- HOME

- Billing basics

- What is Customer Lifetime Value (CLV) - Definition, Formula, Calculation with Examples

What is Customer Lifetime Value (CLV) - Definition, Formula, Calculation with Examples

New customers are always exciting, but which ones are contributing most to your revenue growth?

The customer who makes a one-time purchase worth $1000 or the one who makes repeated purchases of $50 for several years?

It turns out that a customer who makes small yet repeated purchases for years is often the one to bring more revenue than the one who splurges on a discount once and doesn't come back. Hence, it's good for your marketing and customer success teams to focus on retaining such kind of high-value customers. But how do you figure out which of those are high-value customers?

That's where the metric Customer Lifetime Value (CLV) enters. Measuring CLV can help you learn how well you resonate with your target audience, how much your customers like your product or service, what you should improve to earn their loyalty, and how you should budget for your customer retention campaigns.

This guide will walk you through what CLV is, how you can accurately calculate it, and why monitoring is crucial for any subscription business.

What is Customer Lifetime Value(CLV)?

Customer Lifetime Value (CLV) is the total predictable revenue your business can make from a customer during their lifetime as a paying customer.

For instance, if a customer subscribes to one of your products under a one-year plan, at that time, the lifetime of that customer is one year long. Their lifetime value will be the amount you expect to make in that year.

Hence, the longer the customers stay and the more often the customer buys from you, the greater will be their CLV. If you can determine the profile of the customers that produce the highest CLV, you can use those profiles to acquire more customers that closely resemble those existing high-value customers.

Why is calculating Customer Lifetime Value important for your subscription business?

Let's look at some of the significant benefits of monitoring CLV for a subscription business.

Identify high-value customers

Businesses don't want to spend their money and resources on acquiring customers that will not be profitable. They want to know how much they should invest in marketing activities that will attract the best customers. But what does 'Best Customer' mean to them? There are different answers to this: Customers who are the most loyal, customers who are the most profitable, customers who are easier to attract and retain.

Well, how about all of the above? These are called high-value customers or customers having high Customer Lifetime Value (CLV). By calculating the CLV of each customer and ranking them by the results, you can identify the high-value customers. The higher the CLV, the more valuable the customer. Hence, measuring CLV helps you to knowledgeably build out your product, tailor your marketing and sales activities to maximize the likelihood of acquiring and retaining such high-value customers.

Determine how much to invest in the acquisition

Nothing bogs down a business faster than spending more money to acquire customers than you receive once they've signed with you. That's why understanding how your CLV relates to the Customer Acquisition Cost is important. While CAC answers how much it costs to acquire a new customer, the CLV reflects the other half of the equation - how much is a customer worth. The balanced ratio of these two metrics gives answers the ultimate question - "what is the true value of the customer to my business?". Together, the metrics CAC and CLV represent a prototypical Return On Investment (ROI) a business can gain from an acquired customer and helps to check whether the investment levels are sustainable for long-term business viability and value creation.

Let's understand the relation between CLV and CAC through the example of a subscription based business:

Let's assume they sell their products under three different plans: Basic plan: $8, Standard plan: $16, and Premium plan: $21.

Suppose the average customer stays subscribed for 24 months and pays $16 per month.

The CLV can be calculated as:

CLV= Average Monthly Revenue × Average Customer Lifespan

CLV = $16 * 24 = $384

This means each customer, on average, contributes $384 in revenue over their lifetime.

The cost to acquire customers includes marketing expenses, sales commissions, etc. Let’s say the total cost to acquire 500 customers is $10,000. Then, the CAC per customer is

CAC= Total Acquisition Cost/Number of Customers

CAC = 10,000/500 = $20

This means on average, it costs $20 to acquire each new customer.

Relationship between CLV and CAC: To assess the health of the business, you compare CLV to CAC. Ideally, CLV should be significantly higher than CAC to ensure profitability and sustainability.

In this example, the CLV of $384 is much higher than the CAC of $20. We can infer that the business is spending its marketing budget wisely and will gain more profits from each customer than it invested in acquiring them.

