From magazines and utilities to software and digital services, the subscription business model is more popular now than ever. The popularity of the subscription model is due to the steady cash flow and other advantages that come with recurring payments.

Because they benefit both businesses and customers, recurring payments are gaining steam worldwide. On one hand, business owners receive their payments on time and cut down on administrative costs associated with payment delays. On the other hand, customers don’t need to open and act on their invoices every billing cycle. Once a recurring payment system is set in place, the funds will be automatically debited from the customers’ accounts on time, saving them from possible late payment penalties.

But there is more to the recurring payment system than just automation. This guide will walk you through how recurring payments work and how they benefit your business.

What does recurring payment mean?

Recurring payment is a payment model where the customers authorize the merchant to pull funds from their accounts automatically at regular intervals for the goods and services provided to them on an ongoing basis.

Once the customers give permission, the amount will be automatically deducted at predefined intervals until the customer retracts their permission or the subscription expires.

What are the types of recurring payments?

Recurring payments can be categorized into two types:

-

Regular or fixed recurring payments

With fixed or regular payments, the customers are charged the same amount each time. Gym memberships and magazine subscriptions are some examples of regular recurring payments.

-

Irregular or variable payments

With variable or irregular recurring payments, the amount charged is subject to change based on the customers’ usage of the product or service. For example, electricity and other utility bills change month by month based on consumption.

How do recurring payments work?

Recurring payments are collected automatically from customers’ bank accounts via their payment cards or through other methods like ACH and Direct Debit fund transfer. To accept these payments, the business must have a merchant account and a payment service provider.

A merchant account is a type of bank account that allows businesses to accept payments from customers’ accounts. The amount debited from the customer’s account gets deposited first in the merchant account and then transferred to the business’s bank account.

The payment service provider handles various aspects of payment processing, from collecting recurring payments on behalf of merchants and processing them securely to depositing the amounts in the businesses’ bank accounts.

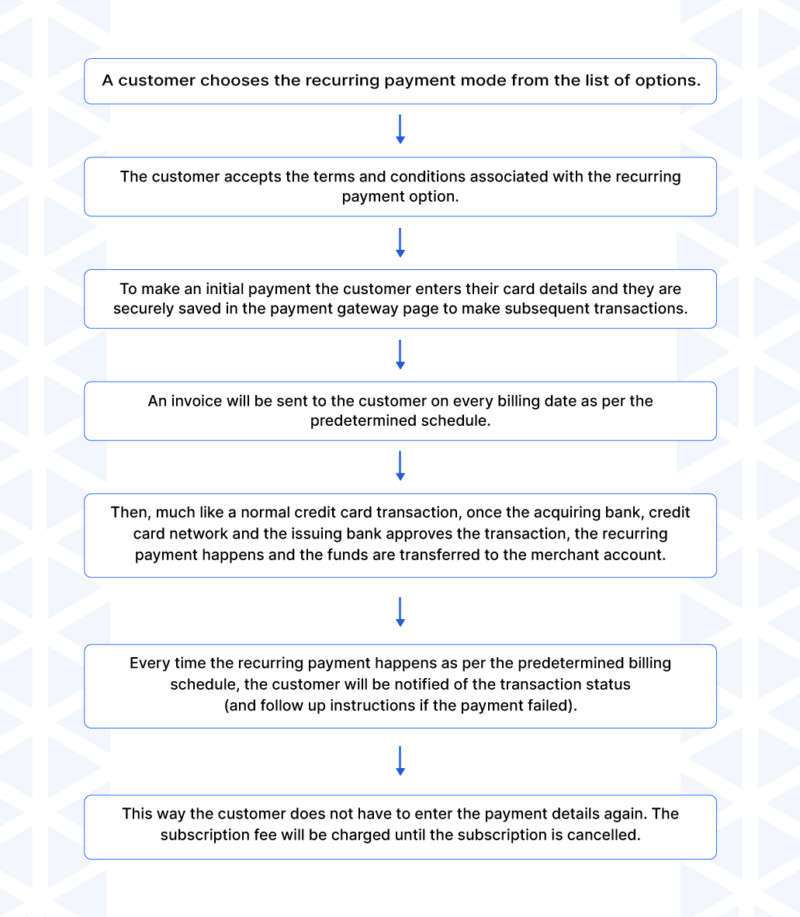

Though different recurring payment processors have different workflows, they typically follow these steps.

