- HOME

- Payment basics

- How payment settlements work

How payment settlements work

The payment settlement process plays a critical role in finalizing transactions by transferring funds between customers and merchants smoothly. Whether you’re running an ecommerce store, a subscription-based service, or a B2B business, understanding how payment settlements work can help you manage your cash flow better and identify potential issues.

How payment settlements work

Payment settlement process

Payment authorization

Once the payment is initiated by the customer via a payment gateway, the first step is obtaining approval for the transaction.

Here’s how this works:

The payment gateway sends the transaction details to the acquiring bank (the merchant’s bank).

The acquiring bank communicates with the payment network (for example, Visa, Mastercard, RuPay, or UPI) to validate the transaction.

The payment network contacts the issuing bank (the customer’s bank) to check for sufficient funds and verify the legitimacy of the transaction.

If all checks are passed, the transaction is approved, and the payment gateway notifies the merchant.

At this stage, the funds are reserved in the customer’s account but are not transferred to the merchant yet.

Payment capture

Once authorization is complete, the merchant confirms the sale and requests the funds. In many cases, authorization and capture occur simultaneously.

Payment clearing

The transaction is reconciled and prepared for settlement:

The acquiring bank forwards the transaction information to the payment network.

The payment network communicates with the issuing bank to deduct the transaction amount from the customer’s account.

The funds are then routed back to the acquiring bank through the same payment network.

Clearing ensures the transaction is processed accurately and matches the original authorization.

Payment settlement

Finally, the settlement involving the transferring of funds from the acquiring bank to the merchant’s account takes place. The acquiring bank deposits the funds into the merchant’s account, typically after deducting processing fees. These fees may include:

