The importance of keeping your financial documents organized can’t be overstated. As a business owner, you probably already know that a well-organized invoice system will not only help you with payment collection but also help you keep track of your finances and simplify your auditing and tax filing processes. But do you know how this can be achieved through invoice numbering?

This guide will help you learn all about invoice numbering, the different ways to number invoices, and how it plays a critical role in your business.

What is an invoice number?

An invoice number is a unique number assigned to each of your invoices so that you can identify, organize, and document them. An invoice number, also referred to as an invoice ID, is typically found at the top of an invoice and can be either be purely numeric or alphanumeric with special characters.

Why is the invoice number important?

In addition to the legal requirement in most jurisdictions that invoices be numbered, invoice numbers are all about tracking, convenience, and organization. Let’s see how invoice numbering can help you manage your financial records.

Identify transactions

The details included in a typical invoice are not necessarily unique. In such cases, locating a specific invoice by job type or client details may not yield the desired results. This is especially true when you do milestone invoicing, where you issue invoices to your client at each stage of the project as agreed in the contract. If all your invoices are to be identified by ‘job name,’ it may cause confusion as to which invoices are paid, which remain unpaid, and how much is yet to be paid. Your client may also wonder if they are being double billed. Then, sorting this out can be taxing because all invoices have identical job names.

Assigning unique invoice numbers to each of your invoices helps you distinguish one transaction from another and match the payment received to the respective invoices.

Organize invoices for easy access

Without invoice numbering, the task of even unearthing a specific invoice can be a time-consuming headache for both the business owner and the customer. If a customer raises an issue related to an old, unpaid invoice, it can be easily found and the issue can be sorted out quickly if your business follows a logical invoice numbering system.

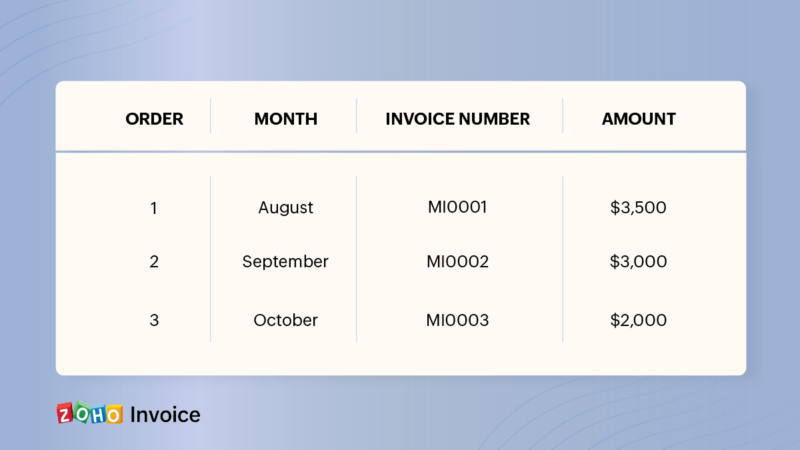

For instance, consider you run a web development and digital marketing agency that works for clients on a contract basis. A company hires your services under the contract for three months, say, from August to October. You send three separate invoices over three months to get the payment for the work done each month. Let’s say you number each invoice like this:

About six months after the contract, the same client contacts you for some additional work. The client claims that you charged $500 last time when you actually charged $2,000.

If you have organized your invoices with a clear invoice numbering system, you can quickly locate the invoice MI0003 and show it as evidence for the cost of the task.

Avoid duplicate payments

Duplicate or double invoicing is when the seller issues multiple invoices for the same goods or services delivered. Left undetected, duplicate invoices can lead to loss in funds and reputation.

When invoices are issued with unique invoice numbers, it’s easier for both the vendor and the buyer to reconcile every outgoing and incoming payment with respective invoices. This way, numbering the invoices with unique IDs helps the businesses prevent payment errors, ultimately averting the greater risk of unintentional fraud and losing money due to double invoicing.

Document revenue for tax filing

The core purpose of a tax audit is to verify whether the financial transactions made by the taxpayer are recorded and accurately accounted for in their income tax return, in accordance with the relevant income tax laws.

That said, properly maintaining your invoice records with all the required elements, such as invoice numbers, helps you ensure the legitimacy of your transactions and avoid the complications of tax non-compliance. Numbering your invoices with unique IDs makes the audit process much simpler by helping the auditors compare the internally logged financial records with the company’s bank statement and reconcile incoming and outgoing payments with specific invoices. Also, some countries like the UK have strict regulations on including invoice numbers.

How to assign invoice numbers?

There are no standard rules for numbering invoices. The choice entirely depends on the business owner’s preference. However, regardless of the format, the invoice number should be structured in a way that invoices can be documented and retrieved easily. Here are a few great methods.

