- HOME

- Taxes & compliance

- Making Tax Digital for Income Tax: A complete guide for landlords

Making Tax Digital for Income Tax: A complete guide for landlords

Making Tax Digital is HMRC's initiative to create a digital tax system. It was introduced to make tax filing easier for taxpayers through commercial software. MTD for Income Tax is applicable for both sole traders and landlords, and the mandate begins in April 2026.

This guide explores MTD for Income Tax, its benefits for landlords, and how to be prepared for the digital shift.

What is Making Tax Digital for Income Tax?

MTD for Income Tax is an initiative developed by the UK government to replace self-assessment returns for sole traders and landlords. Under this mandate, individuals with qualifying income must maintain digital records of all their income and expenses and send periodic updates to HMRC using compatible software.

How does MTD for Income Tax work for landlords?

MTD for Income Tax for landlords will require you to submit quarterly updates instead of the usual annual return. This will replace the current annual self-assessment tax return system for taxpayers starting in April 2026.

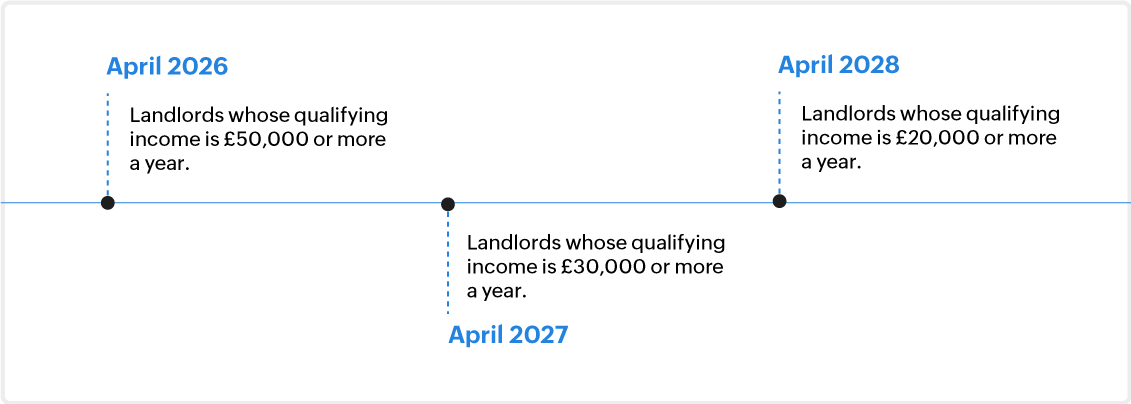

MTD Income Tax for landlords timeline:

Key compliance dates:

Below are the key dates for MTD for IT compliance for landlords:

Start date | Income threshold |

6 April 2026 | More than £50,000 |

6 April 2027 | More than £30,000 |

6 April 2028 | More than £20,000 |

What do landlords need to do under the new MTD for IT regulations?

From April 2026, landlords who fall under the given income threshold will have to do the following:

Maintain digital records

If you're a landlord eligible for the MTD for Income Tax mandate, you must begin maintaining digital records using MTD‑compliant accounting software. These records should include details of your property income and expenses. If you're also a sole trader, you must maintain separate digital records for your business and property finances.

Register for MTD for Income Tax

Landlords (or their accountants) must register for MTD for Income Tax before April 2026. Remember, even if you're already registered for Self Assessment or MTD for VAT, you will not be transferred automatically to MTD for Income Tax; you must register separately.

Send quarterly updates

Landlords with an income above £50,000 must begin submitting a summary of their property income and expenses to HMRC every three months using compatible accounting software. The deadlines will be the same for everyone who has to follow MTD for Income Tax. From 6 April 2026, it will be:

7 August

7 November

7 February

7 May

Complete End Of Year Submissions

End-of-year submissions help finalise a taxpayer’s position under Making Tax Digital for Income Tax. The Business Source Adjustable Summary (BSAS) allows businesses to review and adjust income and expense figures submitted during the year. Once business figures are finalised, the Annual Submission confirms allowances, adjustments, and the final business position with HMRC. After this, Individual Losses, which are not tied to a specific business, can be reported to carry forward or offset losses against other income.

Make a final declaration

At the end of the tax year, HMRC calculates the final tax payable based on the information submitted during the year. This calculated tax position is presented to the user as part of the final declaration. The user reviews the tax payable and related figures and, once satisfied, submits the final declaration to HMRC. This submission confirms the accuracy of the data and formally closes the tax year’s obligations.

How to be prepared for MTD for Income Tax as a landlord

Listed below are a few tips that you can use to get ready for MTD for Income Tax as a landlord.

Choose the right software: Select an HMRC‑approved, MTD‑compliant accounting solution.

Migrate your data: Import and transfer your existing records. Opt in for accounting tools that make this transition easier.

Practice submissions: Even you currently don't fall under the income bracket mentioned by the HMRC, you can still choose the eligible accounting software from April 2026 to get familiar with the process.

Stay consistent: Keep up with regular bookkeeping and update your data monthly.

Seek expert help: Work with a bookkeeper or accountant experienced in MTD to ensure compliance.

Why choose Zoho Books to stay MTD-compliant?

Coming soon! With changing rules and new mandates, Zoho Books ensures that businesses can manage tax changes and transition with ease. That’s why our MTD‑compliant accounting software now includes a new feature designed specifically for landlords at no cost. With the Zoho Books Free plan for landlords, you can:

Maintain digital records

Send quarterly updates

Report your Business Source Adjustment Summary (BSAS) and individual losses

Make annual submissions

Submit final declarations

And much more!

Final thoughts

MTD for Income Tax changes the way landlords file their taxes. This digital shift is one of the important steps towards compliance and staying prepared before the mandate, which lets you stay on top of your finances. Remember, with the right tool, staying compliant becomes hassle free.