Payment gateway fees

Acquirer fees

Payment network fees

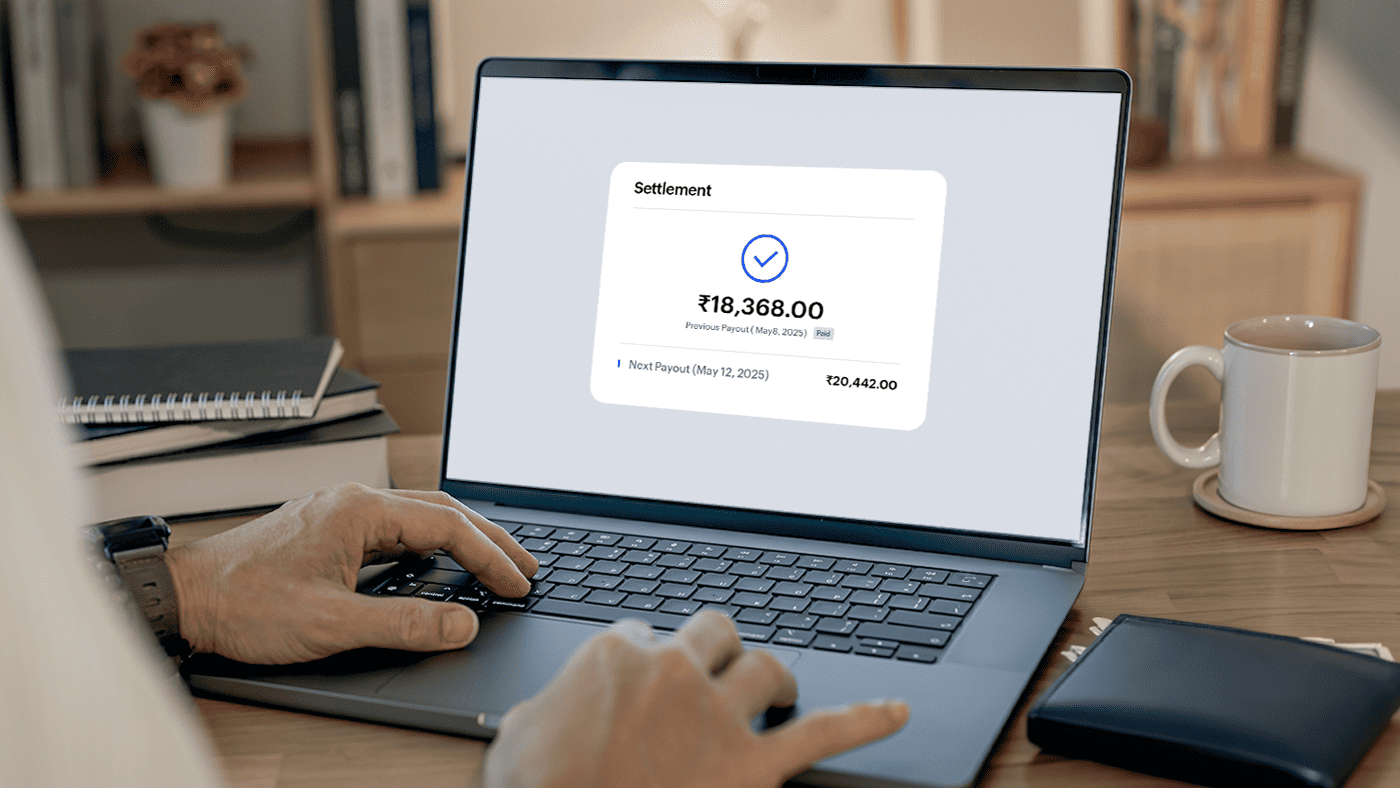

Payment settlement timelines

Settlement timelines vary depending on the payment method and agreements with the payment processor.

Typically in India, it takes two working days from the transaction date (T+2) for card transactions to be settled, while UPI transactions are settled in T+1 days.

In the US, card-related transactions are settled within T+2 days, electronic fund transfers take T+1 days, and digital wallets take up to T+3 working days. International bank transfers generally take longer and can take up to T+7 days to settle.

Payment settlement cycles

To help merchants, some payment gateways allow merchants to choose their payment cycles. Here are a few possible cycles.

Same-day settlement: Transactions are processed and settled within the same business day, ensuring funds are immediately transferred and available. This is commonly used for domestic payments.

Next-day settlement: Transactions are settled on the next business day, typically for payments made late in the day or when additional processing time is required by financial institutions.

Two-day settlement: Settlement occurs within two business days, often used for inter-bank transfers or transactions involving different financial institutions to allow for processing and verification.

Weekly settlement: Payments are settled on a weekly basis, often applied in financial markets or for bulk transactions where multiple payments are accumulated and processed together.

Monthly settlement: Transactions are settled at the end of the month, commonly used for recurring billing or accounts with longer payment terms, enabling consolidated processing and settlement.

Special cases in payment settlement

While most settlements follow standard processes, certain scenarios introduce additional complexities that require careful handling. Here are some examples.

Refunds: When a customer requests a refund, the settlement process works in reverse, transferring funds back from the merchant’s account to the customer's. This may delay the merchant’s cash flow and require additional record-keeping for reconciliation. Merchants have to pay an additional processing fee, too.

Chargebacks: Chargebacks occur when a customer disputes a transaction, typically due to unauthorized payments or dissatisfaction with a product or service. The disputed amount is withheld or reversed during the investigation. Frequent chargebacks can lead to financial losses, increased fees, or penalties from payment processors. Maintaining detailed transaction records, transparent communication with customers, and implementing fraud detection measures can reduce the likelihood of chargebacks.

Batch settlements: In high-volume industries, businesses may consolidate multiple transactions into a single batch for settlement. This approach minimizes processing costs and simplifies reconciliation. Efficient batch settlements may result in delays in receiving funds compared to individual transaction settlements.

In conclusion, payment settlement serves as the foundation of every transaction, facilitating the secure and efficient transfer of funds from customers to merchants. For businesses, a clear understanding of the settlement process is essential for effective cash flow management. Knowing when funds will be accessible enables better financial planning. By knowing the nuances of this process, merchants can streamline operations and position themselves for sustained success.