free plan

Perfect for sole traders and self-employed professionals just getting started.

£0.00

Per organisation Per Month

Start for Free*No credit card required

HMRC recognised & MTD-compliant

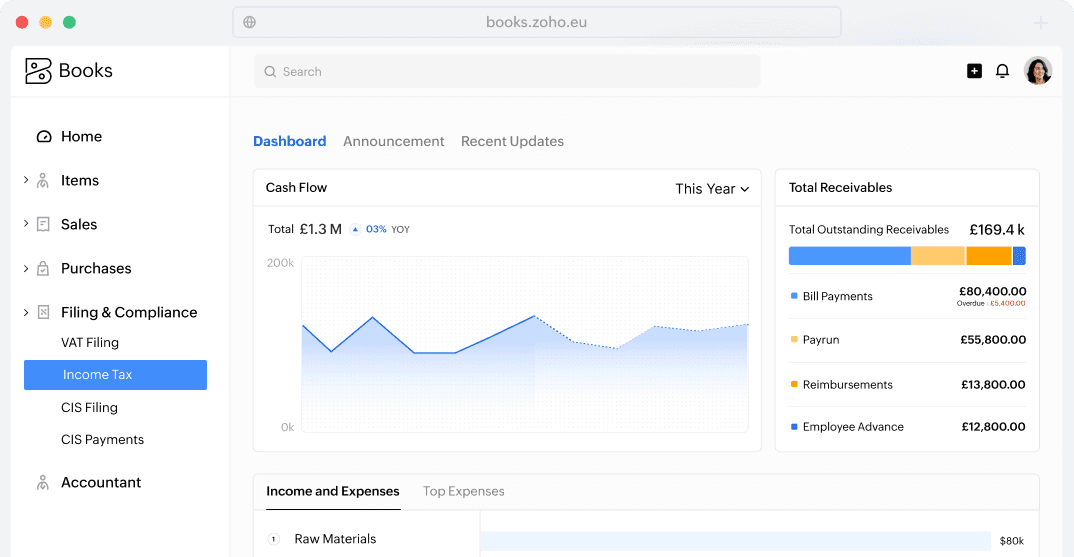

Manage income and expenses with ease, gain smart business insights, and stay ready for Making Tax Digital for Income Tax with HMRC-recognised Zoho Books. Start for free today.

BUSINESS ESSENTIALS

Perfect for sole traders and self-employed professionals just getting started.

£0.00

Per organisation Per Month

Start for Free*No credit card required

Find the right accountant or implementation partner for your business.

Find an ExpertWhether you're migrating from spreadsheets or need guidance, our product experts are here to assist you every step of the way.

Contact Us

+44 800 0856099

Email Us

support.uk@eu.zohobooks.comA sole trader is a self-employed individual who runs their own business and is personally responsible for its income, expenses, and taxes. You must be registered as a sole trader with HMRC if your earnings during the tax year exceed £1,000. As a sole trader, you must keep accurate records of your finances and report your income through Self-Assessment to HMRC each year.

You will be required to pay income tax if you are registered as a sole trader with HMRC.

Previously, you would have manually filled out and submitted the self-assessment form online. The shift to MTD for Income Tax frees you from filling in the details manually.

From April 2026, if you are a sole trader and your annual turnover exceeds £50,000, you are required to file income tax returns with an MTD-compliant accounting software.

Zoho Books additionally offers the SA103F/S Summary, which you can generate as needed to help with the self-assessment and ensure a smooth transition when the time comes.

HMRC's Making Tax Digital (MTD) for Income Tax initiative empowers sole traders to maintain digital records of their business transactions and simplify income tax filing with the help of online accounting software. From April 2026, sole traders with an annual income over £50,000 must submit their income tax returns with HMRC-recognised accounting software.

Yes, Zoho Books offers a free plan for sole traders to help streamline their accounting processes and ensure compliance with government regulations. The plan includes:

...and more.

To complete your self-assessment tax return, you must report your business income and expenses to HMRC. Zoho Books automatically tracks your earnings and expenses and helps you prepare quarterly updates for your sole trader business. You can review and share it with your accountant or use it to file directly with confidence.

Our free plan helps VAT- and non-VAT-registered sole traders submit income tax returns directly to HMRC. However, as your business grows and graduates to an LLP or limited company, we have many other plans that might work for you. If you are already looking for some advanced features, view our pricing plans to find out what works best for you.

Yes, you can have your accountant handle your income tax returns. Our free plan gives both you and your accountant full access to your Zoho Books account. If you need an accountant, you can easily find one nearby to support you with your MTD requirements here.

If you are an accountant or a bookkeeper with your own firm, we also offer a practice management solution for bookkeepers and accounting firms through Zoho Practice, which seamlessly integrates with the Zoho Books accounting platform. This integration makes it easier to capture your clients financial insights directly within your practice dashboard and manage them efficiently from a single place. Become a partner to discover additional benefits for your company and clients.

Absolutely. Zoho Books makes it easy to import your existing spreadsheet data, including contacts, transactions, and account balances. Our tech team can assist you in migrating your data to Zoho Books, ensuring a smooth and secure transition.

If you would like a guided walkthrough of the platform, you can book a free one-on-one demo with our product experts by emailing us at support.uk@eu.zohobooks.com. We will help you get started and make the switch to Zoho Books effortless