- HOME

- Accounting and payroll

- Beginner's guide to payroll accounting in India

Beginner's guide to payroll accounting in India

Payroll accounting is the process of tracking and recording an organization's expenses related to employee payroll. It helps employers get a clear picture of the cost of each employee and cash flow of the business.

Payroll accounting is a complex process that can have a major impact on a company's bottom line. Whether you are a small business owner, payroll professional, or financial executive, you need to understand the intricacies of this process to make informed decisions that will benefit your company.

This guide will help you learn what payroll accounting is, its components and purpose, and how to set it up effectively. Additionally, this will explain how an integrated payroll and accounting software can help you streamline this crucial business process.

What is payroll accounting?

Payroll accounting refers to the process of recording, organizing, and managing an organization's employee expenses information. It includes all the financial aspects related to employee compensation, such as salaries, bonuses, arrears, deductions, and taxes.

Accountants or payroll professionals in an organization typically track these financials through journal entries. These journal entries are made in the company's books of accounts each month once the payroll for the month is processed.

This demanding yet critical process helps you maintain financial records, ensure timely and accurate payments to employees, and meet statutory requirements.

As per the Companies Act of 2013, every company in India is required to maintain books of accounts to record their financial transactions, including payroll expenses.

Why payroll accounting is important

Besides complying with tax laws, payroll accounting is essential for you to make strategic decisions and scale your business. Here are a few reasons why payroll accounting is important.

- Make informed decisions: Maintaining meticulous payroll accounting allows you to understand labor costs and trends within your business. This will come in handy when you are making decisions regarding employee hiring, compensation, and benefits.

- Improve your cash flow: Payroll is a major expense for most businesses. By analyzing your payroll data, you can identify areas where you can save money on payroll costs and improve your business's cash flow.

- Create realistic budgets: It provides valuable insights into your business's financial health. This information will help you forecast future expenses and come up with budgets that are flexible enough to accommodate change.

What's included in payroll accounting?

Payroll accounting consists of several components that may vary based on your organization's specific requirements. However, in general, it covers the following key components.

- Employee information: Maintain records of employee details like names and employment contracts.

- Gross earnings: Calculate and track employees' gross earnings, which includes monthly wages, overtime pay, bonuses, commissions, and allowances.

- Deductions: Account for various deductions from employees' salaries, such as provident fund contributions, health insurance premiums, and other statutory deductions.

- Taxes: Calculate and withhold applicable taxes, including income tax, professional tax, and any other relevant taxes.

- Employee advances: Track advance money paid to employees until they are repaid or accounted for as company expenses.

- Reimbursements: Maintain records for reimbursements due to be paid out to employees.

How to set up payroll accounting

Establishing payroll accounting from the ground up can be daunting, but it will help you keep your records clean as your business grows. Here is a step-by-step guide for implementing a payroll accounting system.

- Register your business.

- Determine how you want to maintain your books of accounts.

- Choose an accounting method.

- Establish a comprehensive salary structure.

- Create a chart of accounts for payroll expenses.

- Set up a business bank account.

- Configure recurring payments to employees.

- Record salary journal entries.

Register your business

Ensure your business is legally registered and obtain a unique Tax Deduction and Collection Account Number (TAN), as well as registration numbers from statutory bodies such as the Employees' Provident Fund Organization (EPFO),Employees' State Insurance Scheme (ESI), labour welfare fund, and professional tax authorities.

Determine how you want to maintain your books of accounts

After completing the registration process, choose how you want to maintain your business's books of accounts. The three common methods of maintaining accounts are as follows.

- Recording transactions manually: This is a traditional approach where businesses rely on spreadsheets to maintain their accounts. This method is prone to manual errors, can be time consuming, and lacks automation features.

- Hiring an accountant: A few businesses choose to hire an accountant as they bring in their expertise in financial management and ensure accurate reporting of transactions. However, if you are a small business and are stringent with money, this approach can turn out to be costly.

- Choosing an integrated payroll and accounting software: This is the efficient and modern way of organizing your books of accounts. A tightly integrated software like Zoho's can help you achieve seamless data flow, eliminate duplication, and streamline your accounting and payroll processes.

