- See all featuresCore FeaturesComplianceEffortless Accounting

- Pricing

- By Size

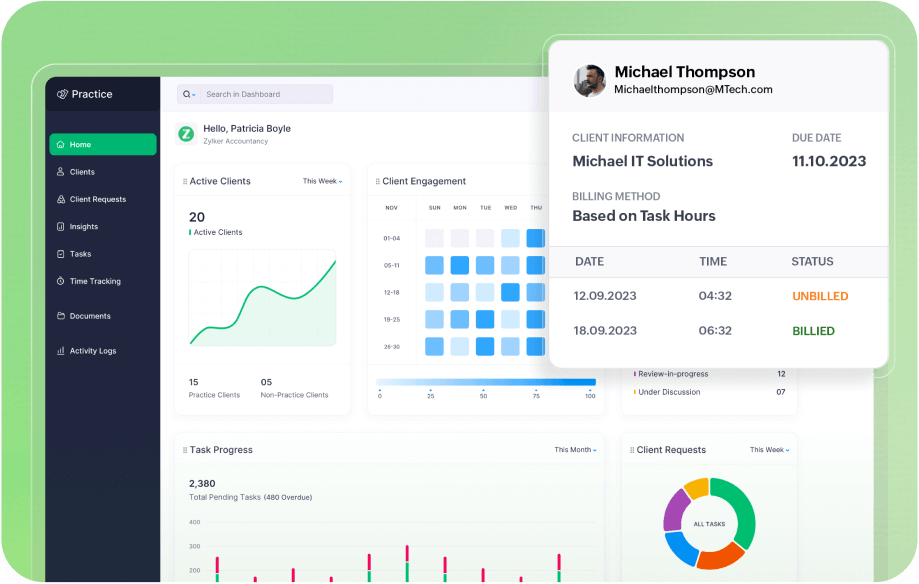

Introducing Zoho Practice

The ultimate practice management software for modern accounting and bookkeeping firms.

- Customers

- Partner with us

- Available on IOS

- Available on Android