Note:

If CLV > CAC: The business is likely profitable because each customer generates more revenue than the cost to acquire them.

If CLV < CAC: The business may struggle to be profitable in the long run, as the cost of acquiring customers exceeds the revenue they generate.

Build brand loyalty

Brand loyalty is one of the important and most challenging strong points for a business to achieve. The CLV provides a better dimension to customer relationships by making businesses aware of a customer's worth, especially those considered loyal having high CLV.

High CLV customers are loyal customers, and they offer your company many benefits. They stick with your business longer and offer valuable feedback as they grow with you. Those customers become the best brand advocates giving you good word-of-mouth referrals that hugely help in building your brand reputation.

Hence, focusing on improving your CLV through different loyalty initiatives plays a significant role in driving customer engagement and building strong brand loyalty.

How to calculate Customer Lifetime Value (CLV)?

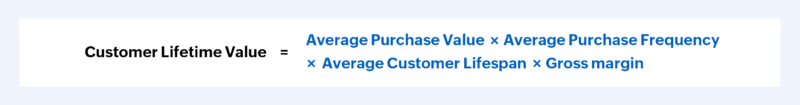

Customer Lifetime Value is calculated by multiplying your customers' average purchase value, average purchase frequency, and average customer lifespan.

Customer Lifetime Value formula:

Step 1:

Average Purchase Value (APV) can be calculated by totaling the revenue earned in a specific period and dividing it by the total number of sales generated during that same period.

For instance, if your business generated $20,000 revenue in a month from 200 sales, the APV for that period is $20,000 / 200 = $100.

Step 2:

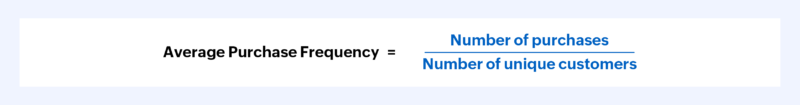

Average Purchase Frequency (APF) is calculated by dividing the number of purchases made by the number of unique customers.

If a customer made multiple purchases over a specific period, they are counted only once in the calculation.

If your business generated $20,000 in a year from 40 customers who collectively made 200 purchases, then the APF is 200 purchases / 40 customers = 5 times.

Step 3:

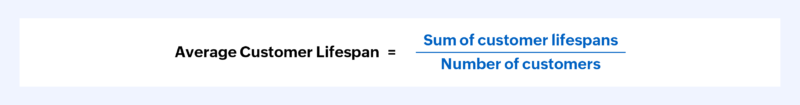

Average Customer Lifespan (ACL) is calculated by adding all of your customer lifespans and dividing by the total number of customers.

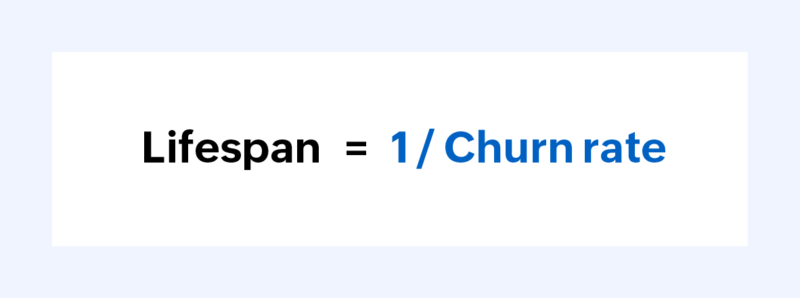

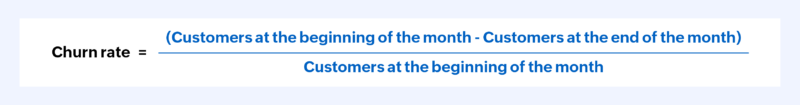

If your business is new and lacks the sample size of customers required for the calculation, ACL can also be derived from the churn rate.

Churn rate = (Customers at the beginning of the period - customers at the end of the period) / customers at the beginning of the period

For instance, if your business has 50 customers at the beginning of the month but only has 45 at the end of the month, then the churn rate is (50 - 45) / 50 = 0.1.