Designate invoice numbers sequentially

Sequential invoice numbering is the most common method used across industries, where the invoice number increases by one every time a new invoice is issued. For example, you can start numbering the first invoice with 1, followed by 2, 3, 4, and so on for subsequent invoices. However, it is not advisable to simply start numbering the invoices ‘1’, ‘2’, ‘3’, etc. as this practice may become confusing when invoice numbers reach double or triple figures as the business grows. Hence, it’s prudent to choose a suitable numbering system that would remain effective as your business expands.

The commonly used sequential invoicing format is INV-001, INV-002, INV-003, etc.

This is not only a practical way to easily track invoices, but in most countries with a VAT or GST regime, sequential invoice numbering is a legal requirement.

Assign chronological invoice numbers

Chronological numbering includes the date of the project completion as the invoice number.

For example, the invoice number INV-22-03-003 includes the month and year, indicating that it’s the third invoice issued in March 2022, and INV-22-04-001 is the first invoice of the following month, April 2022. On the other hand, if you want to organize and easily locate multiple invoices issued on the same day, say, on 21st March 2022, the generated invoices will have the invoice numbers like 20220321-1001, 20220321-1002, etc. The first series of the invoice ID is the date following the format YYYYMMDD, and the second series of numbers is the sequential, unique identifier of the invoice.

Chronological invoice numbering is convenient as every project has a start date, which means you can easily look up where you are in the invoicing sequence. However, as you take up multiple projects, they often become scattered where one starts before the other finishes. Hence numbering the invoice by date might not always arrange projects perfectly in your books. To avoid confusion, you can consider assigning invoice numbers according to the project code or customer ID.

Consider using project codes or customer IDs to number invoices

Chronological invoice numbering is convenient, but as you take up multiple projects at a time, your accounting operations may become increasingly disorganized. This is where the idea of assigning invoice numbers based on project codes or customer IDs helps.

For instance, construction companies where several teams often work on different work sites simultaneously use the project ID to identify their clients. This invoice numbering format will include the project code, customer ID, and a unique sequence number at the end. You can organize it in either of these two ways:

1. Project code – Date – Sequence number

For example, a combination of project code-based chronological invoice numbers can be RJT-2210-001, which would stand for the client Rob & Joe Traders, for whom the service was provided in October of 2022.

2. Customer ID – Sequence number

If your business has the practice of assigning unique IDs to each of your customers, you can use that to number your invoices. For instance, if you have a client named Mathias whose customer ID is number MA36, then the customer ID-based invoice number sequence would be MA36-001, MA36-002, MA36-003, and so on.

How can online invoicing software help?

An online invoicing solution automatically generates invoices with unique invoice numbers that you can customize and send to your customers. You would no longer have to manually refer to the previous invoice number or constantly check for duplicates because the invoicing solution assigns sequential, consecutive unique invoice numbers automatically. Even though some small businesses use spreadsheets to generate and record invoice numbers, having a dedicated invoicing solution proves to be much more productive for any business as it automates the entire process.

Key takeaway

Invoice numbering primarily helps you track payments, prevent duplicate payments, and simplify tax filing and auditing. If you are manually numbering invoices, you need to watch out for invoice sequencing errors as they often lead to double invoicing or payment duplication, which can result in serious legal implications. With online invoicing software, your business can eliminate all such discrepancies and ensuing confusion with automation. It numbers invoices automatically, thus improving the accuracy and efficiency of your invoice tracking process.

That said, with many invoicing solutions on the market, finding the best software that meets all your requirements can cost a lot of time and money. With Zoho Invoice, you can either use the default numbering system provided or format your own invoice number sequence—all for free. The software automatically updates the sequential numbers when you create a new invoice and ensures no gaps, skips, or repeated numbers are present.

Sign up for Zoho Invoice today to discover how it can be a real asset to your business at absolutely no charge!

3

3

its a nice article you have prepared. its very useful for me. can i get one info, How can i automate invoice number on excel

Zoho Invoice also has the ‘Order Number’ field along with ‘Invoice number’ field. While the Invoice# is auto-generated or mandatory, the Order Number field doesn’t appear auto-generated pr mandatory field. Could you share more information on this Order Number field of Zoho Invoice?

Hello Nishant,

The Invoice Number can be auto-generated or you can manually enter it by clicking on the gear icon on the Invoice Number tab and configuring it. Unlike the Invoice Number field, the Order Number field is a relative field. For instance, if you have a physical sales order or a purchase order from your customer in hand, you can record the order number of the sales order associated with the invoice using the Order Number field.

For further queries, please feel free to contact us at support@zohoinvoice.com.