VAT for United Kingdom

VAT - Value Added Tax. According to HMRC, VAT is a tax that is charged on most goods and services that VAT registered businesses provide in the UK. It is also charged on goods and some services that are imported from countries within and outside the European Union (EU).

You need to create a New Organisation and choose the UK edition to make use of this feature.

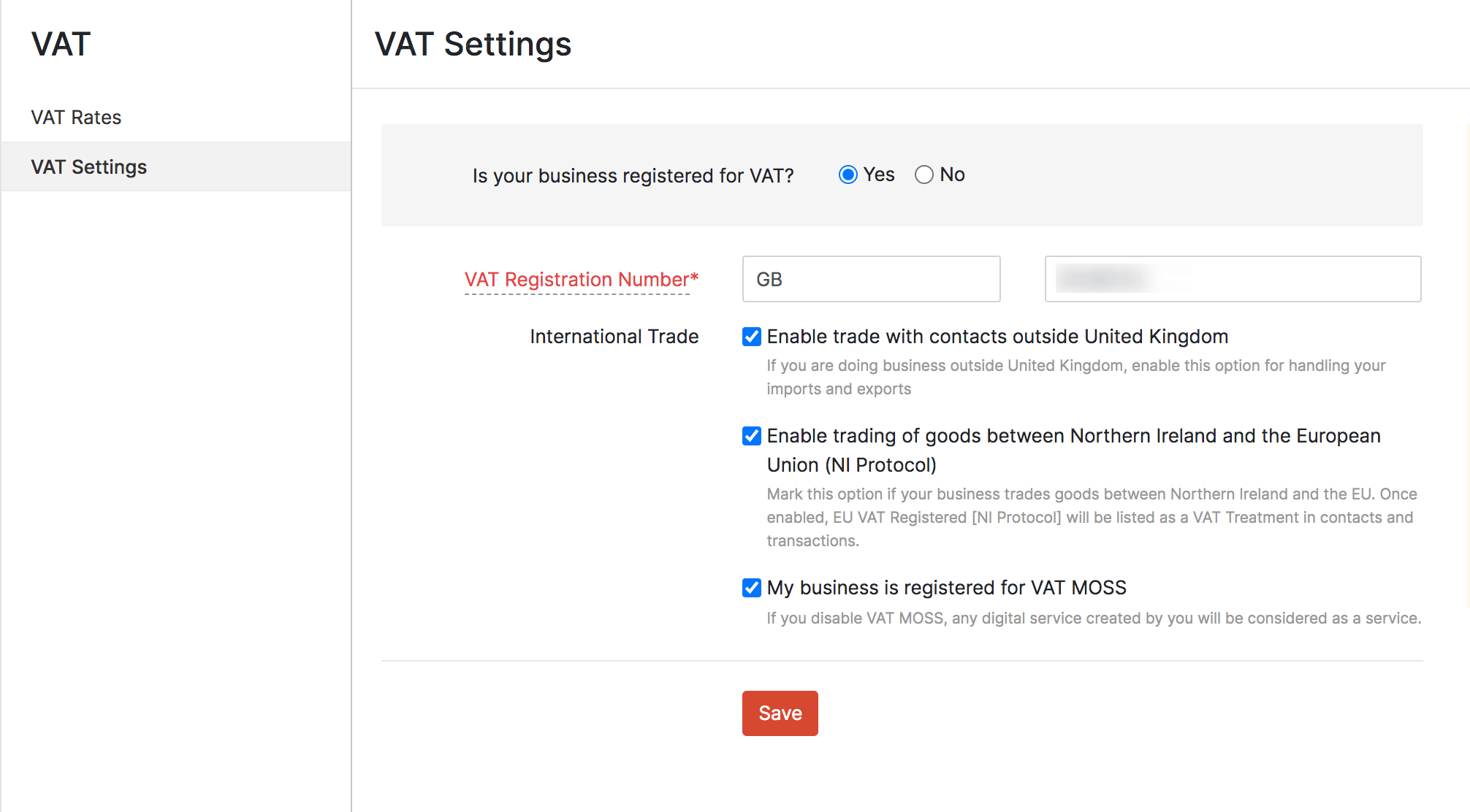

VAT Settings

To start setting up your VAT in Zoho Billing, navigate to Settings > VAT and check the VAT Registration box.

