ERP software powered by a world-class tax engine

Your vision deserves a tax compliance engine that keeps pace. From GST and invoicing to payroll, manage every regulatory requirement with the most powerful ERP software.

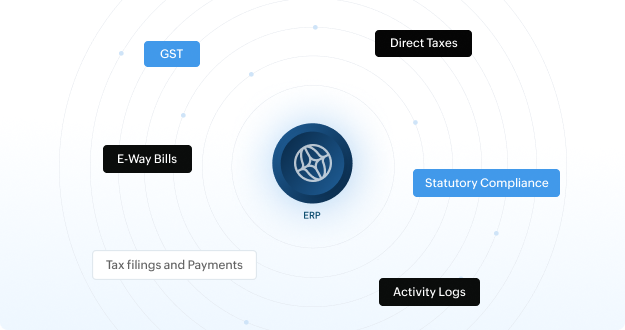

Taxes and compliance built as a tech layer

Every financial movement in Zoho ERP is governed by built-in tax logic and statutory rules, making compliance a permanent state, not a periodic task for your business.

- GST returns, filings, and payments

- Direct taxes

- e-Invoicing

- e-Way Bills

- Payroll compliance

One unified ERP software for a thousand moving parts

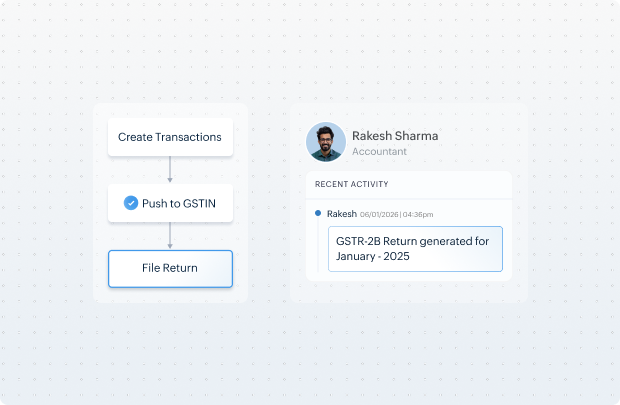

GST and indirect taxes

From high-volume invoicing to month-end closure, Zoho ERP handles how GST is calculated, recorded, and reported across your organisation.

- Prepare and file GST returns with system-verified accuracy

- Reconcile input tax credits with purchase registers automatically

- Standardise GST handling across branches and business units

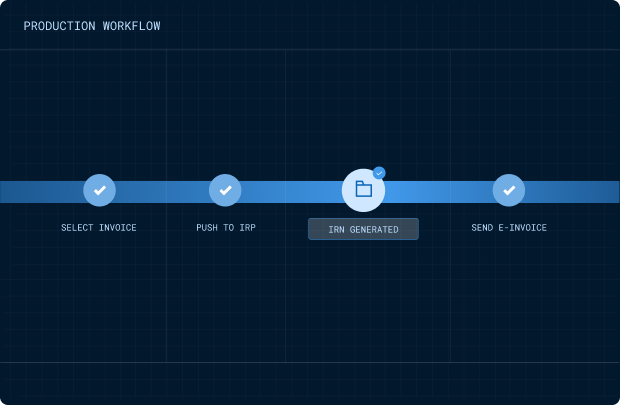

e-Invoicing compliance

Make compliance a part of every invoice. Create, verify, and register e-Invoices with government portals, providing a single source of truth for all your statutory obligations.

- Upload invoices directly to the IRP through GST Suvidha providers

- Automate recurring invoices and submissions

- Monitor multi-branch transactions via multiple GSTINs

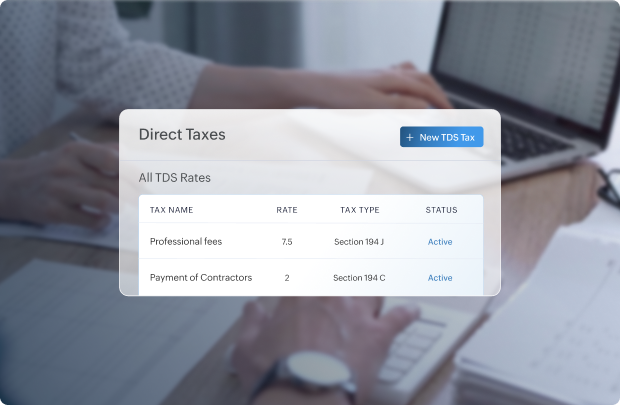

Direct tax management

Apply TDS and TCS exactly where required. Calculate taxes at the transaction or line-item level, keeping every deduction and collection aligned with income tax regulations.

