How can I remove the negative values from GSTR-3B Summary?

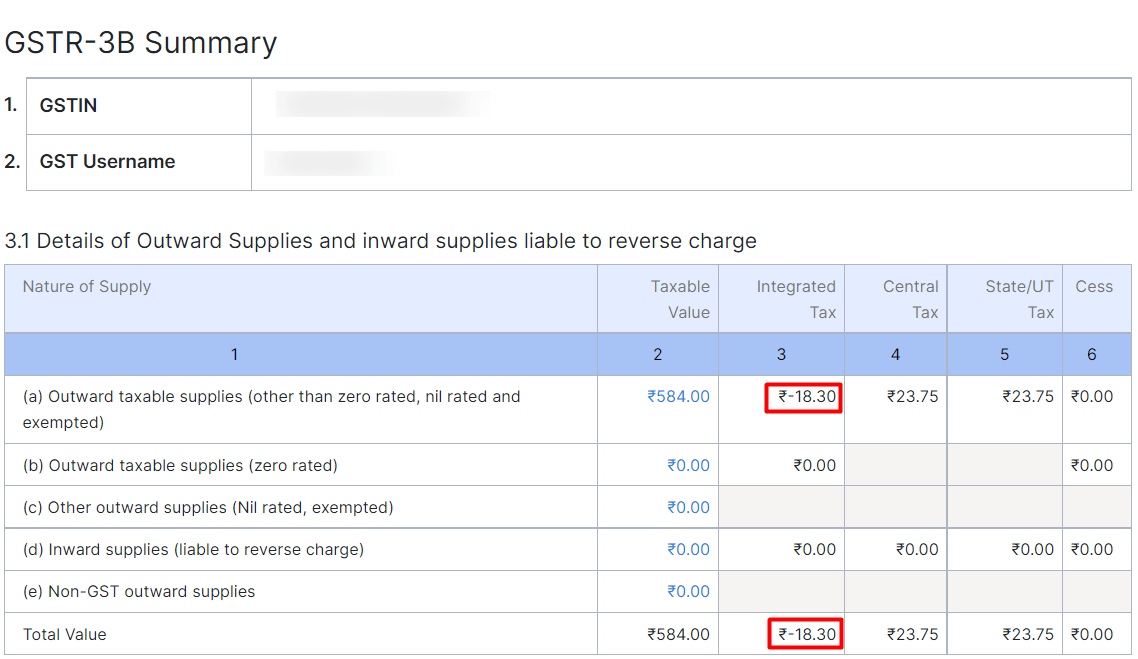

GSTR-3B Summary is a monthly or quarterly return filed by every GST-registered business based on their turnover for a particular tax period. When you generate the GSTR-3B Summary, you may find negative values in table 3.1. This happens when the total value of credit notes for a month or quarter is greater than the total value of invoices. Let’s look at a scenario to understand this better.

