- HOME

- Taxes & compliance

- Registering for Excise Tax in the United Arab Emirates: A Comprehensive Guide

Registering for Excise Tax in the United Arab Emirates: A Comprehensive Guide

Excise tax registration

A person who conducts (or intends to conduct) activities like producing, importing, transfering or stockpiling of excise goods should pay excise tax.

They must register within 30 days after either the onset of business, or the effective date of the law, whichever is earlier. They cannot be a part of any transaction involving excise goods until they have registered for excise tax in the UAE. There is no registration threshold for excise tax.

Exceptions to excise tax registration

A person who does not import excise goods regularly will not have to register for excise tax. They will need to prove that they do not import excise goods more than once in six months or four times in twenty-four months.

Excise tax will still be due on imports where the value of the excise goods exceeds the duty-free threshold.

Excise tax deregistration

If a person who has registered for excise tax is no longer dealing with excise goods, they can apply for deregistration.

Questions to ask yourself before completing the registration form

- Should I register for excise tax?

- Do I plan on supervising a Designated Zone as a warehouse keeper? If yes, you will need to complete additional forms.

- Do I have all the supporting documentation & information that I’ll need to upload?

- Am I an authorized signatory of the business being registered (a director, an owner, or someone with the power of attorney to sign on behalf of the business)?

How to register for excise tax

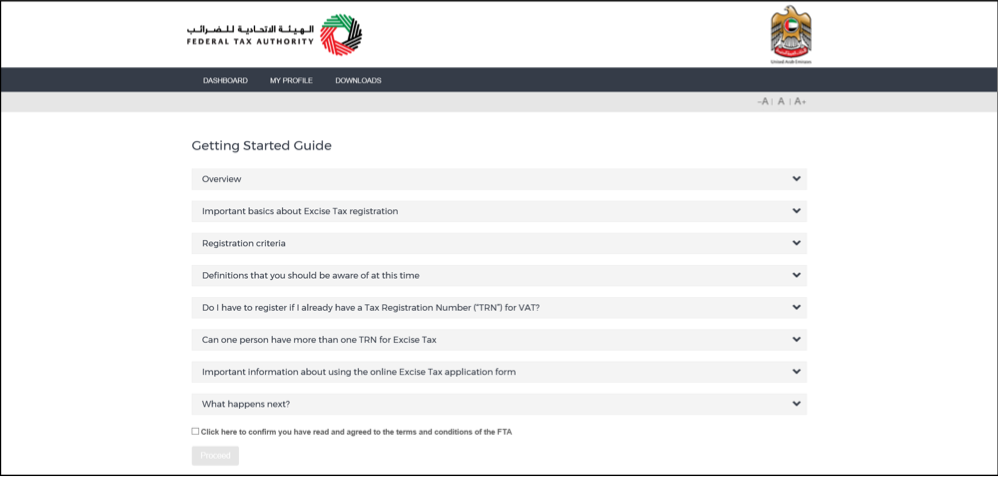

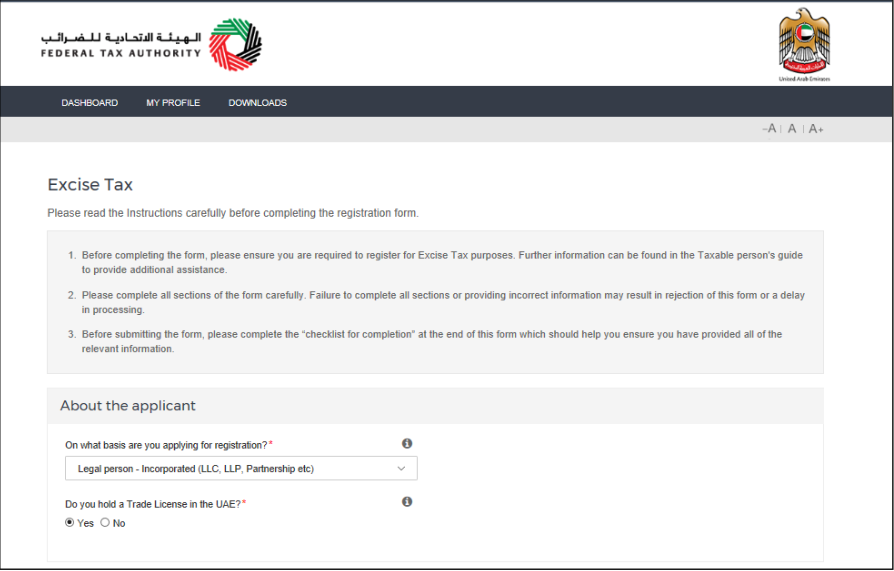

If you are required to register for excise tax, you can complete the registration form online via the FTA portal.

