- No late fee is imposed on candidates who file Form GSTR-4 (applicable for the duration between July, 2017 and September, 2018) between the 22nd of December 2018 to the 31st of March 2019.

GSTR 4 is a return meant for composition scheme dealers, that has to be filed on a quarterly basis.

GSTR-4 is a document that needs to be filed once every 3 months by registered tax payers who have signed up for the composition scheme (they are known as composition vendors). The GSTR-4 contains the total value of the sales and supplies made, the tax paid at compounding rate, and invoice-level details of purchases the composition vendor made from other registered tax payers during the tax period. When you make purchases from registered vendors, the information from their sales returns (GSTR-1) will be available in the GSTN portal as GSTR-4A) for you to use in your GSTR-4. Before you file your return, you can check this information, make changes if necessary, and add any details that were not auto-populated.

This return can be filed as soon as the relevant quarter ends. The last day to file the GSTR-4 is the 18th of the month following the end of the quarter. For example, if you are filing the GSTR-4 for the July-September quarter, you have to file it before the 24th of December, 2017.

The GSTR 4 format consists of several pieces of information about composition dealers. Let’s take a look at each section in detail.

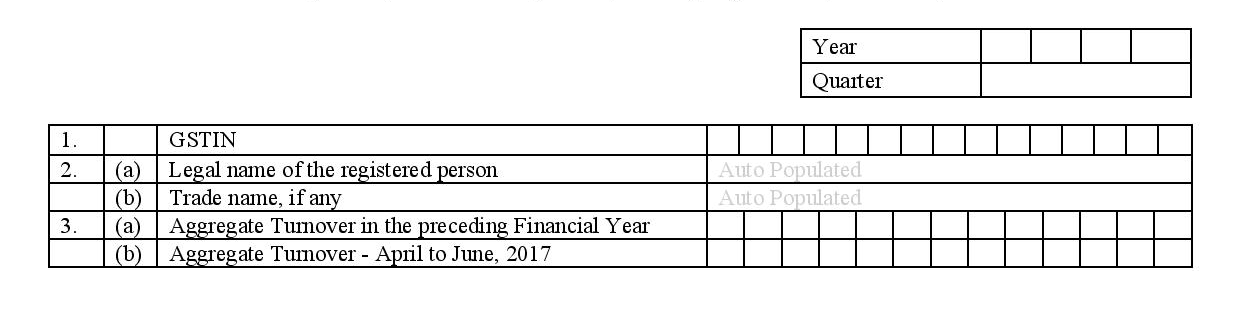

The first section asks for the year and the quarter for which the GSTR-4 is filed. The following sections ask for the tax details from that period.

1. GSTIN:

Your unique PAN-based 15-digit Goods and Services Taxpayer Identification Number.

2. Name of the Taxpayer:

Legal name (as well as trade name, if any) of the registered tax payer or the authorized signatory for your business.

