What are Section 206AB and Section 206CCA? How do I manage them using Zoho Books?

What are Section 206AB and Section 206CCA?

Section 206AB and Section 206CCA are not separate new sections but are special provisions that have been introduced in the Income Tax Act, 1961 through the Finance Act, 2021.

Section 206AB (TDS) allows you to deduct tax at source (TDS) at a higher rate for non-filers of Income Tax returns.

Section 206CCA (TCS) is a similar provision to collect tax at source at a higher rate from non-filers of Income Tax returns. This section is effective from 1 July 2021.

When are Section 206AB and Section 206CCA effective from?

The sections, 206AB and 206CCA, are effective from 1 July 2021.

From whom should you deduct TDS as per Section 206AB?

You will have to deduct TDS as per Section 206AB if the vendor meets all the following conditions:

- The vendor has not filed Income Tax returns for two previous years immediately before the previous year in which TDS is required to be deducted.

- The time limit for filing an IT return has expired.

- The aggregate total amount of TCS and TDS in each of these two previous financial years is ₹50,000/- or more.

For example, if the current FY is 2021-2022, then we must check if the time limit to file the income tax return for FY 2020-2021 has expired. If yes, you must consider FY 2019-2020 and FY 2020-2021. If it has not expired, then you must consider FY 2018-2019 and FY 2019-2020, provided the aggregate total amount of TCS & TDS in those years in more than ₹50,000.

To make this easier for businesses, the Ministry of Finance has released a Compliance Check Functionality which will help you identify if the vendor meets the conditions mentioned above. Read More

What is the rate at which TDS must be deducted?

The tax must be deducted at the following rates, whichever is the highest:

- At twice the rate specified in the relevant provision of the Act.

- At twice the rate or rates in force; or if the government changes the rate for a specific year due to any emergencies, as it was done in 2020 due to Covid-19.

- At the rate of five percent.

Scenario: Kumar has a bill and in general, he must deduct TDS of 5% under Section 194H. His vendor did not file the IT returns and he matches the criteria that we have mentioned above. In this case, according to the new provision, Kumar must deduct TDS under Section 194H at a rate of 10%, at twice the rate specified in the relevant provision of the Act.

When is Section 206AB not applicable?

This provision is not applicable for:

- TDS sections 192, 192A, 194B, 194BB, 194LBC, or 194N.

- Non-residents who do not have a permanent establishment in India.

My Vendor falls in the criteria described under Section 206AB and my vendor did not furnish PAN details. At which rate should I deduct TDS?

If PAN is not furnished by your vendor, then under Section 206AA, you would already be deducting TDS at a higher rate. If both the Section 206AA and Section 206AB is applicable to your vendor, then the TDS shall be deducted at the highest of the two rates.

To create a TDS tax with a higher rate:

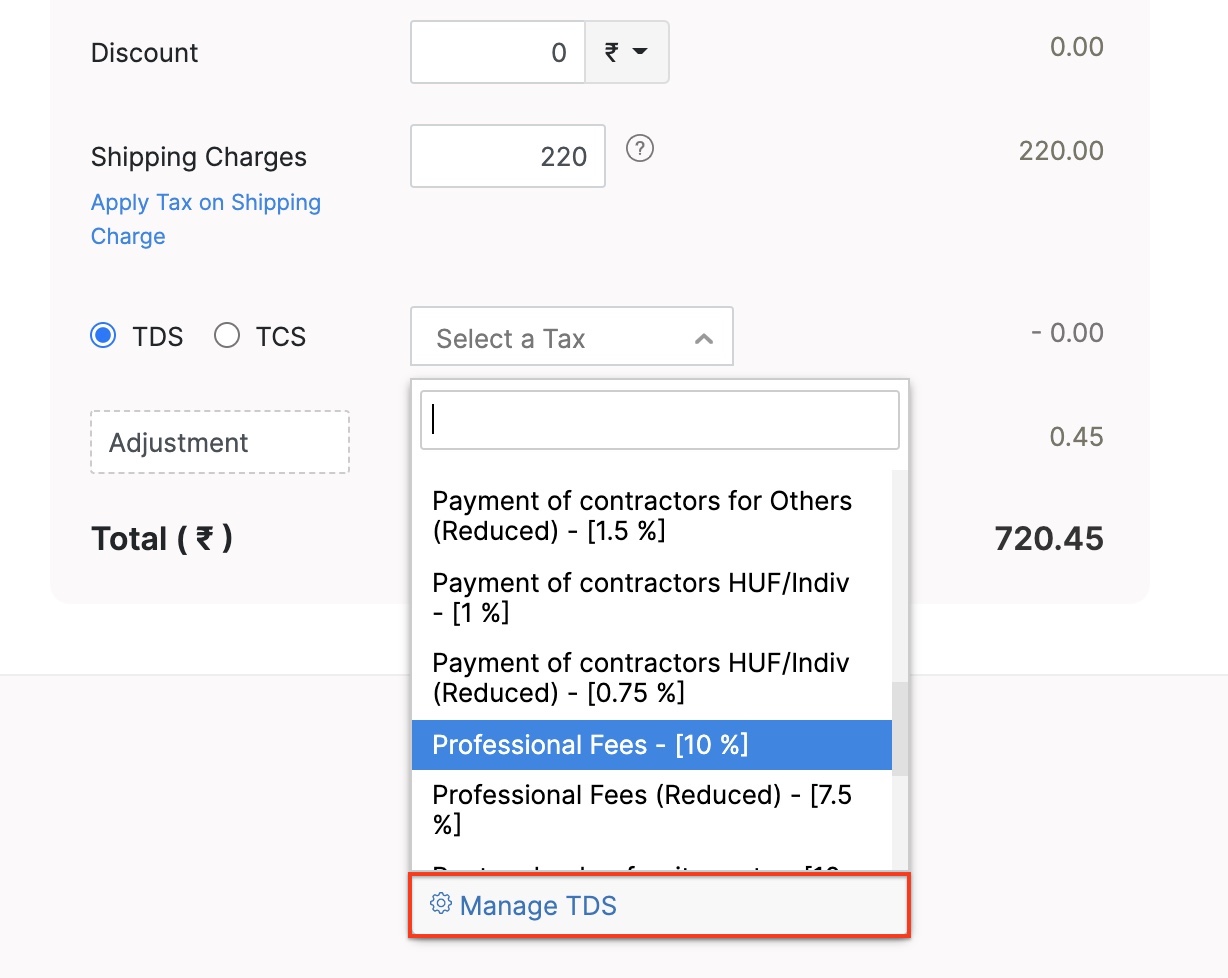

- Go to the creation page of a bill or a recurring bill.

- Click the dropdown next to TDS and select Manage TDS.

