- HOME

- Accounting Principles

- The chart of accounts: How to set it up & maintain it properly

The chart of accounts: How to set it up & maintain it properly

During the initial stages of any business, expenses can easily be grouped under a few categories like salaries, rent, utilities, and the like. As businesses grow, their financial activity becomes more complex. The same categories that the company initially used to group their financial transactions will no longer meet the requirement. Without a clear structure to organize this information, financial reporting quickly becomes messy and unreliable. This is where the chart of accounts steps in.

A chart of accounts is like the index of all accounts under which a company's financial transactions are recorded. The chart of accounts is the backbone of every company's accounting system, ensuring each transaction lands in the correct bucket and every financial report gives a real-time view of reality. Whether you are a small business owner trying to organize your books or an accountant setting up accounts for a client, a clearly structured COA lays the foundation of sound financial practices. This article will explain what a chart of accounts is, how to set it up, and how to maintain it as your business grows.

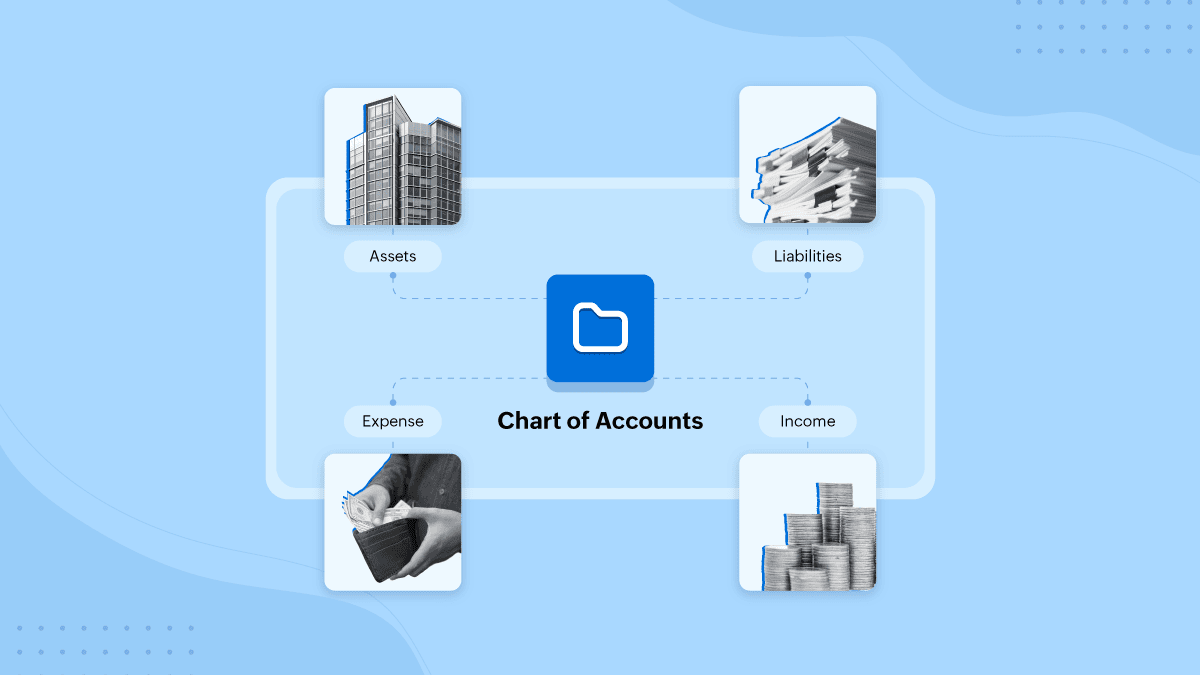

What is a chart of accounts?

A chart of accounts is the organized list of all the accounts your business uses to track its financial transactions. Think of it as a master folder where each expense, sale activity, asset purchase, salary payment, and the like finds its corresponding subfolder.

A typical chart of accounts comprises the below five categories:

Assets - Everything that the business owns (Inventory, land, cash, etc.)

