Best accounting software for self-employed

Juggling too much at once? Balance it with Zoho Books. Our affordable accounting software helps you manage your finances, giving you more time to focus on strategy and growth. The best part? Our plans start from £0.

*No credit card required

Be a self-starter with Zoho Books

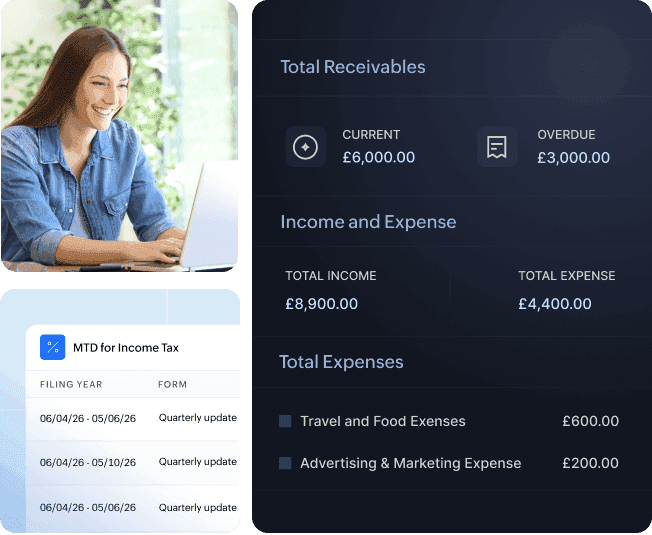

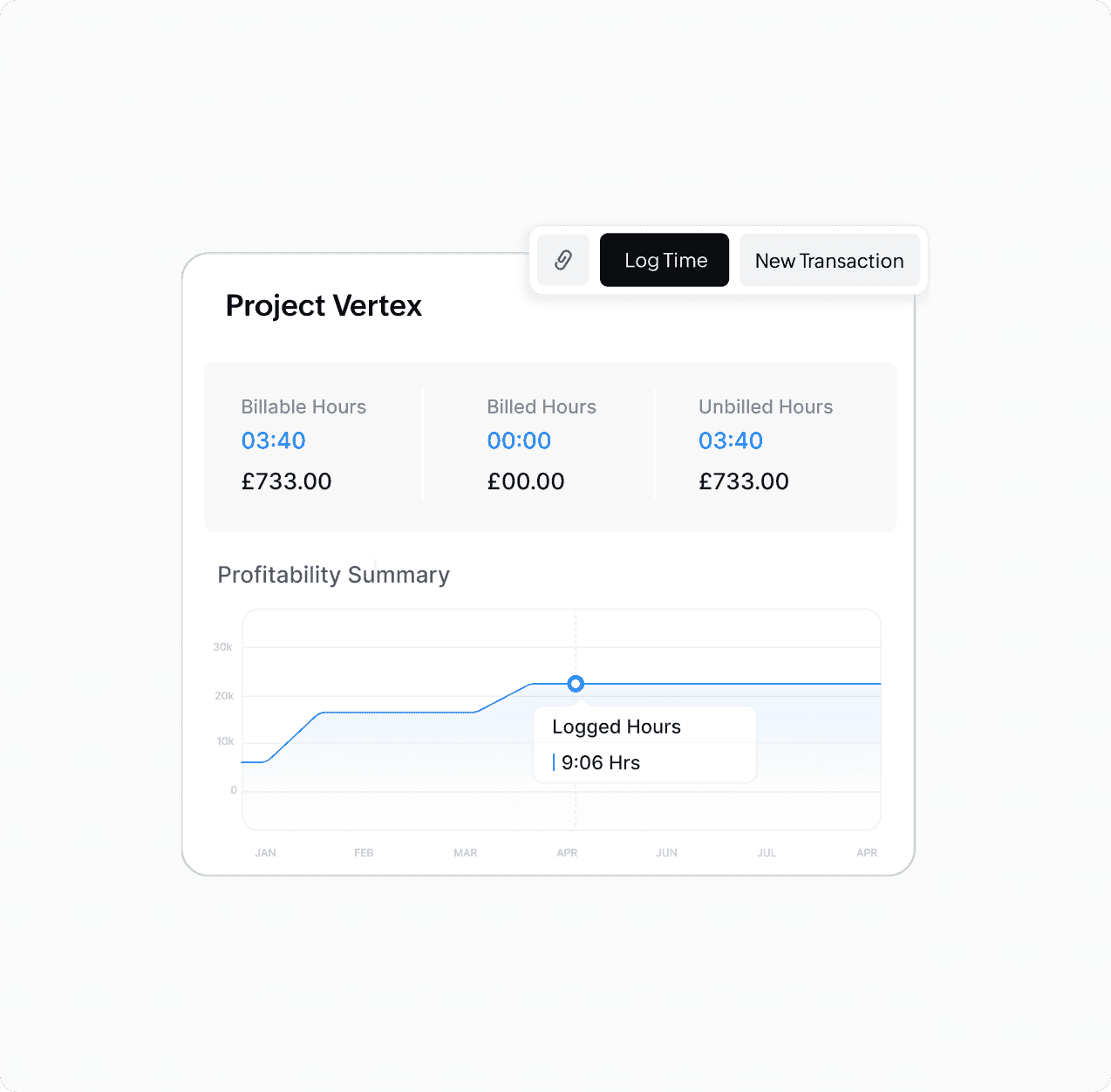

