IN THIS PAGE…

Form DRC-01C

In the 50th GST Council meeting held on 11 July 2023, the Indian government introduced a new mechanism to address ITC mismatches between GSTR-2B and GSTR-3B. Subsequently, CGST Rule 88D was notified on 4 August 2023, vide CGST notification 38/ 2023, allowing the GST system to send automatic notifications to taxpayers regarding significant ITC discrepancies between these returns.

If the difference between the ITC available in your GSTR-2B return and the ITC claimed in your GSTR-3B return exceeds a pre-defined limit, you will receive a notification in Form GST DRC-01C.

The ITC mismatch details will be available in Part A of Form DRC-01C. In such cases, you must file Form DRC-01C Part B to provide the necessary details and reconcile the difference.

Filing Form DRC-01C Part B

To file Form DRC-01C Part B:

- Go to the GST portal.

- Click Login on the top right corner of the page.

- On the following page, enter your GST Username and Password and click Login.

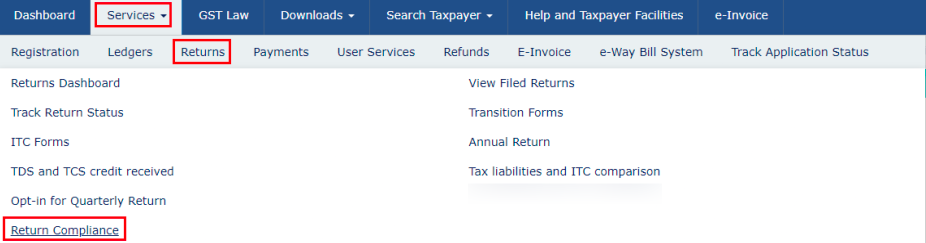

- Click Services from the top bar.

- In the dropdown, hover over Returns and select Return Compliance.

(or)

- Click Return Compliance in the Dashboard.

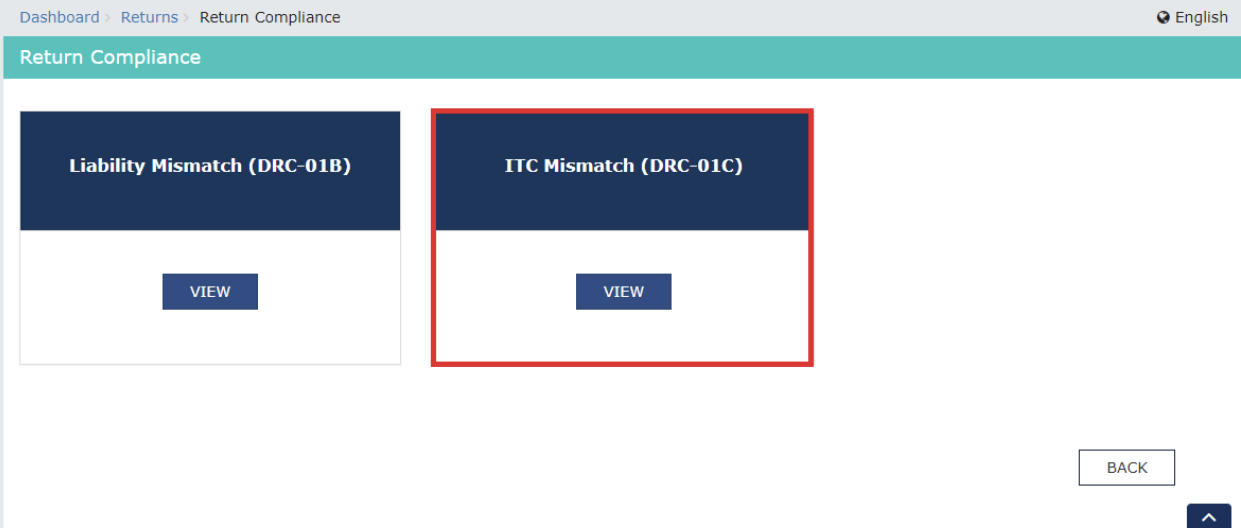

- On the Return Compliance page, click View in the ITC Mismatch (DRC-01C) tile.