Then the Average Customer Lifespan (ACL) will be,

1/ Churn rate = 1 / 0.1 = 10 months.

Step 4:

Now that we have all the components needed for CLV, we can calculate it by simply multiplying them all together.

With an Average Purchase Value of $100, an Average Purchase Frequency of 5, and an Average Customer Lifespan of 36 months, the Customer Lifetime Value is:

Average CLV = $100 * 5 * 36 = $18,000

Using gross margin to get a more accurate CLV

Calculating CLV tells you how much revenue you're getting from each customer, but not how much profit. To get a more accurate idea of the profitability of each customer, you'll need to factor in your gross margin or the percentage of your revenue that generally goes toward buying more goods.

Your gross margin is the percentage of your total revenue that remains after subtracting the Cost Of Goods Sold (COGS).

For instance, if your total revenue generated per month is $20,000 and your COGS is $8,000, you would first subtract the COGS from the revenue and get $20,000 - $8,000 = $12,000.

Then, divide the resulting value by the total revenue (12,000 / 20,000 = 0.6) to arrive at a gross margin of 0.6.

To represent gross margin as a percentage: 0.6 * 100 = 60%

To arrive at your more accurate CLV, multiply the customer value, average customer lifespan, and gross margin:

CLV = 500 * 36 * 0.6 = $10,800

This value is significantly lower than the $18,000 we got from the earlier CLV calculation, showing that quite a lot of the revenue you get from each customer is simply recouping the cost of the goods they're purchasing. If you want to understand the value of your customers in terms of the money you can actually put back into the rest of your business operations, it's worthwhile to put in the effort to determine the gross margin and include it in the CLV calculation.

Approaches to CLV calculation

Although we saw one simple CLV formula above, there isn't just one way to calculate CLV. There are several approaches, including historical, predictive, and traditional, and the best method to use depends on your business type and resources.

Historical approach

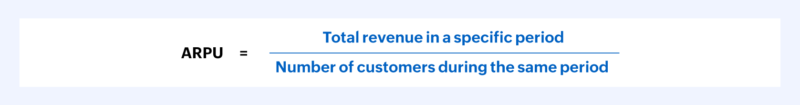

Historical CLV is a straightforward approach to calculating a customer's lifetime value based on the gross profit your business has made in the past. The calculation is simple because you only need data on previous purchases. You can compute historical CLV using either Average Revenue Per User (ARPU) or cohort analysis.

Suppose that 20 of your customers brought in $1,300 in revenue for your business over three months. Your ARPU for three months is $1,300 / 20 = $65

Let's calculate how much these customers will bring you in one year.

ARPU for 12 months = ARPU for 3 months * 4

$65 * 4 = $260 per year per customer

Cohort analysis takes the ARPU method further by grouping together customers who made their first purchase during the same month and have similar characteristics. If you have a large enough data set, you can use cohort analysis to calculate the average revenue for specific cohorts whose characteristics are relevant to the forecast you're trying to create, instead of for your average customer.

The biggest drawback of historical CLV is that it lumps customers together who may not have the same purchasing behavior at all. This can be a problem if you're changing your products or marketing behavior, for example. Changes you've made recently may already be bringing in new customers whose preferences and purchasing decisions won't be accurately predicted by historical CLV. Cohort analysis can help to some extent, by allowing you to select cohorts of customers that are more likely to resemble your future customers. But as long as you're still using data derived from older customer cohorts, you may still find that it's not accurately predicting your future CLV.

Predictive approach

Predictive CLV is intended to measure the total value a customer will give a business eventually over their entire lifetime. The predictive approach is based on both historical transactions and current customers' behavioral trends, such as purchase frequency. Unlike historical CLV, which can provide only insights into what has happened before, predictive CLV helps you understand the present worth of a customer and forecast how their value will change in the future. This may help you launch targeted campaigns and prioritize your acquisition and engagement activities so that they attract and retain customers with high lifetime value.