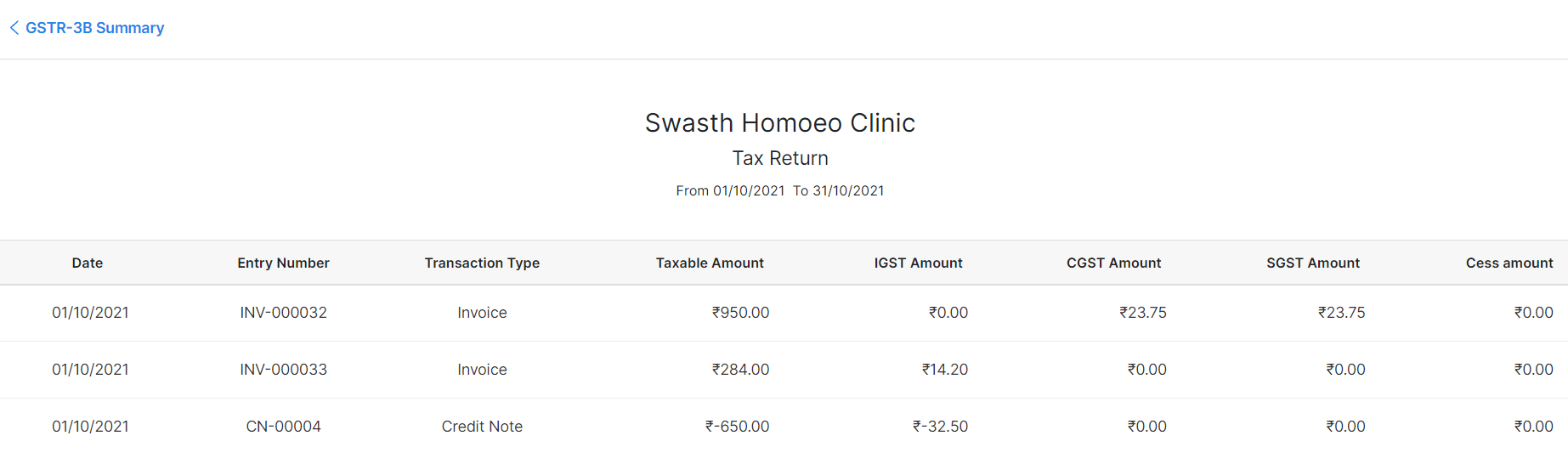

Scenario: Let’s say you have three transactions for the current month which includes an intra-state invoice of ₹950, inter-state invoice of ₹284 and one credit note for an inter-state reverse transaction of ₹625. The inter-state invoice of ₹284 is less than the inter-state reverse transaction of ₹625, therefore the IGST will be computed as a negative value.

Pro Tip: The tax levied for intra-state transactions is the sum of CGST and SGST, whereas the tax levied for inter-state transaction is IGST.

To remove the negative values in table 3.1, you will have to void the credit notes.

Before you do that, check if you fall under any of the following cases:

Case 1: If you have filed your GSTR-1 from GSTN portal for a particular month, then you will have to unfile GSTR-1 before you proceed with the steps below.

Case 2: If you have filed GSTR-1 from Zoho Books, or have submitted it, then write to our support team at support.india@zohobooks.com.