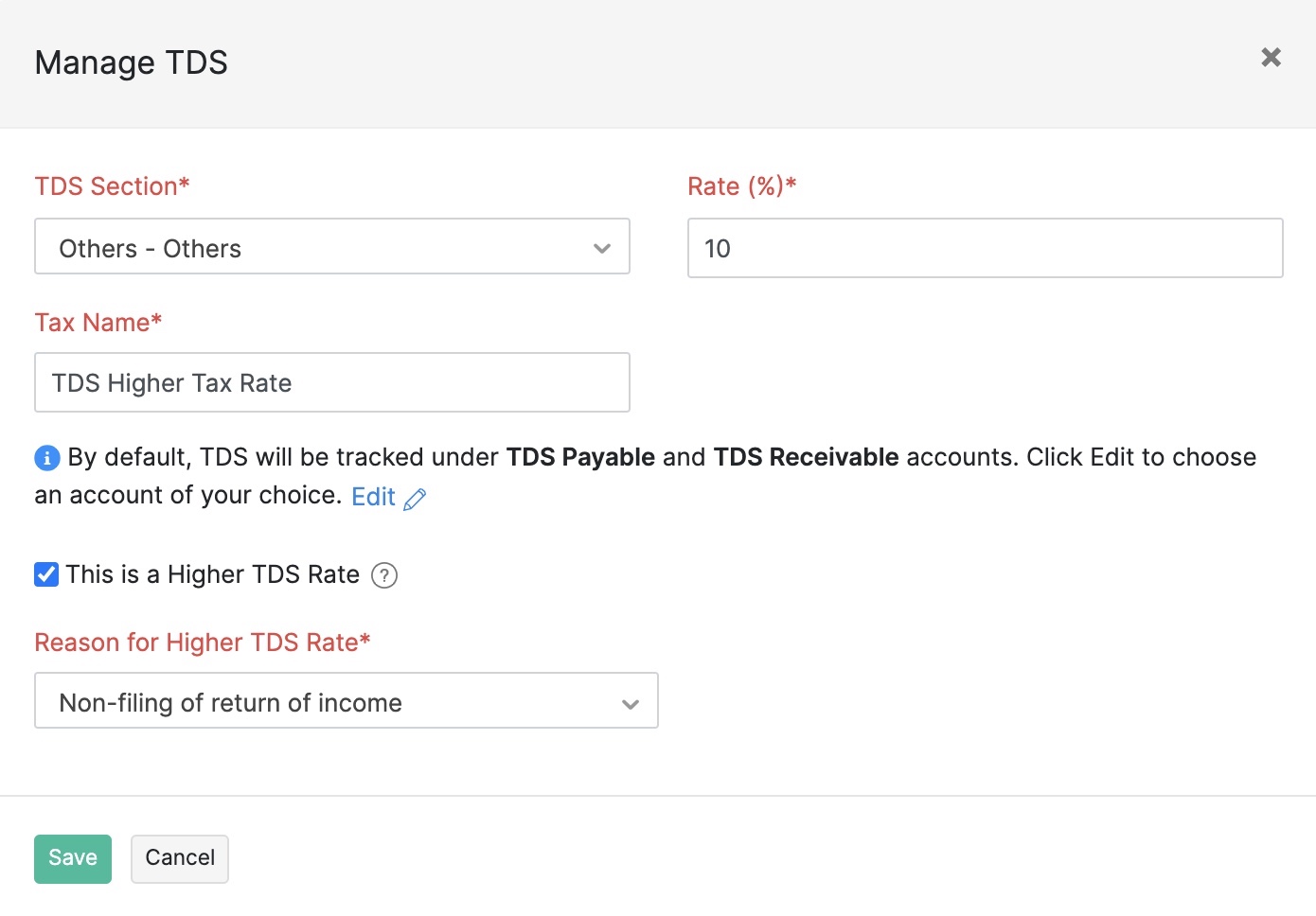

- Click + New TDS Tax.

- Select a relevant TDS Section from the list.

- Enter the higher rate and the name.

- Mark the This is a Higher TDS Rate option.

- Select a Reason for Higher TDS Rate.

- Click Save.

Now, a TDS tax with a higher rate will be created and applied to the purchase transaction.

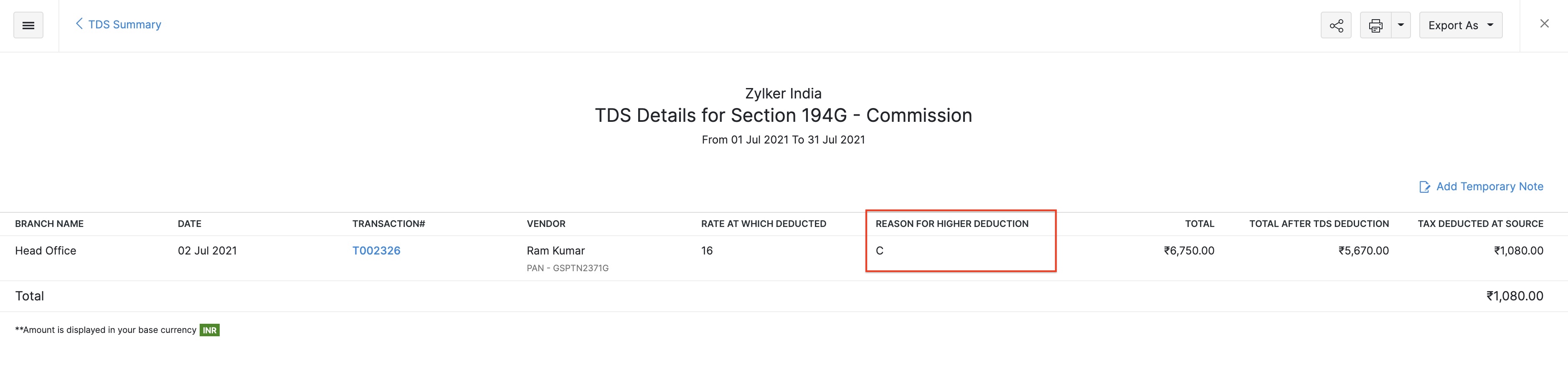

How do I track the higher TDS rate that is applied to the transactions?

