- HOME

- Expense Management

- The complete guide to office supplies and business expenses

The complete guide to office supplies and business expenses

In high-growth, multinational environments, day-to-day business expenses may look trivial, like buying office supplies, onboarding employees, or scaling operations. These transactions collectively shape operating cost structures, reporting accuracy, and financial governance. Properly categorizing these purchases is essential for clear accounting, accurate profit measurement, and effective budgeting.

This guide helps you classify stationery, office supplies, and office equipment. This approach helps finance teams enhance transparency, strengthen cost controls, and reinforce financial discipline across the organization.

What is considered stationery?

From a finance and procurement perspective, stationery is primarily used for documentation and daily administrative tasks.

Examples of stationery include pens, pencils, letter pads, business cards, copier paper, and ink. These are recorded as operating expenses. For more information on operating expenses, please refer to this blog post: Operating expenses: Get everything you need for building a better cash flow.

What items are considered office supplies?

When categorizing business expenses, it is important to distinguish office supplies from office equipment assets. While both support operations, they differ in financial treatment, tax implications, depreciation, and balance sheet reporting.

Purchases consumed within the operating cycle that support administrative efficiency are classified as office supply expenses. Office supplies typically include stationery, consumables, and accessories used in daily business operations.

Example of office supplies

Consider a typical office scenario to illustrate expense classification.

Office printers and their usage demonstrate the difference between capital assets and operational consumables. The cost of purchasing printers, desks, and tables is classified as office equipment and recorded as a fixed asset on the balance sheet, with value reduced over time through depreciation. In contrast, paper and ink cartridges are treated as office supply expenses because they are consumables.

How are printing services categorized?

Printing costs are not always recorded under a single expense category. Finance teams classify printing expenses based on purpose, department, and business impact.

Administrative expenses: Printing for internal operations, such as HR documents or handouts, is categorized as an office expense.

Marketing expenses: Printing for brand promotion or customer acquisition is classified under marketing or advertising expenses.

Cost of goods sold (COGS) or project costs: The printouts that are part of customer deliverables or billable projects are classified as direct business costs. These are usually recorded under COGS or project expenses and can be billed back to the customer.

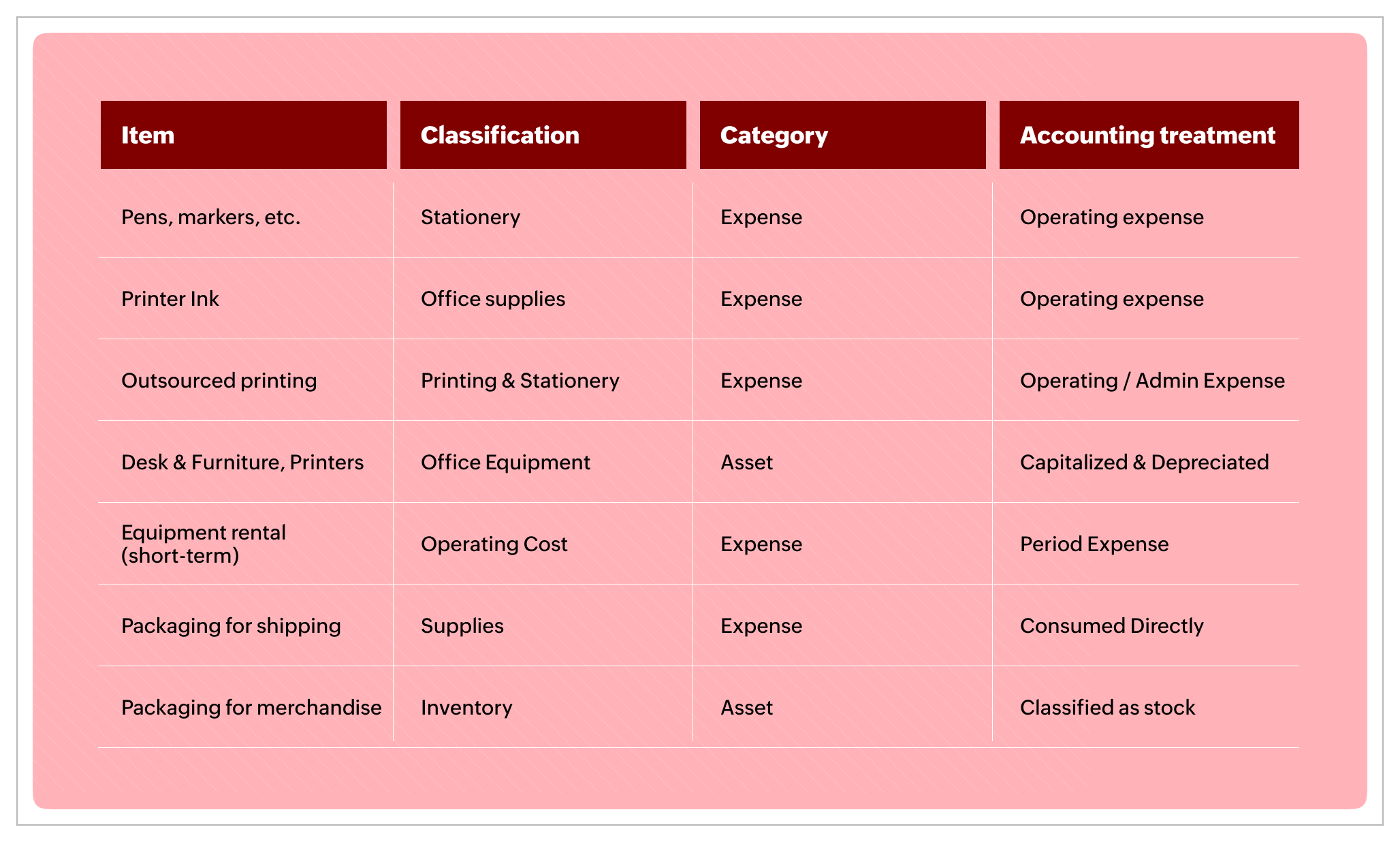

Beyond the broad classification above, organizations can tag printing costs to specific departments or cost centers where the expense was incurred. This provides clearer financial insights and supports enterprise-level spend optimization. The detailed chart below classification supports enterprise resilience, financial clarity, and spend accountability, especially when applied across geographies, business units, and projects.

Does a desk fall under office equipment?

Desks, printers, and other workstation items with long-term utility and value retention over multiple accounting periods are classified as office equipment. Other examples include chairs, desktop computers, and laptops.

Tax implications for stationery and office supplies

Office supplies and stationery are recorded as expenses and are fully deductible operating expenses in a financial year.

On the other hand, office equipment, such as desks, printers, and computers, is recorded as capital investments and does not qualify for a full upfront deduction. Instead, tax benefits are realized through depreciation.

Conclusion

Office supplies, stationery, equipment, and packaging may seem tactical, but their proper financial treatment strengthens reporting accuracy and spend governance. By distinguishing between consumables and assets, organizations improve cost visibility, ensure compliance, and allocate capital more effectively.

With Zoho Expense's end-to-end expense management software, you can automate all employee business spending. Enforce policies, budgets, and set up approvals for to office supplies to identify leaks and maintain financial health.

- Neil Varshiney

A focussed marketer and seasoned Fintech writer helping finance professionals and business owners to find and help them evaluate the right tech stack to run their operations effectively.