3. Turnover of the Taxpayer:

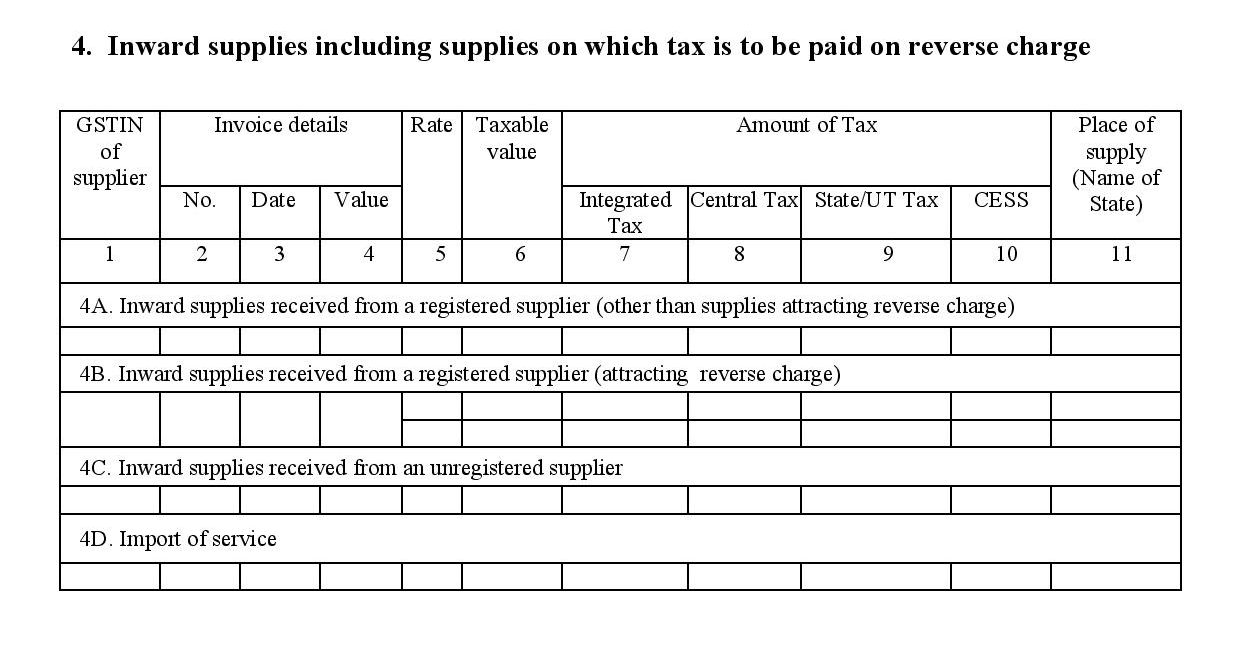

4. Inward supplies including supplies on which tax is to be paid on reverse charge: This section requires you to capture the details of purchases you have made during this quarter. This includes GSTIN of suppliers, invoice numbers, invoice dates, amounts on the invoice, GST rates of items and services purchased, taxable value, place of supply (the location where you received those goods and services) and the amount of tax paid.