How can recurring payments benefit your business?

Recurring payments offer some compelling benefits:

Reduce late payments and collection time

Late payments are detrimental to businesses, as they affect both revenue and customer relationships. With recurring payments, you can set up the system once, and rest assured that the payment collection will be repeated automatically based on your predefined schedule. Your business will spend less time chasing down customers for payments and having awkward conversations about late payments, leaving more time for other essential business tasks.

Minimize effort

Automated recurring payments cut down the cost and effort associated with manual invoicing and payment processing. All you need to do is establish the original payment plan once, and then the software handles payment processing for you. Your intervention will be required only when changes need to be made to the payment type or amount charged.

Improve customer relationships

Recurring payments are much more convenient for customers because they need to enter their billing information only once. Recurring payments take it from there and deduct funds from their bank accounts right on the appropriate billing dates. Customers don’t need to set any reminders to pay outstanding bills or enter their payment details every billing cycle. Done right, recurring payments can create a feeling of goodwill between the business and the customers, ensuring a healthy customer relationship.

Defend against fraud

The integrated payment gateways that process recurring payments store the payment information provided by customers securely in their servers. They protect against fraud with methods like tokenization and best practices like compliance with the Payment Card Industry Data Security Standard (PCI DSS). These fraud detections and prevention technologies not only defend the funds against fraudulent motives but also reinforce a trustworthy image of the business among customers and save the resources that would be otherwise spent on finding and resolving fraudulent transactions.

What businesses can use recurring payments?

In today’s world, the recurring revenue model is driving growth in diverse industries from personal grooming to pet food, covering businesses of every size and type.

Utility providers

Providing a recurring payment option to pay taxes and utility bills like electricity, gas, water, and phone bills ensure they are collected promptly. ACI Worldwide payment solutions is a good example in this context. It provides scheduled auto-payment options to US federal taxpayers who are making personal income or business tax payments to the Internal Revenue Service (IRS).

Membership businesses

Many types of membership-based businesses use recurring payments, including gyms, learning courses, and co-working spaces. Here, customers are charged a fixed amount for their membership at either monthly or yearly intervals.

Subscription businesses

A wide range of businesses are now using the subscription model. It can be found in services like newspapers and streaming media; box deliveries like Blue Apron and Dollar Shave Club; and SaaS products like Adobe and WordPress, among many others.

Financial services

Recurring payments can be used in personal financial services, where a certain fixed amount is deducted from the customer’s salary account and then transferred to pay general insurance, loan repayments, or mutual investments at regular intervals. With this arrangement, the financial service provider doesn’t have to manually follow up with the customers to ask how much they want to debit from their bank account every month.

For example, UPI AutoPay in India allows customers to set up electronic payments for multiple use cases including insurance premium payments, loan installments, and mutual fund investments.

The customer has to set up an electronic mandate with their insurance company and select the bank account to be debited and agree to the payment terms. After the customer authenticates the mandate, the AutoPay function will be enabled.

At periodic intervals, the selected amount will be deducted from the customer’s account and transferred to the insurance company automatically.

Key takeaway

The recurring payment system is convenient for both customers and businesses. Not only does it enhance a positive customer experience by reducing the friction that occurs with repeated manual payments and delays, but it also ensures a stable cash flow for the business. If you run a business where you collect payments repeatedly from the same customers, then it is worth giving the recurring payment model a try.

Take Zoho Subscriptions for a test drive today to see how it helps in collecting recurring payments and makes the whole process a breeze.

2

2

I’d like to read what the downsides are for the customer, as they are not covered in this organisation orientated summary above.

Hi Carole,

Thank you for reaching out to us!

We don’t see any downsides for the customer in opting for a recurring payment model and the increasing popularity of subscription model across industries validates that.

On contrary, we see the recurring model as a win for the end customer, and here’s why:

– The pay-as-you-go working provides customers the freedom to cancel anytime and have better control over their spending.

– They can split and make several smaller payments instead of paying upfront in bulk.

– It’s an easy one-time setup 🙂