- HOME

- HR insights

- A guide to how gratuity is calculated in the UAE

A guide to how gratuity is calculated in the UAE

- Last Updated : January 6, 2026

- 367 Views

- 3 Min Read

End-of-service gratuity, also known as ESG, is a significant benefit that financially rewards employees for their service at the end of their tenure. As a lump-sum payment, this benefit enables departing employees to manage their career transition without added financial stress. It's also legally mandated by Federal Decree Law No. 33 of 2021, so it's important for organizations to have a clear and compliant gratuity process in place. In addition to assuring responsible employee offboarding, a well-managed system helps foster trust and transparency in the workplace. This blog post details everything you need to know about managing gratuity in the UAE.

Who qualifies to receive gratuity in the UAE?

To qualify for gratuity in the UAE, employees must be under a formal employment contract and must have completed at least one year of uninterrupted service. Extended absences, such as sabbaticals, typically disqualify employees from eligibility. Gratuity calculations are based on actual days worked. Employees who resign before the minimum service period specified in their contract, or who are dismissed for serious misconduct, may lose eligibility.

How is gratuity calculated in the UAE?

For full-time employees, gratuity is calculated using only the basic salary. This excludes other benefits, bonuses, commissions, or allowances. For hourly, temporary, or part-time employees, the calculation uses the ratio of hours worked to full-time hours.

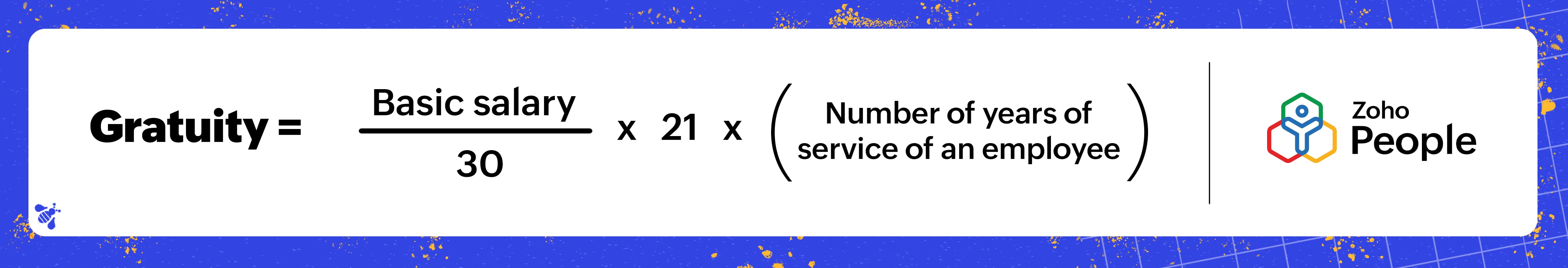

Gratuity calculation for one to five years of service

During the initial five years, employees generally earn gratuity equal to twenty-one days of their basic salary for every completed year. However, the total gratuity payout shouldn't exceed two years' total basic salary range.

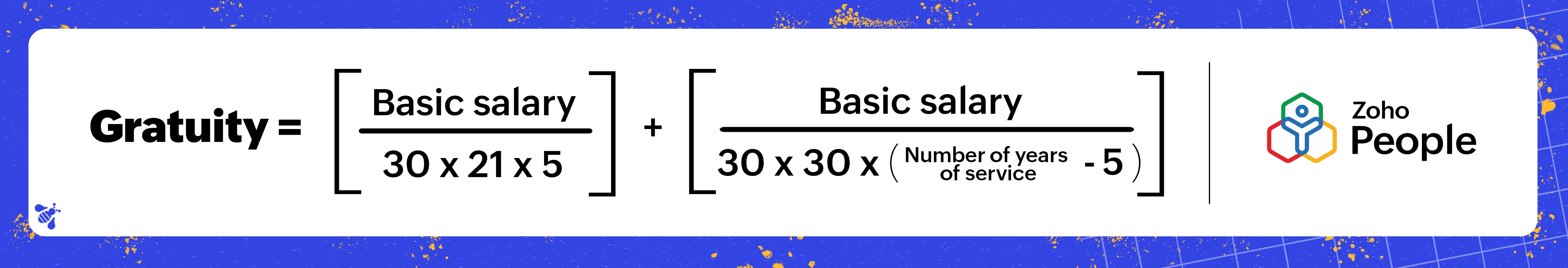

Gratuity calculation for beyond five years of service

For employees who have completed more than five years of service, the gratuity calculation differs significantly. Typically, employees receive gratuity equivalent to twenty-one days of basic salary for each year worked within the first five years. Every year after the fifth year, they're entitled to receive 30 days of basic salary for every additional year of service. Like the previous case, gratuity should not exceed two years of their total basic salary.

Note:

Under the old UAE Labor Law, gratuity calculation differed for unlimited contracts, especially when employees resigned. Resignation reduced gratuity to one-third or two-thirds, depending on the employee's years of service.

However, under the updated UAE Labor Law (Federal Decree Law No. 33 of 2021):

- Unlimited contracts are no longer in use.

- All contracts must be limited.

- Gratuity is now calculated the same way for all employees, regardless of contract type.

- Gratuity payout is usually the same, irrespective of resignation, termination, or the end of the contract.

Some practical examples to help you understand gratuity calculation

Example 1: Employee with three years of service

Basic salary: AED 5,000

Years of service: Three

Formula: Gratuity = (Basic salary / 30) * 21 * Number of years of service of an employee

Actual gratuity payout = 5,000 / 30 * 21 * 3 = AED 10,500

Example 2: Employee with seven years of service

Basic Salary: AED 6,000

Years of service: Seven

Formula: Gratuity = (Basic salary/30 * 21 * 5) + [ Basic salary / 30 * 30 * (Number of years of service – 5) ]

Actual gratuity payout = (6,000/30 * 21 *5) + [ 6,000 / 30 *30* (7 – 5 = 2) ] = 21,000 + 12,000 = AED 33,000

Understanding gratuity calculation for non-standard employment types

Gratuity calculation may vary for hourly, part-time, and temporary employees. For instance, employees who work part-time are also entitled to receive their gratuity pay at the end of their service, but on a pro-rated basis. While calculating a part-time employee's gratuity, their actual working hours are compared to those of a full-time employee's working hours, and the basic salary they've earned during the period is considered. If a part-time employee works 20 hours per week while a full-time employee works 40, the part-time employees are entitled to receive half of the gratuity received by the full-time employee. Gratuity calculation for a remote employee may not differ as long as they are enrolled as a full-time employee in a limited employment contract.

Wrapping up

As an HR professional in the UAE, understanding the various steps and regulations involved in gratuity calculation helps you ensure that employees are paid fairly and in a way that complies with labor laws. This also makes for a smoother offboarding experience for your employees. By accurately taking into account basic salary, years of service, and employment type, HR teams can ensure that every departing employee receives the end-of-service benefit they are entitled to.

Note: While this guide outlines the fundamental rules for gratuity calculation, it's recommended to review UAE labor regulations from time to time to ensure continued compliance. When in doubt, consult with your legal or payroll specialist.

Tarika

TarikaContent Specialist at Zoho People