T: Average number of transactions per month

AOV: Average Order Value

AGM: Average Gross Margin

ALT: Average customer lifetime (in months)

Now let's create some hypothetical values to plug into this formula.

T (Average number of transactions):

Period: 3 months

Total transactions: 120

T = 120/3 = 40

AOV (Average Order Value)

Total revenue over a specific month (August): $10,000

Number of orders: 20

AOV = $10,000 / 20 = $500

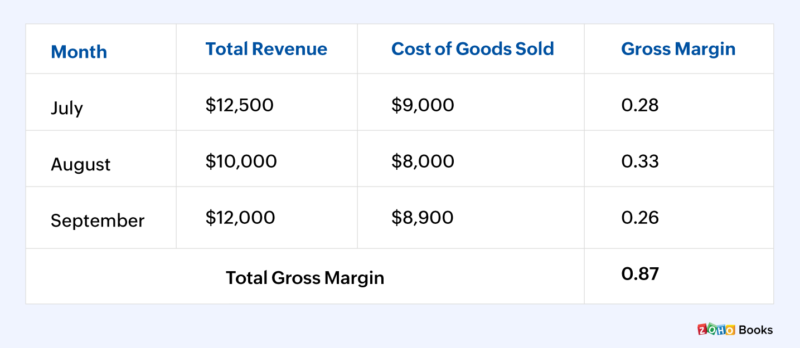

AGM (Average Gross Margin)

- Calculate gross margin percentage per month

Gross Margin = [(Total Revenue - Cost of Goods Sold) / Total Revenue] * 100

Example:

Total revenue (August): $10,000

Cost of Goods sold: $8,000

Gross Margin (%) = [($10,000 - $8,000) / $10,000] * 100 = 33%

- Determine average gross margin for a three-month period.

Total Gross Margin = 0.87

Average Gross Margin = 0.29

ALT (Average lifespan of a customer)

ALT = 1/ Churn rate

To measure churn rate:

Example:

You had 200 customers at the beginning of August and 150 customers at the end of September. The churn rate will be:

200 - 150) / 200 = 50 / 200 = 0.25, or 25%

ALT (Average customer lifespan) = 1 / 25% = 1 / 0.25 = 4 months

Now, we have all the values needed for our predictive CLV calculation:

Average number of transactions (T) = 40

Average Order Value (AOV) = $500

Average Gross Margin (AGM) = 0.29

Average customer lifespan (ALT) = 4 months

Predicted CLV = (T * AOV * AGM *ALT) / Number of customers at the end of the particular period

Predicted CLV = (40 * $500 * 0.29 * 4) / 150 customers at the end of September

= $23,200 / 150

= $154.66

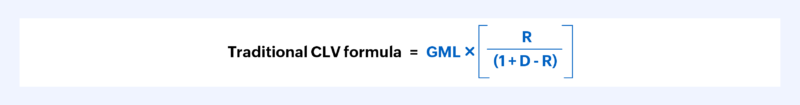

Traditional approach

Business growth is anything but linear. So, what happens when your sales per customer don't stay the same year after year, and you need to consider the changes that happen across the customer's lifetime? In this situation, you need a more in-depth CLV formula that takes margins, inflation, and retention rate into account and gives a more nuanced picture of how CLV changes over the years.

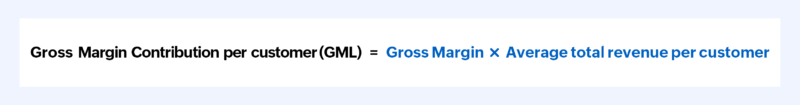

GML is the Gross Margin contribution per customer, which is the profit you expect to make over the average customer lifespan. It consists of revenue minus the Cost of Goods Sold.

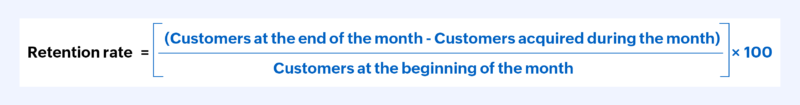

R is the retention rate: the percentage of customers who stick with your business over a defined period.

