Back

How do I create TDS rates in Zoho Books?

When you create an invoice or bill, you will see the TDS field where you can create and apply the respective TDS rates. Here’s how:

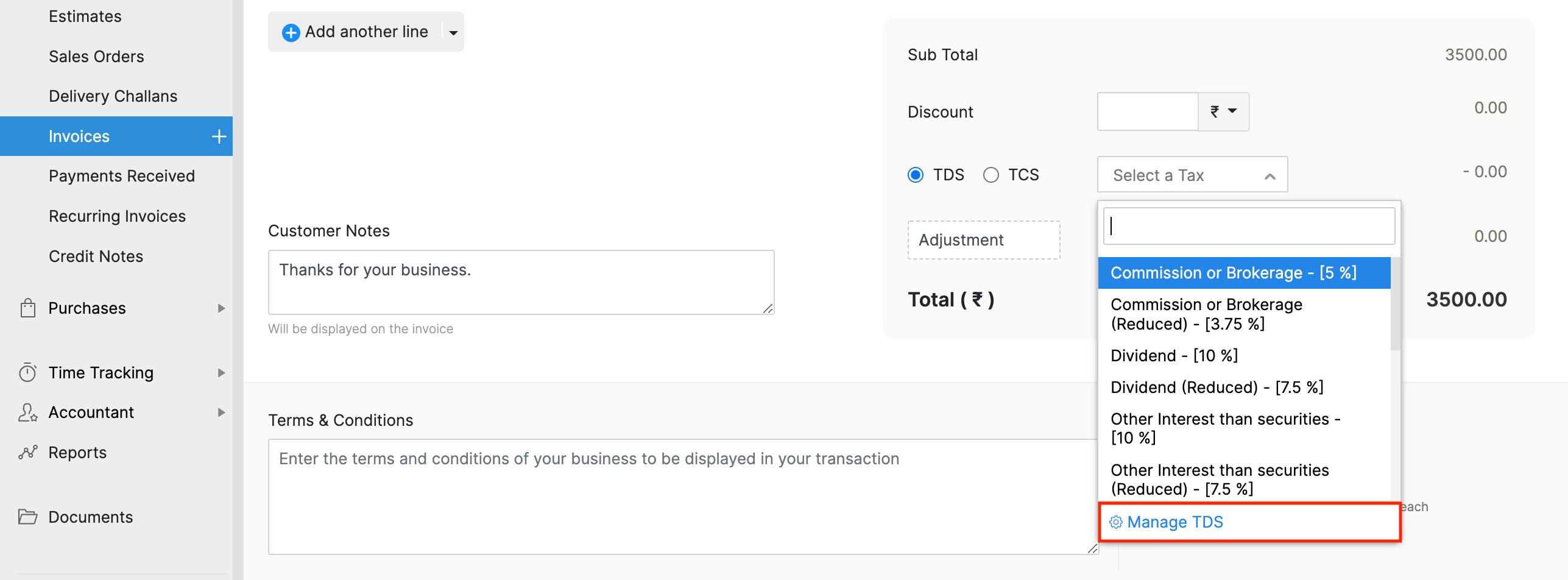

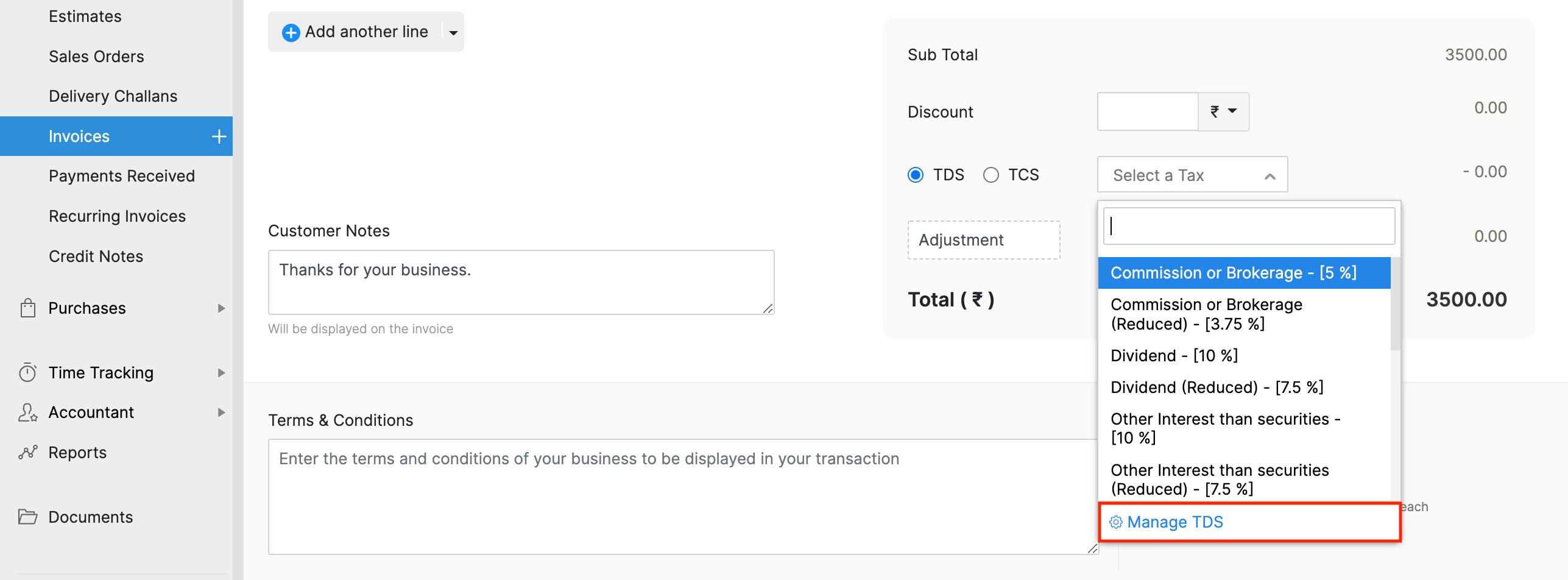

- Create an invoice/bill for your customer/vendor in Zoho Books with all the necessary details.

- In the Total section below the Item Details, select the TDS option and click the dropdown next to it.

- Click Manage TDS.

