- HOME

- Accounting Principles

- Difference between bookkeeping and accounting

Difference between bookkeeping and accounting

People often use bookkeeping and accounting synonymously. In reality, they represent two different layers of your finance function. They work closely together, but they serve different purposes.

Bookkeeping and accounting have existed in some form for centuries. Bookkeeping began as a simple way to track what people earned and spent. Accounting evolved from this foundation as businesses grew more complex and needed a clearer view of their financial position, performance, and reporting requirements. Even with modern tools and automation, both functions still play distinct roles. Understanding how they differ makes it easier to manage your finances and choose the right tools or support.

This article walks through what bookkeeping and accounting each do, how they fit into the financial cycle, and the key points that distinguish between bookkeeping and accounting, helping you clearly understand the difference between the two.

How bookkeeping and accounting fit together

A useful way to understand the difference is to think of your financial data as a story:

Bookkeeping records each event as it happens—sales, purchases, payments, and receipts.

Accounting looks at the full story and explains what it means—how healthy the business is, whether it’s profitable, and what actions are needed next.

Most experts describe bookkeeping as the foundation; it focuses on recording transactions in a consistent, organized way. Accounting builds on that foundation to create financial statements, analyze results, and support decision-making.

Without solid bookkeeping, accounting becomes a clean-up exercise. Without accounting, bookkeeping becomes a list of numbers with no direction.

What bookkeeping covers

Bookkeeping is the structured process of recording a business’s financial transactions, usually on a daily or near-daily basis. This includes:

Recording sales and purchase invoices

Posting cash and bank transactions

Maintaining customer and supplier ledgers

Tracking expenses, reimbursements, and petty cash

Keeping the chart of accounts and balances updated

In practice, a bookkeeper:

Works directly with source documents like bills, receipts, bank statements, and invoices

Ensures every transaction is captured correctly

Helps maintain complete, gap-free records

Modern cloud tools make this work easier. A system like Zoho Books can help bookkeepers:

Create and send invoices

Record expenses and bills

Use bank feeds for quicker reconciliation

Track inventory and generate basic reports

No matter the tool, the core responsibility stays the same: clean, complete, and well-organized records.

What accounting covers

Accounting takes the detailed records created through bookkeeping and turns them into a bigger picture that helps the business understand its performance.

Typical accounting tasks include:

Reviewing and adjusting the books at period-end

Applying accruals, prepayments, and depreciation

Preparing financial statements (profit and loss, balance sheet, cash flow)

Analyzing performance using ratios, trends, and comparisons

Supporting tax calculations and filings

Advising management on budgets, costs, and strategic decisions

Bookkeeping deals with day-to-day activity; accounting deals with interpretation. It answers questions such as:

Are we making money, and if not, why?

Can we meet our upcoming financial commitments?

Which products or services perform best?

How can we improve margins or reduce costs?

Because accounting relies on judgment and technical knowledge, accountants usually require deeper training in standards, tax rules, and financial analysis.