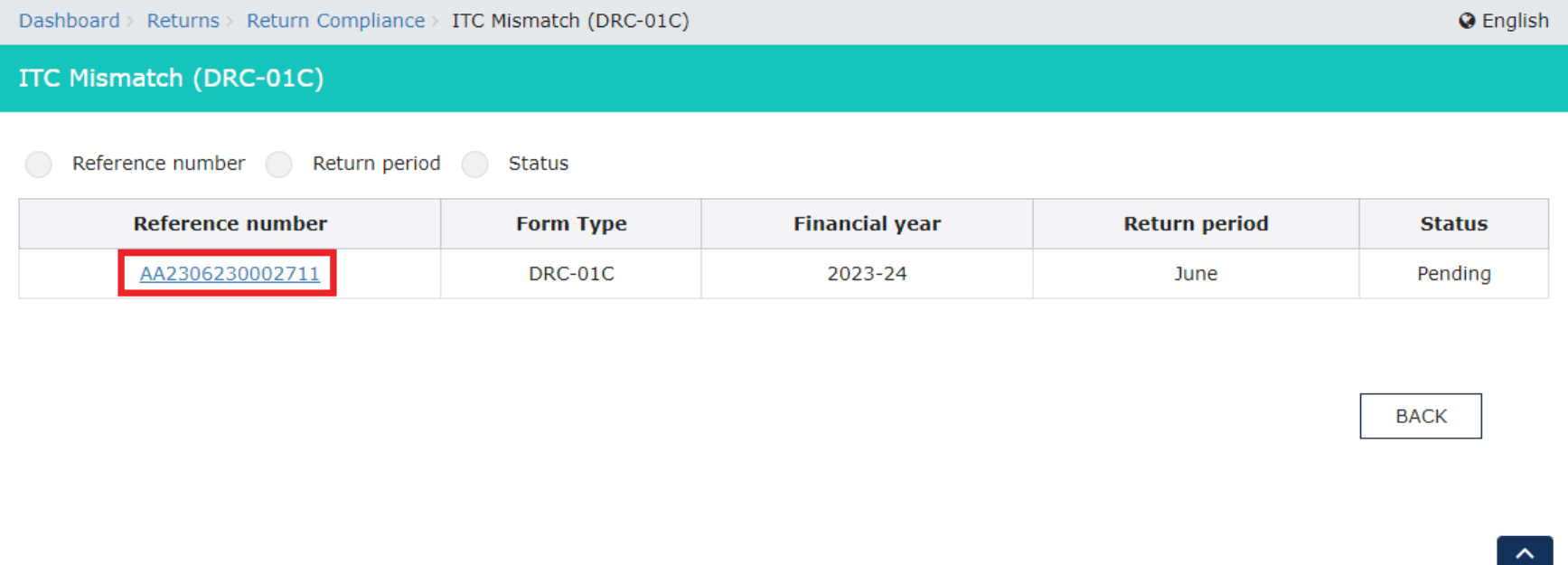

- On the ITC Mismatch (DRC-01C) page, you can view the reference number of all the return periods for which you received the notification in Form DRC-01C Part A.

Insight: You can also select from the Reference number, Return period, or Status options at the top and search for the required details.