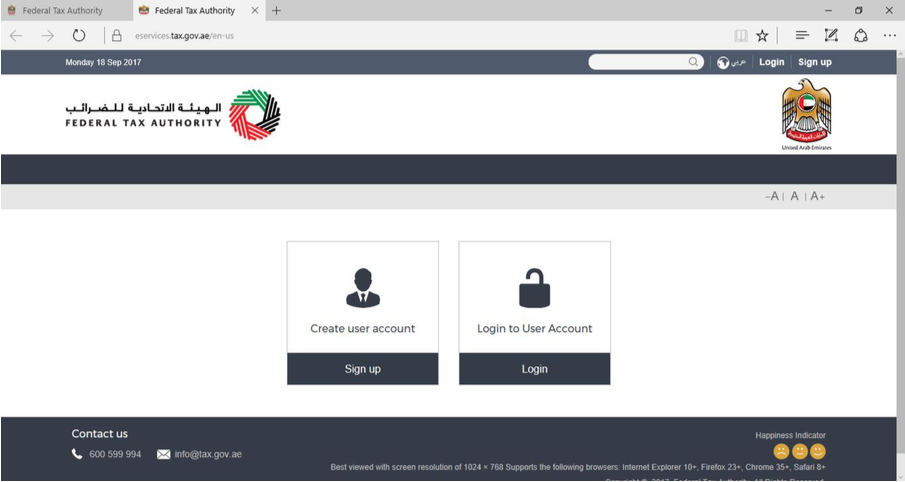

- Open the registration portal on the FTA website and create your user account.

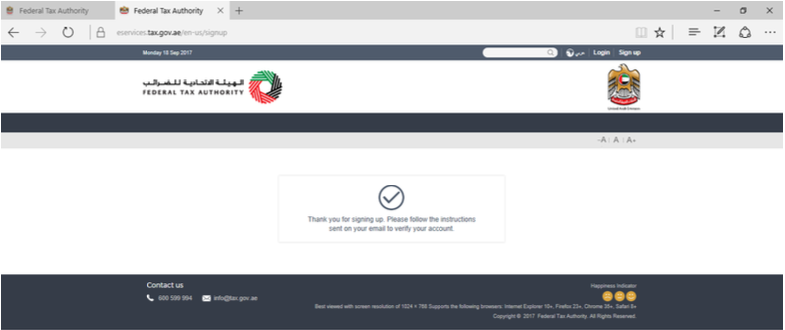

- Verify your details and activate your account using the link sent to your registered email id.

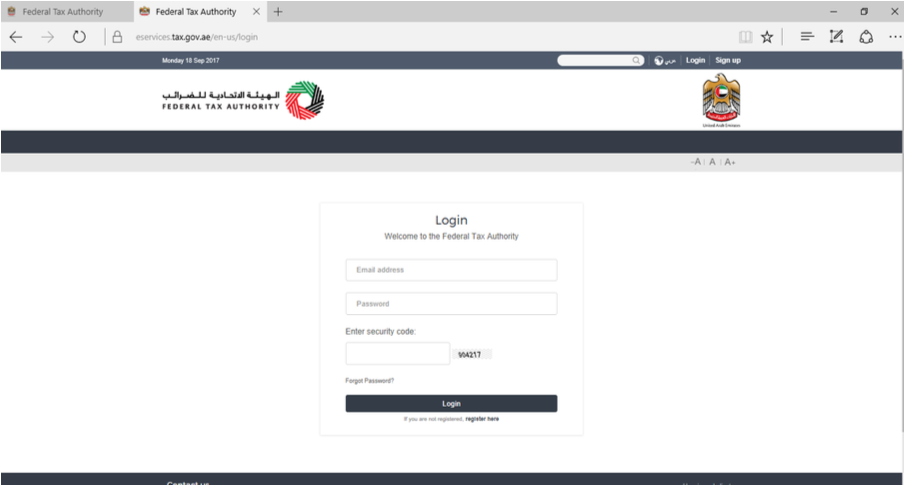

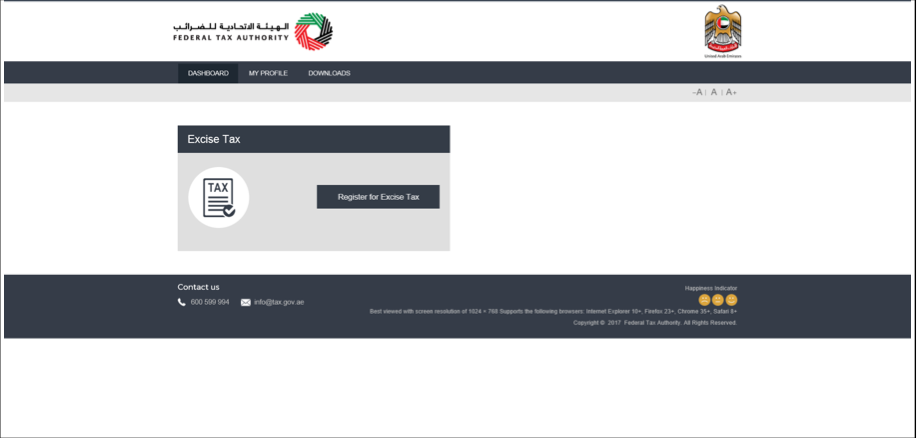

- Log in to the FTA portal using your credentials and navigate to the excise tax registration form.

Complete the form and check that all of the details are correct. Click submit to send the form to the FTA.

After approving your application, the FTA will notify you of your new Tax Registration Number.

Documents required for excise tax registration

You will need to provide several documents during registration to authenticate your information. The supporting documents required are:

- Passport copy

- Emirates ID

- Trade license

- Any other official records that entitle the business to administer activities within the UAE.

Business details required for registration

- The role in which you are registering for excise tax (producer, importer, etc).

- Details of the excise goods with which the business is involved.

- Details of your Customs Authority registration, if applicable.

- If you are registered for excise tax in another GCC State, provide the TRN for that GCC state.