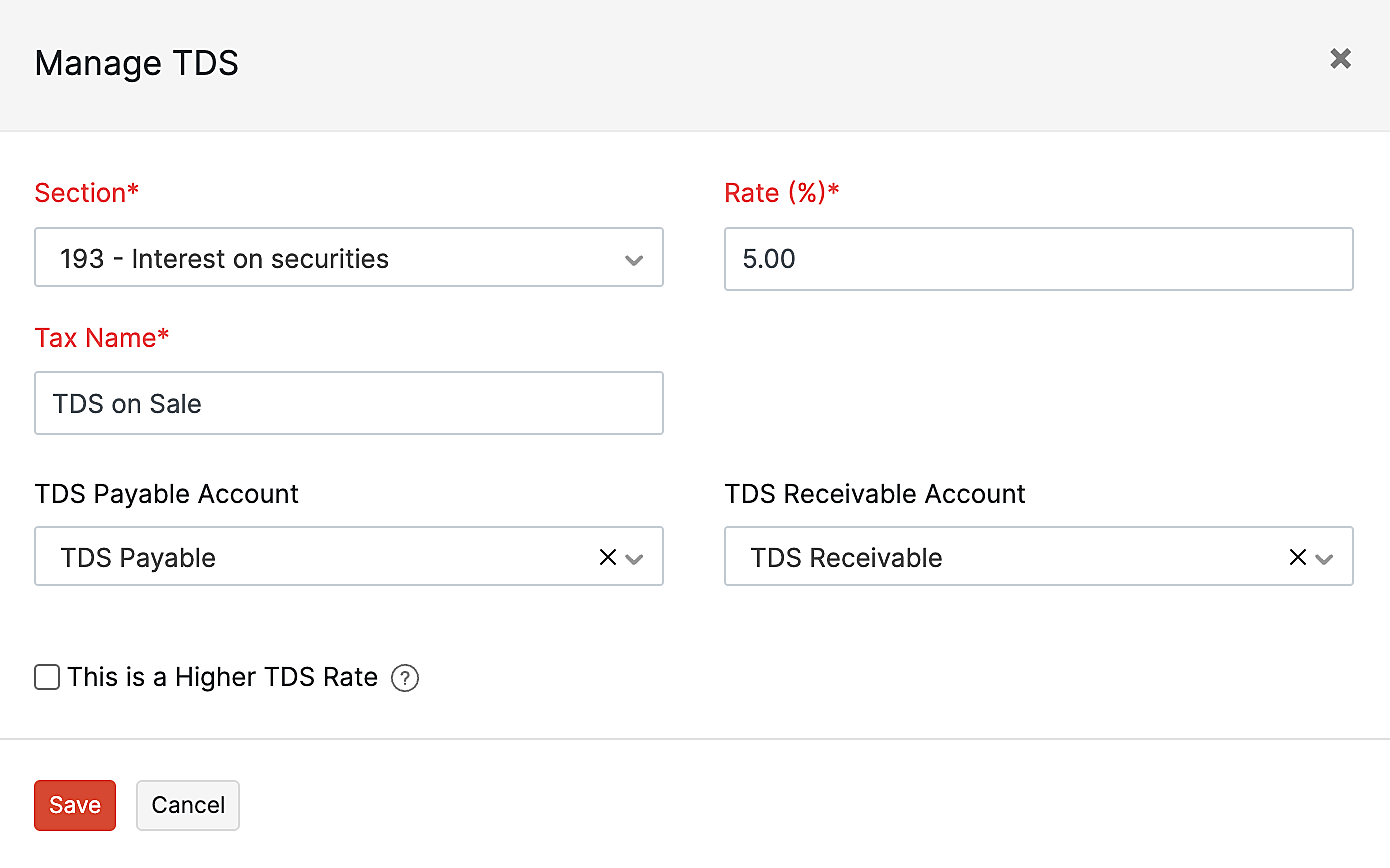

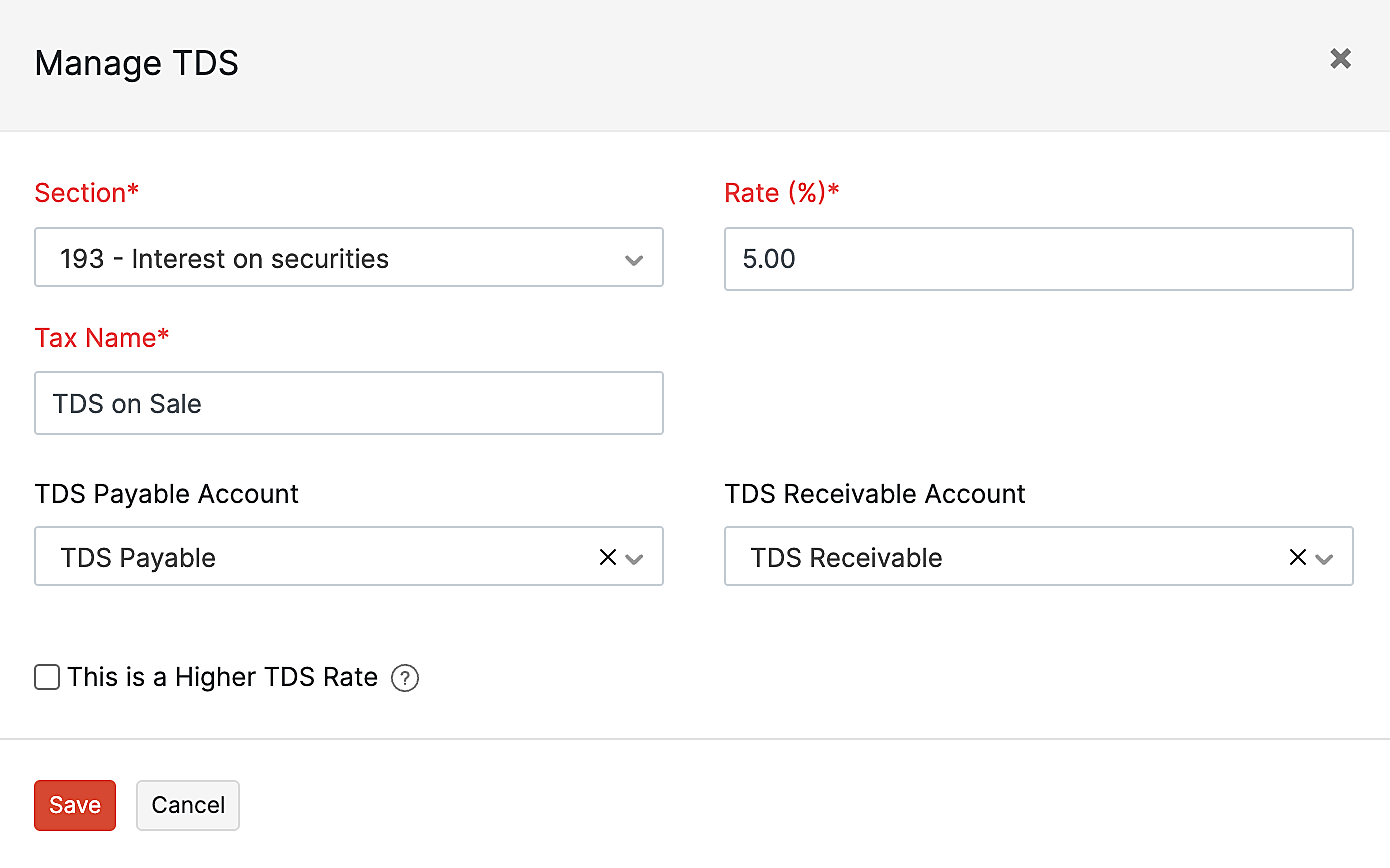

- Click + New TDS Tax to create a new tax rate.

- Enter the following details.

| Field | Description |

|---|---|

| Section | Select the applicable TDS Section. |

| Rate | The percentage of TDS deducted. |

| Tax Name | Name of the tax that’s deducted. |

| TDS Payable Account | Other current liability account that is used to track the TDS deducted from vendors (TDS on purchases). |

| TDS Receivable Account | Other current asset account that is used to track the TDS deducted by your customers (TDS on sales). |

- Click Save.

Yes

Yes