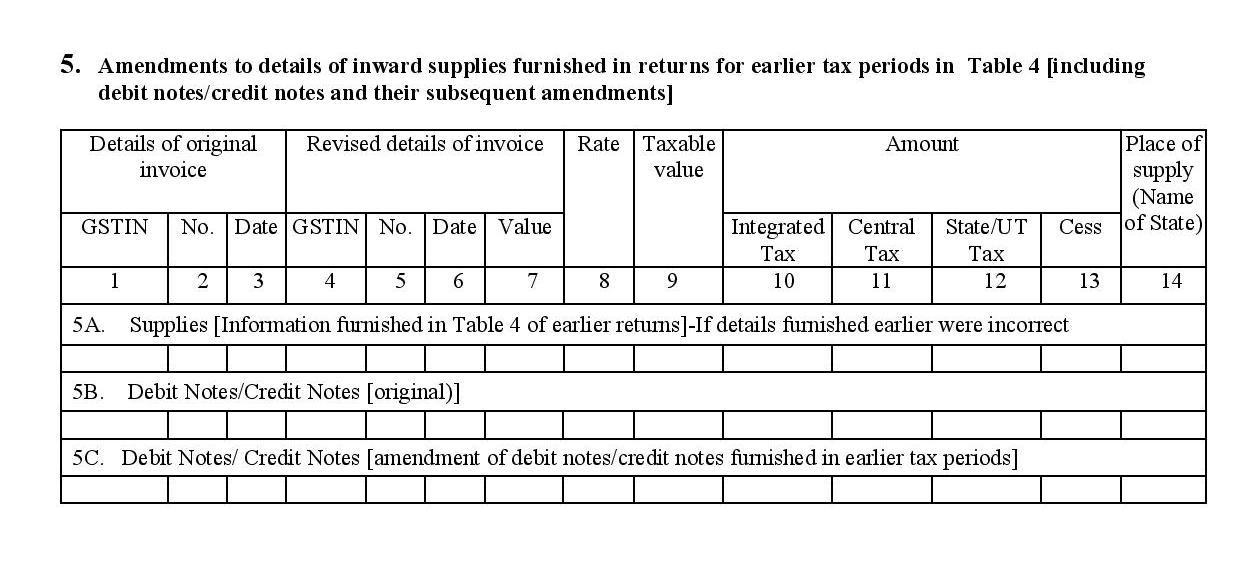

5. Amendments to details of inward supplies furnished in returns for earlier tax periods in Table 4 (including debit/credit notes and their subsequent amendments):

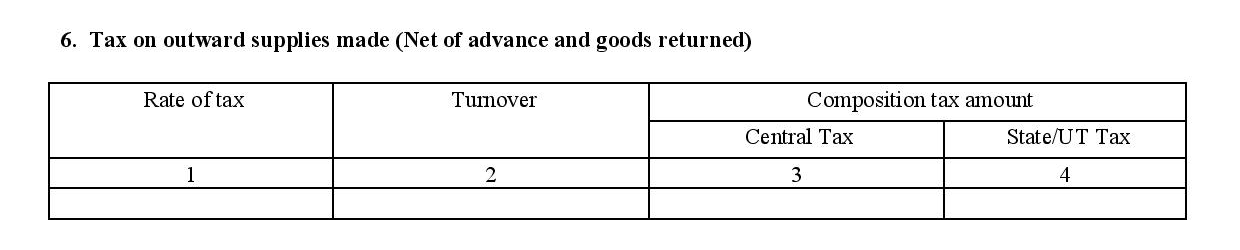

6. Tax on outward supplies made:

Details of outward supplies (sales), including advances received and net goods returned during this quarter. The details have to be categorised based on the GST rate (0%, 5%, 12%, 18% or 28%) associated to your items and/or services sold along with the turnover made under every bracket and the tax you need to pay at composition rate (which is 1% of turnover for traders, 2% for manufacturers and 5% for restaurants).

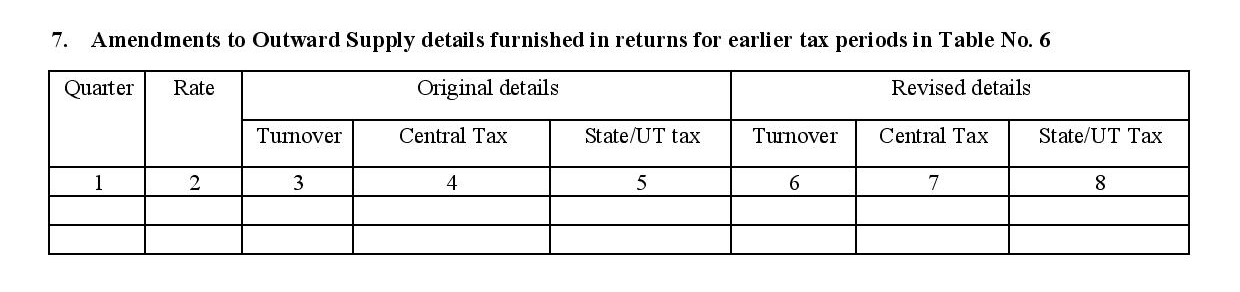

7. Amendments to outward supply details furnished in returns for earlier tax periods in Table No. 6:

Modifications to the information under table 6 of previous GSTR-4 returns, can be done under table 7. To do so, you have to specify the details of the original document (Quarter, GST rates, turnover and tax paid at compounding rate) and the details of the modified documents. This will allow the GSTN to calculate the change in your turnover made for that quarter along with the change in your tax liability for the same (the tax you have to pay). Any excess amount paid as tax during that quarter will be adjusted for this quarter (same applies for any dues that you have to pay, arising due to the change in taxable turnover).

