- HOME

- Taxes & compliance

- Understanding GST invoicing: A quick summary

Understanding GST invoicing: A quick summary

As India is gearing up to make the switch to GST, there are lots of new rules and regulations to follow when it comes to invoicing. The Government has specified the tax elements that are mandatory to each invoice, and it is absolutely essential that business owners across India update their invoicing processes accordingly.

Types of invoices

There are two types of invoice in the GST regime:

- A tax invoice is issued when a registered dealer supplies taxable goods or services. It is mandatory for claiming input tax credit.

- A bill of supply is issued when a registered dealer supplies GST-exempt goods or services, or for any sale where the supplier is registered under the composition scheme.

GST-specific elements that must be added to a tax invoice

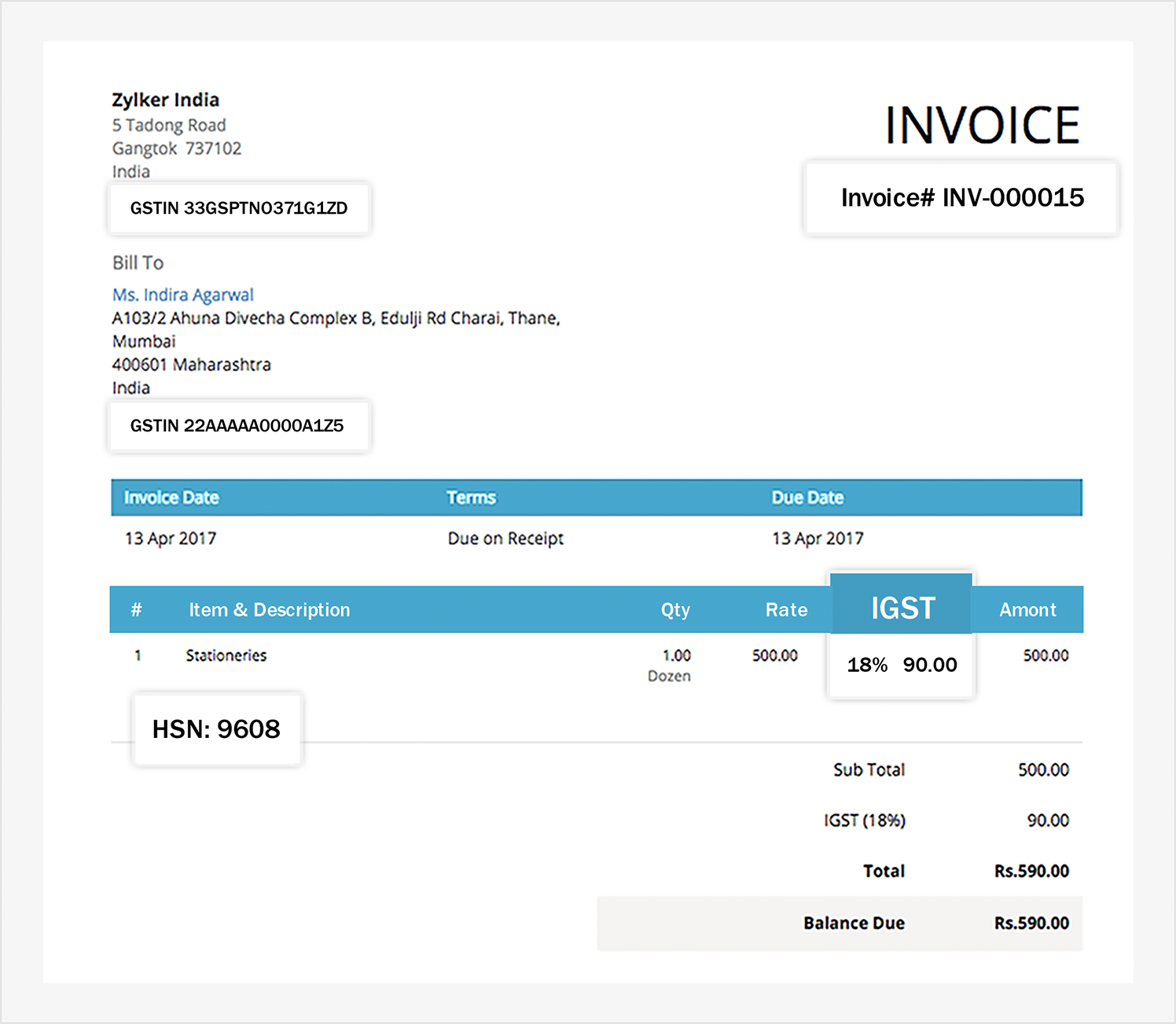

Based on the rules prescribed by the Government, here is what a sample tax invoice will look like in the GST regime:

Let’s now look at all these details individually and see what they mean:

- The type of invoice - It needs to show whether the issued document is a tax invoice, a debit note or a credit note.

