What is a Transaction Posting Date and how does it work in Zoho Books?

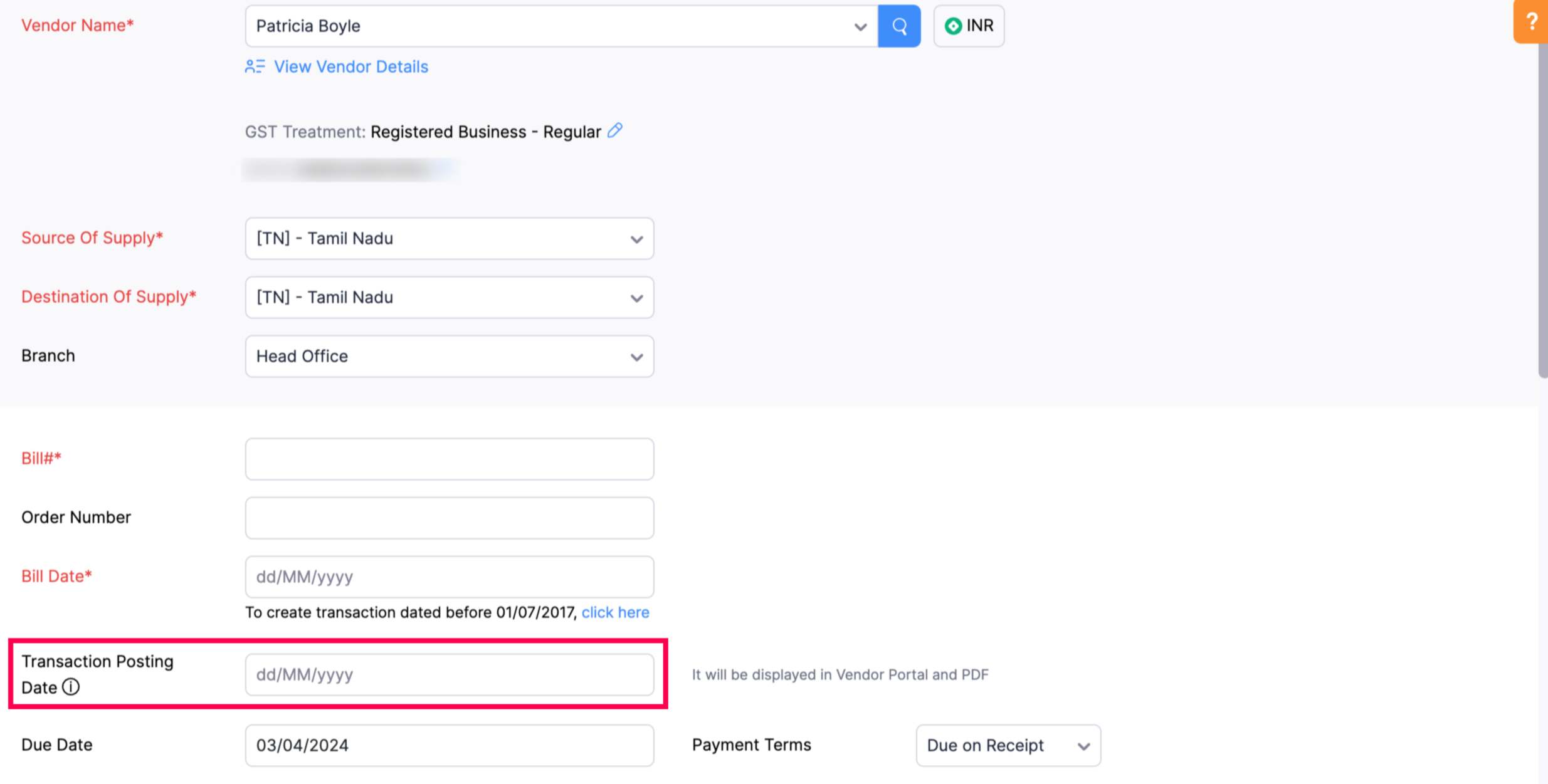

A Transaction Posting Date is the date on which journal entries are posted for the bills that you create in your Zoho Books organisation.

