- HOME

- Taxes & compliance

- How to get VAT compliant with Zoho Books

How to get VAT compliant with Zoho Books

Any new tax regulation brings about a significant change in how businesses function. VAT is a form of indirect tax that will be levied on goods and services (including ones that are imported or exported) as they are sold in Oman.

If you are already doing business in Oman, you will first need to check if the eligibility criteria set by the Sultanate apply to your business. You will then need to obtain a Commercial Registration Number (CRN) before registering your businesses with the Oman Tax Authority.

Once registered, you will have to shoulder the responsibility of tracking and maintaining the transactions taking place at different stages of the supply chain. You will have to check the amount of tax that has been levied and collected at each stage in order to file your returns on time.

All returns filed in the Sultanate need to be filed electronically. The VAT period will be a minimum of one month, and all payments and returns must be filed by the last date of the same month in which they occurred (which is also the end of the tax period).

All tax records need to be stored for a minimum of 10 years and should be made available during audits.

The need for compliance with these regulations from the Oman Tax Authority has business owners scrambling for an appropriate accounting solution. Meanwhile, for the businesses that have been doing accounting manually, the introduction of VAT has increased the need to adopt technology to meet the compliance requirements set by the authorities.

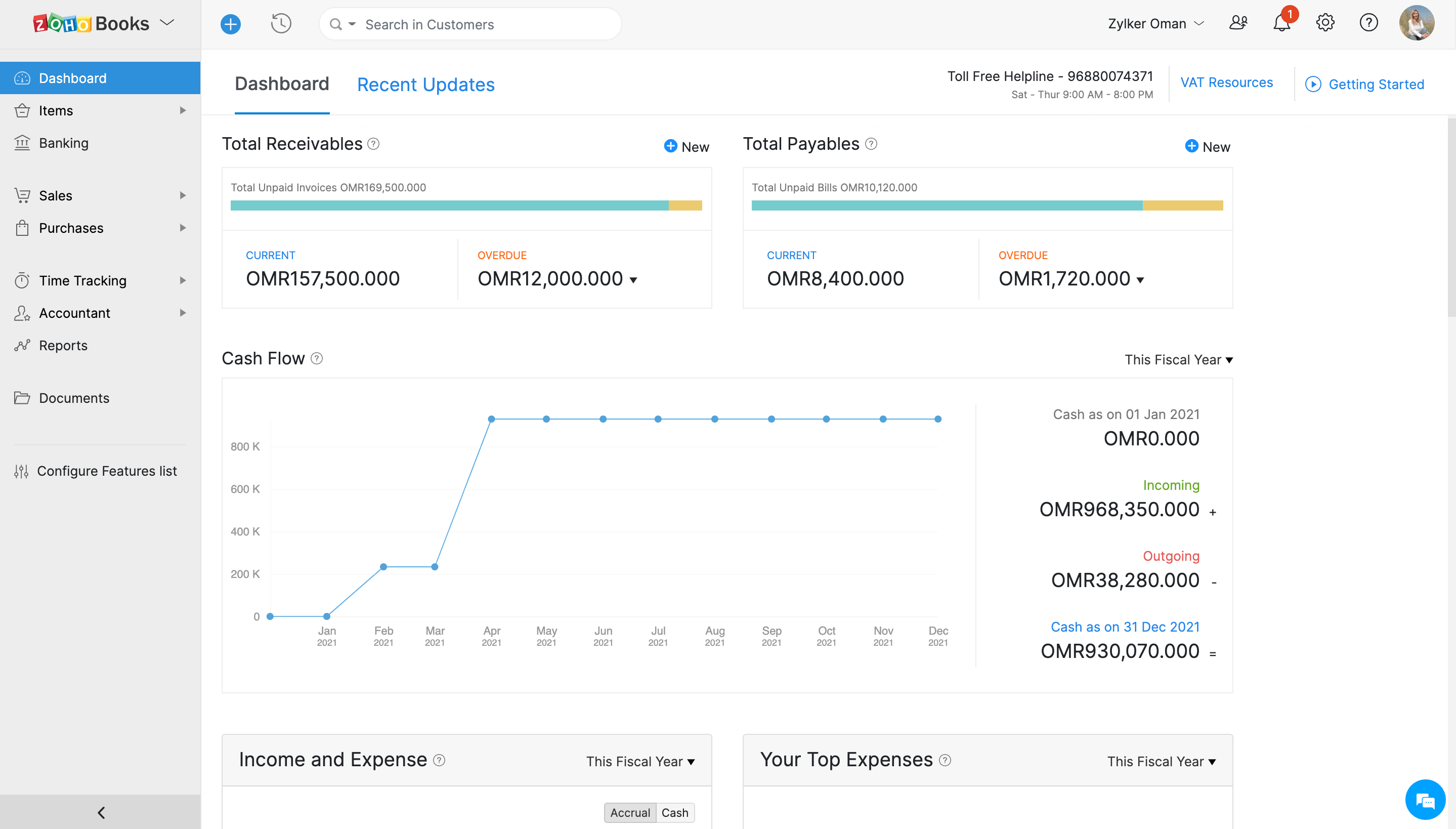

To help businesses with the new tax system, the Oman edition of Zoho Books has been built from the ground up to be VAT compliant. Zoho Books is a powerful accounting solution that will help you generate and issue VAT-compliant documents, file your tax returns in a few clicks, and even help you store your transactions for future audits.

Here's how Zoho Books helps with VAT compliance.

Associating appropriate tax with stock items

According to the regulations from the Oman Tax Authority, taxpayers are supposed to record item details like VAT rate, place of supply, and value of supply. This will help determine what VAT rates will be applicable when these items are being imported or exported in Oman.

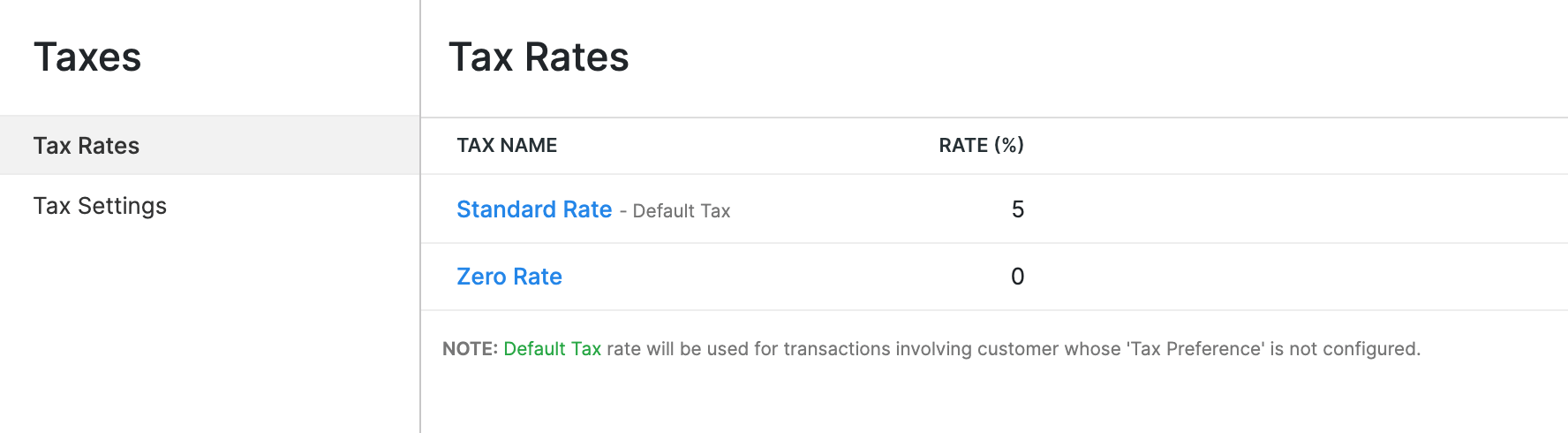

For determining the value of items, there are three tax categories: standard rate (5%), zero-rate, and exempt. Using Zoho Books, you can pre-define these tax categories and simply select them from a dropdown menu when you are recording transactions.