- Name, address and GSTIN of the supplier - These details are crucial for matching your outward supplies with your customers’ inward supplies in the GSTN portal.

- Invoice serial number - The invoice serial number must be part of a consecutive series containing only alphabets and/or numerals. It must also be unique for a financial year.

- Name, address and GSTIN of the recipient - Just like the supplier details, the recipient details will be used for matching and reconciling the transactions.

- UIN - This ID is assigned to agencies of the United Nations, consulates or embassies of foreign countries, and certain other persons. Not all invoices will include a UIN.

- Destination state name - Invoices for inter-state transactions must specify the destination state.

- HSN or SAC code - If you’re supplying goods, you must include the HSN code (unless your annual turnover is less than Rs. 1.5 crores). If you’re supplying services, you must include the SAC code.

- Tax amount charged - The CGST, SGST, and IGST tax rates, along with the corresponding tax amounts, must be shown in separate columns.

- Reverse charge statement - The invoice must state whether reverse charge is applicable to the transaction or not.

- Signature - The supplier or other authorized person must sign either in physical form or digitally.

Note: If the recipient is not registered under the GST regime, and the value of supply is more than Rs.50,000, the invoice should contain the following details:

- Name and address of the recipient

- Shipping address

- State name and State code

Time limits for issuing tax invoices

Supply of goods

If the supply involves the transfer of finished goods from one place to another, then the invoice must be issued at or before the time of transfer. So if a dealer is purchasing pens from a supplier, the supplier needs to issue an invoice at or before the time the pens leave the warehouse. If the supply does not involve the transfer of finished goods, the supplier can issue the invoice when the goods are delivered to the recipient. If a dealer is purchasing a custom partition wall for his/her office that will be completely assembled on-site, the invoice must be issued at the time the completed wall is made available at the recipient’s office.

Supply of services

In most cases, the tax invoice must be issued within 30 days from the date of supply. If the supplier is a bank or an insurer, then the invoice must be issued within 45 days from the date of supply.

Number of tax invoice copies that are to be issued

For the supply of goods, the following copies are required:

- The original invoice is issued to the recipient, and is marked as ‘Original for recipient’.

- A duplicate copy is issued to the transporter of goods, and is marked as ‘Duplicate for transporter’. This duplicate needs to be shown by the transporters whenever they’re asked for evidence, unless the supplier has obtained an invoice reference number. (The supplier can obtain an invoice reference number by uploading their tax invoice in the GST portal. It is valid for 30 days from the date of upload.)

- A triplicate copy is retained by the supplier for their own use, and is marked as ‘Triplicate for supplier’.

For the supply of services, the following copies are required:

- The original invoice is issued to the recipient, and is marked as ‘Original for recipient’.

- A duplicate copy is retained by the supplier for their own use, and is marked as ‘Duplicate for supplier’.

Note: Physical copies of tax invoices are not required if the invoice has been generated by the supplier as per rule 48(4) of the CGST Rules, 2017. This rule states that an e-invoice must contain the details of Form GST INV 01 after obtaining the Invoice Reference Number by uploading the information to the online portal.

Revising an already-issued tax invoice

When an invoice is already issued, but there are changes to be made in the taxable value of the product or the tax amount, one of the following needs to be issued:

- Supplementary invoice/Debit note - If there is an increase in the price of an already supplied item, then the supplier needs to issue a debit note to the recipient. The debit note needs to be issued within 30 days of making such a price revision. From January 1, 2021, the date in which a debit note is issued (not the date of the invoice) will determine the relevant financial year for the purpose of section 16(4) of CGST act, 2017, which highlights the eligibility criteria for availing ITC.

- Credit note - Similarly, if there is a decrease in the price, the supplier must issue a credit note needs to the recipient. The credit note must be issued on or before 30th September of the next financial year, or before the filing of the annual GST return, whichever is earlier.

The format of these documents is exactly the same as that of a tax invoice. The only difference is that it needs to be explicitly specified at the top whether the document is an invoice, a debit note, or a credit note.