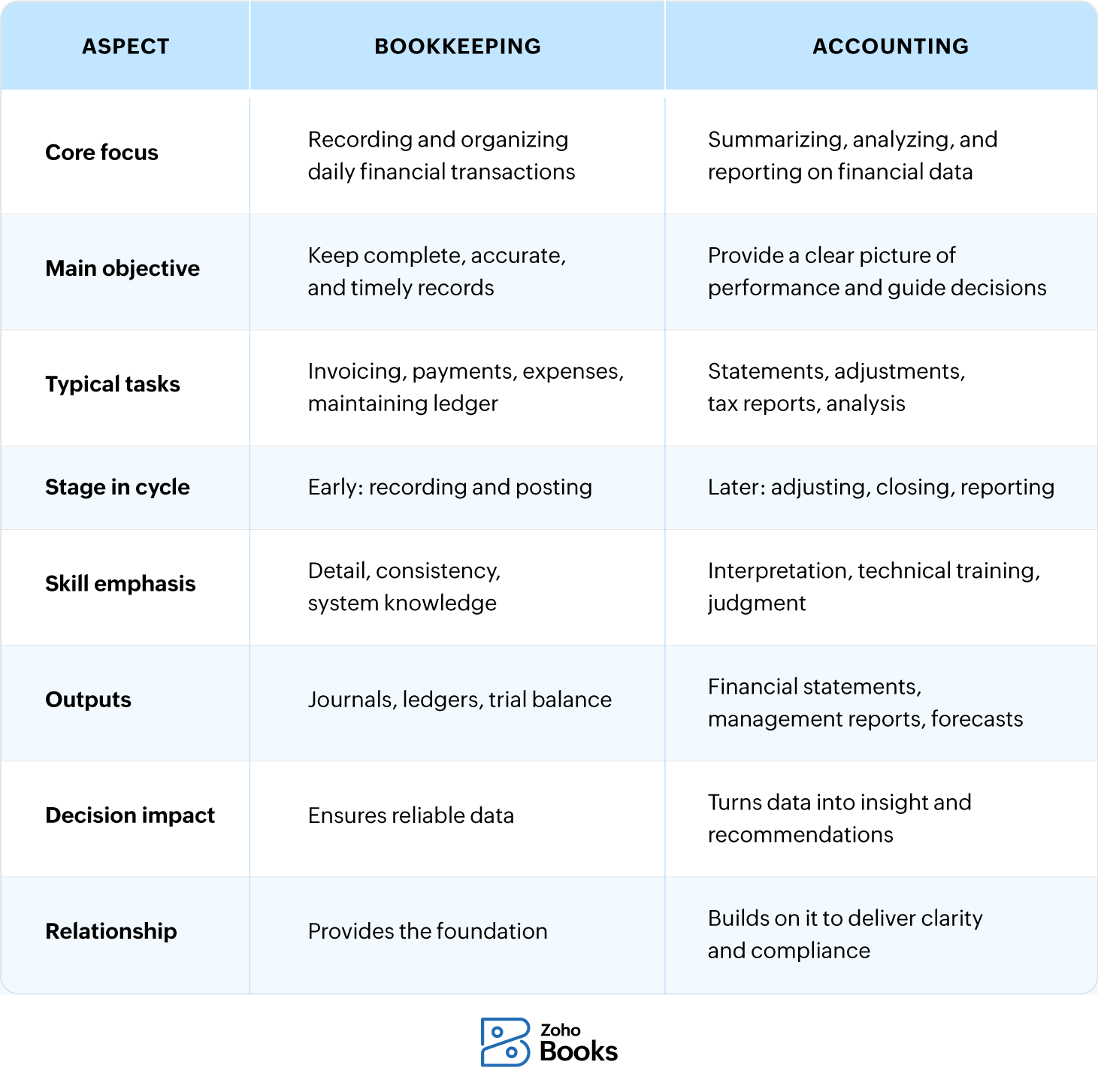

Main differences between bookkeeping and accounting

Even though both functions work closely together, they differ in scope, purpose, and focus.

Purpose

Bookkeeping: Record and organize all financial transactions accurately and on time.

Accounting: Explain what the numbers mean, support compliance, and guide business decisions.

Scope of work

Bookkeeping includes:

Recording entries in journals and ledgers

Maintaining balances

Basic reconciliation

Tracking daily inflows and outflows

Accounting includes:

Preparing financial statements

Posting adjustments and closing entries

Analyzing results and trends

Managing tax and compliance reporting

Position in the accounting cycle

The accounting cycle runs from identifying a transaction to issuing financial reports.

Bookkeeping dominates the early stages—capturing and posting transactions.

Accounting takes over in the later stages—adjusting, summarizing, and reporting.

Skills and qualifications

Bookkeepers need attention to detail, consistency, and a strong understanding of ledgers, debits, credits, and documentation.

Accountants typically have formal qualifications and may be certified to sign off accounts, perform audits, or represent the business before tax authorities.

Outputs

Bookkeeping outputs:

Journals and ledgers

Trial balance

Customer and supplier balances

Accounting outputs:

Income statement, balance sheet, cash flow statement

Management reports and dashboards

Budgets, forecasts, and analysis notes

Impact on decision-making

Bookkeeping ensures the data is reliable.

Accounting turns that data into meaningful insights.

Poor bookkeeping leads to inaccurate reports. Without accounting, you may have good data but no clear direction.

How software brings bookkeeping and accounting together

Traditionally, bookkeeping involved manual entries and paper ledgers, often resulting in slower updates. Today, cloud-based accounting software helps streamline record-keeping and supports more timely, organized financial records.

Bank feeds import transactions automatically.

Receipt scanning turns images into expense entries.

Rules categorize frequent transactions.

Reports update in real time.

For bookkeepers, this reduces repetitive data entry and frees time to focus on accuracy.

For accountants, it means faster access to updated information and a clearer view of the business.

A platform like Zoho Books supports both roles within the same system. Bookkeepers can handle invoicing, expenses, and reconciliation, while accountants can access the same data to prepare statements, review performance, and advise management—all without working in separate tools.

Do you need both?

For most businesses, yes.

Small businesses may have one person managing both bookkeeping and accounting tasks, often with help from an external accountant at year-end.

Growing and larger businesses typically separate the roles: bookkeepers manage daily entries, while accountants oversee the books, prepare reports, and support planning.

What matters most is not the job title, but ensuring that both functions are handled properly, transactions recorded accurately, and results reviewed thoughtfully.

Key takeaways: Bookkeeping vs. accounting

To help differentiate between bookkeeping and accounting at a glance, here’s a simple comparison table.

Understanding how bookkeeping and accounting differ gives you a clearer view of how your finance function should work and which tools can support both sides effectively. When consistent daily records meet proper review and analysis, businesses gain real clarity—not just numbers on a screen.

Zoho Books helps bring these pieces together by making daily entries easy for bookkeepers and giving accountants the reports, adjustments, and visibility they need. With everything connected in one place, financial insight becomes easier to access and far more powerful to act on.