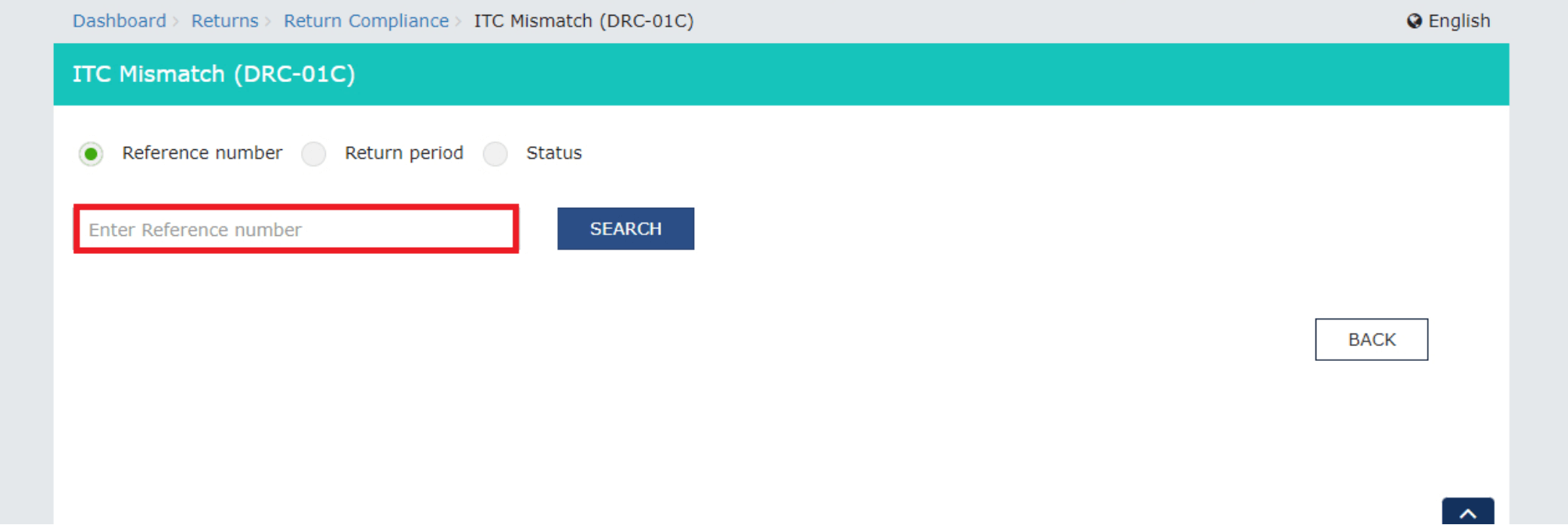

Reference Number

If you select Reference number, enter the Application Reference Number (ARN) and clcik Search.

If the status of the record is Pending, you can file Form DRC-01C.

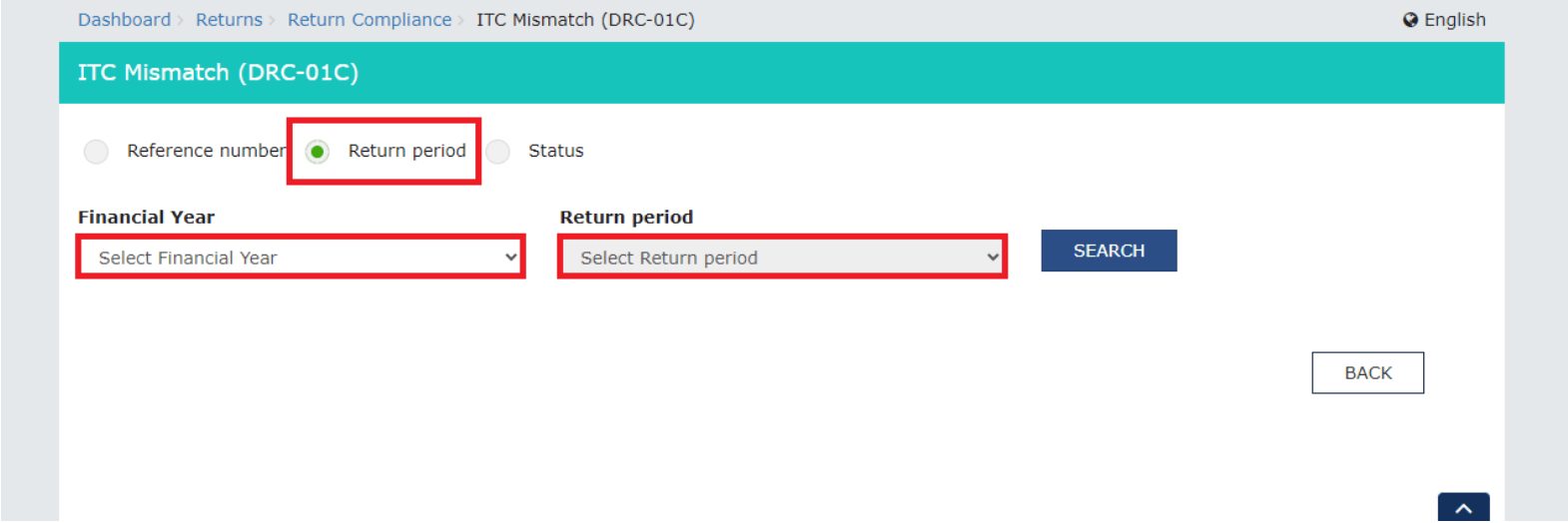

Return Period

If you select Return period:

- Select the financial year for which you want to file Form DRC-01C from the dropdown below the Financial Year field.

