- HOME

- Billing basics

- What is Dunning Management? | Definition, Importance & Working

What is Dunning Management? | Definition, Importance & Working

Payment declines and transaction failures are common in subscription businesses, and you will likely have to deal with them on a regular basis. Although just 2% of monthly payments fail on average, this can account for 22% of annual loss in total recurring revenue. Recurring revenue is the lifeline of any subscription business, and losing it due to payment failures can be detrimental to its growth rate. Serious intervention is necessary to get it under control.

When a payment fails, you typically contact your customers to notify them of the payment failure and follow up to recover the amount due. This may be feasible when you have a handful of customers. However, when your customer base expands, manual follow-ups become almost impossible.

Your recurring billing software needs to have a better workflow that automatically acts on failed payments and keeps your revenue flowing; this is exactly what dunning does.

In this guide, we will see how dunning management benefits your business as well as the various approaches for implementing it.

Dunning Management - Definition, Importance & Working

Dunning management is an automated payment recovery mechanism that is set in motion in the event of payment failure. Here, the customers are first notified of the payment failure via email, text messages, or in-app notification. Next, the payment recovery process is initiated.

How does dunning management help to recover failed payments?

Generally, payments can fail due to a variety of reasons, such as card authorization failure, card expiration, insufficient funds, lost or stolen card, restricted card, outdated credit card information, and processing errors.

Dunning management helps solve these issues and tackle payment failures by following a two-step approach:

1. Payment retry:

The system first notifies the customer of payment failure, then retries the declined card to recover the payment within a stipulated time. Depending on the billing system, the number of retries varies. However, a minimum of three retries is recommended with a frequency of three to five days.

2. Pre-dunning:

In this approach, customers are notified beforehand if their credit card is about to expire, and are requested to update new card details before the billing date.

Why is dunning important?

Recovers failed payments

In subscription businesses, credit cards are most commonly used for payment processing. While it eases the entire payment process, a simple glitch in the payment network can lead to a transaction failure and spoil your income. Dunning management solves this by identifying failed transactions and initiating communication with the customer to recover payments.

Avoid involuntary churn

Imagine one of your customer's recurring payment failed due to an expired card. Without any proper process in place to alert the customer of the payment failure, they are locked out of their account. Eventually, as the customer fails to update their payment information, their subscription terminates, leading to churn. These customers who churn out likely still want to do business with you. Losing such customers over payment failure can be detrimental to your growth.

Unfortunately, involuntary churn is not marginal, and businesses simply can't afford to allow it anymore. According to research by DigitalRiver, payment failures account for a whopping 34% of involuntary customer churn. Needless to say, a high churn rate is fatal to business growth and must be reduced. Dunning management does exactly that.

When the payment fails due to an expired card, insufficient funds, or any issue with the bank, dunning lets the customer know that the payment failed and gives them a chance to update their billing information and make the payment. If the transaction failed due to reasons other than the customer's choosing, several attempts are made to recover the payment through the retry process. The subscription is canceled only when all the retry attempts fail to prevent involuntary churn.

As the subscription cancellation or revoking of some special access due to non-payment (because of payment failure) may disrupt your customers' everyday operations, it's vital to take all appropriate measures, keeping cancellation only as a last resort. If the subscription is canceled without any effort to recover the amount, you not only lose your revenue but also end up gaining a bad impression for the business even from your satisfied customers.

By not canceling the subscriptions immediately and ensuring interruption-free service, even in the event of payment failure, you not only can save your business from churn but also increase customer satisfaction and loyalty.

Automation saves time

If you are manually dealing with all declined payments and sending out reminders to your customers, you may want to consider the time you could save by automating the entire process.

The automated dunning management system brings a better workflow to deal with missed payments, saves resources, and helps your business be more efficient. Instead of spending hours checking and drafting emails individually for each customer whose cards have been declined, the billing system does this on behalf of your business. You can even customize the emails before sending them to customers.

Although email is an effective medium, it's important not to completely rely on it, especially when your customer base grows geographically. Apart from email, SMS can be used as an additional channel as research shows that the SMS open rates are as high as 98% compared to just 20% of all emails. Furthermore, adding CTAs to platforms or portals that customers often visit and guide them to the next set of actions may produce better and faster results.

When you have a billing system with an automated dunning facility in place to take care of payment recovery, you can reallocate your resources to concentrate on other value-adding tasks.

How does dunning management work?

When a payment declines, the customer will be notified of the payment failure. Additionally, they will be informed that their card will be retried in the next few days.

The number of retries and the time-lapse between each retry are configured in the dunning system.

Let's examine this with an example. A subscription is set to renew at the beginning of every month. Unfortunately, on December 1st, the payment fails and the customer will be immediately notified about the failure. The retry process will then kick into action, and the failed card will be retried again after few days, in this case on December 4th. If this attempt fails, the next attempt will be made on December 7th, followed by another attempt on December 10th, and so on until the payment is recovered. After each retry attempt, the payment status and the next retry attempts will be sent to the customers via email so that they can take appropriate action. For instance, if the payment fails due to outdated card information, the customer can update their new card information using the link provided in the notification email so that the next retry attempt will be successful.

