Revenue forecasting is the process of estimating the total revenue your business will generate over a specific period. It uses concrete facts to provide actionable insights and help you decide and plan effectively. A realistic forecast can take your business to new heights and sustain it through changing market dynamics. However, it can be quite tricky to forecast your revenue accurately in the beginning, especially with subscription businesses. Subscription revenue forecasting depends on parameters like customer acquisition, retention, upgrades, and churn rate, each of which adds a little complexity to the whole process.

In this guide, we will walk you through some critical components of subscription revenue forecasting and introduce some factors to consider to increase the accuracy of your forecasts.

What is subscription revenue forecasting?

A subscription revenue forecast is a projection of the recurring revenue a subscription business is expected to generate over a specific period (monthly, quarterly, or annually). Using this forecast, businesses can get insights into how they should allocate budgets and plan for business expansion, while investors can decide whether the company’s stocks are worth purchasing.

Metrics used in subscription revenue forecasting

Accurate revenue forecasting is possible only with the support of solid metrics that quantify how your business is doing. Revenue forecasting takes into account parameters including past financial performance, market sentiments, sales pipeline, churn rate, and more. Let’s understand a few of these parameters here.

Monthly Recurring Revenue (MRR)

MRR is the total revenue a subscription business is expected to make in a particular month from all of its active subscriptions.

For instance, if you have 10 customers and each of them pays $30 every month, then your MRR would be $30 * 10 = $300

MRR uses the subscription prices that are contractually agreed upon upfront with customers to calculate the monthly revenue from subscriptions that span multiple billing cycles. Therefore, unlike dynamic revenue generated by one-off sales, MRR represents consistency and predictability for the business, making it indispensable for revenue forecasting.

For instance, let’s assume your current MRR is $100K and your MRR has been growing by 10% per month for the past year. With that data, you can start to forecast how much revenue you will generate 3, 6, or 12 months from now at your current pace.

You can also create better and worse scenarios to compare—for example, what will your MRR be if your monthly growth is 5% as opposed to 10%?

Churn rate

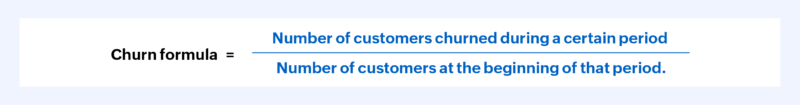

The churn rate is the rate at which a business loses customers (and therefore potential revenue) due to subscription cancellations over a certain period.

When you consider the factors that influence your future revenue, it is vital to include those that deplete it. Your churn rate can be interpreted as the probability that your existing customers will cancel or downgrade their subscriptions. With the help of your historical churn, you can analyze the impact of this potential revenue loss on future earnings and avoid the possibility of overestimating your revenue.

For instance, let’s assume you have MRR of $150,000. For the last year, your sales have risen 12% month-over-month, while your monthly churn has been about 3% each month.

By multiplying the last month’s revenue by your expected growth and subtracting your expected churn, you can forecast your next month’s revenue.

$150,000 + ($150,000 * 0.12) – ($150,000 * 0.03) = $150,000 + 18,000 – $4,500 = $163,500

Your forecasted revenue for next month would be $163,500.

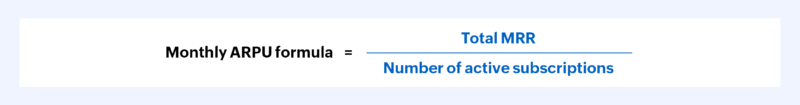

Average Revenue Per User (ARPU)

ARPU is the revenue received by the business from each customer over a period, usually a month or a year. Since ARPU is used to assess the revenue-generating capabilities of a business at the per-customer level, it plays a significant role in revenue forecasting.

For instance, if one of your subscription products is generating $3.5M revenue per month from 10,000 customers, then the ARPU for the product is ($3,500,000 / 10,000) = $350 per month per customer.

If you know your current ARPU and customer count, you will be able to forecast your revenue growth.

For instance, let’s say 30 customers earned you $990 in revenue over two months. The ARPU for this period is $990 / 30 = $33. To forecast the revenue these same customers will generate in a year, all you have to do is multiply this two-month ARPU by six. The yearly ARPU is $33 * 6 = $192.