- Select the return for which you want to file Form DRC-01C from the dropdown below the Return period field.

- Click Search.

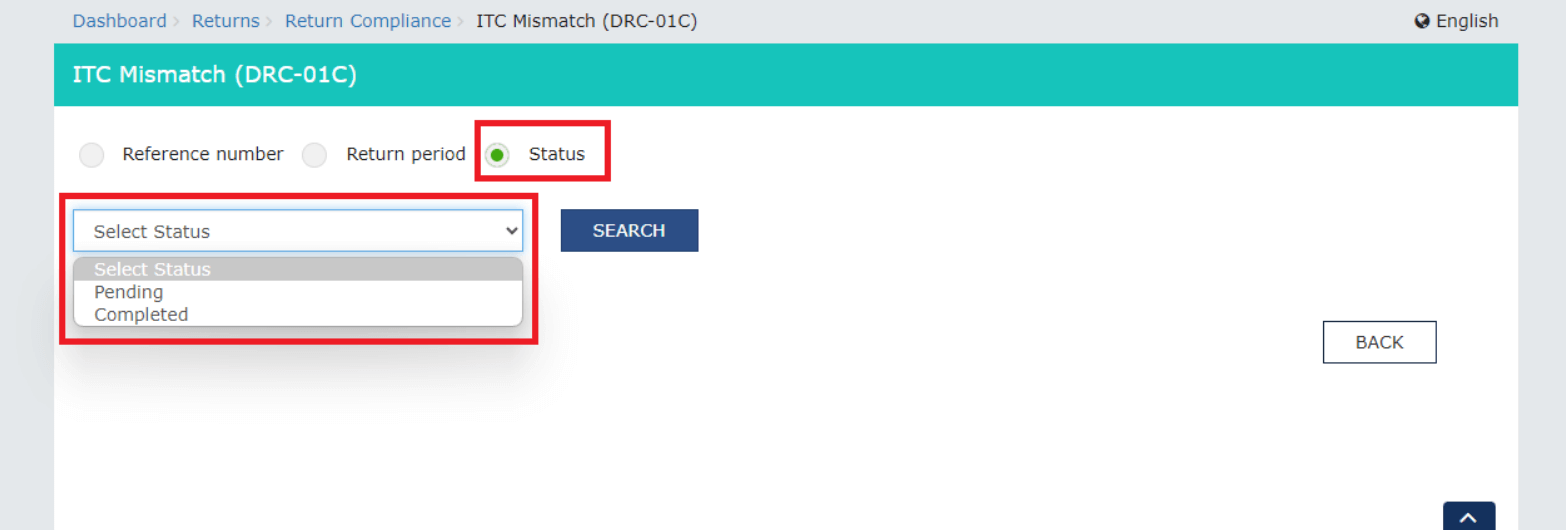

Status

If you select Status, select either Pending or Completed as the status from the dropdown and click Search.

- Click the ARN for the period for which you want to file Form DRC-01C.

