Let’s say a department in your firm needs specific raw materials to continue their operations. How do you go about it? In a perfect world, the departmental manager would reach out to their usual supplier, place an order, negotiate the contract, and get the supply delivered the very next day.

Unfortunately, the purchasing process is much more complicated, but there are good reasons for that. First off, when dealing with expensive transactions, it’s important to gather evidence that can be used to resolve conflicts in case of payment, supply, or quality issues. It’s not enough to just rely on invoices from suppliers to manage your business finances. Secondly, line or departmental managers placing orders with suppliers directly can lead to increased expenses and fraud.

As your firm grows in size and complexity, you need to have a streamlined system in place that ensures all purchases are validated, ordered, fulfilled, and documented. This is where using purchase orders can help. Without purchase orders, tracking your organization’s expenditure becomes tedious, and it’s easier to overspend.

What is a purchase order?

A purchase order is a legally binding document drafted by an organization when placing an order with its suppliers. Submitting a purchase order confirms the buyer’s intent to purchase a certain quantity of goods or services for the negotiated amount from the supplier. Since the document is issued before the supplier sends an invoice, it acts as insurance against non-payment, failure to deliver the supply, and quantity or quality issues. Once the supplier accepts a purchase order, a binding contract is formed between them and the buyer.

Contents of a purchase order

Purchase orders generally require:

-

Purchase order number (Used to track the purchase order’s status throughout the purchasing cycle)

-

Name, contact information, and address of the buyer and the supplier

-

Type of the product or service being purchased along with the item number (if applicable)

-

Quantity of each item

-

Organization’s billing address

-

Shipping method, shipping date, and shipping address

-

The agreed-upon price (unit price and total price of the items ordered)

-

Appropriate tax amount (if applicable)

-

Payment terms (Net 30, upon delivery, or in installments)

Benefits of using purchase orders

Here are a few benefits of using purchase orders in your procurement process:

They act as legally binding contracts

Purchase orders are legally enforceable contracts. Having a written agreement that clearly communicates all the details of an order protects both the buyer and the seller. If there are ever any disputes over the items delivered or the negotiated amount, both parties can refer to the order to resolve the dispute. For example, if the supplier delivers the wrong item or if the buyer refuses payment for whatever reason, the order confirms the transaction details that everyone agreed upon. If the problem persists, the purchase order can be used as evidence of a breach of contract at court.

Prevents duplicate orders

As your firm expands, your number of purchase requests will increase. The absence of a proper process will make it difficult to track who ordered what, when, and from which supplier. This makes it easy to accidentally place the same order twice. Purchase orders prevent duplicate spending by linking the purchase requests to the appropriate purchase orders. Also, buyers can use the unique purchase order number to track orders placed with different suppliers and avoid placing the same order again.

Helps track expenditure and inventory

Purchase orders are an effective tool to document and track the incoming orders and expenses for different departments. This helps the purchasing and finance departments keep an eye on how much money is being spent, when, and what it’s being spent on. Additionally, a well-organized purchase order system helps identify the products coming in at any point of time, thereby simplifying the inventory and shipping process.

Facilitates accurate invoicing

The purchase order workflow is advantageous for all stakeholders—the supplier, buyer, and finance team(s).

-

With a purchase order in hand, the supplier will raise an accurate invoice for the purchases.

-

On delivery, the buyer can carry out three-way matching by comparing the invoice and packing list against the purchase order. This is especially useful when the buyer has placed multiple orders of identical products. Matching invoices to purchase orders is easier because they have the purchase order numbers for reference.

-

When these invoices are routed to the finance team (or accounts payable team), having a purchase order to compare with the invoice helps determine if the charges are authorized. With purchase orders, your finance team can focus on swiftly processing invoice payments rather than combing through records and verifying their legitimacy.

Helps with overall cost control and reduction

Purchase orders control the costs in many ways:

-

By having the price laid out and documented, the buyer can avoid unexpected price increases and discrepancies.

-

Purchase orders add a layer of security to your procurement process since the approvers can oversee employee spending, ensuring accountability and compliance since they’re aware of their purchases being tracked.

-

Purchase orders facilitate compliance with budget thresholds, preventing negate maverick spending right from the beginning. The buyer can verify the cost of the items to be ordered against the budget to ensure that internal approval is granted before the purchase order is forwarded to the supplier.

-

The purchasing department can analyze these documents to identify purchasing patterns. Based on this, they can consolidate multiple purchase requests from various departments into a single bulk purchase order to secure discounts.

-

The purchasing department can also infer how many orders have been placed with a particular supplier in the last year and how much has been spent on procuring goods or services from them. This can be used to negotiate effectively and request volume discounts.