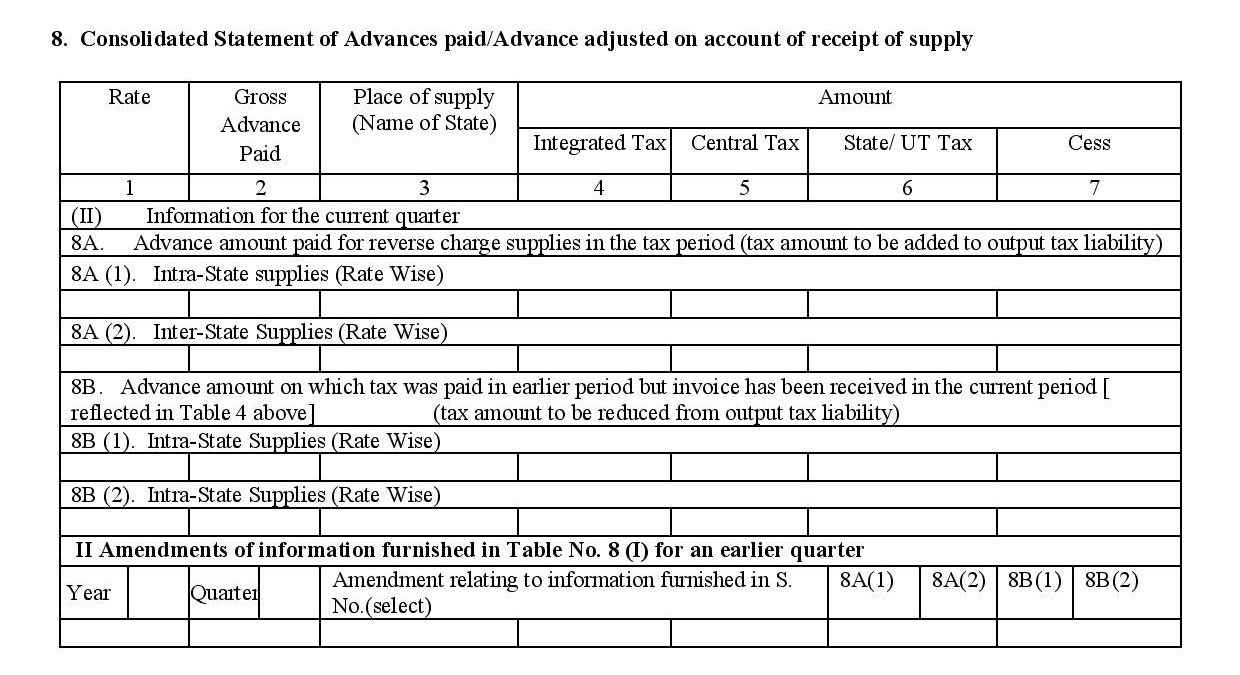

8. Consolidated statement of advances paid and advances adjusted on account of receipt of supply

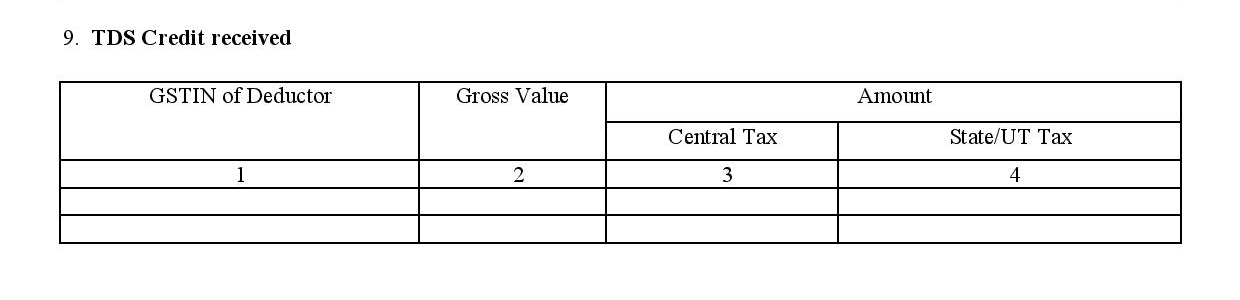

9. TDS credit received:

Details of any tax deducted at source by customer will be automatically updated here. This includes GSTIN of the customer, the gross value on the invoice and the amount of tax deducted. For example, an electronic showroom hires your services to fix a certain electronic gadget for one of their customers. Upon fixing it, you give an invoice to the showroom. If the showroom deducts tax on your invoice amount and pays you the balance, then in this case, this tax deducted at source (TDS) will be made available to you as credit (in the form of TDS credit).

