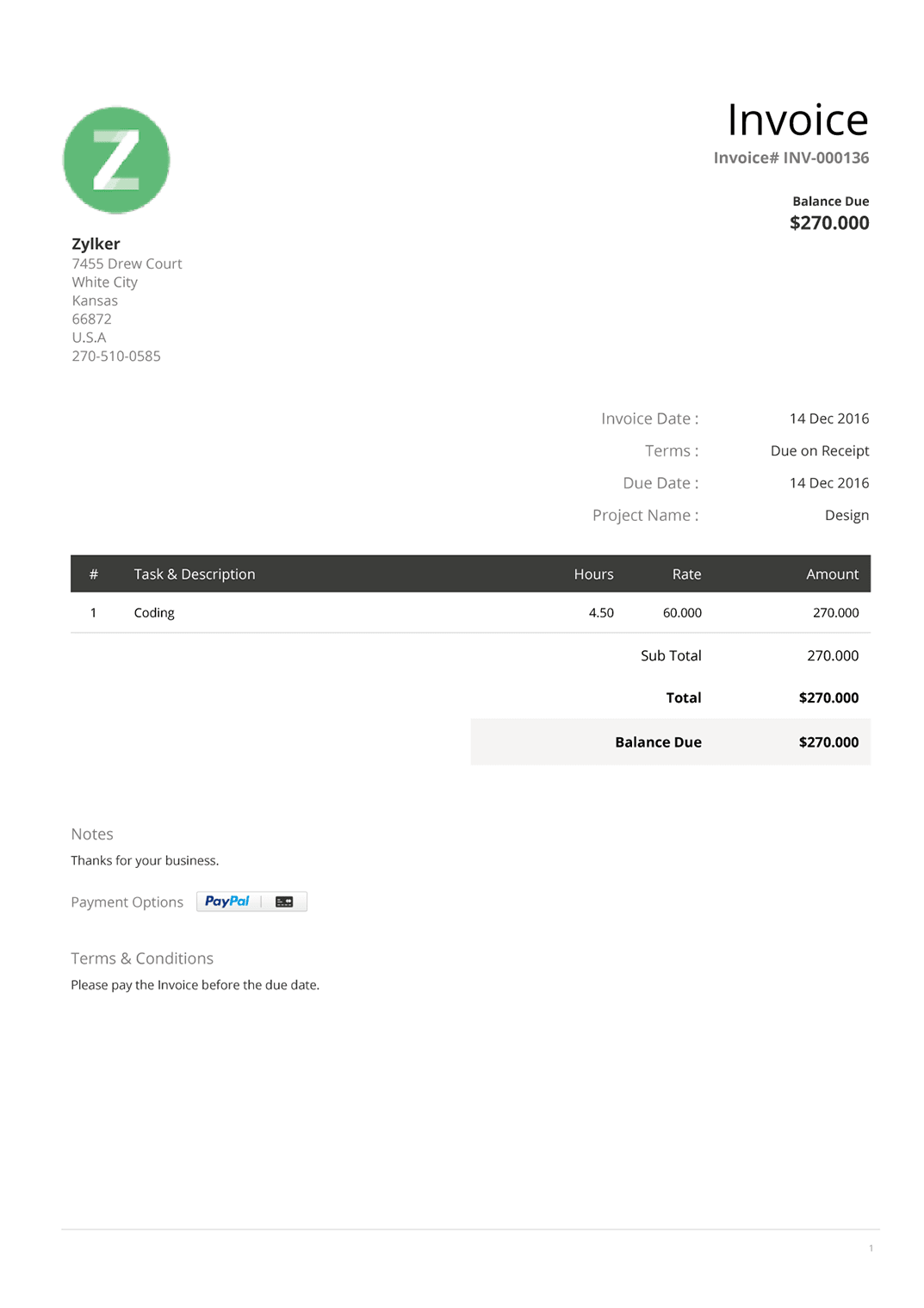

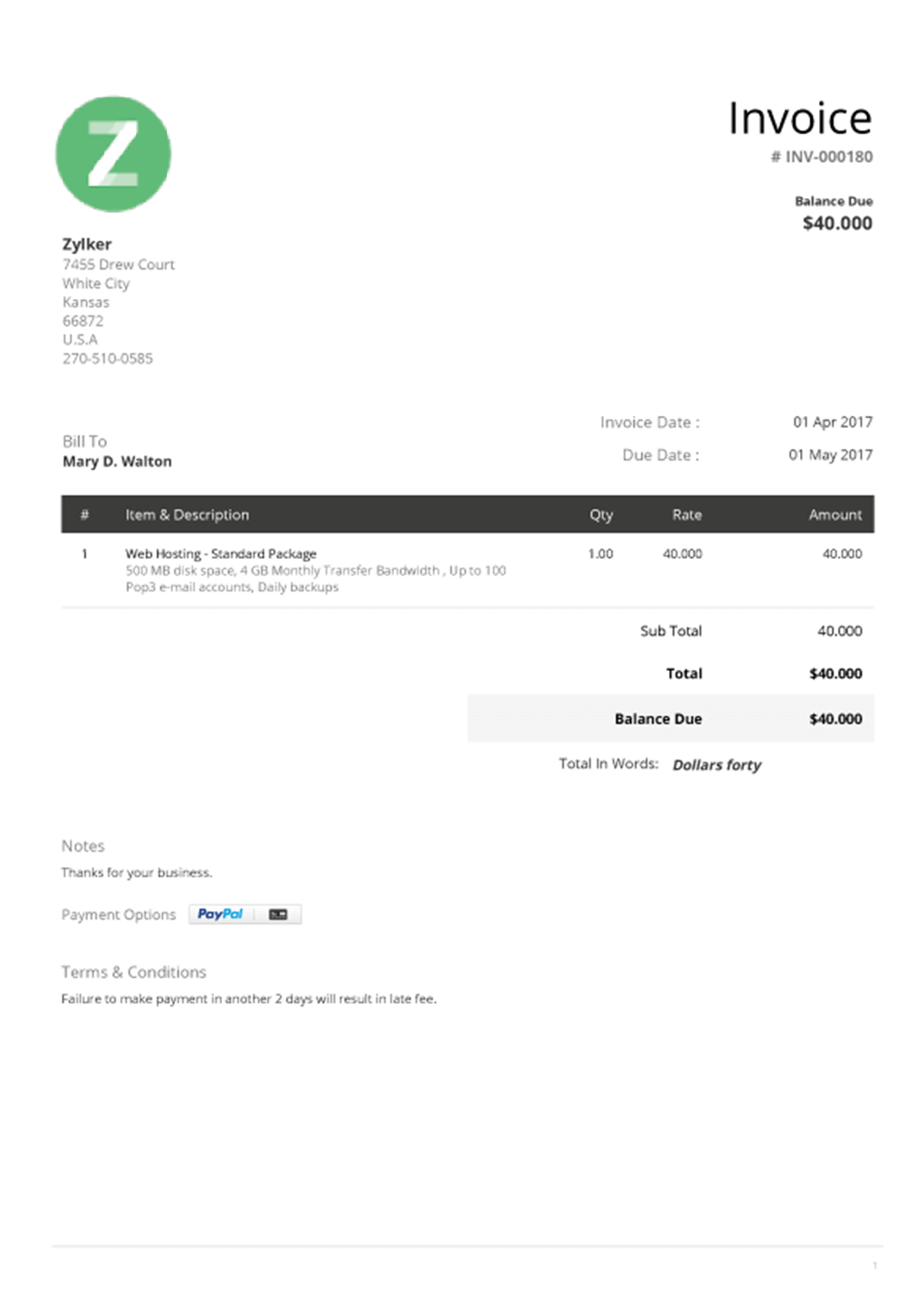

A timesheet invoice is sent to a customer to charge them for work done or services rendered on an hourly basis.

Recurring invoices are created and sent to customers at regular intervals, for repeating transactions like subscription fees.

Elements of an invoice

A good, legally-sound invoice should contain all the information the customer will need to make payments and provide an avenue to address any questions. Let's take a peek at the various elements of an invoice:

-

The word "INVOICE"

-

Invoice number

-

Date of service rendered

-

Date of sending invoice

-

Contact and name of org / seller

-

Name and contact of buyer

-

Terms and conditions

-

A line detailing each product or service

-

Cost per unit of product

-

Tax rates

-

Total amount owed with currency

-

A personalized note

-

The word "INVOICE"

The word "Invoice" and the company logo must be prominent on the document so that they can be identified easily.

-

Invoice number

Every invoice must have a unique identifier like an invoice number, purchase order number, or reference number to distinguish it from the rest of the seller's invoices.

-

Date of service rendered

Recording the date of service rendered or date of sale can help simplify cataloguing.

-

Date of sending invoice

The date of sending the invoice must be included to ensure payments are made on time.

-

Contact and name of org / seller

The invoice should clearly show the seller's name and contact information to ensure the customer can contact you for any queries.

-

Name and contact of buyer

The client's contact info must also be included to ensure legality of the document.

-

Terms and conditions

All the company's terms and conditions, including due dates and penalties for non-payment or partial payments, must be clearly included in the invoice.

-

A line detailing each product or service

The invoice must describe each product or type of service rendered.

-

Cost per unit of product

The cost of each individual item or service must be included.

-

Tax rates

The taxable amount for the products or services must be included.

-

Total amount owed with currency

The total amount due for payment must be clearly included in the invoice.

-

A personalized note

Invoices can be personalized by including a customized thank-you note.

Tips for invoicing

Here are some tips to help you make the best use of your invoices and ensure that you get paid promptly:

Incentivize on-time or early invoice payments

Make the invoice and payment process more convenient for customers

Use recurring invoicing, if applicable

Negotiate and establish payment terms in writing

Get upfront payments

Automate invoicing

Work on creating closer relationships with clients

Hold the work or stop projects if a client doesn't pay on time

Want to learn more about how to get a customer to pay an invoice on time? Forbes has some guidelines for you.