- Automated TDS and TCS computation

- Accurate tax treatment for contractor and vendor payments

- Built-in handling of TCS for eligible goods and services

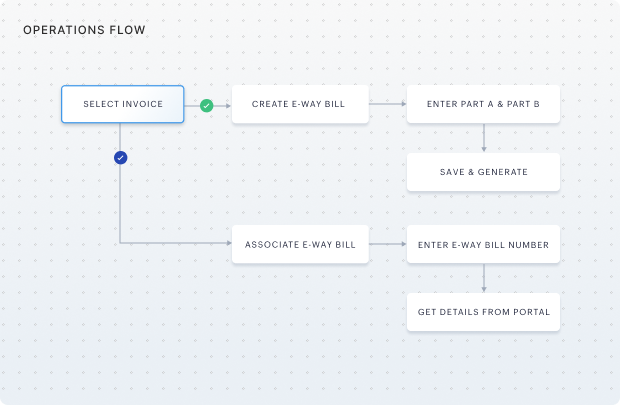

e-Way bill automation

Keep your goods moving and take your business forward with e‑way bills that are created and reconciled in the background as shipments are prepared.

- Auto‑generate e‑way bills from invoice and shipment data

- Validate details before submission to government portals

- Sync e‑Way bill status across locations and routes

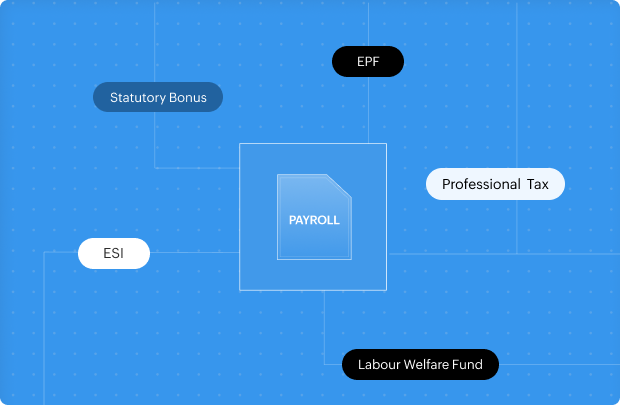

Payroll statutories

Process every salary with utmost accuracy and care. From retirement contributions to state taxes, Zoho ERP makes compliance an integral part of every payroll process.

- Built-in compliance with EPF, ESI, LWF, and employee TDS

- Automated state-specific rules for professional tax calculations

- Generation and distribution of Form 16 and tax worksheets

The Zoho ERP Tax Engine

Backbone of business complianceEvery process, every calculation, and every line of code is built with compliance at its core, turning all your operations into a cohesive, audit-ready framework.

Advanced guardrails for your most critical data

Offer role-based workspace

Show the right information to the right people. Surface only the modules, dashboards, and insights relevant to their role while keeping sensitive data secure.

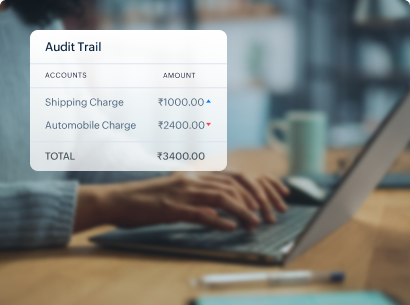

Activity logs and audit trails

Track the full lineage of your data with logs that record all actions. Compare versions, review changes over time, and make audits easy with complete visibility.

Manage all your documents in one place

Bring your financial and organisational documents into a single, structured repository. Link files directly to transactions for instant context when you need it.

We protect your data the same way we protect our own

All your financial data stays secure and isolated in Zoho-owned private data centres with strict access controls. No third-party data mining. No advertising-driven compromises.

Questions you might have before signing up

Tax compliance in Zoho ERP are built into day-to-day operations, not handled as end-of-month tasks. Every invoice, payment, payroll run, and statutory record follows predefined tax rules and validations so compliance is maintained continuously as your business operates.

Yes, Zoho ERP supports GST and other indirect taxes, direct taxes such as TDS and TCS, e-invoicing, e-Way bills, and payroll statutory compliances including EPF, ESI, professional tax, and labour welfare fund, with state-specific applicability where required.

Regulatory change is built into the system’s design. Updates to tax laws, slabs, and compliance rules are applied automatically at the core, keeping your operations aligned with current regulations.