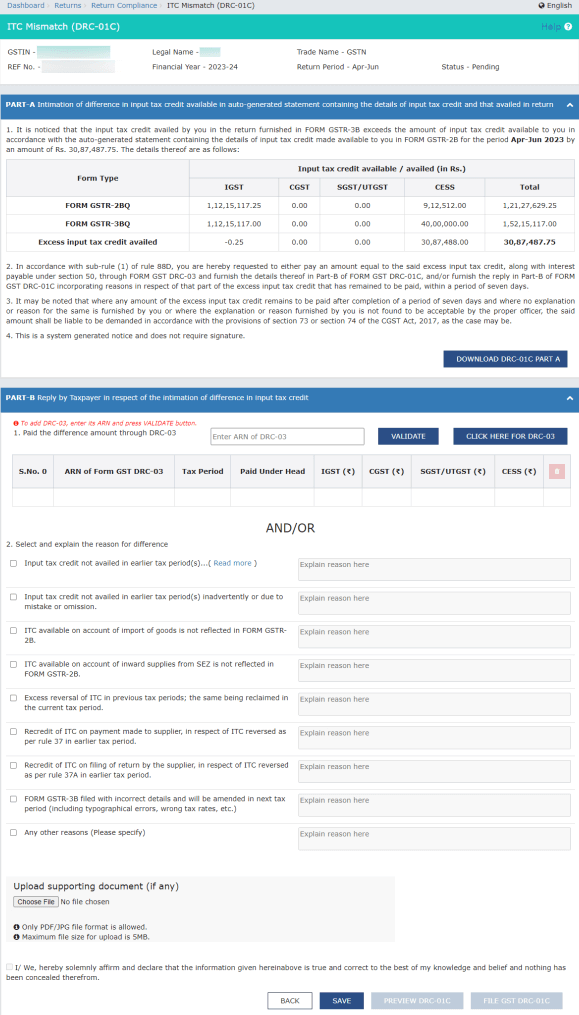

The Form DRC-01C for the ARN entered will be displayed. It contains two parts: Part A and Part B.

Part A contains the section - Intimation of difference in input tax credit available in auto-generated statement containing the details of input tax credit and that availed in return.

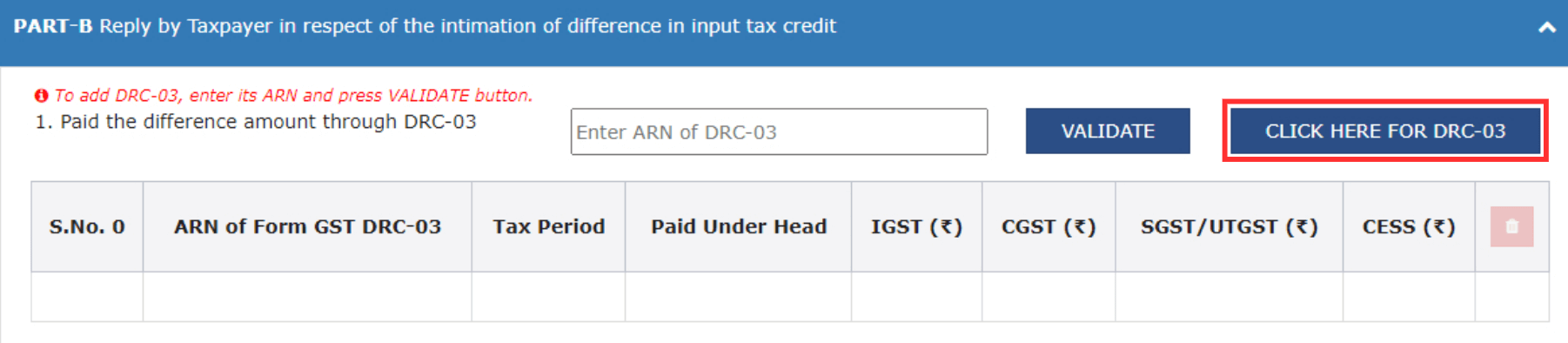

Part B contains the section - Reply by Taxpayer in respect of the intimation of difference in input tax credit. It is further divided into two sub-parts. In subpart 1, you can make payment for the Difference in ITC. In subpart 2, you can select a Reason for the Difference in ITC and provide further explanation for the same.

As a taxpayer, you’ll have to make a payment for the Difference in ITC or select a Reason for the Difference in ITC and provide further explanation for the same in the Part B.