D is the discount rate, which is included to account for inflation. Generally, a discount rate of 10% is used for SaaS businesses.

Example:

- Gross Margin Contribution per customer (GML)

Gross Margin = 0.29

Average total revenue = $1,000

GML = 0.29 * 1,000 = $290

- Retention rate

Suppose that for September you had:

Customers at the end of the month = 300

Customers acquired during the month = 50

Customers at the beginning of the month = 270

R = [(300 - 50) / 270] * 100 = (250 / 270) * 100 = 0.9 * 100 = 90%

- Discount rate: let's take the standard discount rate of 10%.

Now just plug the values into the CLV equation.

CLV = GML * [R / (1 + D - R)]

CLV = $290 * [0.9 / (1+ 0.1 - 0.9 )]

= $290 * (0.9 / 0.2)

= $290 * 4.5

= $1,305

CLV vs LTV

CLV and LTV both refer to customer lifetime value, which measures the total revenue or profit a customer generates over their entire relationship with a business. However, they are often used interchangeably depending on the context.

Lifetime value (LTV) refers to the total value of all customers to a business over their entire lifetime. It provides a broad perspective on the overall revenue or profit contributed by all customers collectively.

LTV is often used in strategic planning, financial analysis, and understanding the overall health of the customer base.

Customer Lifetime Value (CLV) focuses on the value or worth of each individual customer to the business. It takes into account factors such as customer acquisition costs, retention rates, purchase history, and potential future value.

Calculating CLV helps businesses identify high-value customers, personalize marketing strategies, and prioritize customer service efforts.

LTV and CLV are related concepts that measure customer lifetime value. LTV looks at the collective value of all customers, whereas CLV provides insights into the specific value of individual customers and their potential future value to the business. Both metrics are essential for businesses aiming to optimize customer relationships and maximize long-term profitability.

Closing remarks on customer lifetime value

Successful subscription businesses regularly monitor their customer lifetime value and constantly strive to increase it. CLV offers companies an opportunity to refine their marketing and customer management strategies to increase customer retention rates and revenue. There are different approaches to calculating CLV. They all have their advantages and drawbacks, and the right approach depends upon the type of business you are running, the type of industry your company operates in, the tools you have to calculate your metrics, and the way you calculate your sales and marketing investments.

CLV is just a piece of the complex financial puzzle, but when compared with other metrics and combined with advanced analyses, it can be a powerful way to understand the value of your customers and make the most of their business.

Improve your CLV with Zoho Billing for sustainable growth.

Zoho BIlling is an end-to-end billing software designed to simplify your complex billing needs. Its advanced billing features and business reports on Churn Rate, ARR, MRR, and CLV help business maximize revenue with minimum effort.

With Zoho Billing's detailed CLV reports, you can grow your market presence, improve retention rates, and establish yourself as a customer-focused brand. This gives you a competitive advantage against others in the industry in today's market.

Take Zoho Billing for a spin with our free demo account and explore the world of optimized billing efficiency.

Most Frequently Asked Questions

1. Why is CLV important?

CLV helps businesses make informed decisions about customer acquisition, retention strategies, and overall marketing investments. It guides decisions on how much to spend on acquiring new customers versus retaining existing ones.

2. How can businesses increase CLV?

Businesses can increase CLV by improving customer satisfaction, encouraging repeat purchases, upselling or cross-selling, offering loyalty programs, providing excellent customer service, and personalizing marketing efforts.

3. How does CLV differ from customer acquisition cost (CAC)?

CLV focuses on the value a customer brings over their entire relationship with the business, whereas CAC calculates the cost incurred to acquire a new customer. The ratio of CLV to CAC is a key metric used to assess the long-term health of a business.

4. Is CLV applicable to all businesses?

Customer lifetime value is particularly relevant for businesses with a focus on recurring purchases or long-term customer relationships, such as subscription services, retail, telecommunications, and financial services.