Choose an accounting method

Once you decide how to maintain your books of accounts, the next step is to select the most suitable accounting method for your business.

- Cash accounting: In this, you will be recording transactions when cash is received or paid. It focuses on actual cash inflows and outflows, making it straightforward to implement for small businesses. However, this method may not provide an accurate representation of a business's financial performance.

- Accrual accounting: In this method, revenue and expenses are recorded regardless of the cash flow timing. Revenue is recorded when earned, and expenses are recognized when incurred. Advantages of this approach include accurate representation of business activities, improved tracking of liabilities and receivables, and compliance with accounting standards. However, it requires more complex record keeping, including estimations and adjustments for uncollected revenue and unpaid expenses.

To ensure your business's financial health and growth, it is advisable to assess your accounting needs and opt for an accounting method that aligns with your operations and compliance requirements. Learn more about the pros and cons of each accounting method in this article on different types of accounting methods.

Establish a comprehensive salary structure

A salary structure refers to the framework that defines the different components and their respective proportions in an employee's compensation package. It consists of basic pay, allowances, bonuses, and other benefits.

To create a salary structure, begin by analyzing your business needs, employee job roles, their experience levels, and market benchmarks. Identify the salary components based on the various labor laws laid out by the government and establish a well-defined salary structure.

Pro tip: You can simplify this process by using payroll software that comes with built-in salary components.

Besides promoting transparency and fairness in employee compensation, a thought out salary structure aids in your business's financial planning. It ensures accurate classification of employee compensation and simplifies your chart of accounts.