Make Payment for the Difference in Liability Reported

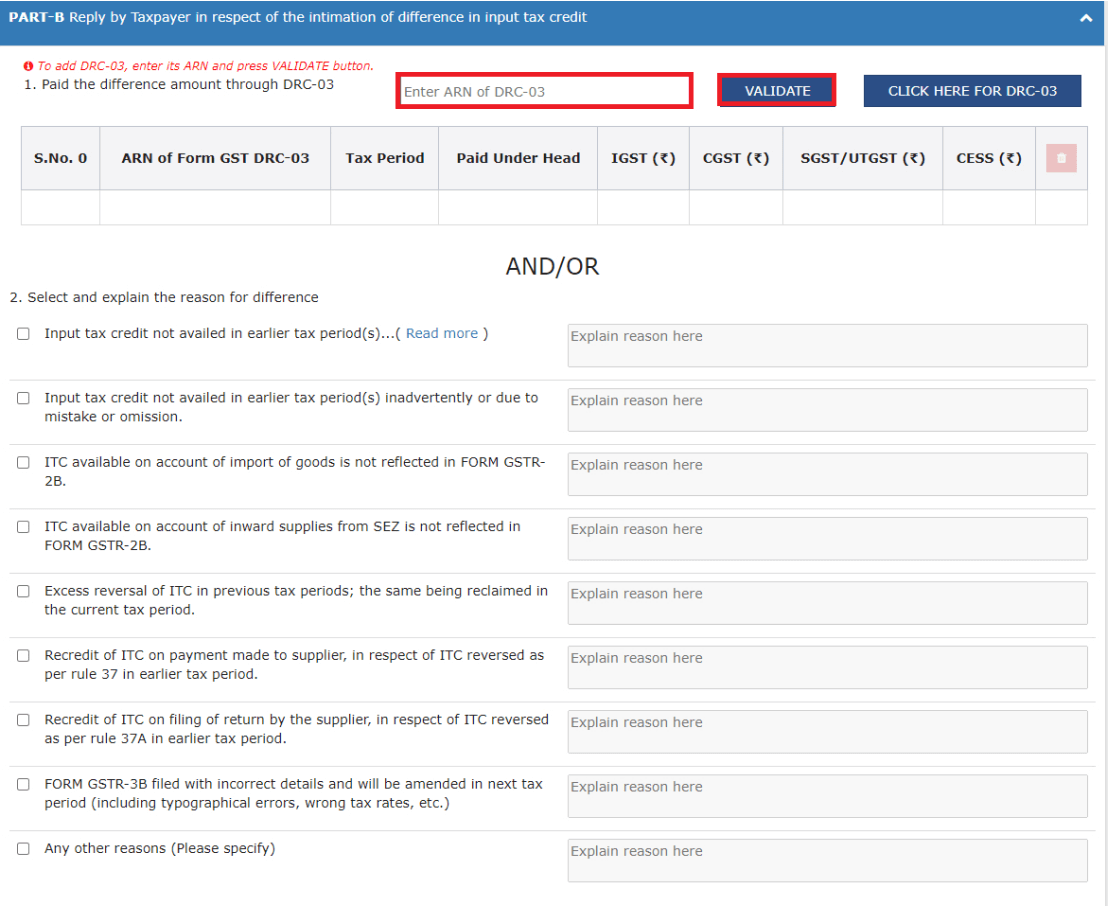

To make payment for the difference in liability reported:

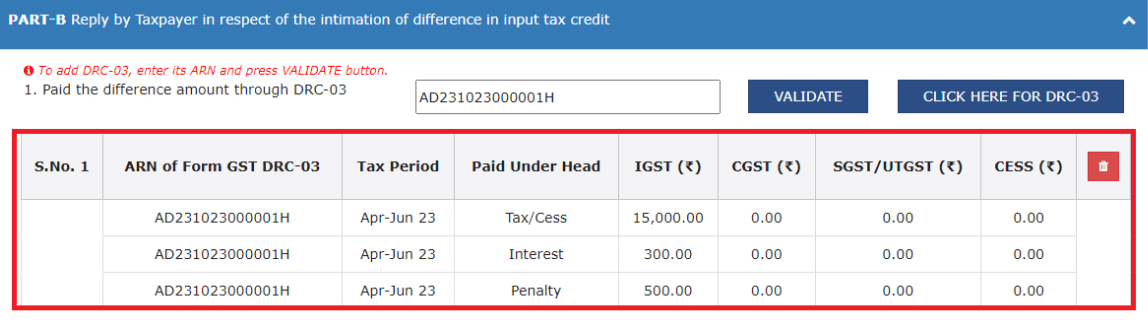

- In the 1. Paid the difference amount through DRC-03 section of the Part B of Form DRC-01C, enter the reference number of the period for which you received the DRC-01C Part A notification in the ARC for DRC-03 text box.

- Click Validate.

The summary of the payment details that have been paid through DRC-03 towards the difference in ITC will be displayed.