To save time on defining the tax value of every item, Zoho Books allows you to create groups of similar items containing shared attributes.

For example, let us assume that you are the owner of an electronics showroom in Oman. Among other goods, you sell five types of refrigerators, and they all receive the same tax treatment.

You could set up the tax settings for each type of refrigerator individually, but that's time-consuming. Instead, you can make an item group for refrigerators, with all five types included, and set up the tax settings just once for the whole group.

When you create a transaction for the sale of any of your types of refrigerator, you'll just need to select what kind of transaction it is, such as within Oman or outside the GCC. Zoho Books will then use the tax settings you configured for the whole group of refrigerators to calculate the VAT on that particular sale.

VAT treatment

The new regulations have brought about a significant change in the way transactions are carried out in Oman. According to the new rules, there are different tax rates assigned for different types of transactions, and specific rules defining what rates will be applied on supplies of goods and services within Oman, between Oman and GCC countries, and between Oman and locations outside the GCC.

You will need to know whether a transaction is an import or an export and what the place of supply is to determine what VAT rates will be applicable on it. Entering the rates of goods and services manually for all of these different situations would be a tedious task.

With an easy, one-time setup in Zoho Books, you can accurately record your purchase and sales transactions, and generate invoices containing multiple items and multiple tax rates. Zoho Books even helps you generate invoices in multiple currencies and then covert them into your base currency (i.e., Omani Rial).