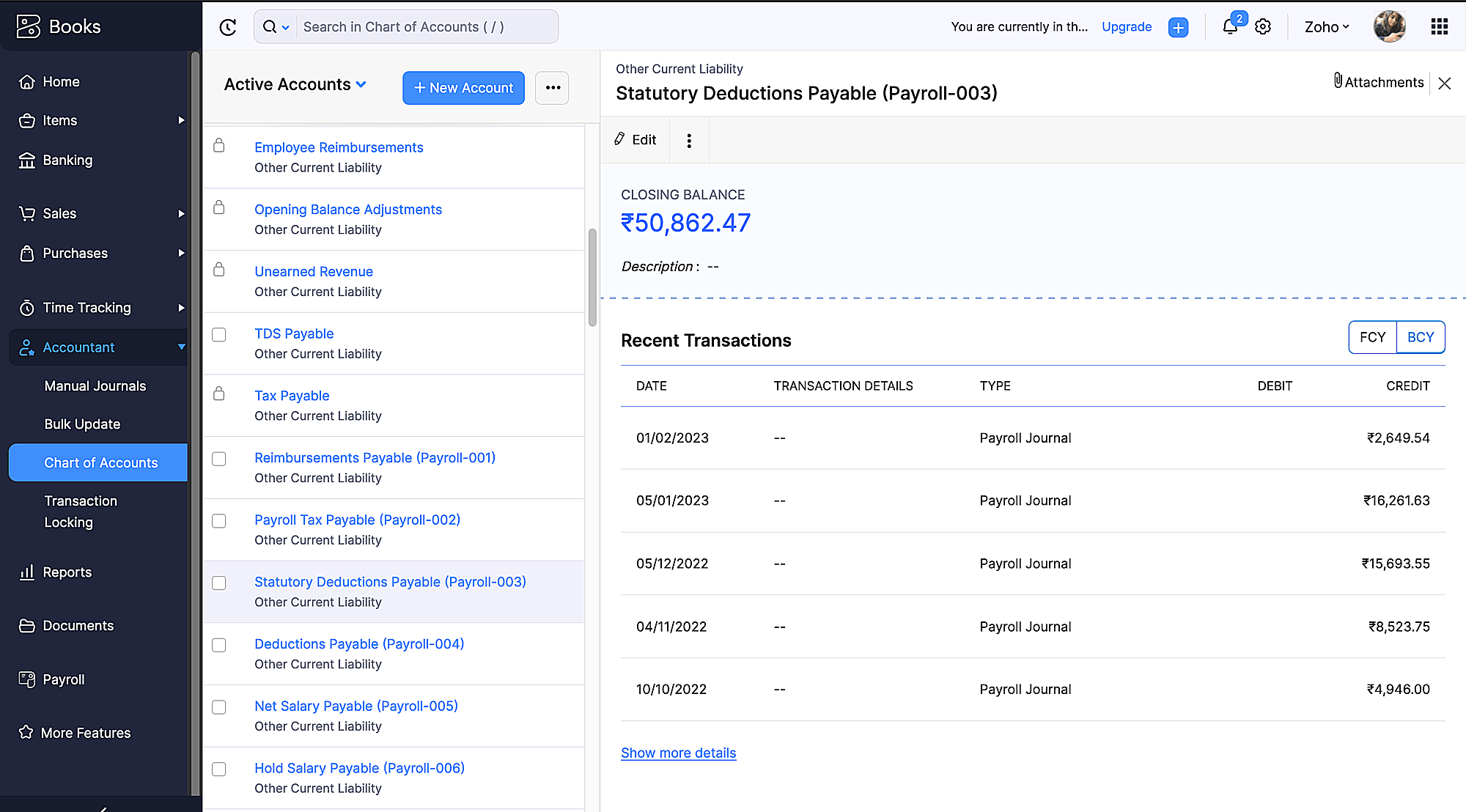

Create a chart of accounts for payroll expenses

As a part of your accounting setup, you need to create a chart of accounts for each expense that's part of your payroll. A chart of accounts is a list that categorizes the financial transactions of a business. A payroll chart of accounts includes net salary payable, salary on hold, statutory deductions made, employee reimbursements, and other payroll-related expenses.

A typical chart of accounts will look like this:

To set up a payroll chart of accounts, follow the steps below:

- Analyze your payroll process.

- Identify relevant accounts.

- Assign appropriate codes to each account.

If you are new to the process, consider getting help from your accountant and using accounting software with built-in chart of accounts capabilities.

Set up a business bank account

Having a dedicated bank account for your business ensures clear separation between personal and business finances. It allows you to track business income and expenses effectively and reconcile bank accounts.

To create a business bank account, you will need to submit a copy of your business registration certificate, PAN card, proof of address, and proper identification to the bank authority. Research and compare different banks to find the one that offers suitable services for your business.

Configure recurring payments to employees

Once you have created a bank account, implement a systematic process to run payroll for your employees.

Payroll is the routine task of calculating and disbursing employee payments within an organization.

The process involves managing recurring payments such as salaries, deductions, and other benefits. You can automate salary calculation and processing with the help of payroll software.

Payroll software can help you streamline the process by automating many of the tasks involved, such as calculating deductions, generating pay slips, and issuing payments. This can save businesses time and money, and help to ensure that payroll is processed accurately and on time.

Record salary journal entries

After paying your employees, be sure to record salary journal entries to complete the payroll accounting cycle for that pay period.

A salary journal entry is a record of the salary expenses incurred by a company.

It is made of two parts: debit and credit. The debit side of the journal entry records the expenses of the salary, while the credit side records the liability to pay the salary. Here's a table representing some of the debit and credit components involved in payroll:

| Salary journal entries | |

| Debit accounts | Credit accounts |

| Salary expense | Net salary payable |

| Deduction expense | Reimbursement payable |

| Employee benefits expense | Statutory deductions payable |

Doing this manually can be a tiring process, leaving room for miscalculations. An integrated payroll and accounting software can help you eliminate errors by automatically generating and posting journal entries based on payroll calculations. It can help you track labor costs and generate reliable financial statements for better decision-making and for compliance purposes.

The final word

Payroll accounting is the routine task of recording, organizing, and managing an organization's employee financial information. By automating this time-consuming process using tightly integrated software, you can reduce the burden on your payroll and accounting teams while ensuring regulatory compliance. It also helps you gain real-time insights into your transactions and foster financial stability, which is crucial for scaling your business.