-

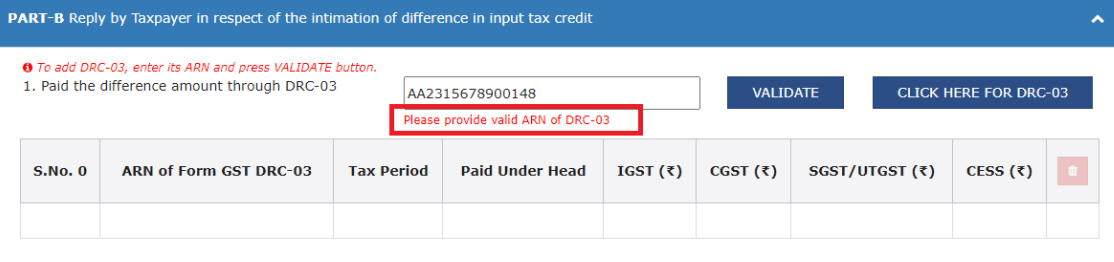

If you get the error message Please provide valid ARN for DRC-03, check the following:

- Ensure that the ARN is valid and that it corresponds to the DRC-03 and GSTIN for which you received the DRC-01C Part A notification.

- Verify that the cause of payment specified in DRC-03 is I****TC mismatch – GSTR-2A/2B to Form GSTR- 3B.

- The DRC-03 has been filed on or after the date on which you received the DRC-01C Part A notification was issued.

- The overall tax period aligns with the period for which of the DRC-01 Part A notification was issued.

- If you file your GSTR-3B return every month, ensure that the from and to dates match the period.

- If you file your GSTR-3B return every quarter, ensure that the period covers at least one month within the quarter.

- If you haven’t made payment for the difference in liability reported, click Click Here for DRC-03.

Select Reason for the Difference in ITC

To select a reason for the difference in ITC:

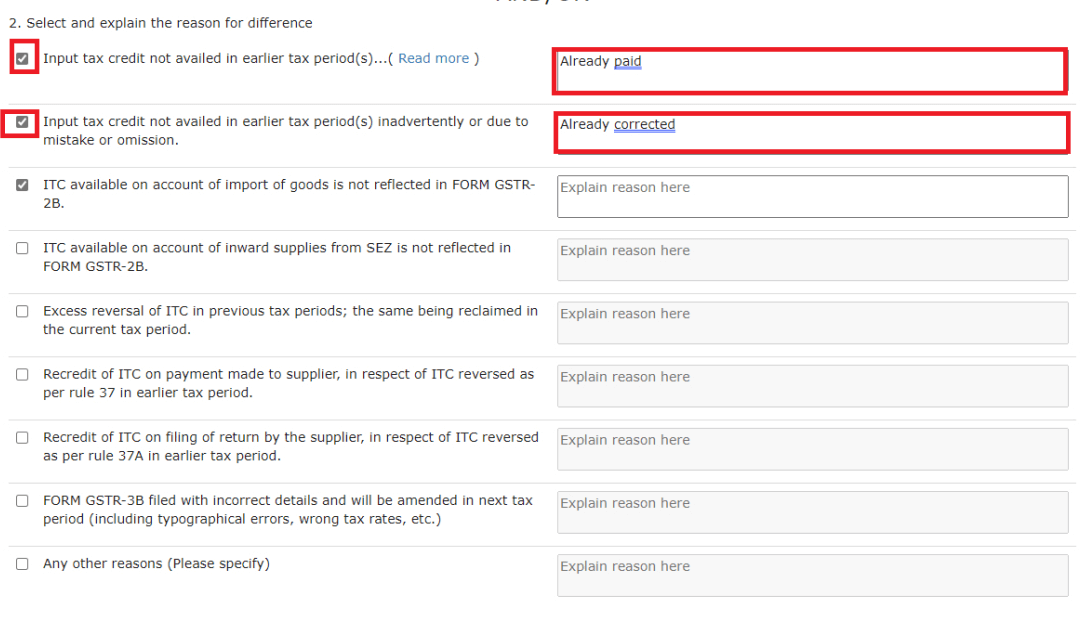

- In the 2. Select and explain the reason for difference section of the Part B of Form DRC-01C, check the checkbox with the relevant reason, and provide a detailed explanation in the text box next to the reason. The reason can be up to 500 characters.

