Introduction

The Finance Ministry of India recently announced a new tax regime for the employees under the Union Budget 2020. This newly proposed tax regime will be applicable starting from the fiscal year 2020-2021. For the upcoming fiscal year, employees can choose to stick with the existing tax regime or opt for the newly proposed tax regime. Since employees now have a choice, it is important for them to know the difference between the two tax systems. In this article, we will take a look at the existing tax system and the newly proposed tax system, decode which tax regime is better for which salary range, and provide a comparative study so that employees can make informed decisions.

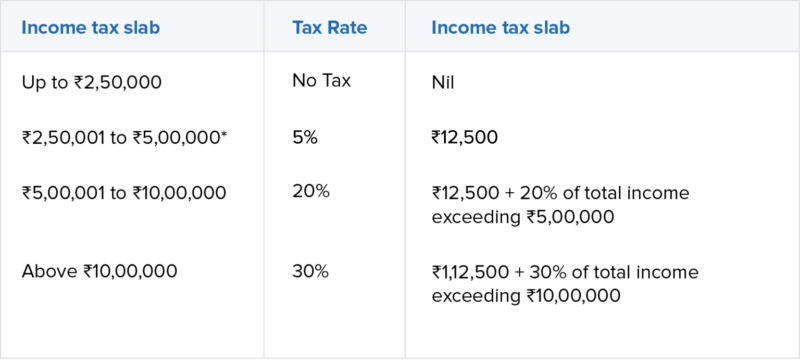

Current tax structure

Employees’ tax slab and tax percentage are classified by factors including the income earned and the individual’s age. The lower the income, the lower the tax liability. Employees earning less than 5 lakh per annum are fully exempt from taxes by rebate. Throughout this article, we will look at the calculations for salaried employees whose age is less than 60.

Newly proposed tax system

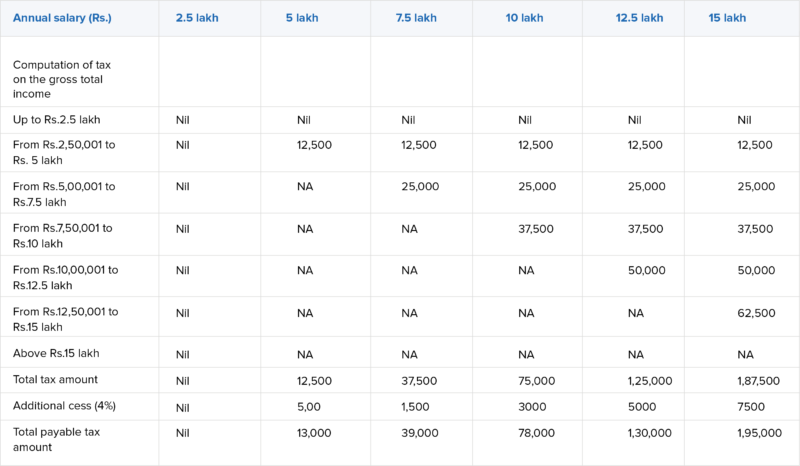

With the newly proposed tax system, the Government of India has brought in reduced tax rates for various income tax slabs. Example: for employees earning between ₹5,00,000 – ₹7,50,000, the tax percentage has been reduced from 20% to 10%

* Employees earning 5L per annum are exempt from taxes by rebate.

Here’s a detailed tax liability matrix for various tax slabs according to the latest tax regime.

Which one is better? A comparative study

We know that there are two different tax regimes in place now. So as employees, which one should you choose to ensure that you save the most amount of tax? Just by taking a look at the tax slabs, you might come under the impression that the new tax rates will be beneficial because of the lower tax slabs. However, that might not be the case because, under the new tax regime, you would have to forego numerous known deductions and exemptions.

These include key deductions that come under Section 80C, 80D, Section 24, Section 80CCD, and Section 80E. You would also have to forego the benefits of most exemptions under Section 10, such as HRA and LTA. You have to take into account the impact of these tax breaks on your final tax liability before deciding to switch or stay.

So here’s how you can compare and calculate your tax liabilities to make the right decision.

