- HOME

- Taxes & compliance

- Learn everything about Supply under VAT in Oman

Learn everything about Supply under VAT in Oman

What is a supply?

A supply refers to goods or services that are exchanged between a buyer and a seller for the purpose of consumption. It can also be defined as a transaction taking place between two stakeholders where at least one of them is a registered taxpayer.

Components of supply under VAT

There are three main components that help a business owner determine the VAT to be applied on a supply in Oman: place, date, and value.

1. Place of supply: This component determines whether the transaction is occurring inside or outside Oman, and it is determined separately for goods and services. It may even vary between taxable (B2B) and non-taxable customers (B2C).

If you sell goods to a customer outside Oman, the supplier's place of residence is also the place of supply. If you provide services to a customer outside Oman, the customer's place of residence is the place of supply. If the customer is not registered for VAT, then the supplier's location will be used as the place of supply for both goods and services.

For instance, if you sell an office table from Oman to a customer in the USA, your place of supply will be Oman. If you provide consultancy services from Oman to a customer who is registered for VAT in Saudi Arabia, the place of supply will be the customer's location—which is outside of Oman. However, if your consultancy services customer in Saudi Arabia is not registered for VAT there, the place of supply will be the supplier's location—which is Oman.

2. Date of supply: This component determines the tax period during which the transaction is taking place. Generally speaking, the date of supply is when the services are completed, or when the goods are either shipped or provided to the customer. However, VAT may be applied before that date.

VAT becomes applicable to the transaction on the earliest of the following dates:

- when an advance payment is received for the supply

- the actual date of supply

- the date of the invoice for the supply

- when full payment is received for the supply

For continuous supplies, VAT becomes applicable on the earlier of:

- the payment date specified in the tax invoice

- the date of actual payment

For example, suppose you make a sale for which you receive an advance payment on 30 April, ship the goods on 15 May, invoice the customer on 1 June, and receive full payment on 30 June. The date of supply is 15 May, but VAT is applied to the supply on 30 April when you receive the advance payment.

3. Value of supply: This component determines the base value on which VAT needs to be applied. The value of supply includes the price of the goods or services plus any expenses or fees added by the supplier, but it does not include VAT or discounts applied. The VAT for a transaction can be calculated as 5% of the value of the supply.

Types of supply

Under Oman VAT, supply can be classified into four types:

1. Standard-rated supply: The standard VAT rate of 5% will be applicable on all goods and services of this type.

Suppose you sell stationery products and other office supplies to consumers or businesses. These supplies you provide to your customers are standard-rated supplies according to the VAT law. For these supplies, a VAT rate of 5% will be applied. All the goods and services that aren't specifically included in the zero-rated or exempted categories are standard-rated supplies.

2. Zero-rated supply: These supplies are taxed at 0% and cannot be used to claim rebates. An invoice raised for a zero-rated supply will have 0% mentioned in the tax column. Following are the goods listed by the Oman Tax Authority which are zero rated:

- Food items including dairy products, fruits and vegetables, fresh eggs, water, tea, and more

- Supplies of crude oil, oil derivatives, and natural gas

- International transport of goods

- Medical-related supplies including medicines, medical equipment, and more

3. VAT-exempt supply: Supplies which are not affected by the VAT implementation are known as exempted supplies. VAT will not be charged for such supplies. If any VAT was paid previously during purchase, that won't be available for credit.

For example, let us assume that an educational institution distributes books to students every year. Since education is tax exempt, the institution cannot charge any VAT on the books that they distribute or get any VAT credit for the books that they purchased.

Some VAT-exempt supplies include financial services, healthcare, local passenger transport, and renting or resale of residential property.

4. Out of scope: If the supply of goods and services takes place within Oman, then it falls under the scope of the law and VAT will be charged. However, if the supply is made outside of Oman, then it will be considered outside the scope of law and VAT will not be charged. For example, company A wants to sell books to company B. The books are shipped from company A's warehouse in India to company B's warehouse in Bahrain. The goods do not pass through Oman, so VAT will not be applicable on these goods.

The following are the supplies which are outside the scope of Oman's VAT law:

- Supplies made by non-taxable persons

- Supplies made outside Oman

- Sales/exchanges between two entities located outside Oman

Application of VAT on goods, services, and contracts

Let us say your supply needs to be done in parts. You will provide one part of the supply before the implementation date and the rest after the implementation date. In that case, the VAT rates applicable will be different depending on whether the supply involves goods or services, and whether it involves a contract.