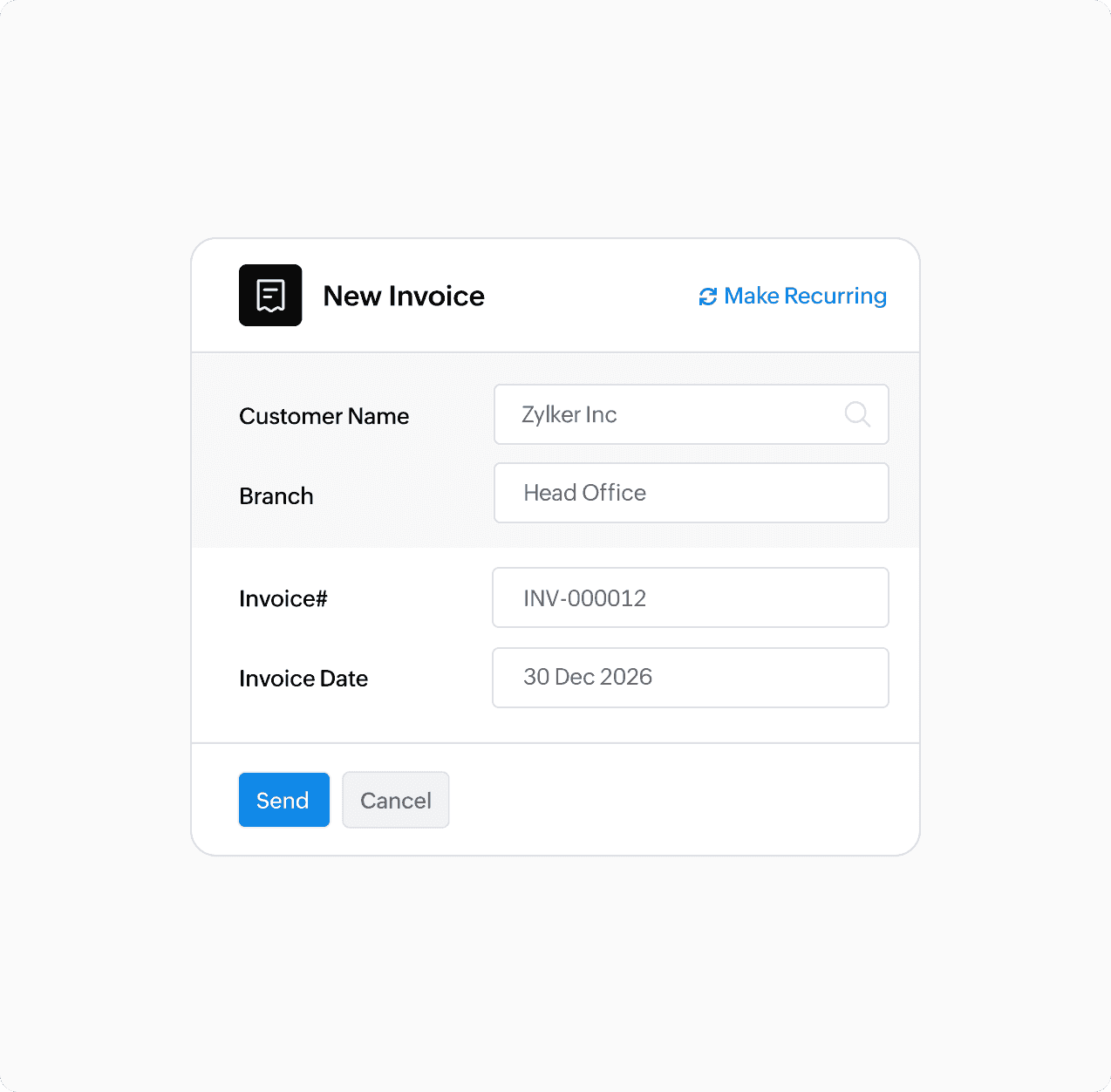

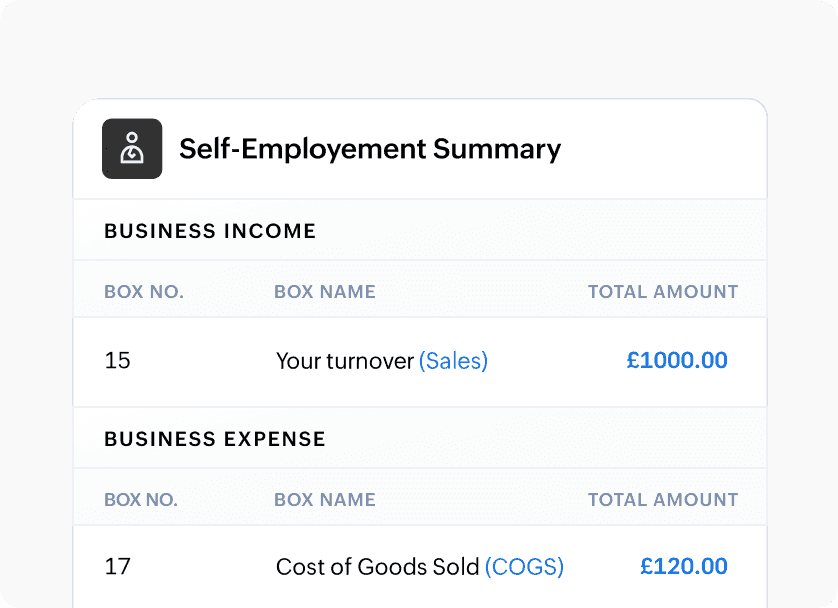

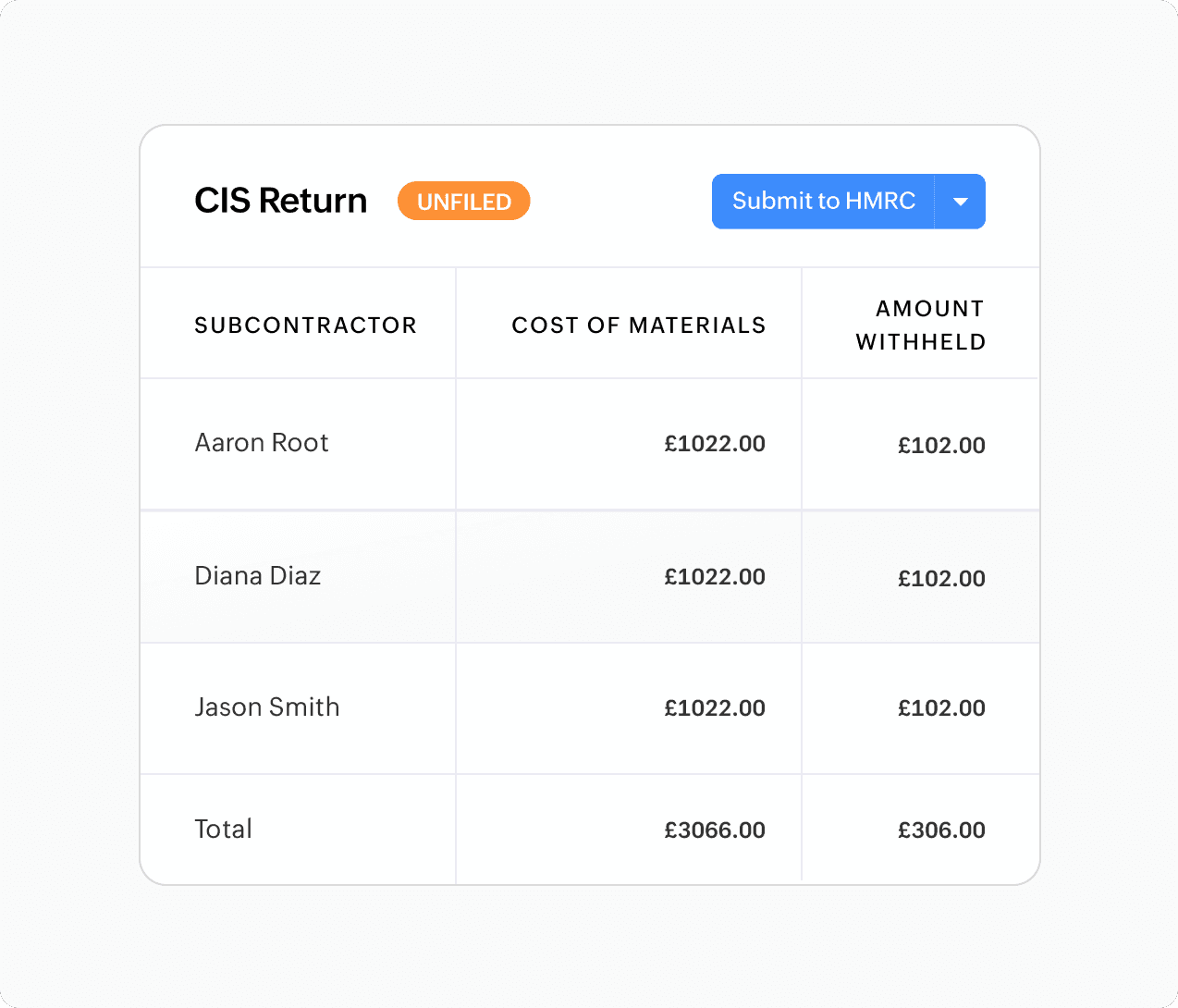

From managing finances to staying compliant, Zoho Books makes accounting simple and personalised

More ways Zoho Books works for self-employed

Effortless business management through seamless integration

Need assistance?

Got queries about features, need help with setting up, or want clarity on compliance requirements? We've got you covered!

Frequently Asked Questions

No. Zoho Books offers a user-friendly interface that makes navigation easy. Whether you're new to accounting or just starting with the basics, you can use the software without prior expertise.

Yes. You can manage both business and property income in Zoho Books by setting up separate organisations.

Yes. Zoho Books understands that a growing business needs feature upgrades, which is why we offer a wide range of affordable plans to suit your business at different stages. You can start with the free plan and move to the one that best fits your needs as your business grows. Check out our pricing plans to explore the options available.

