form16

What if the tax deductor is not an employee in the organisation?

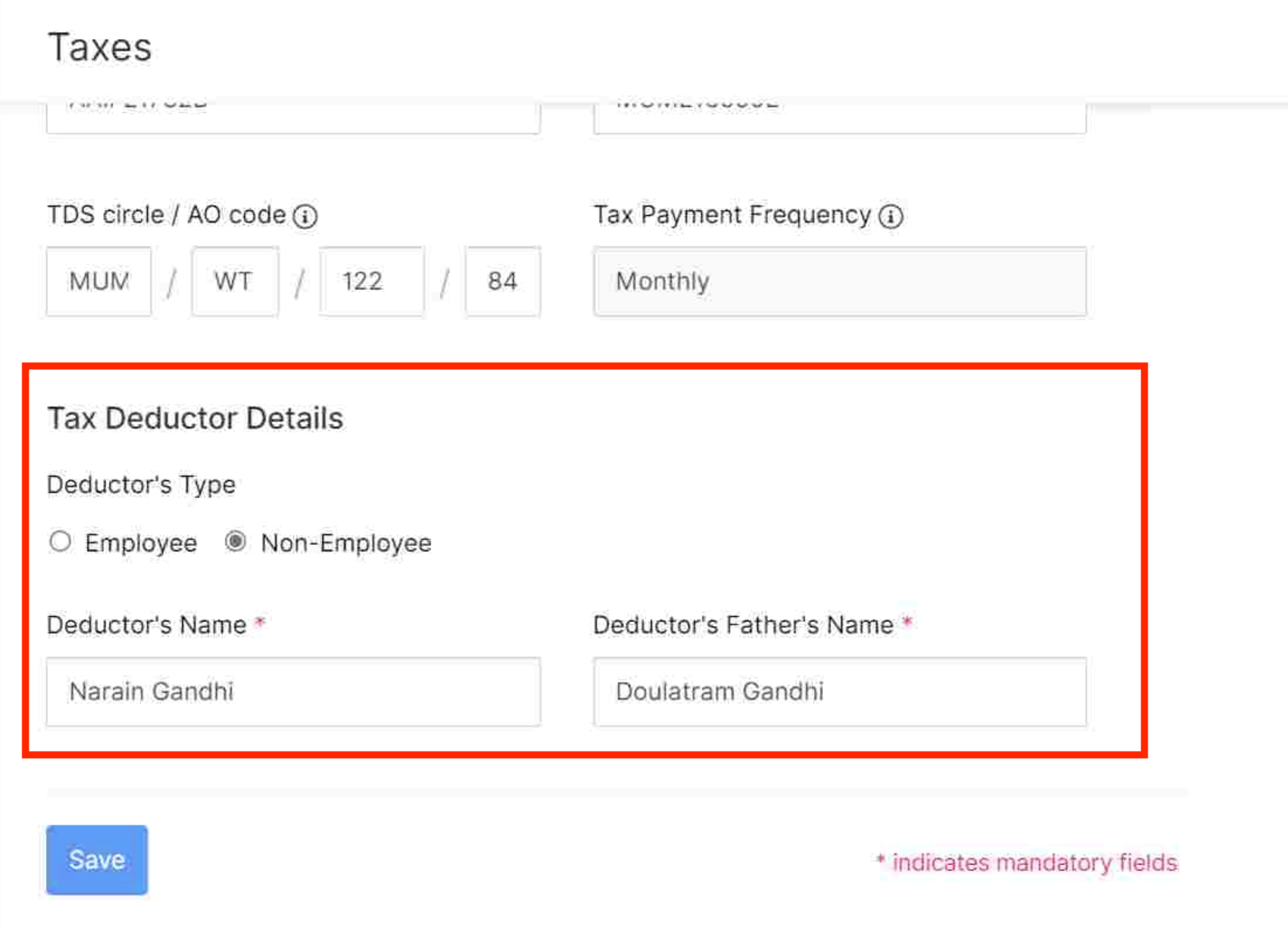

A tax deductor is assigned in every organisation to dutifully collect the taxes from its employees and submit it to the Government. If the tax deductor is not an employee in the organisation, Zoho Payroll still allows you to add this member as the tax deductor.

- Go to Settings > Taxes.

- Under Tax Deductor Details, select Deductor’s type as Non-Employee and fill in their information.

- Click Save.

The tax deductor details will be uploaded in the organisation records and can be used to sign Form 16.