- If the reason is not specified, check the Any other reason****s option and provide a detailed explanation in the text box next to it.

- Click Save.

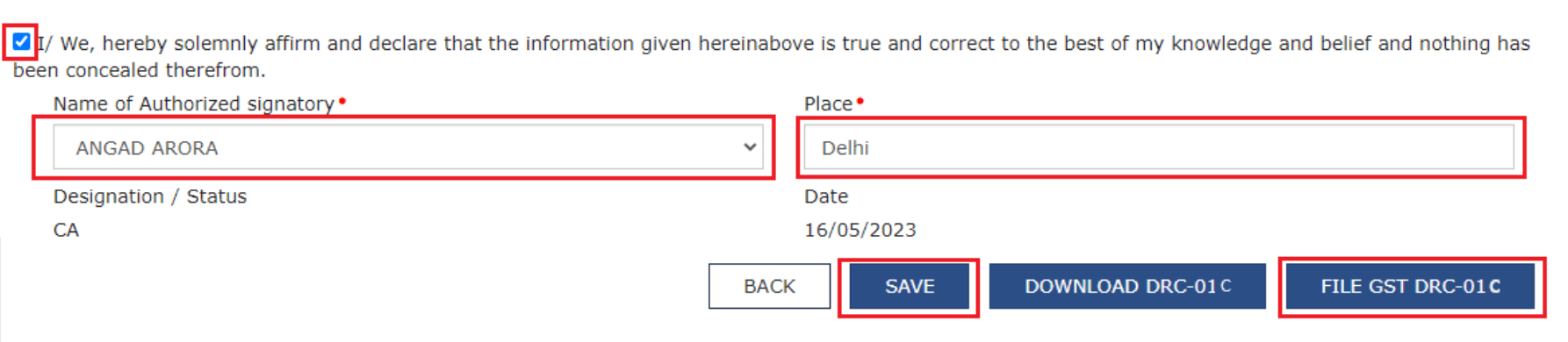

- Check the declaration check box at the bottom. The checkbox will be enabled only after you click Save.

- Select the Name of Authorized signatory from the dropdown below the field and enter the P****lace in the text box below the field. The Designation/Status and Date fields will be auto-populated.

- Click Save. You’ll get a notification that the details have been saved.

- Click File GST DRC-01C. This button will be enabled only when you check the declaration check box and enter the required details in it.

- Click Download DRC-01C. A system-generated draft order will be downloaded into your system as displayed. Check the draft order carefully to rule out any discrepancies.

- In the pop-up that appears, click Proceed.

- On the following page, you can choose whether you want to file using an Electronic Verification Code (EVC) or a Digital Signature Certificate (DSC). Click File DRC-01C With EVC or File DRC-1C With DSC.

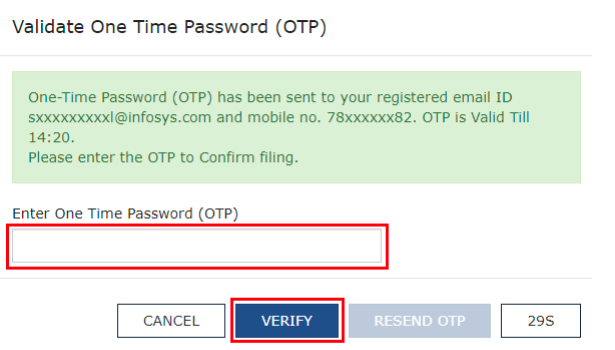

- Enter the OTP sent to the email address and mobile number of the primary authorized signatory registered on the GST portal, and click Verify.

Note: If you don’t receive the OTP within 30 seconds, you can click Resend OTP to get a new OTP. You request for a new OTP up to 3 times.

- In the pop-up that appears, click OK.

With this, you have filed your reply for the DRC-01C Part A notification. You can check the status from the Status option.

To know more about Form DRC-01C, read our FAQs on Form DRC-01C.

Warning: If you don’t file a response to Form GST DRC-01C for a previous tax period within 7 days from the date on which you received the notification, then for the subsequent tax period, you will not be able to file your GSTR-1/IFF return. This will continue until you either deposit the amount specified in the notification or provide an explanation for non-payment.

Yes

Yes

Thank you for your feedback!

Thank you for your feedback!