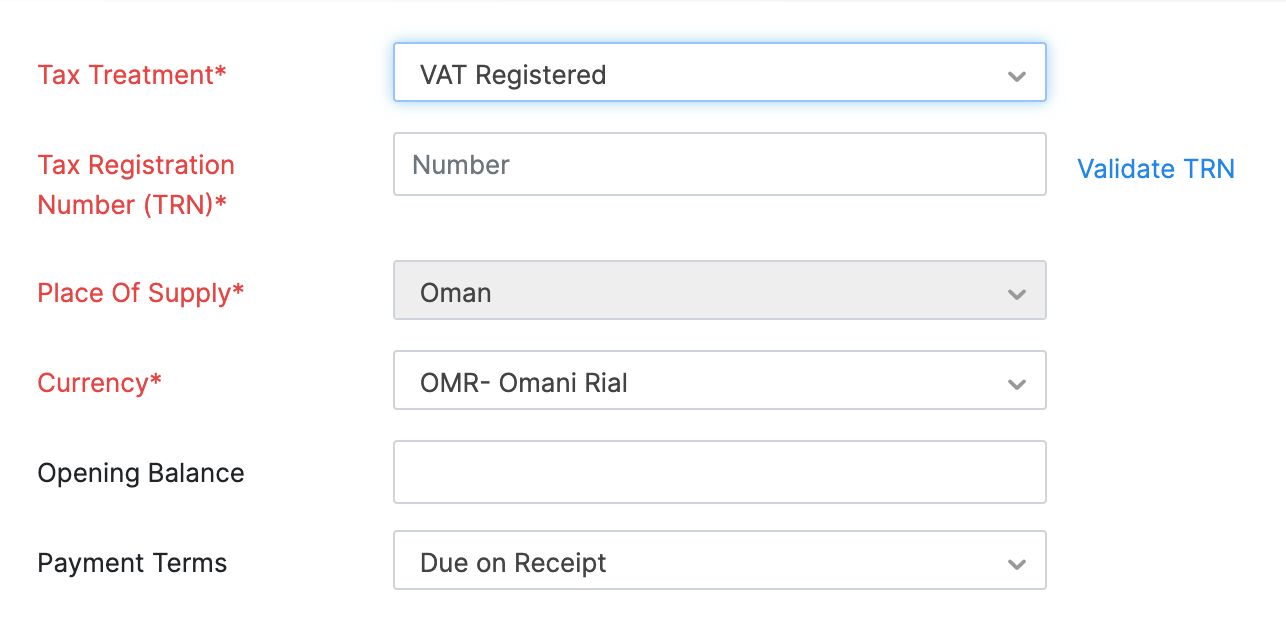

Zoho Books also has a provision to help you handle transactions both inside and outside of Oman. You can easily categorize your contacts (customers and vendors) into VAT registered, non-VAT registered, GCC non-VAT registered, and non-GCC.

This will help you determine the appropriate place of supply and specify the applicable VAT rates. You can even mention the currency and payment terms.

For example, let us assume that you are supplying goods to a customer in Singapore. For VAT purposes, all exports from Oman will be considered zero-rated. In this case, you can select the VAT treatment of non-GCC from the dropdown, the default place of supply will be set as Oman, and you can select the currency of Singapore Dollars from the dropdown. Once this is done, the tax rate of zero will be applied to the supplies mentioned in that transaction automatically. The user need not set each and every supply in the transaction as zero-rated.

Specifying VAT treatment this way will also help you sort your transactions while filing VAT returns.