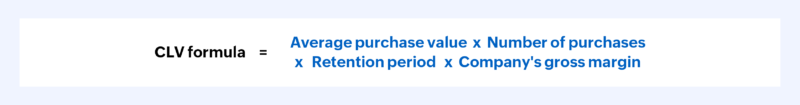

Customer Lifetime Value (CLV)

Customer Lifetime Value (CLV) is the total amount of money a customer brings to your business during their time as a paying customer.

Customer Lifetime Value (CLV) is a key metric used in revenue forecasting, as each paying customer brings additional revenue to the business every billing cycle and throughout their projected lifetime. Factoring CLV into the forecasting process helps you understand the importance of each customer, especially when comparing it with the Customer Acquisition Cost (CAC), which is the cost of acquiring a new customer.

For instance, suppose that your business is planning to lower the pricing of one of your products to attract new leads, but estimates that the new CLV of a customer using that product will be lower than the current CAC for that segment. This insight helps you realize that reducing the price point of that product is an unsustainable business decision.

Factors to consider while forecasting subscription revenue

Now that we have seen the key metrics that must be incorporated while forecasting revenue, let’s look at some best practices to follow to keep your estimates as accurate as possible.

Analyze past performance

Your historical records are an important source of revenue information but don’t forget to think about what you’ve changed since you collected that data. Have you recently introduced a new product or added new marketing activities? This might increase the rate at which you acquire new customers. Have you provided new functionalities and raised your prices to match? That should increase your CLV, but could also increase churn. Are you offering improved customer support? Churn might decrease as customers get a better resolution to their issues. Think about which of your metrics each of these new activities will affect. Even if you don’t have the exact figures needed to calculate the effects yet, you can still identify areas of your forecast to watch for possible changes.

Consider the sales pipeline

Your sales pipeline is a reliable early indicator of how much revenue you can make in the near future, by gauging how many leads your business has that could potentially convert to sales. Studying your past records of the number of customers who were once at the same stage in the pipeline as your current prospects can help you predict the present conversion rate. Remember to consider the time taken for conversion in your revenue forecasting to figure out whether you’re looking at short-term or long-term revenue potential from these leads.

Take sales, marketing, and other factors into account

A good revenue forecast should factor in the company’s marketing and sales performance, as they are critical drivers of your new SaaS sales. Accurate recurring revenue predictions depend on many factors: the stage of growth your company is in, the seasonality of your business, new marketing initiatives, promotions, discounts, the success of your sales reps, and so on.

Especially in B2B markets, sales quota planning is critical to forecasting recurring revenue. You can start by analyzing the opportunities within the sales pipeline, considering factors such as sales cycle length, an individual rep’s average win rate, and deal sizes.

For instance, one of your sales reps may have a high win rate with deals worth between $5,000 and $7,000 within a 30-day sales cycle. Therefore, all the open opportunities in that rep’s current pipeline that fit those parameters can be assumed to have a high chance of closing. You can estimate that they will close X number of those deals, bringing X amount in revenue, which becomes part of the forecast.

Predict the renewal rate

Indicators like NPS score and adoption rate can help you predict some of your customers’ behavior, but for accurately forecasting subscription revenue, it’s vital that you also understand your renewal rate. A customer’s likelihood of renewing their subscriptions doesn’t stay the same across their life cycle. For instance, a high churn rate is typical in the early billing cycles after a trial period, compared to the later billing cycles of satisfied long-term customers. There is a significantly higher chance that a customer who has been billed 12 times already for your service will renew their subscription for a 13th billing cycle, compared to a customer who has been billed only once.

Cohort analysis is one way of calculating the likelihood of customers being renewed each month by grouping the users into cohorts based on timeframe and persona.

Time-based cohorts divide users by when they signed up first for your product/service. You might break down these cohorts by the day, the week, or the month they signed up and see how many of them continue to be active as time goes on.

Behavioral cohorts divide your customers into personas based on their interactions with the product, such as frequency of product usage, use of certain features, demographics, and so on. By dividing your customers based on their characteristics, you can better understand your customer behavior, realize what best works for that specific group and what doesn’t, and plan suitable retention strategies for your product.

Key takeaway

Recurring revenue is the lifeblood of any subscription business, and forecasting it plays a crucial role as your business scales. By tracking a set of essential subscription metrics and considering the other factors at play, you can accurately predict your revenue growth, know where your opportunities lie, adapt to market changes, and make strategic investment decisions.