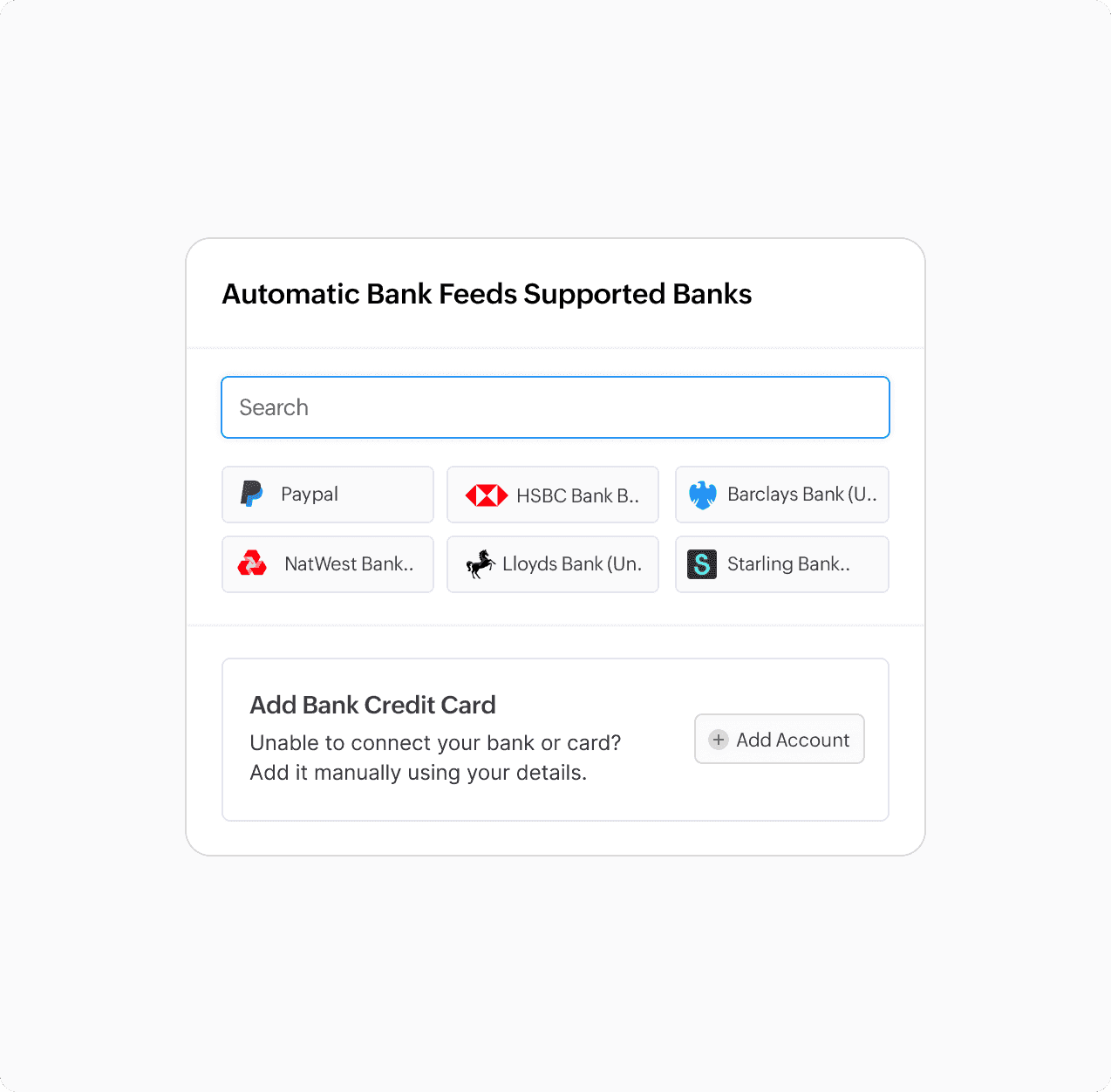

Yes. Zoho Books supports bank feeds from major UK banks, allowing you to connect your accounts for secure, real-time data.