If your business is VAT registered, HMRC would provide you with a certificate containing the VAT details for your business. Enter the details from your HMRC certificate into the VAT settings page in Zoho Billing.

| Field name | Description |

|---|---|

| VAT Registration | Check the box if your business is registered for VAT. |

| VAT Registration Number | Registration number provided for your business by HMRC. |

| International Trade | Check this box to enable trade with customers outside the UK. Once international trade is enabled, Zoho Billing will take care of the Acquisition VAT and Reverse Charge Handling in transactions. This will be recorded in the European Commission (EC) Sales List Report which will be available in the Taxes section under Reports. If you are registered for VAT MOSS, then check the Registered for VAT MOSS box. To know more about VAT MOSS, Click Here. |

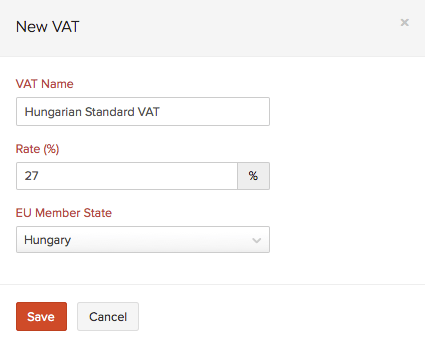

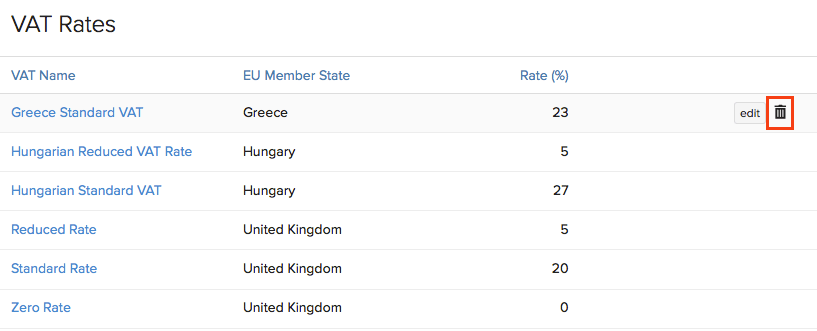

Adding New VAT Rate

To create or add a new Tax rate, kindly follow the below mentioned steps:

- Navigate to Gear icon > VAT.

- Select the VAT Rates tab.

- Click on +New VAT.

- In the new VAT rate form,

- Enter the VAT Name, i.e: Austrian VAT or Belgium Reduced VAT.

- The VAT Rate(%) for the EU member country.

- Select the country from the EU Member State drop-down provided.

- Click on Save.

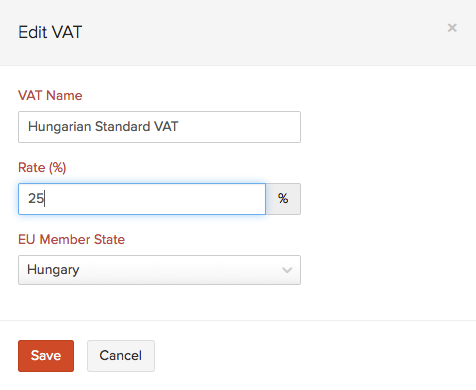

Edit VAT Rate

To edit an existing VAT rate, kindly follow the below mentioned steps:

- Click on the Gear icon found on the top right hand side corner of the screen and click on More Settings. Click on VAT.

- Select the VAT Rates tab.

- In the Edit VAT screen, edit the desired fields such as VAT Name, Rate, EU Member State.

- Click to Save the edited VAT.

Delete VAT Rate

To delete an existing VAT, kindly follow the below mentioned steps:

- Click on the Gear icon found on the top right hand side corner of the screen and click on More Settings. Click on VAT.

- Select the VAT Rates tab.

- Scroll over the desired row and click on the delete icon (trash bin). Confirmation pop-up screen will double check your intention. Click to OK to Delete or Cancel to skip.

Thank you for your feedback!

Thank you for your feedback!