- HOME

- Billing basics

- What is an invoice? | Definition, purpose, examples

What is an invoice? | Definition, purpose, examples

An invoice is an itemized commercial document that records the products or services delivered to the customer, the total amount due, and the preferred payment method.

The seller can send either paper or electronic invoices to the customer. The invoices can be paid in one go or in installments, depending on the payment terms that were agreed upon. Depending on the purpose, there are different types of invoices that businesses can create for their customers.

What is the purpose of an invoice?

Invoices represent more than just a formal document that provides the information required to obtain payments from customers. They can help you project a professional image and stay organized during tax filing. Here are the top reasons why invoices are essential:

Helps with accurate bookkeeping

Invoices record the incoming revenue to help track sales. They keep track of when a product was sold or when a project was completed and how much money was made. This data is essential for maintaining accurate bookkeeping records, and for tallying sales and expenses to calculate key metrics such as net profit, net margin, and asset turnover ratio.

Furthermore, invoices help monitor payments due. As a seller, you can check which clients have invoices that remain unpaid or partially unpaid, and which invoices need following up. This way, you can not only keep an eye on your cash flow but also estimate future earnings.

Provides legal protection

What would you do if a customer falsely claimed that you did not deliver goods as promised? Or if a customer refused to pay for the services you rendered?

A professional invoice that serves as a legal document comes to your rescue. Proper invoices can protect your business from unsubstantiated lawsuits. In most cases, customers will pay the unsigned invoices without any issues. However, if you want the invoices to be legal documents, invoices must have a signature to be official. An invoice with all the required details signed by both the seller and the buyer is proof that both parties understood the business terms and agreed to abide by them. It acts as a reliable record of the transaction that establishes the seller's right to payment.

Simplifies tax filing

Invoices back up the information you provide on your tax forms, and they serve as a reliable data source when audits are carried out. Tax filing becomes a hassle-free process in any country when you record and retain all your invoices. For instance,

the IRS (Internal Revenue System) of the United States recommends businesses retain records to support the income, deductions, or credit on income tax returns for at least seven years from the date the returns are filed. The IRS can audit the returns and request to see supporting documents. If your business maintains an organized record of its sales invoices, accurate tax filing and audit preparedness are simple.

Assists in business analysis

Since invoices record the sales you've made, they contain key information such as unit prices of goods or services, the total amounts and dates of transactions that happened, and so on. These records help you gain insights into customers' buying patterns, payment trends, peak buying periods, bestsellers, and much more. This aids you in tailoring your inventory by forecasting demand and developing effective marketing strategies to target the right customers with the right products at the right time.

What should an invoice include?

The specific things to be added to your invoices depend on the industry you are in, region-specific regulations, and the type of work you do. But here are some common things that should be included in any invoice.

The word 'Invoice'

Unique invoice number

Tax ID (if applicable)

Seller name, address, and contact details

Buyer name, address, and contact details

Date of delivery of products or services

Date of sending the invoice

Description of services or products including quantity, cost per unit, and total item cost

Total amount charged, including tax information

Payment terms

Payment options

Purchase order number (if any)

Terms and conditions related to late fees, payment processing fees, return/replacement of goods purchased, and so on

