- HOME

- Taxes & compliance

- Essential information about VAT in Oman

Essential information about VAT in Oman

Tax is defined as a compulsory fee imposed on individuals or organizations, that is collected by the government bodies for public services and welfare initiatives. Tax can be broadly classified into direct and indirect tax.

Direct tax, as the name suggests, is paid directly to the government. Indirect tax, on the other hand, is collected by the seller on behalf of the government, such as on the sale of goods and services.

Value Added Tax (VAT) is a form of indirect tax levied on good and services which are bought, sold, or imported into the Sultanate. It needs to be paid at every stage of a supply chain, from the purchase of raw materials to the sale of the end product. VAT is commonly expressed as a percentage which is added to the total cost.

The implementation of Value Added Tax (VAT) in the Sultanate of Oman will change the way your business performs its accounting operations. This guide is meant to help you understand the basics of VAT and how it will impact you and your consumers.

In this guide we will take a look at the following:

- How does VAT work?

- Why is it being introduced in Oman

- Who should register for VAT

- VAT rates

How does VAT work?

The tax under the VAT regime in Oman can be classified into two types: output tax and input tax. If your business is VAT registered, then output tax is the value added tax that you need to charge the buyer when you sell your own goods and services. Input tax is the value added tax that you will need to pay for the goods and services that you purchase.

As per government norms, the value of VAT to be remitted to the Tax Authority (TA) is usually the difference between output tax (VAT charged on sales) and input tax (VAT paid during purchase).

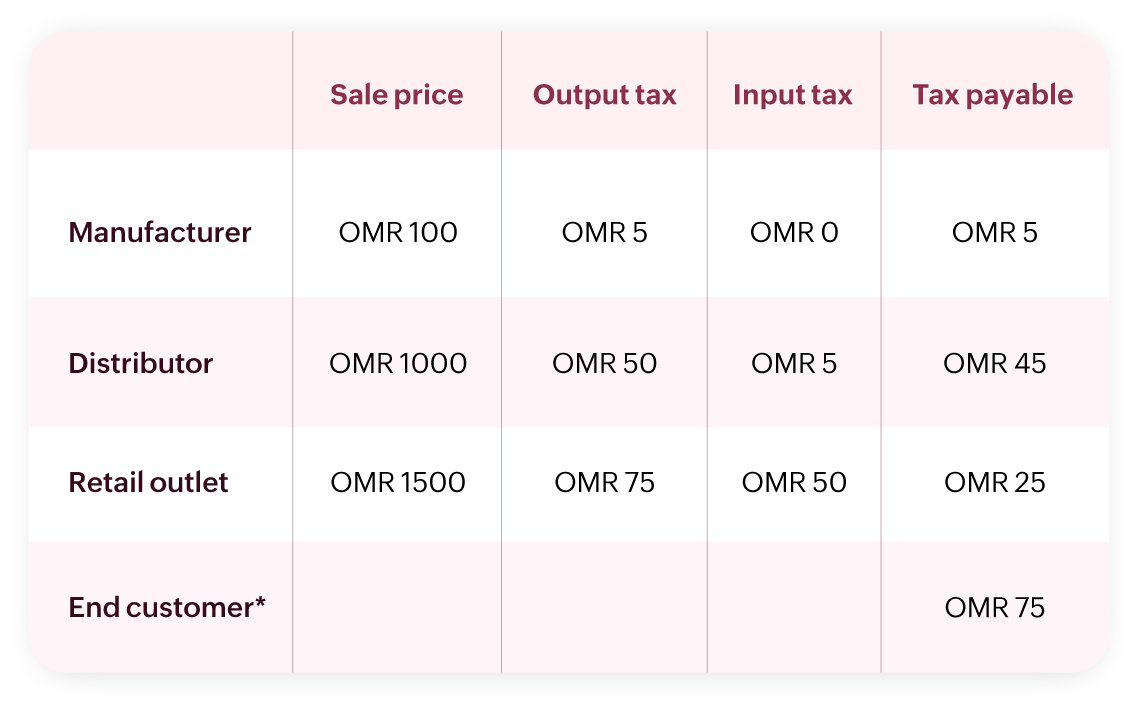

Let us look at an example to understand this better.

1. Let us assume that a 3D printer manufacturer sells a printer to a distributor at OMR 100 and charges 5% VAT (OMR 5). As per the new tax system, the manufacturer will collect VAT on behalf of the government. The distributor pays OMR 105.