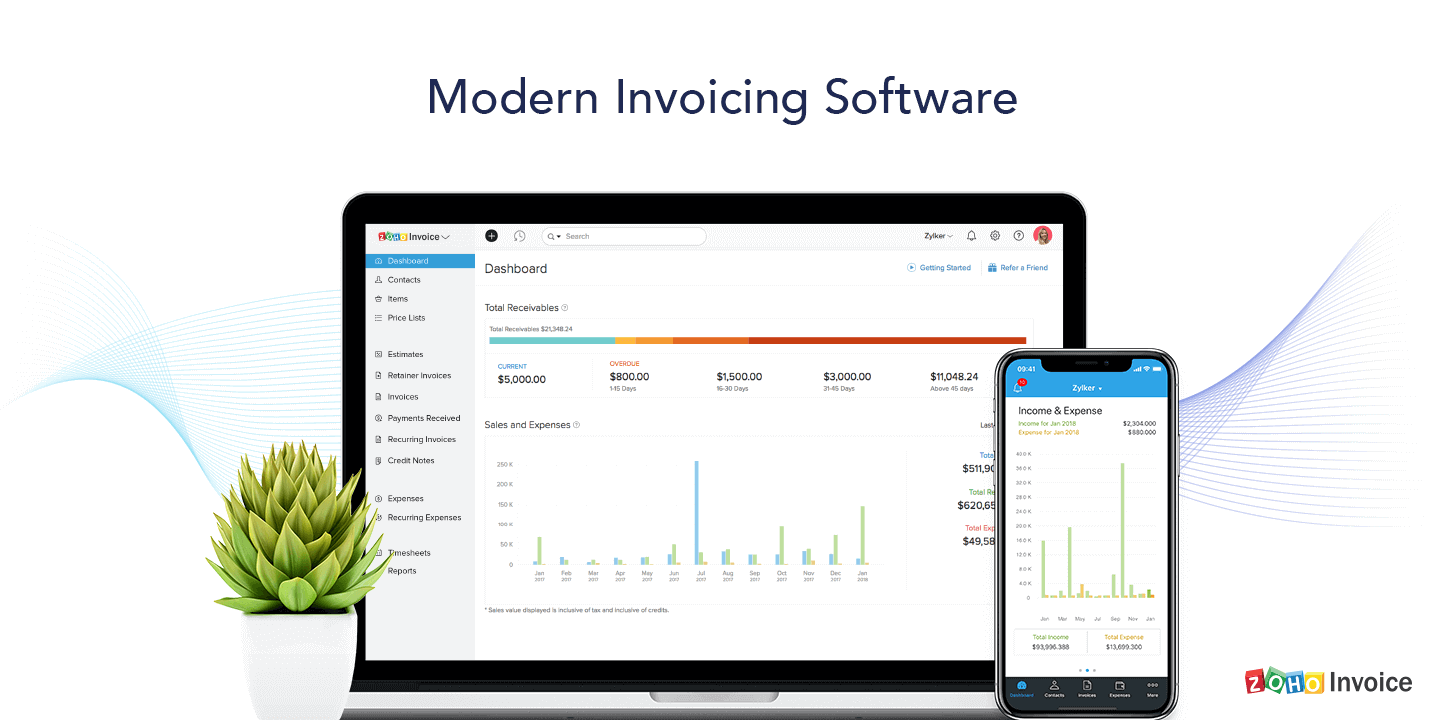

Modern invoicing software

Modern invoicing software products from SaaS companies enable you to automate, speed up, and manage the invoicing process so that you get paid on time.

What you can do with invoice software:

Create customized invoices

Enjoy complete freedom over the look and feel of your invoices. Choose a premade template from a gallery and tailor it so you can build your brand the way you want.

Automate your workflows

Sit back and let your software take care of your invoices by automating tedious recurring tasks from invoicing workflows to payment reminders.

Make payments easy and secure

Invoicing software ensures that payments are absolutely secure with PCI DSS compliance. You can even automatically collect payments on a recurring basis.

Improve customer relations

Invoicing software helps your customer relationships reach a new level. Good invoicing software includes CRM support and a customer portal for customers to track their transactions or make payments online.

Advantages of using invoice software

Invoice software helps to streamline your accounting and financial processes by automating important tasks. By doing so, you can:

Cut costs by reducing staff in the invoicing and billing department

Save time on following up and chasing late payments

Improve your cash flow with faster payment of invoices

Reduce fraud and improve security

Enhance customer relations by offering faster error resolution

Find out how you can best use invoicing software in your field of work

Professional services:

Business owners:

Trusts and nonprofits:

A good invoice isn't just a sales receipt, but a legal document that protects your business against errors and risks. The right invoicing tools can help you streamline your invoicing process, improve your cash flow, and even simplify your accounting. A mobile-friendly SaaS invoicing system is an easy modern upgrade for any business that's stuck in the stone invoicing age.