14. Thank you/personalized note

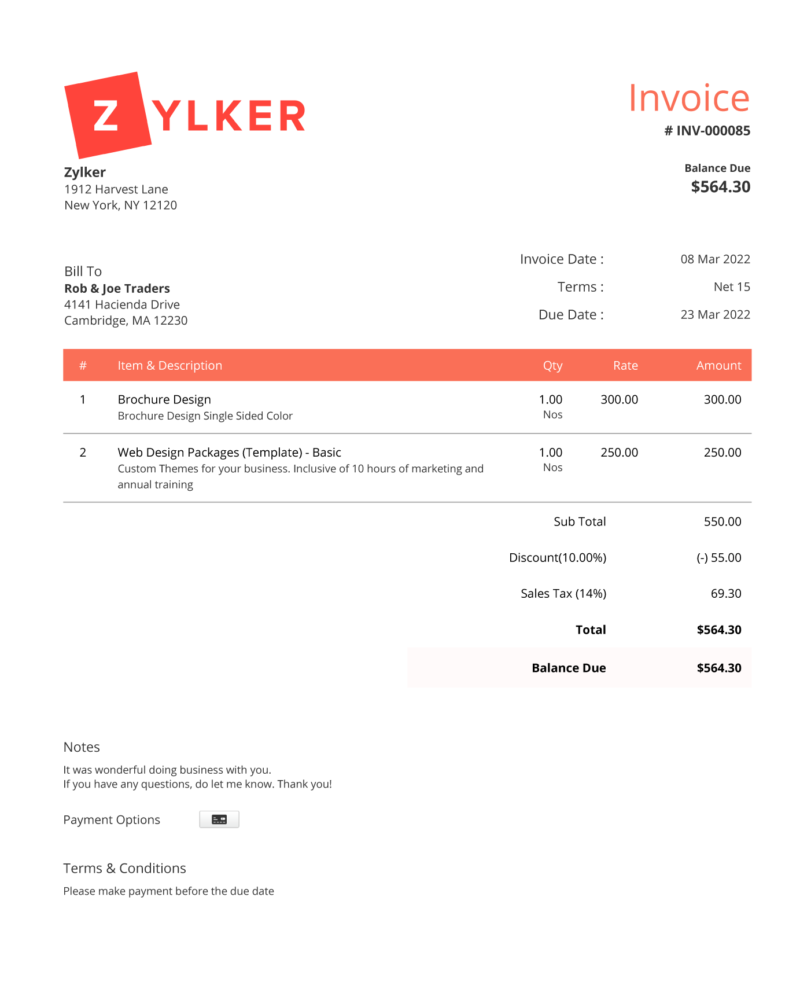

What does an invoice look like?

Sample invoice

When should you send an invoice?

Timing plays a critical role when it comes to sending invoices. The best time to invoice a customer depends on the type of product or service you provide and how often you provide it. For instance, will you be issuing an invoice before or after the delivery, and on which day of the week will you be invoicing your client?

Typically, sending invoices after the product or service is provided is the most common practice. However, many businesses adopt different practices when sending invoices. Here are the most common ones:

Advance invoicing

With this method, the invoices are sent to the customers before the project has been initiated or the product has been delivered. The amount quoted in the invoice could be a deposit, partial payment, or the entire sum. Once you send an invoice seeking advance payment and receive it, you will need to record the transaction. After the completion of the project, the final invoice will reflect the advance already paid and display the remaining balance due.

If you are involved in a long-term project, you may choose to send invoices in advance requesting payment upfront to cover the cost of materials required for the project's completion.

An advance payment confirms the client’s commitment and offsets the possible loss to the business if the customer suddenly cancels the project.

Invoicing each milestone

In this type of invoicing, a client is invoiced after the completion of specific stages or milestones of a project. Each milestone represents a clear sequence of tasks that will eventually build up to fulfilling the contractual obligation. This invoicing practice can be used for expensive or long-term projects.

For example, a digital marketing agency hired for a new product launch could break the project down into milestones, with each milestone priced as one service on the sale order. An invoice is issued at each milestone.

Milestone 1: Marketing audit - $500

Milestone 2: Creating brand identity - $1000

Milestone 3: Campaign launch and PR - $1500

Invoicing on delivery

This is the most commonly followed invoicing method. Businesses send invoices to the customers after the goods have been delivered or the services have been rendered to their customers according to the agreement.

The best practice is to notify customers first that the work is done from your end and verify all the details. Once you receive confirmation that your clients are satisfied, proceed with sending them a professional invoice to get paid.

Recurring invoices

If you are delivering services on a recurring basis to the same customer, then invoices are sent at fixed intervals according to the agreement. This is called recurring invoicing.

For instance, if a customer orders the same three items from you every month, you can set up a recurring invoice for those three items that goes out each month on a particular date.

Key takeaway

In addition to ensuring you get paid for the goods or services rendered, a professional invoice provides legal protection to a business, simplifies tax filing, and assists in analyzing business growth.

No matter how good your product or service is, you will have a hard time retaining customers if your post-project handling is hasty and unprofessional. Once you develop an understanding of the invoicing process, you will be able to get paid faster, manage your accounts more effectively, and better scale your business.

If you are new to this and overwhelmed about handling invoices and payments, don't worry! Fortunately, creating and managing these critical business documents doesn't have to be difficult. Whether you are a freelancer looking for a wide range of customizable free invoice templates or a small business searching for invoicing software to make your invoicing process effective and effortless at zero cost, Zoho Invoice can set you up for success.