You can schedule the number of retries and the interval between each retry in the dunning system. When all the retry and follow-up attempts fail to recover the payment, the subscription will be canceled, and the customer will churn out.

Modern dunning management

Dunning management has evolved to ease the process of handling payment failures by adopting various approaches.

Smart retry logic

When a payment fails, the system will automatically retry the customer's account to collect the due charges. However, the transaction can't be retried every day, as there is a cost associated with it every time the account is retried, and it gets expensive for the business. If there are too many failed transactions from the same credit card, it will trigger warnings from the payment network, which might put the business account on hold. Hence, it's necessary to schedule your retry attempts logically.

This is where smart retry logic comes into play.

Smart retry is the process of assessing and choosing optimal times to retry failed payments so that there is a maximum likelihood for a successful transaction.

In a conventional retry mechanism, a common charging schedule is applied to all failed payments. By contrast, in smart retry, the retry schedule is dynamic and adjusted to specific requirements based on historical data of the industry, target customers, and so on. The retry logic takes into account factors such as payment gateways, card brands, local time zones when there is a high rate of successful payments and other financial patterns of the customers.

This way, the retry process is guaranteed to result in a decreased number of unsuccessful attempts, reduced cost of payment processing, and higher chances of approved transactions.

Retry logic based on error code

Whenever a payment fails, the payment gateway returns an error code with a message indicating the reason for the transaction failure. Based on the type of transaction error, the retry logic can be dynamically scheduled so that the chance of payment recovery is high.

For example, hard declines occur when the issuing bank (customer's bank) does not approve the transaction. Stolen or invalid cards and closed accounts are typical instances of hard declines. If the declined transaction returns error codes such as Invalid Card or Do Not Honor (which means that the credit card is not authorized), retrying the card will not work, and it's recommended to contact the customer directly.

On the other hand, soft declines occur when the transaction fails due to other reasons, such as insufficient funds, expired credit cards, exceeded card limits, and so on. Unlike hard declines, there are more chances to recover the payments through the retry process, as they occur mostly due to issues that can be resolved immediately.

For example, if a payment declines due to insufficient funds, it makes more sense to wait and try the card again after a few days, as it's possible that the customer will have added funds to their account to cover the payment.

Such intelligent retry mechanisms not only recover the payment but also minimize involuntary churn. It's critical for your subscription management platform to have such smart retries set up if you want to maximize your revenue.

Automated email notifications

When customers' credit cards are about to expire, an email is sent to customers automatically notifying them that their card is about to expire. This proactive notification prevents payment failure due to card expiration and is called the Pre-dunning process.

However, handling these dunning emails can be precarious. While sending customers a series of transactional emails to notify them of their expired cards is a thoughtful approach to prevent payment declines, it might border on spamming and put off the customers if you are not careful. It's important to strike a balance between resolving payment issues and reminding customers of the value of your product while handling dunning emails.

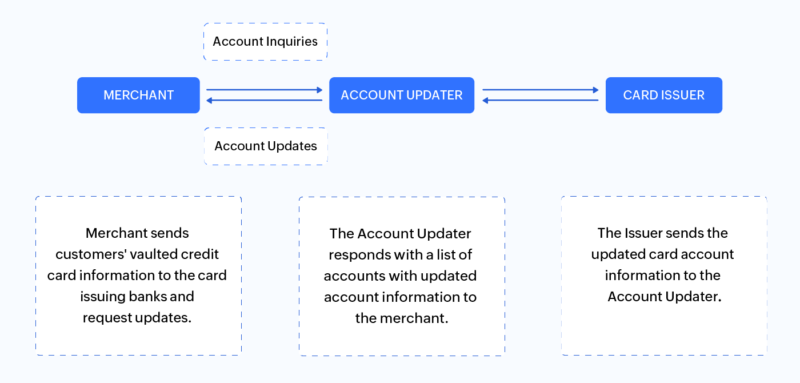

Automatic Account Updater

Automatic Account Updater is a service offered by payment card networks that ensures that the merchants have up-to-date card details of their customers by checking them for updates with the card networks frequently.

Customer's card information can change for several reasons. They might receive a new card due to updated technology or simply replace a lost card. While you should allow the customers to update the payment information on their own, you cannot solely rely on them to do so.

Automatic Account Updater enables you to collect updated credit card information such as new card numbers, contact information, and expiration date directly from the credit card providers by detecting changes in the card information.

The process unfolds like so:

This mechanism increases the possibility of successful payments, preventing payment failure due to invalid card information or card expiration. If the automatic update fails due to any technical error, the business will be notified of this so that they can directly contact the customers.

Key takeaway

While you are busy keeping one eye on timely payments and another on revenue growth, the importance of retaining customers might slip your mind. Your subscription business depends on your customers, as they guarantee a stable source of revenue. It's worth going the extra mile to protect your recurring revenue by automating the payment recovery process. Dunning management does exactly that for you. When done right, dunning can help you automatically recover lost revenue due to payment failures, prevent you from losing customers due to payment declines, reduce involuntary churn, and save you loads of time spent following up manually.