Plays a key role in budgeting

Without purchase orders, an invoice for a large amount could arrive with a short payment deadline, throwing a wrench into your firm’s budget. With these documents, firms can better foresee future payments and budget accordingly. By analyzing budgets over time, you can derive clear insights into your firm’s spending patterns for more accurate budgeting.

Provides a comprehensible audit trail

During financial audits, auditors often ask to see approval from managers as evidence for the company’s purchasing decisions. Purchase orders are perfect for this since they contain all the necessary details of the purchase, offer an accountable trail to the auditors, and can be traced back to the invoice. A streamlined purchase order process denotes a well-defined flow of orders and accurately tracked expenditure, confirming that your business is doing procurement the right way. This offers reasonable assurance to stakeholders, auditors, and banks alike.

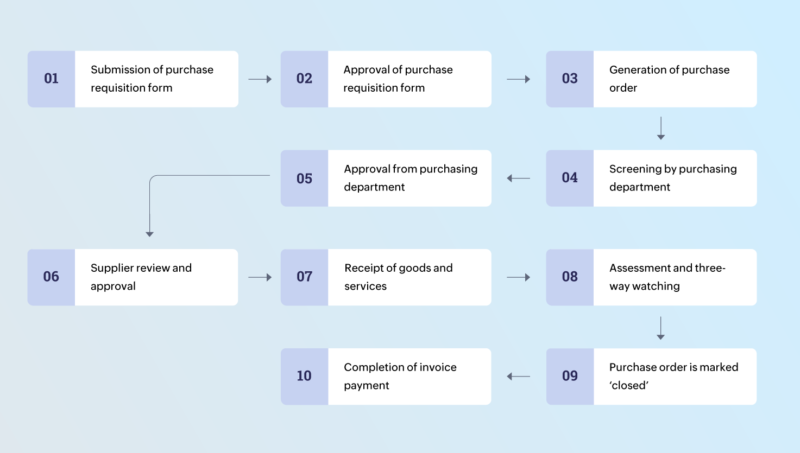

Steps involved in the purchase order process

The steps in a purchase order workflow may vary from one company to another depending on its industry, size, organizational structure, and more. However, the basic outline of the process remains the same:

Buyer issues and submits a purchase requisition form

The first step is to create a purchase requisition form with the details of the goods or services to be purchased. This form is submitted to the line manager and then the purchasing department. On its review and approval, a purchase order is generated.

Buyer drafts the purchase order

When the goods or services that need to be purchased are agreed upon, the purchase order is created by documenting the necessary information. Organizations usually have their own ways of generating purchase orders—paper forms, digital forms that are sent via email and then electronically signed, or forms generated by expense management software.

Purchase order is sent for internal approval

Before the purchase order is submitted to the supplier, it must go through internal review and approval. The firm’s approval hierarchy will determine who must approve the document before sending it forward. Often, purchase orders go through multiple stages of approval, starting with the head of the department, followed by the procurement or purchasing manager. They check the legitimacy of the purchase order and also ensure that the expenditure does not exceed the department’s budget.

Purchase order is sent for supplier’s review and approval

After internal approval, the purchase order is sent to the supplier. The supplier can choose to accept or reject the order. Once they accept and confirm the purchase order, it becomes a binding contract. Following this, the purchase order is considered ‘open’ and will remain ‘in progress’ until the agreed items are delivered and the order is fulfilled. An open or in process status denotes that the order has been placed but the goods or services have not been delivered yet or only a part of the order has been delivered.

Order delivery and issuing an invoice

The supplier ships the order along with an invoice containing the product details, quantity, price, and payment terms. Both the packaging slip and invoice should contain the purchase order number to help the buyer identify which order has arrived. The corresponding purchase order is then marked ‘payment pending’ after the order has been delivered.

Assessment and three-way matching

When the products or services are delivered by the vendor, the receiving department audits the order for quality and quantity. A three-way matching process checks the purchase order, order receipt/packaging slip, and invoice to confirm the purchase order number, the accuracy of the order, and the agreed-upon price. This ensures that the buyer is charged the right amount for the order and not anything extra. If any returns are required, they are processed by the warehouse or receiving team.

Purchase order is closed and the invoice payment is completed

Provided everything is set and the buyer is satisfied with the order, the finance team approves the invoice, records it under accounts payable, and arranges payment to the supplier according to the payment terms and conditions. At this point, the purpose of the purchase order is fulfilled and marked as ‘closed.’

Here’s your takeaway!

Purchase orders may seem like just more documents to file, but they play an important role in your company’s procurement process. By skipping purchase orders, you’re missing out on the many benefits that they can bring to your firm’s bottom line. This is particularly the case with scaling businesses—with several hundred purchase orders involving multiple suppliers, you need to be aware if you’re receiving the right items for the right price. From acting as a legal document and establishing clear communication with suppliers to helping assess performance and forecast trends, purchase orders offer a smoother purchasing process to all stakeholders involved.