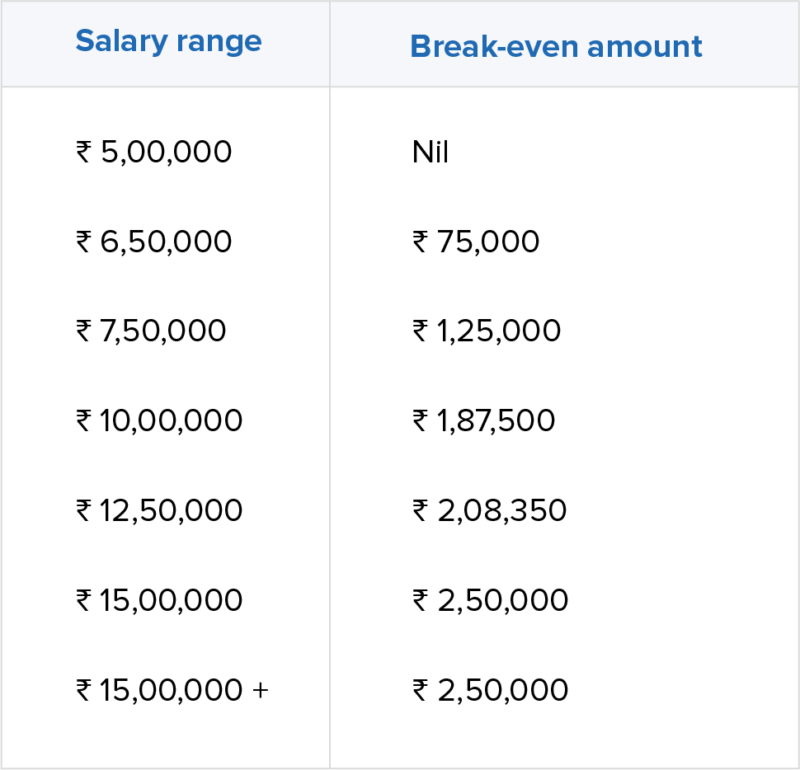

For every gross income drawn by an employee, there is a break-even investment amount at which the tax liability will be the same under the old tax regime and the new tax regime. Once you identify that break-even amount, it’s a matter of knowing if you can make investments to match up to that break-even amount or not. If you invest more than the break-even point, your tax liability will be less with the current tax system. If you invest less than the break-even point, your tax liability will be more with the current tax system, so you are better off switching to the new tax system.

Let’s learn with an example

Consider an individual, less than 60 years old, with a gross annual income of ₹15,00,000. If the deductions and exemptions claimed by this person amount to a total of ₹2,50,000 a year, the taxable income under the old regime becomes ₹12,50,000 and the tax liability for ₹12,50,000 will be ₹1,95,000.

Under the new regime, without the benefit of these deductions and exemptions, the person’s taxable income will be ₹15,00,000. But thanks to lower tax rates, the tax liability will be the same — ₹1,95,000. Thus, at this break-even level of tax benefits, it makes no difference whether the person stays in the old regime or shifts to the new one.

Now, if the person’s tax breaks increase to ₹3,00,000 then his taxable income under the old regime will come down to ₹12,00,000 and the tax liability will be ₹1,79,400, while under the new regime, the tax liability will be ₹1,95,000. So, it will be better to continue with the old regime. On the other hand, if the person’s tax breaks are only ₹2,00,000, thier taxable income under the old regime will be ₹13,00,000 and the tax liability will be ₹2,10,600. This is higher than the tax liability of ₹1,95,000 lakh under the new regime, so it will be worthwhile to shift to the new regime.

Break-even investment amount for every tax-slab

With this break-even amount computed for every tax slab, you will now be able to understand how much you should invest and which tax system to choose in order to maximize your take-home purse.

What should employers do, and how does Zoho Payroll help?

Employers should keep their employees informed that the new tax system is applicable only from the next fiscal year. On top of communicating the importance of the dual-tax system to employees, employers are also responsible for choosing payroll software that is compliant with all these updates made by the government. This is not the first update, and it will definitely not be the last. Since Zoho Payroll is cloud-based, you can reduce the dependency on your IT staff to make the changes, fulfil faster turn-around time expectations from the Government, and stay compliant at all times.