Generating accurate invoices

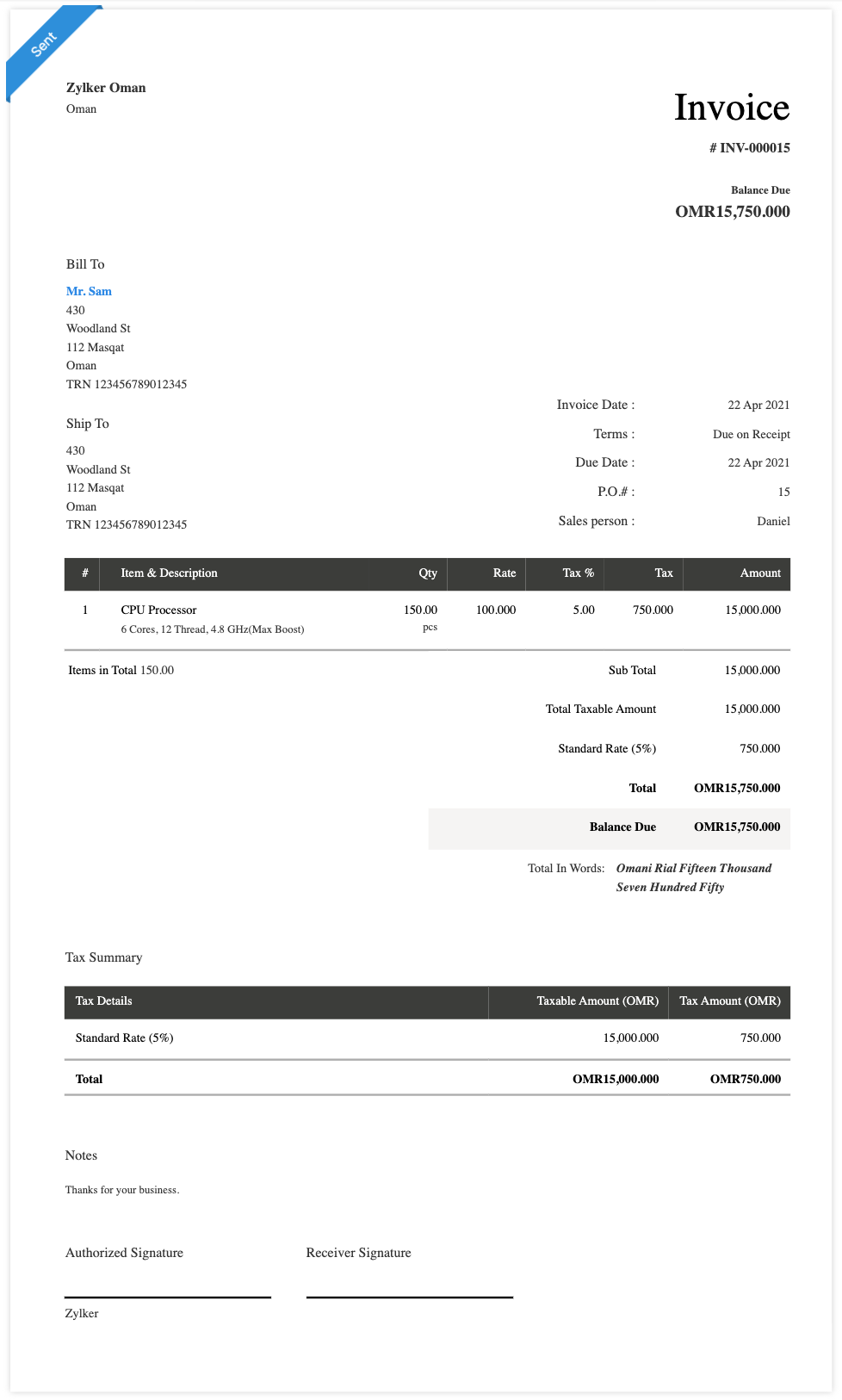

When it comes to tax invoices, the VAT regulations prescribe certain key fields that need to be present while issuing a tax invoice for your goods and services.

The fields in an invoice should include the following:

Tax invoice reference

Supplier name, address, and VAT invoice number (VATIN)

Customer name and address

Sequential invoice number

Date when invoice is issued

Date of supply

Descriptions and quantity of goods (or) services

Taxable amount (in OMR)

Tax rate

Amount of VAT charged (in OMR)

The built-in invoice formats will help you generate the document by just selecting the items from the dropdown menus. The tax rates relevant to those items will be reflected when the invoices are being prepared.

You can even specify the Value Added Tax Identification Number (VATIN) for your business while generating your transaction documents. You have an option to customise these invoices by rearranging the data fields and creating your own invoice templates for business use. You even have an option to set validation rules for invoices.

