- HOME

- Accounting Principles

- What is fixed asset accounting?

What is fixed asset accounting?

Every business owns things that help it run, like the computers on your desks, the vans you deliver in, the furniture in your office. These are more than purchases. They’re long-term investments that help your business grow.

Managing them properly is fixed asset accounting. It’s the process of recording, tracking, depreciating, and eventually removing your long-term assets from the books when they’ve served their purpose.

When done right (or better, automated through fixed asset accounting software), it helps you understand how your investments contribute to your business’s real value.

The backbone of your business

Fixed assets, sometimes called property, plant, and equipment (PP&E), are tangible items that your business uses over several years. They’re not meant for resale or short-term use; they help you produce goods, deliver services, or support operations.

Typical examples include:

Buildings and land

Machinery and tools

Office furniture and fixtures

Vehicles

Computers and equipment

Because these assets last for years, they appear on your balance sheet rather than as immediate expenses. Their cost is then gradually spread over their useful life through depreciation, ensuring each year reflects only the value actually “used up.”

Recording your assets: cost versus expense

Not every purchase qualifies as a fixed asset. Whenever your business spends money, it’s important to decide whether that spending should be capitalized (recorded as an asset) or expensed (recorded as a cost right away).

Capitalizing assets

Under both IFRS and GAAP, a cost is capitalized when it creates or enhances future economic benefits. This usually includes:

The purchase price (net of discounts)

Taxes and import duties

Shipping, installation, and testing costs

Professional or engineering fees directly related to setup

These costs together form the asset’s capitalized cost.

IFRS (International Financial Reporting Standards): A global framework promoting transparent and fair-value-based financial reporting.

GAAP (Generally Accepted Accounting Principles): A US accounting standard focused on consistency and historical-cost reporting.

Expensing costs

Routine maintenance, small repairs, and everyday operating costs are expensed because they don’t extend the asset’s life or increase its value.

Most businesses set a capitalization threshold (for example, USD 5,000). Anything below that limit is treated as an expense, keeping your fixed asset register clear and relevant.

Understanding depreciation

Every fixed asset loses value as it’s used. Depreciation is how we record that loss over time. It ensures your financial statements show an accurate picture of what your assets are really worth.

The simplest and most common approach is the straight-line method, which spreads the cost evenly each year.

Example:

If you buy a machine for $20,000 and plan to sell it for $2,000 after 5 years, your annual depreciation is:

(20,000 – 2,000) ÷ 5 = $3,600

Each year, $3,600 is recorded as depreciation expense. Other methods, like declining balance or units of production, can be used when assets lose value faster or depend on use.

When assets lose value faster

Sometimes, an asset’s value drops suddenly. For instance, if it gets damaged or new technology makes it outdated, this is called impairment.

Under IFRS, you compare the asset’s carrying value (its current book value) to its recoverable value (what it’s actually worth). If the carrying value is higher, you record an impairment loss.

IFRS also allows revaluation, updating the value of asset classes when their market worth can be reliably measured. GAAP, however, keeps assets at their original cost and doesn’t allow upward revaluation.

CapEx vs. OpEx: What’s the difference?

You’ll often hear two key terms: capital expenditure (CapEx) and operating expense (OpEx).

CapEx refers to spending that creates or improves long-term assets, like buying new machinery or upgrading your office building. These costs are capitalized and depreciated.

OpEx covers your regular operating costs, like wages, rent, utilities, and small repairs, which are expensed immediately.

Here’s a simple way to remember it:

If it extends the asset’s life or increases its value, it’s CapEx.

If it just maintains what you already have, it’s OpEx.

For instance, replacing a broken part in your air conditioner is a repair (OpEx). Installing a new, energy-efficient HVAC system is an improvement (CapEx).

Fixed asset rules under IFRS and GAAP

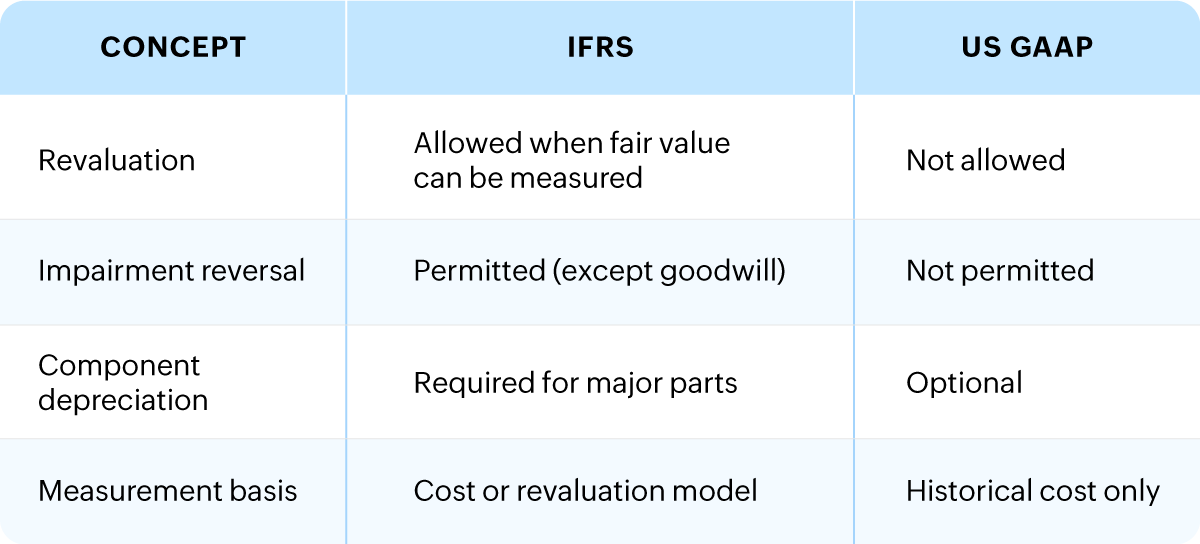

Both IFRS and GAAP follow similar principles but differ in some details:

Whichever you follow, the key is to have a clear capitalization policy for fixed assets—define your threshold, choose a depreciation method, and apply it consistently.

Goodwill: The premium paid during an acquisition for brand, reputation, or customer value, tested for impairment, not depreciated.

Component depreciation: IFRS requires major parts of an asset to be depreciated separately when they wear out at different rates.

Measurement basis: Assets are valued using historical cost, current cost, or fair value, depending on what best reflects their worth.

Simplifying the process with the right software

Manually tracking every purchase, calculating depreciation, and updating your fixed asset register can quickly become tedious. This is where fixed asset management software or asset accounting software makes life easier.

Using a solution like Zoho Books, you can:

Record all your fixed assets with cost, date, and useful life.

Automatically calculate depreciation using straight-line or declining-balance methods.

Track disposals or tax write-offs and record gains or losses automatically.

Maintain an up-to-date fixed asset register and access asset tracking reports instantly.

By automating these tasks, small businesses stay compliant and accurate while saving hours of manual effort.

Seeing the bigger picture

Fixed asset accounting isn’t just about numbers; it’s about understanding how your long-term investments drive your business forward. With the right fixed asset software for small businesses, you can simplify compliance, gain visibility into your assets’ performance, and make smarter decisions about when to repair, replace, or reinvest.

When tools like Zoho Books handle the heavy lifting, you’re free to focus on what really matters: growing your business.