2. In the next stage, let us assume the distributor increases the price of the 3D printer to OMR 1000 and sells it to the retailer with 5% VAT (OMR 50). The retailer pays OMR 1050. The distributor collects the VAT from the retailer on behalf of the government and pays OMR 45 (Output tax OMR 50 - Input tax OMR 5) to the tax authorities.

3. The retail outlet now increases the price to OMR 1500 and sells it to a customer with 5% VAT (OMR 75). The customer pays a OMR 1575. The retailer collects the VAT from the customer and pays OMR 25 (Output tax OMR 75 - Input tax OMR 50) to the tax authorities.

4. The VAT paid by the end customer is OMR 75.

Here's an illustration to understand this better.

*VAT is levied throughout the various stages of the supply chain, but the end consumers will ultimately bear the cost of it.

Why is it being introduced in Oman?

By introducing VAT, the Sultanate of Oman plans to generate more revenue for the government. This will help it recover from the revenue loss caused by the recent slump in oil prices. Further, with the introduction of the consumption tax, the Sultanate will be able to provide better quality public services without being completely dependent on the oil and other hydrocarbon sectors (which act as its main source of revenue). This new tax regime is expected to impact the economic and social services positively, create sustainable infrastructure, and maintain a stable income that will help in predicting and coping with future economic conditions.

Who should register for VAT?

Registration may be mandatory or voluntary, based on the revenue a business generates.

Mandatory registration: You must register your business for VAT if its taxable supplies and imports within the Sultanate of Oman reach or exceed the annual mandatory registration threshold of OMR 38,500.

Voluntary registration: You can voluntarily register your business, if your taxable supplies and imports within the Sultanate of Oman reach or exceed the annual voluntary registration threshold of OMR 19,250.

Irrespective of your business turnover, if your business is not established in Oman but still provides taxable supplies to other businesses in the Sultanate, then you must also register for VAT.

There are two tests to determine whether you need to register your business for VAT in Oman.

Backward look: Here you will need to check if your taxable turnover has exceeded the mandatory VAT threshold for the current month and the previous 11 months.

Forward look: Here you will need to check if your taxable turnover is expected to exceed the mandatory threshold in the current month and in the upcoming 11 months.

The last date for registration is 1 January, 2021. An unregistered business must continuously carry out both of these tests on a monthly basis, and if either condition holds true, then they must immediately register for VAT.

Exemptions

There are a few kinds of businesses that are exempt from registering for VAT:

- If you are a taxable person or business selling exempt supplies, even if your revenue exceeds the prescribed threshold, you do not need to register for VAT.

- If you are a taxable person or business engaged in manufacturing zero-rated supplies, you may request to get exempted from registering for VAT.

Deregistration under VAT

VAT registered persons or businesses can apply for deregistration in the following cases:

They are producing non-taxable supplies

They stop conducting business activities

The value of their supplies is less than the voluntary registration threshold

Any other cases mentioned in the Executive Regulations

VAT rates

As per GCC treaty, the standard VAT rate applicable will be 5%. However, there are certain goods and services which may either be exempt (meaning that VAT will not be applicable at all) or be zero-rated (meaning that 0% VAT will be applicable). The standard VAT rate will be applicable on all goods and services which are not included in the list of exempt or zero-rated supplies.

Zero-rated supplies include:

Food items such as dairy, fish, meat, sugar, salt, and bread

Medicines and medical equipment

International or intra-GCC supplies of goods or services

Supplies of crude oil, oil derivatives, and natural gas

Investment gold, silver, and platinum

Means of transport plus associated services

VAT-exempt supplies include:

Financial services

Health care

Education

Bare land

Local passenger transport

Renting or resale of residential property

Conclusion

With the introduction of VAT in Oman, businesses will need to adapt to new ways of bookkeeping. They will need to check their annual turnover and register for VAT before the registration deadline of 1 January 2021. For some businesses, VAT registration may not be mandatory until the business expands.

When VAT was introduced in UAE, Saudi Arabia, and Bahrain, local businesses who adopted VAT early found it easier to generate tax invoices and file returns. The new system is an important change for Oman, but it doesn't have to be disruptive for your business. By learning about VAT and its requirements early, you can give yourself plenty of time to register your business, implement any new systems you may need, and have a smooth compliance process in place when VAT takes effect.