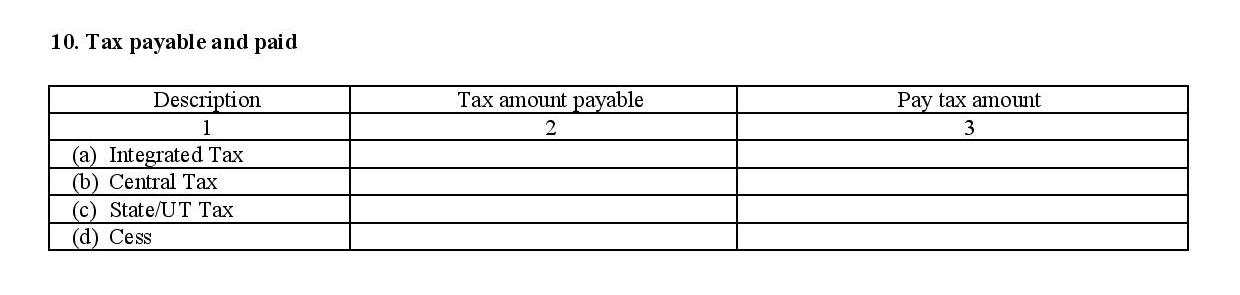

10. Tax payable and paid:

Under this section, you should mention details of the tax you have paid and the tax you still owe for the current quarter under the various tax heads (IGST, CGST, SGST or UTGST, and Cess). The tax payable will be calculated using the data under Table 4, 6, 8 and 9.

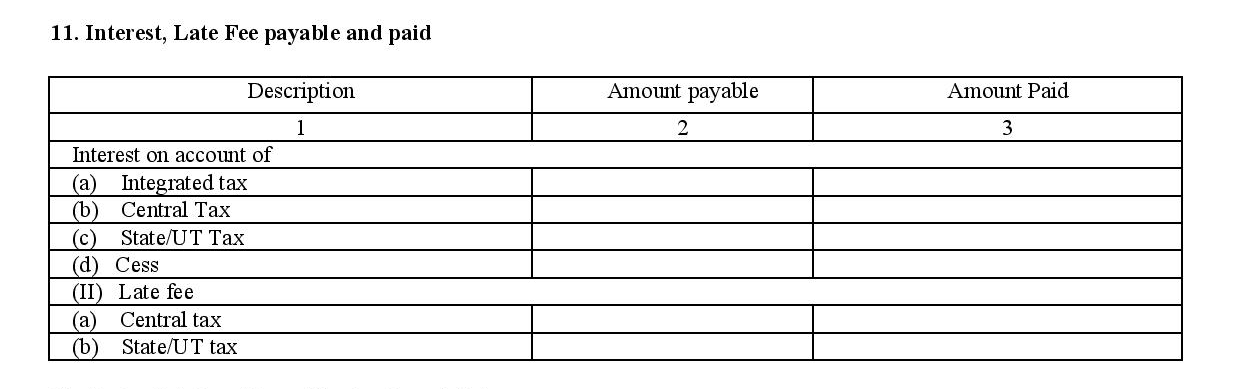

11. Interest, late fee payable and paid:

This table applies mostly to tax defaulters who have been penalised for late submission of returns, late payment or incorrect data filed. Penalties and additional charges paid and owed by you to the tax authority are to be captured here.