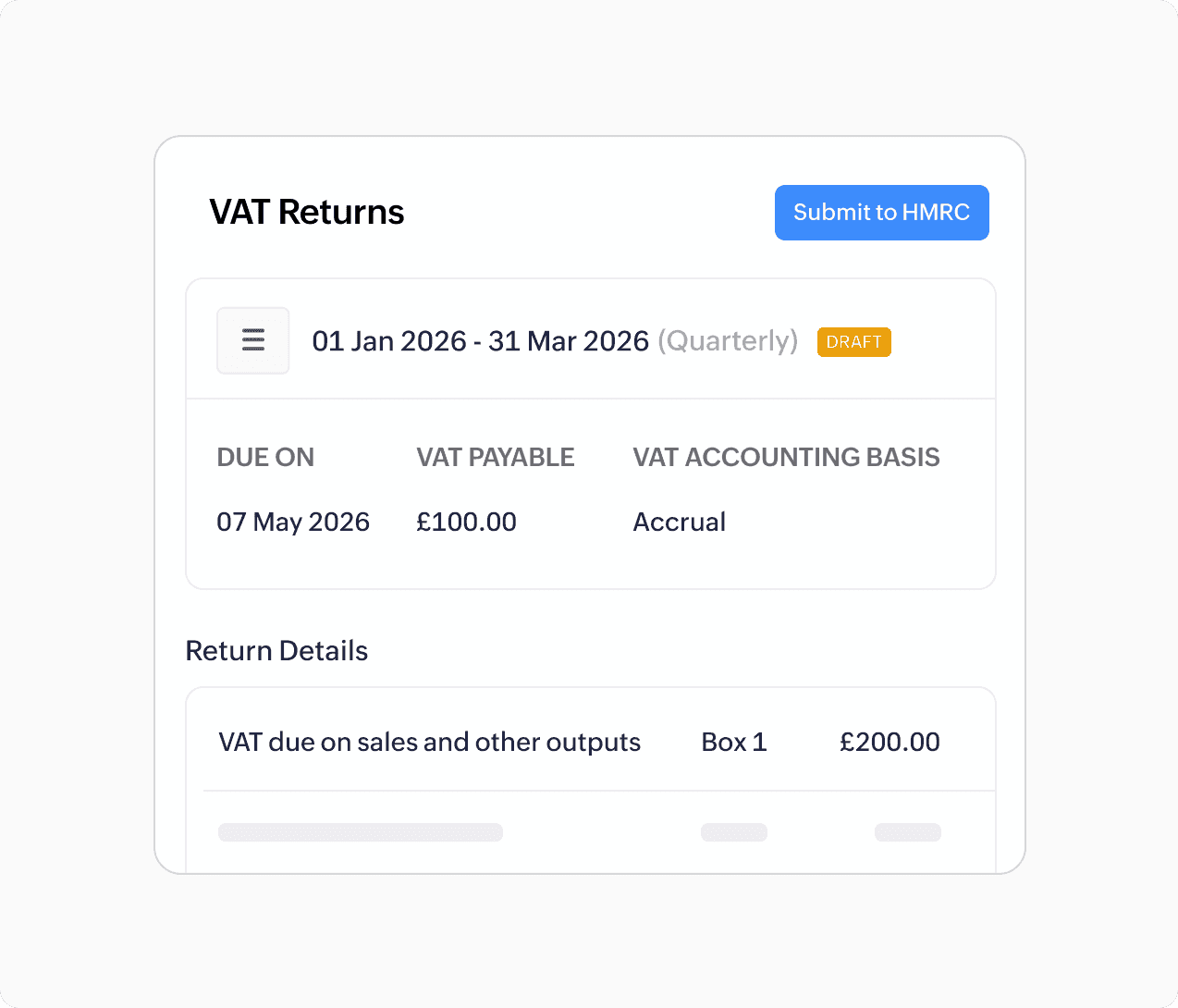

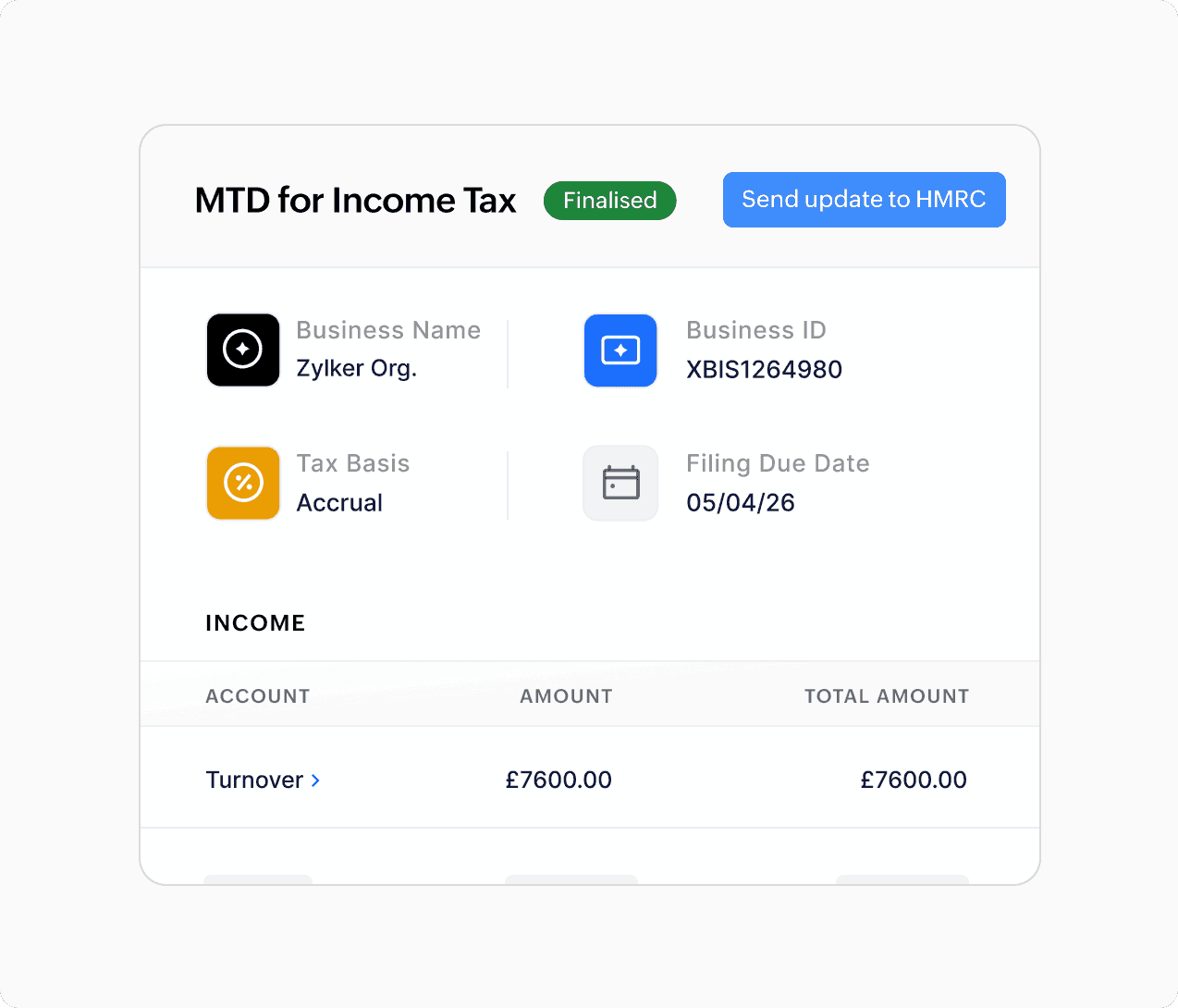

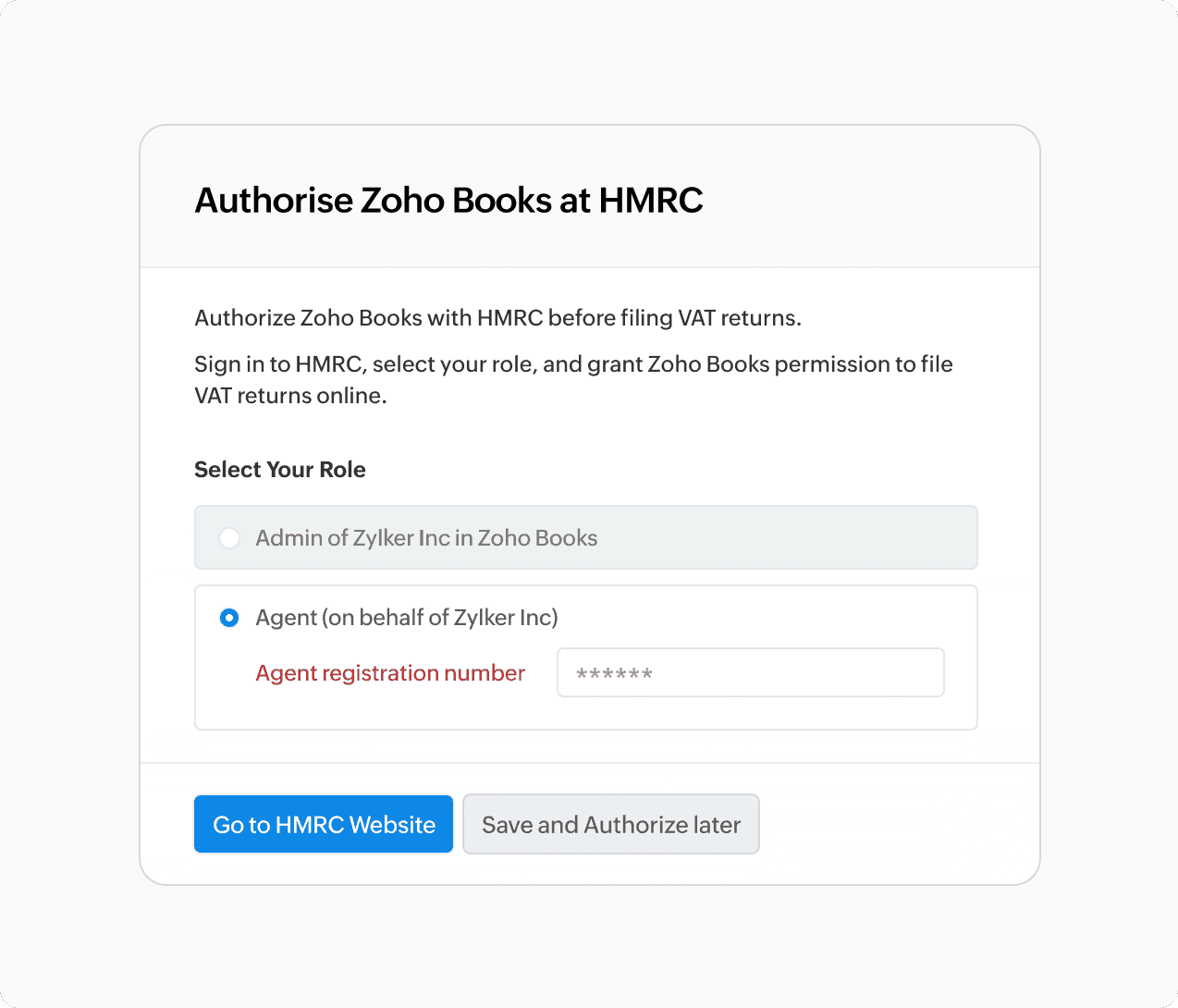

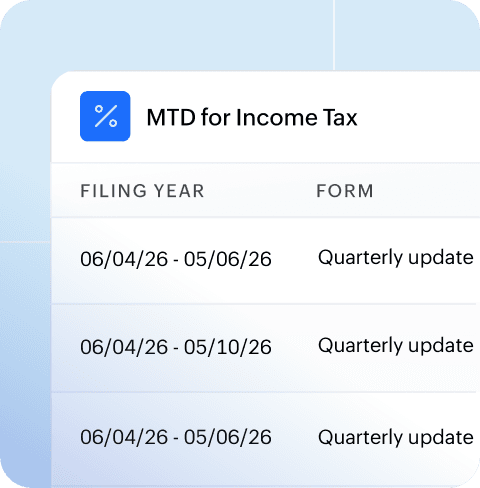

Yes. Zoho Books is official HMRC-recognised accounting software and supports both VAT and income tax. With plans starting for free, whether you run a business, are a sole trader, or own property, you can remain MTD-compliant.