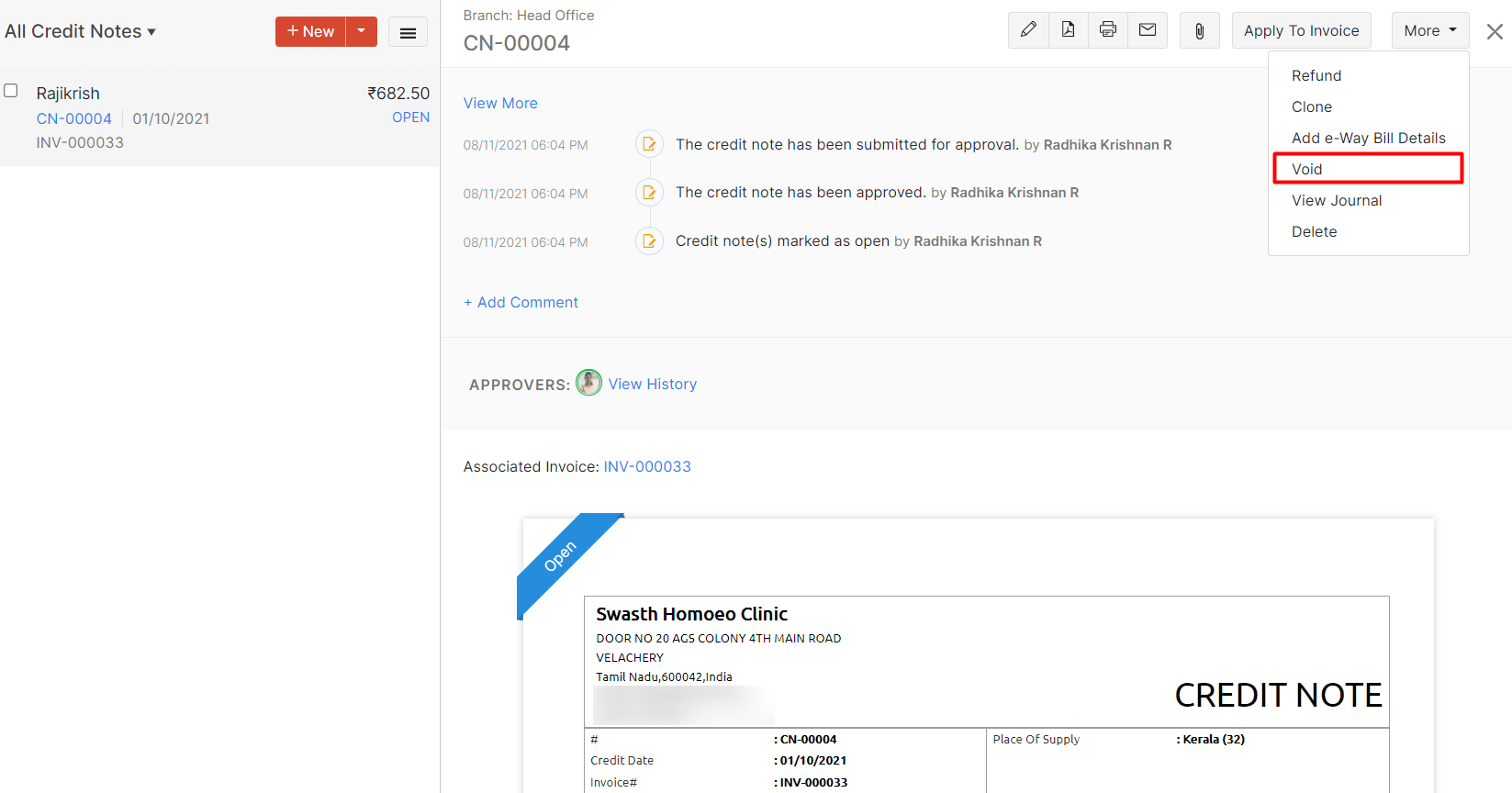

To void the credit notes so that you can remove the negative values:

- Log in to your Zoho Books account.

- On the left sidebar, go to Sales > Credit Notes.

- Click the open credit note of any GST registered customer, slide to the right side of the page and click the More button.

- Select Void from the dropdown.

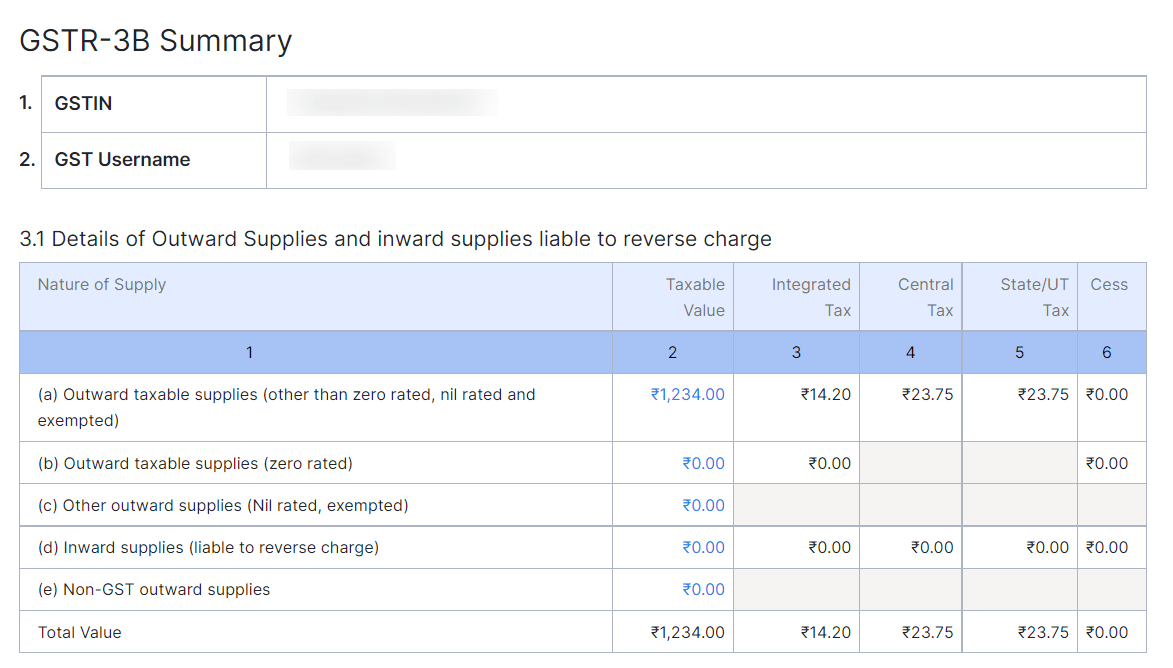

Once you void the credit notes, negative values will be removed from table 3.1. You can now push the GSTR-3B Summary to the GSTN portal and complete the filing.

Note: Ensure to unvoid the voided credit notes, after filing the GSTR-3B Summary. If you unvoid a credit note, it will be in the Draft status by default. You would have to convert the credit note to open for it to be an active transaction again.

Yes

Yes