- See all featuresCore FeaturesEffortless Accounting

- Pricing

- By Size

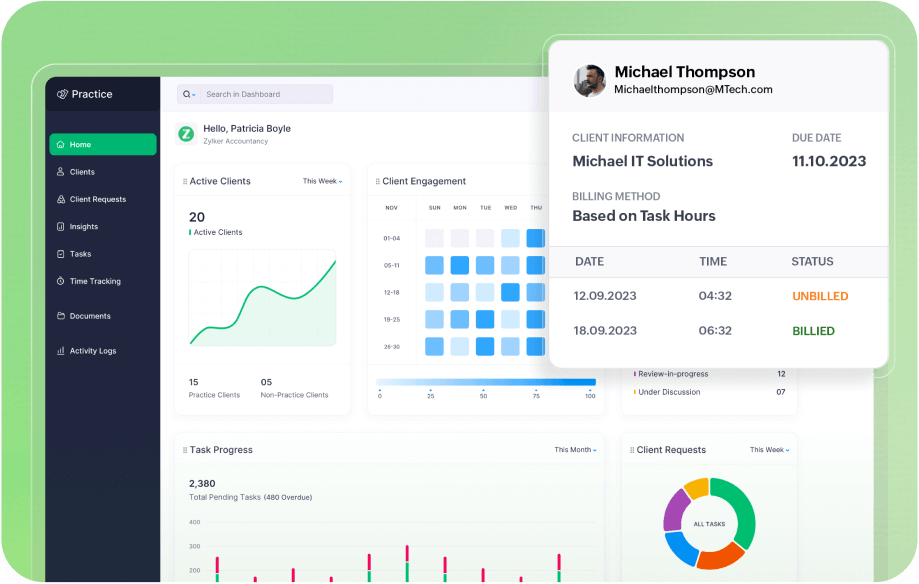

Introducing Zoho Practice

The ultimate practice management software for modern accounting and bookkeeping firms.

- Customers

- Partner with us

- Available on IOS

- Available on Android

Market Mortgage is a UK-based fintech company that provides innovative mortgage solutions, making home-ownership more accessible. Its flagship product, Own New Rate Reducer, launched in February 2024 in partnership with major banks and financial institutions like Virgin Money and Halifax. The product is a subsidised mortgage for new-build buyers. Brian O’Neill, Director of Market Mortgage and winner of the Finance Star Award 2025, said, “Thanks to Zoho, we’re able to run what essentially is a £3–4 million finance department almost single-handedly.”

Before Zoho Books, Market Mortgage relied on Xero but faced limitations in automation and integration. Complex mortgage transactions required extensive manual work, making it difficult to scale.

O’Neill migrated seven years of financial data to Zoho Books and set up workflows that integrated with Zoho CRM.

“Transferring all the transactions actually wasn’t that difficult,” he quipped. “I am a chartered accountant and have a background in financial modelling, so if you are proficient in Excel, you can import and reconcile transactions easily.”

The integration allows every completed mortgage to automatically generate journals and invoices in Books. Builders receive invoices in real time, which improves cash flow and reduces delays.

Zoho Books and CRM automation have significantly reduced manual work, improved accuracy, and saved time.

By leveraging an off-the-shelf, configurable platform, Market Mortgage avoided the cost and delay of building a custom system.

O’Neill is exploring AI-driven features to further enhance efficiency.

Reflecting on his Zoho journey, O’Neill said, “I’m so glad I stumbled across Zoho. It’s helped us to run this business efficiently from day one, without needing armies of developers or expensive systems.”