You can track the higher TDS rate using the TDS Summary report. You will find a new column, Reason for Higher Deduction, which will contain the following values which correspond to the reason for which they were applied to the transaction.

| Value | Reason |

|---|---|

| C | Non-furnishing of PAN |

| U | Non-Filing of Income Tax return |

The value in this column will be U, if the TDS is deducted at a higher rate under Section 206AB.

Section 206 CCA (TCS)

From whom should we collect this TCS?

You must collect tax at source from customers or buyers if:

- The customer or buyer has not filed income tax return for the previous two years immediately before the previous year in which TCS is required to be collected.

- The time limit for filing an income tax return has expired; and

- The aggregate total amount of TDS and TCS is ₹50,000 or more in each of the two previous years.

For example, if the current FY is 2021-2022, then we must check if the time limit to file the income tax return for FY 2020-2021 has expired. If yes, you must consider FY 2019-2020 and FY 2020-2021. If it has not expired, then you must consider FY 2018-2019 and FY 2019-2020, provided the aggregate total amount of TCS & TDS in those years in more than ₹50,000.

To make this easier for businesses, the Ministry of Finance has released a Compliance Check Functionality which will help you identify if the customer meets the conditions mentioned above. Read More

What is the rate at which TCS must be collected?

TCS must be collected at the following rates, whichever is the highest:

- At twice the rate specified in the relevant provision of the act; or

- At the rate of five percent.

Scenario: Priya has an invoice and in general, she must collect TCS under Section 206C 1H (0.1%). Her customer did not file the IT returns and the customer matches the criteria mentioned above. So, according to the new provision, Priya will have to collect TCS under Section 206C 1H with a rate of 5% (at the rate of five percent).

When is Section 206CCA not applicable?

It is not applicable for a non-resident Indian who does not have a permanent establishment in India.

My customer falls in the criteria 206CCA and my customer did not furnish PAN details. At which rate should I collect TCS?

If PAN is not furnished by your customer, then under Section 206CC, you would already be collecting TCS at a higher rate. If both Section 206CC and 206CCA is applicable to your customer, then the TCS shall be collected at the higher of the two rates.