Liabilities - Everything that the business owes (Loans, taxes)

Income - Everything that the business earns (Sale of goods, interest from investments)

Expenses - Everything that the business spends (Rent, employee salaries, maintenance)

Equity - Investments made in the company by stakeholders

The number of accounts under each category will vary depending on the type and size of the business. A small marketing agency will have 15–20 accounts while a global manufacturer might have more than 100.

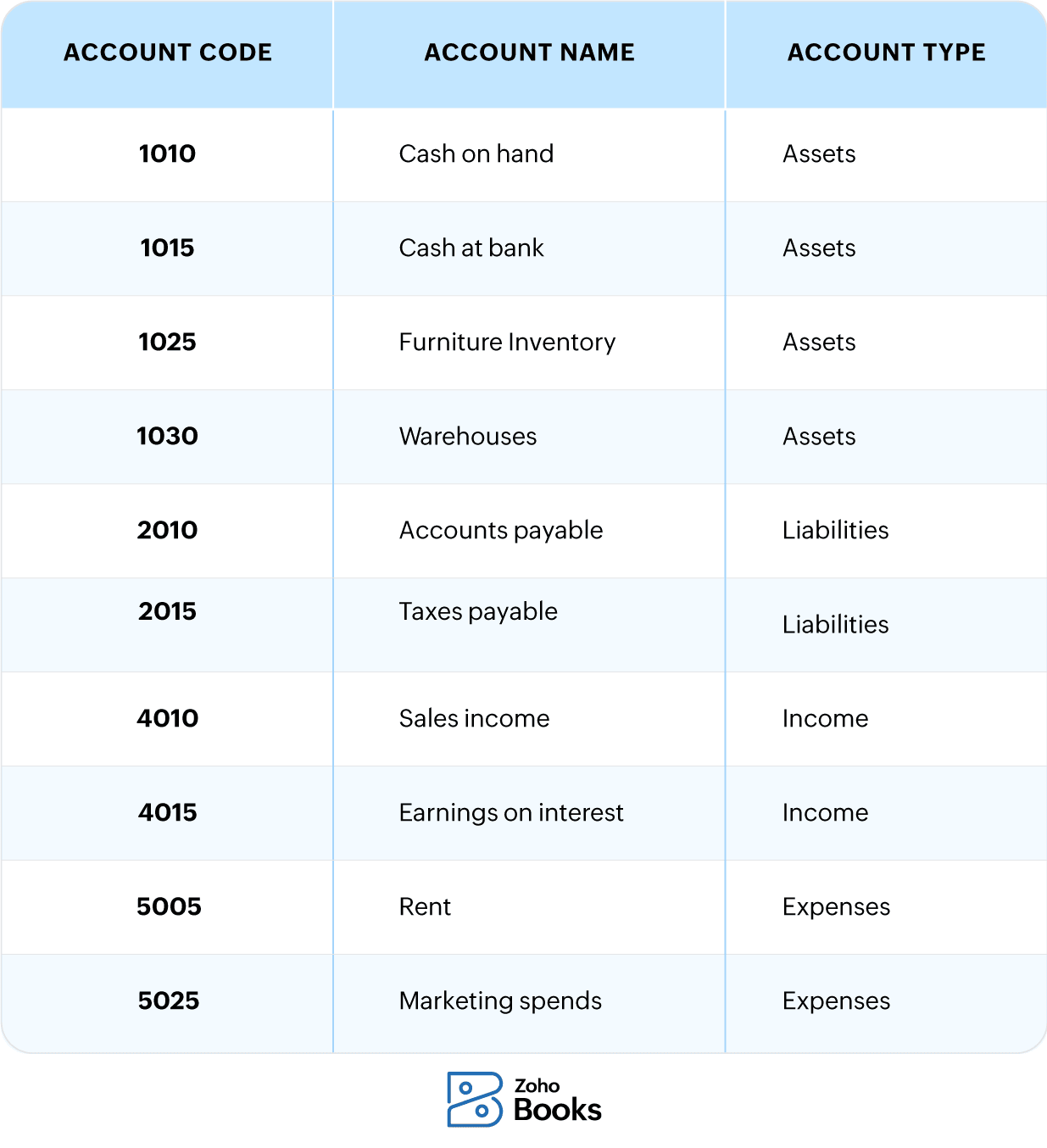

Globally, these categories follow the below number series:

1000–1999 - Assets

2000–2999 - Liabilities

3000–3999 - Equity

4000–4999 - Income

5000–5999 - Expenses

Example of a chart of accounts

Here is an example of what the chart of accounts for a furniture store can look like:

Importance of chart of accounts

A well structured chart of accounts is more than an accounting requirement. It benefits the business in multiple ways.

Clear accounting records: It groups all financial transactions into relevant categories providing a clear picture of where the money is coming from and where the money is going.

Improves efficiency: A clear COA streamlines the entire accounting process, enabling it to be ready for year-end closes and financial audits.

Better financial reporting: With clearly classified records, generating accurate financial reports like P&L reports and balance sheets becomes possible.

Compliance: It helps meet regulatory requirements, and simplifies audits and tax filings as data is available in an easily consumable manner.

Robust decision making: As one can clearly see the break up of revenue and expenses, management can spot trends, identify key opportunity areas, and make better strategic choices.

How to set up a chart of accounts

Setting up your chart of accounts isn't as complicated as it sounds. Follow these basic steps to get started.

Step 1 - Follow the standard set of categories

Employ the universally accepted five categories mentioned earlier: Assets, liabilities, equity, income, and expenses. This sets a strong foundation for the subaccounts that your business may need in the future.

Step 2 - Set a logical numbering system

Follow the numerical ranges mentioned earlier. This plays a major role in keeping your chart of accounts organized and scalable.

Step 3 - Set clear account names

Keep names that are descriptive and easily understandable. This reduces ambiguity and also helps in classifying transactions quickly as and when they occur.

Step 4 - Don't over-complicate the accounts list

One of the most common pitfalls is creating subaccounts that are rarely used. A good rule of thumb is to only create subaccounts that will be used every month.

Going back to the furniture store example, instead of creating subaccounts separately for the sale/purchase of each category of furniture, an ideal way would be to create a single subaccount under income/expenses and use reporting tags for each category of furniture and apply them to transactions accordingly.

Step 5 - Do regular checks

Your chart of accounts is not a one time exercise. You need to check and remove accounts that have been unused for a long period of time regularly. Similarly, as the business grows, new accounts need to be added.

How to maintain a clean chart of accounts

Maintaining your COA is as important as creating it. You need to regularly maintain it to keep it effective and simple. Here are a few tips.

Reduce redundancy - Merge accounts with similar purposes to avoid confusion and eliminate duplicates.

Use descriptive names - Have names that are clear and self explainable.

Review periodically - Conduct periodic reviews to remove dormant accounts.

Leverage accounting software - Tools like Zoho Books helps you organize, customize, and report on your COA easily with minimal manual effort.

Train your team - Apprise your team about account naming conventions, the purpose of each account, and getting updates on idle accounts.

Stay lean - Review stringently before adding new accounts. More accounts doesn't mean more clarity, they might add to clutter.

Your chart of accounts is the first step of creating a sound financial system for your business. With proper creation and regular maintenance, you will bring in order, clarity, and simplicity to your accounting process. Whether you are just starting up or expanding glocally, investing your time and efforts in charting your COA will pay off in the long run. With the right accounting software, maintaining a well structured chart of accounts becomes easier.

Zoho Books makes it simple to create, customize, and maintain chart of accounts as per your business need. With additional features like reporting tags, it ensures you maintain a clean chart of accounts. Learn more about Zoho Books features to understand the benefits it can bring to your business. Get started on your journey towards simplified accounting today.