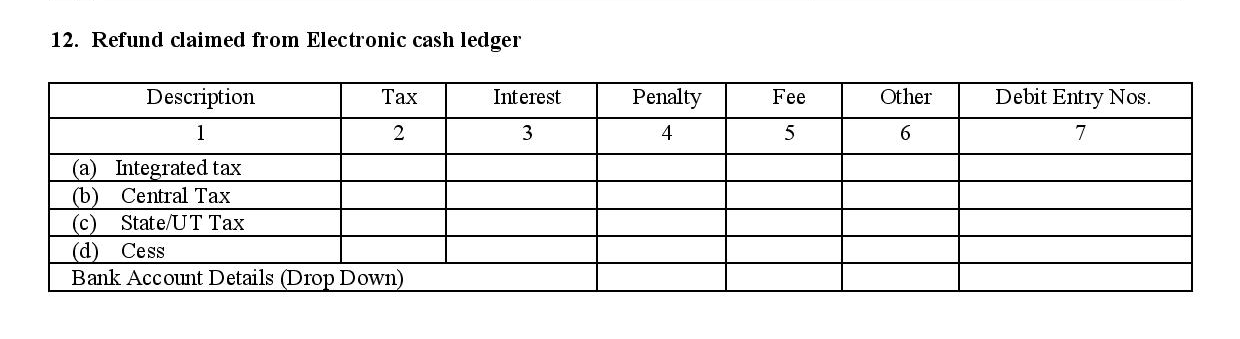

12. Refund claimed from electronic cash ledger:

Under certain circumstances, if the tax that you owe is less than the projected amount, then the difference between the two will be refunded to you. You can find the details of such instances in this section.

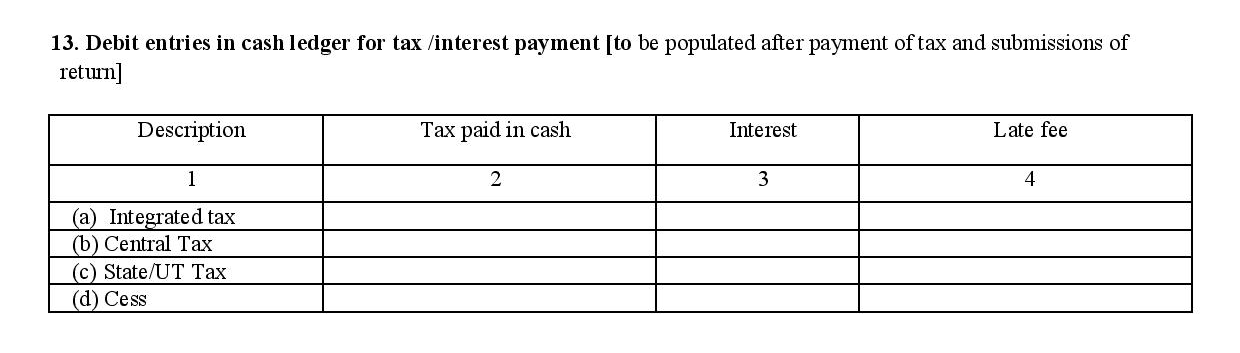

13. Debit entries in cash ledger for tax or interest payment: This section will be auto-populated after payment of tax and submission of the GSTR-4. At the end of the document, there is a declaration of truth that needs to be signed by the authorized signatory of your company either by Digital Signature Certificate (DSC) or Aadhar based verification.

Are there any other returns that need to be filed by composition vendors? Apart from having to file the GSTR-4 once in every three months, you as a composition vendor, are also required to file an annual return called the GSTR-9 for every financial year.

Books

Simplify accounting

and GST filing.