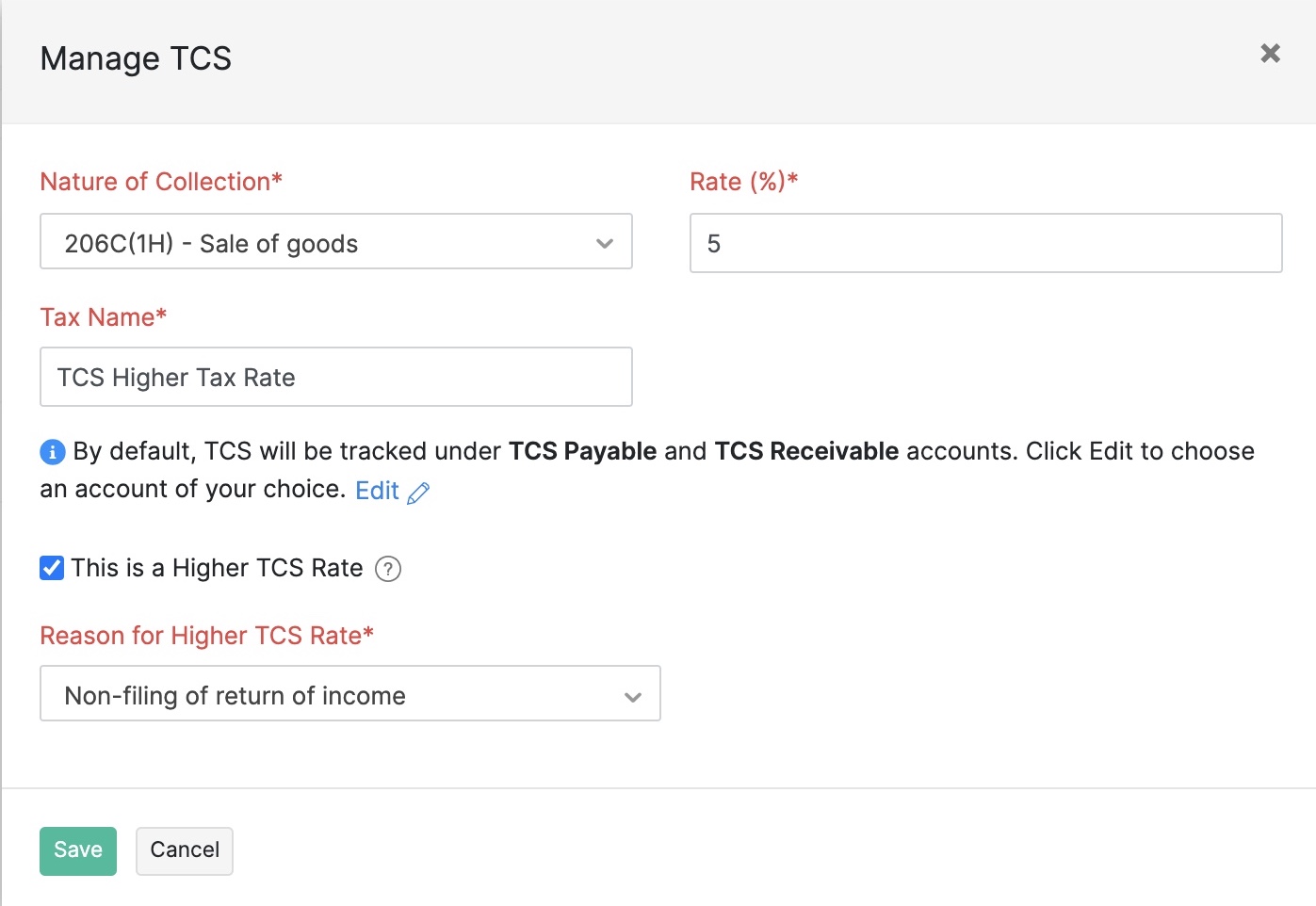

To create a TCS tax with a higher rate:

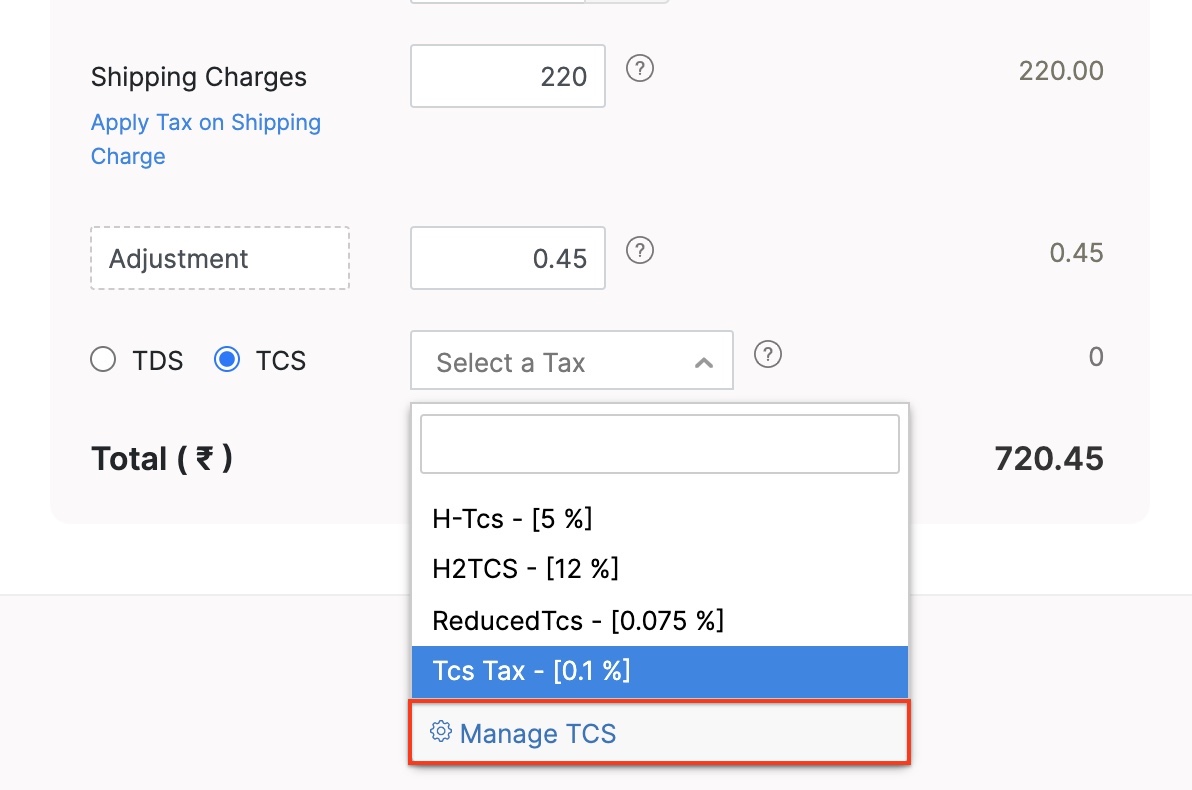

- Go to the creation page of a bill or an invoice.