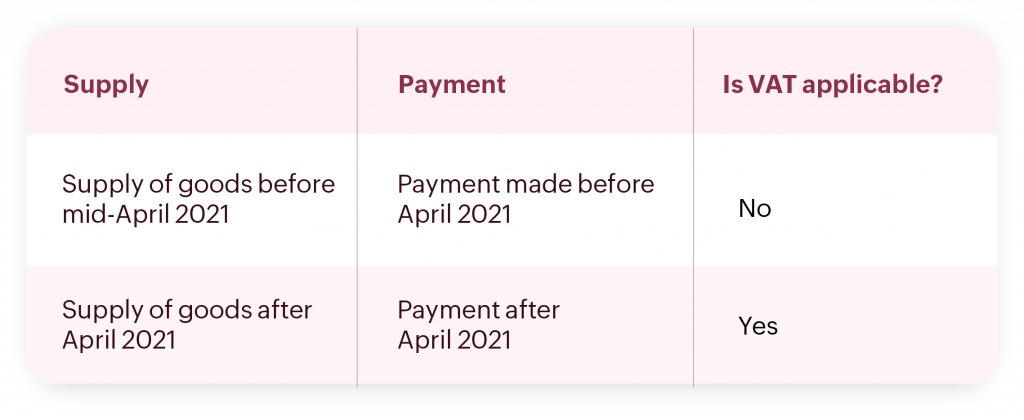

Goods

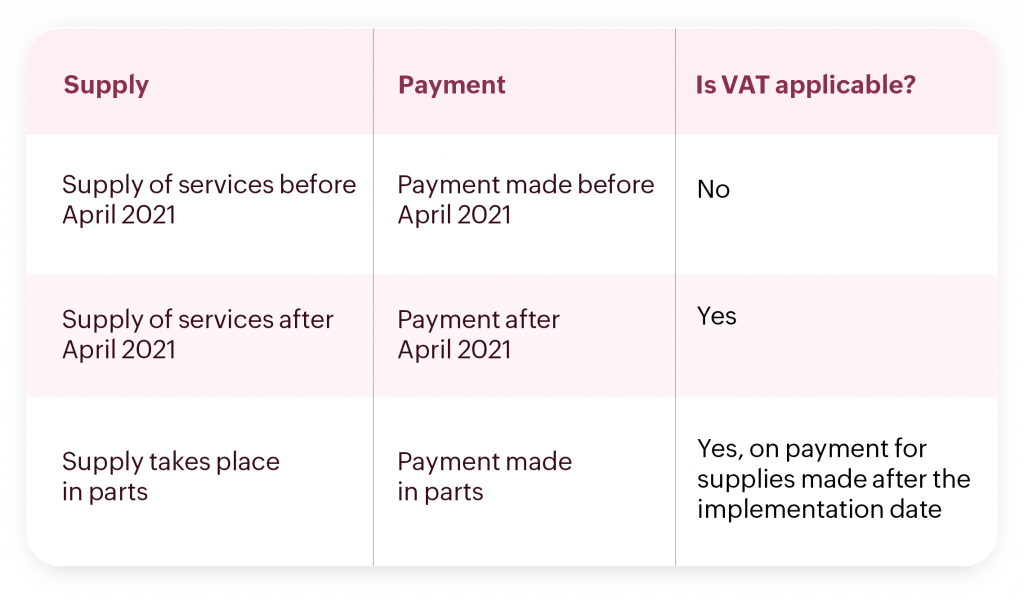

Services

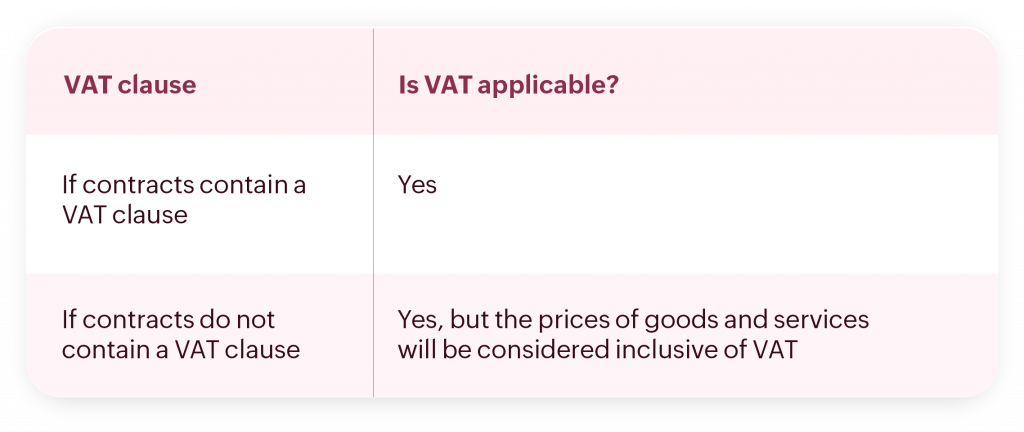

Contracts

If you have signed a contract before April 2021 and this contract will extend past the VAT implementation date, then the application of VAT will depend on whether the contract includes a VAT clause:

Conclusion

As a business owner, you must have a clear understanding of how VAT will be applicable on different supplies and how it will affect your business. You will need to keep a close eye on its impacts on your finances, especially during the transition period. Make sure you know what actions you should take if you are supplying goods or services on a continuing basis or in parts both before and after the implementation date. Knowing the VAT rules and how to apply them to each transaction will help your business seamlessly transition to the new tax regime.