Let’s say you manage a small manufacturing company that purchases raw materials from suppliers. On June 15th, you receive an invoice for the shipment of raw materials. In Zoho Books, you can create the invoice on June 20th, set the bill date as June 15th, and the transaction posting date as June 20th.

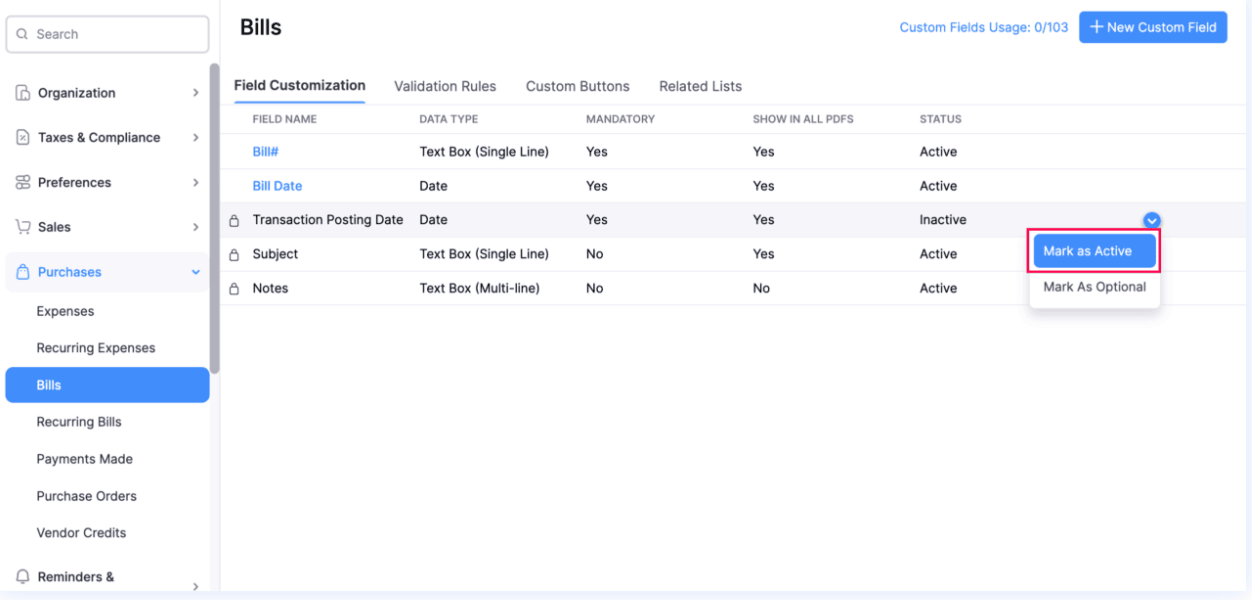

Enable Transaction Posting Date

To use this field in your transactions, you need to enable it first. Here’s how:

- Go to Settings in the top right corner of the page and select Bills under Purchases.

- Navigate to the Field Customisation tab.

- By default, the Transaction Posting Date field will be marked as inactive. Hover over the field, click the dropdown next to it, and select Mark as Active.

Once marked as active, you’ll be able to select the Transaction Posting Date for your existing as well as future bills.

Note:After you enable the Transaction Posting Date, a column displaying the posting date will appear on the bills list page.

Note:When you import bills after enabling the posting date, there will be a separate column for the transaction posting date. You will also be able to export a bill including the transaction posting date in the export file.

Pro tip:You can create custom views and perform advanced searches with Transaction Posting Date as the filter criteria.

Transaction Posting Date in Reports

You can filter your AP Ageing Summary and AP Ageing Details reports based on the transaction posting date. Here’s how:

- Go to Reports on the left sidebar.

- Select the AP Ageing Summary or AP Ageing Details report under Payables.

- Click the Aging By dropdown on the top band and select Transaction Posting Date.

- Click Run Report.

To filter the Bill Details report based on transaction posting date:

- Select the Bill Details report under Payables.

- Click the Report By dropdown and select Transaction Posting Date.

- Click Run Report.

Journal Entries for Bill Payments

The journal entry for a bill payment will use the later date between the bill’s transaction posting date and the payment date. This date will be reflected in the Journal Report.

Yes

Yes