- Click the dropdown next to TCS and select Manage TCS.

- Click + New TCS Tax.

- Select the Nature of Collection for which you’re creating this higher tax rate.

- Enter the higher rate and the name.

- Mark the This is a Higher TCS Rate option.

- Select a Reason for Higher TCS Rate.

- Click Save.

Now, a TCS tax with a higher rate will be created and applied to the transaction.

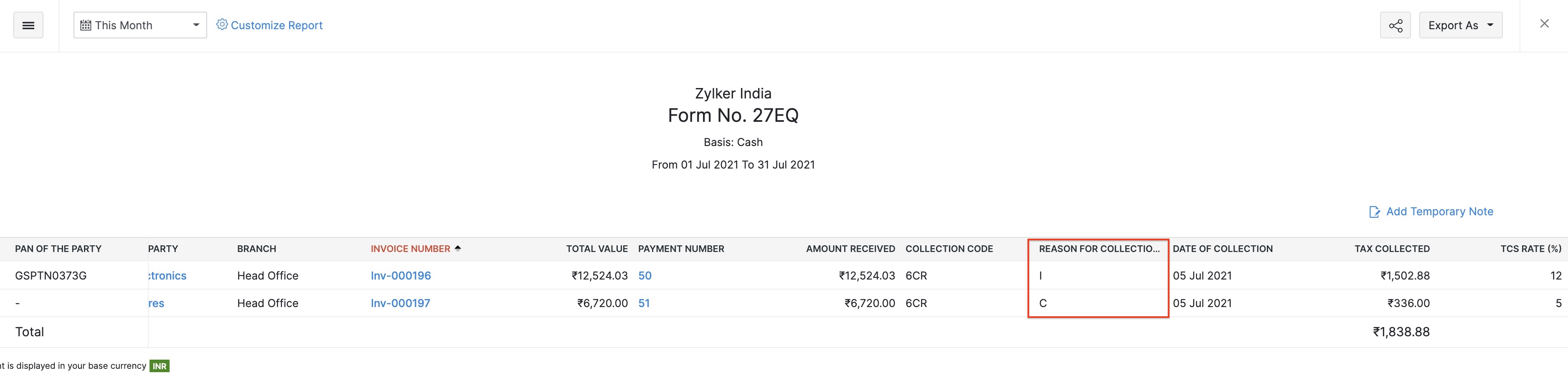

How do I track the higher TCS rate that is applied to the transactions?

You can track the higher TCS rate using the Form 27EQ report. You will find a new column, Reason for Collection at Higher Rate, which will contain the following values which correspond to the reason for which they were applied to the transaction.

| Value | Reason |

|---|---|

| C | Non-furnishing of PAN |

| I | Non-Filing of Income Tax return |

The value in this column will be I, if the TCS is deducted at a higher rate under Section 206CCA.

Compliance Check Functionality for Section 206AB & 206CCA

How can I know whether my vendor or customer falls under the Section 206AB or Section 206 CCA?

To facilitate this option, the Ministry of Finance has released a Compliance Check Functionality for Section 206AB & Section 206CCA.

Here’s how tax deductors or collectors can use the Compliance Check Functionality:

- You must register through TAN on the Reporting Portal of the Income Tax department.

- Next, you will be provided with the ITDREIN details and login credentials.

- Using the ITDREIN details, login credentials, and PAN, you will be able to access the functionality for Compliance Check for Section 206AB & Section 206CCA on the Reporting Portal.

- With this functionality, you will be able check whether the PAN is Specified Person as defined in Section 206AB & Section 206CCA using the two options below:

- PAN Search: To verify for single PAN

- Bulk Search: To verify for PANs in bulk

- You will have to give customer and vendor’s PAN as input and you will get the output as whether this PAN is applicable for the special provisions of Section 206AB & Section 206CCA.

In Zoho Books, if Section 206AB is applicable for the PAN, you can create a new higher TDS rate and set the same as the default TDS rate for the vendor having the PAN. By doing this, whenever you create a bill for this vendor, the associated TDS rate will be applied to the transactions.

Yes

Yes