User interface in regional language

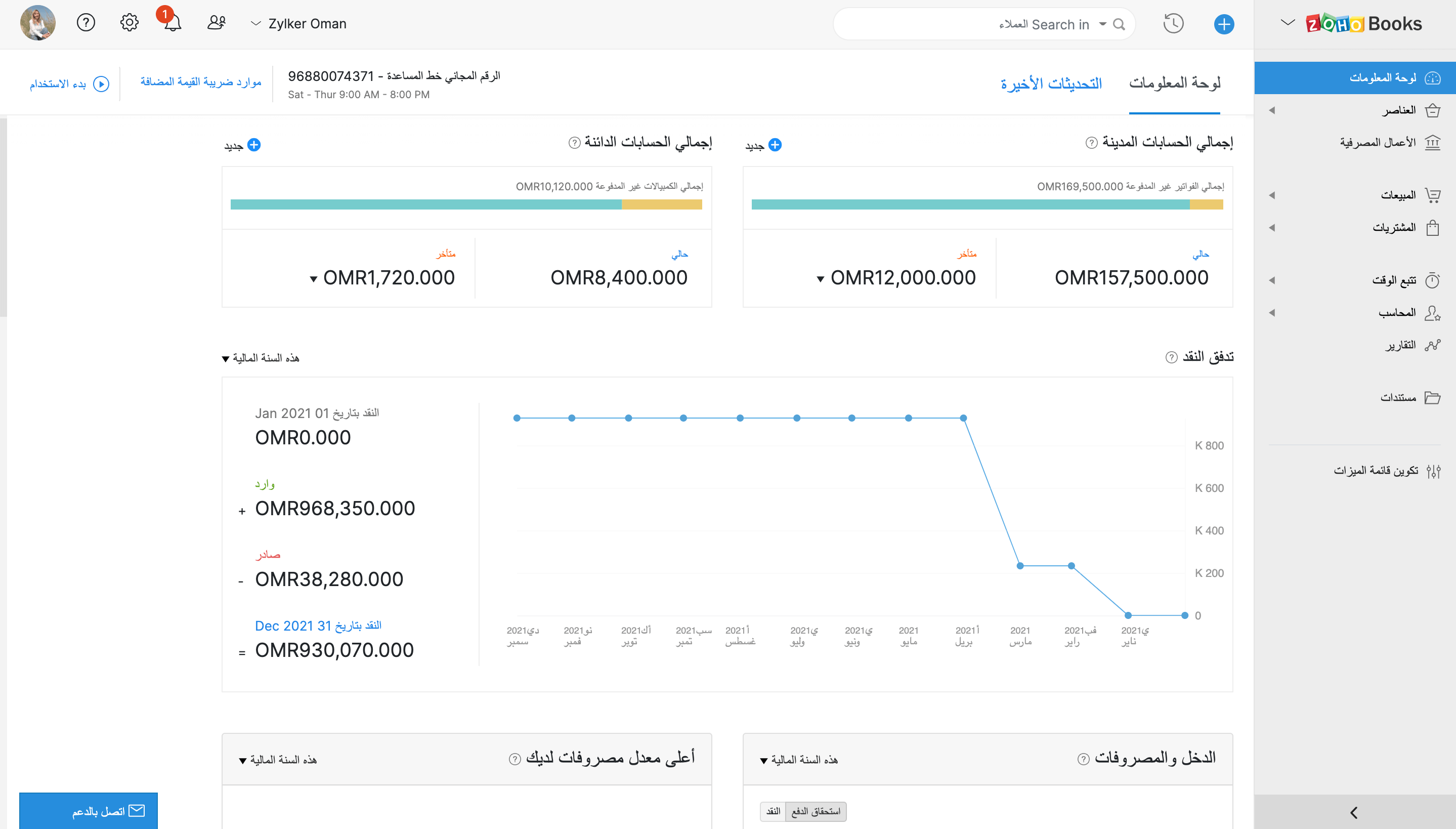

In order to match the needs of a wide variety of businesses in Oman, Zoho Books has been specially designed with the capability to present the user interface (UI) in both Arabic and English. When the language is set to Arabic, the UI also transforms and the information is presented in RTL (right-to-left) format.

English UI

Arabic UI

Important transaction documents like invoices and bills can also be created and printed in the Arabic language.This increases the ease of doing business with customers who prefer transaction information to be exchanged in Arabic.

Maintaining secure financial data

All taxpayers are required by law to maintain appropriate VAT records related to their business for audit purposes. Per Oman's tax law, a taxpayer is required to retain tax invoices, accounting records and books, and customs documents prepared during import and export of goods and services for a duration of 10 years after the end of tax year in which the return is filed. If you own a real estate business, then this duration is extended to 15 years.

Business owners might wonder how to safely maintain data for such a long duration. As a cloud-based solution, Zoho Books offers a way to store your financial data for up to 10 years and still access it at any time. We make sure that your data stored in the cloud is safer than it would be in your personal system or servers.

Zoho's data security policies and practices help you protect your data and keep your business always audit-ready.

Conclusion

While adopting new tax regulations, compliance is an area that calls for close attention. The new tax requirements from the Oman Tax Authority will increase the need to monitor many aspects of your business operations, including international exchanges of goods and services. Ongoing changes in the tax regulations and the need to submit VAT returns on time pose additional challenges for business owners, and failure to adhere to VAT rules can result in significant problems for your business.

To ensure that you can do what it takes to stay VAT compliant, the Oman edition of Zoho Books has been specifically tailored for the businesses in the Sultanate. This cloud-based solution will help you apply the correct VAT treatment on your transactions, file tax returns, secure your data for the required duration, and more.

Take Zoho Books for a spin and see how you can ensure that your business is VAT compliant.