Say hello to better expense accounting with Zoho Expense and Xero

Report expenses in Zoho Expense and account for them effortlessly in Xero.

TRY ZOHO EXPENSE FOR FREE TRY XERO FOR FREE

What is Zoho Expense?

Zoho Expense is software designed to automate organizational travel expense reporting. From receipt to reimbursement, handle all aspects of your expense management.

Why Zoho Expense?

Expense autoscan

Convert receipts into expenses with minimal effort. Take a picture of a receipt and Zoho Expense's autoscan converts it to an expense automatically.

Multi-level approval

Make sure that every expense is verified properly. Configure multi-stage approval flows for your expense reports and advance payments.

Corporate card management

Connect corporate cards to Zoho Expense and fetch the feeds directly from card providers, sans a middleman. Map the cards to employees and manage them centrally.

Cost control

Set up expense policies to put a lid on regional or grade-level spending. Specify daily, monthly, or yearly limits and ensure that no penny goes unaccounted for.

That's not all

Zoho Expense offers more advanced functionalities for business travelers.

Business travel management

Set up pre-travel approval flows and manage business travel itineraries from a centralized portal. Configure your preferences so that allowances are allocated automatically for the specified budget amount.

Expense report automation

With Zoho Expense, automate the complete cycle – expense report creation, submission, and approval or rejection. Expense reports will be generated automatically on a cut-off date and approved as well, based on pre-set criteria.

Per diem

Zoho Expense enables you to set and edit multiple region-based per diem rates and automate the process of per diem expense calculation.

About Xero

- Get a real-time view of your cashflow. Log in anytime, anywhere on your Mac, PC, tablet or phone to get a real-time view of your cash flow. It’s small business accounting software that’s simple, smart and occasionally magical.

- Run your business on the go. Use our mobile app to reconcile, send invoices, or create expense claims - from anywhere.

- Get paid faster with online invoicing. Send online invoices to your customers - and get updated when they’re opened.

- Reconcile in seconds. Xero imports and categorizes your latest bank transactions. Just click ok to reconcile.

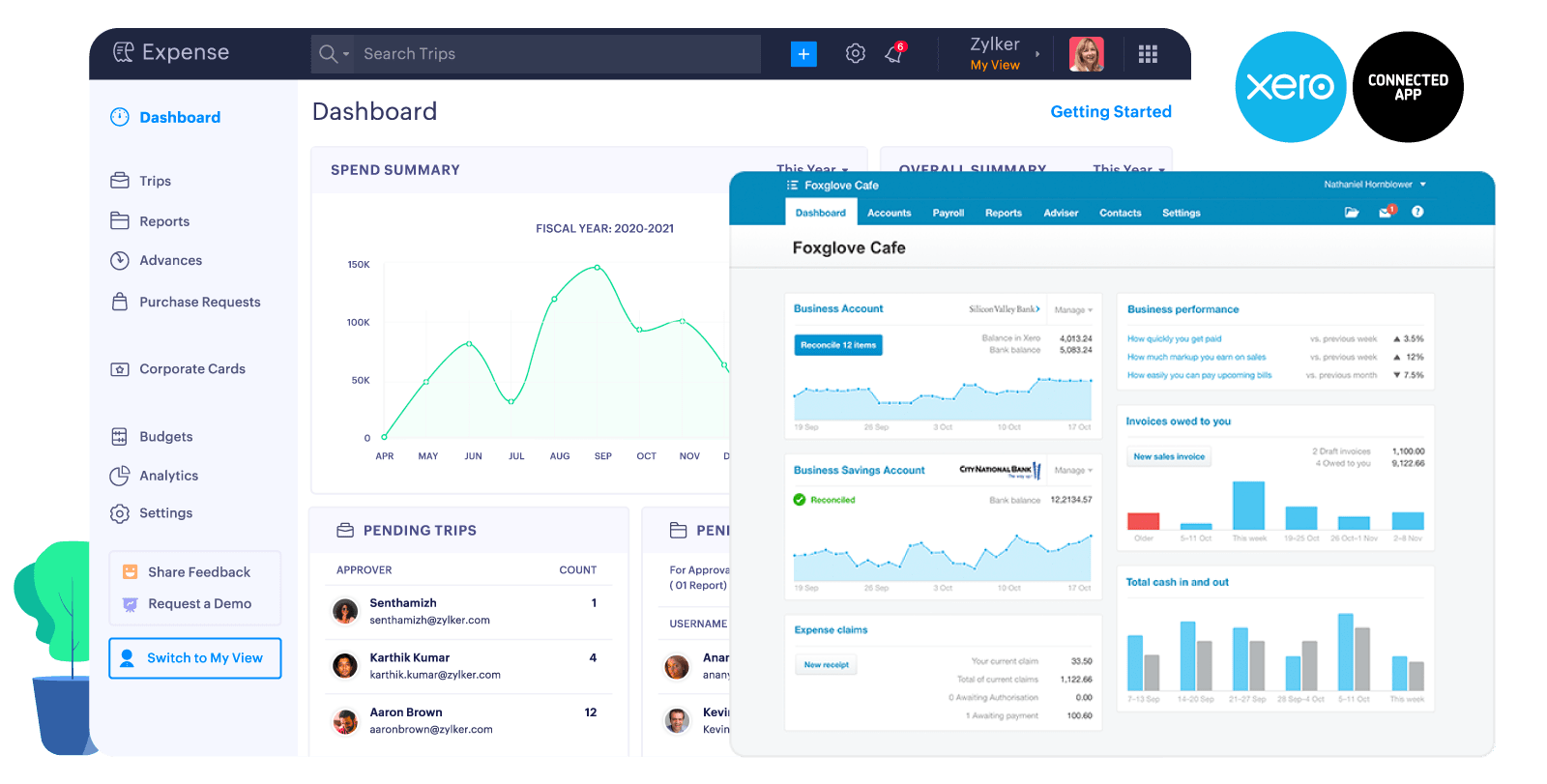

Zoho Expense and Xero make expense accounting a snap

Associate expenses with the right account

Your chart of accounts from Xero will be synced as expense categories in Zoho Expense so that you can always add your expenses under the right account.

Track expenses better

This integration brings tracking categories from Xero into Zoho Expense as tags, helping you track expenses across locations or cost centers.

Auto-sync expense reports

Expense reports will be automatically exported to Xero once they are approved in Zoho Expense. Reimbursable expenses will be synced as bills, and non-reimbursable ones as bank transactions.

Stay updated with daily sync

Data will be automatically synced between the apps once every day so that you always have a current picture of your expenses.

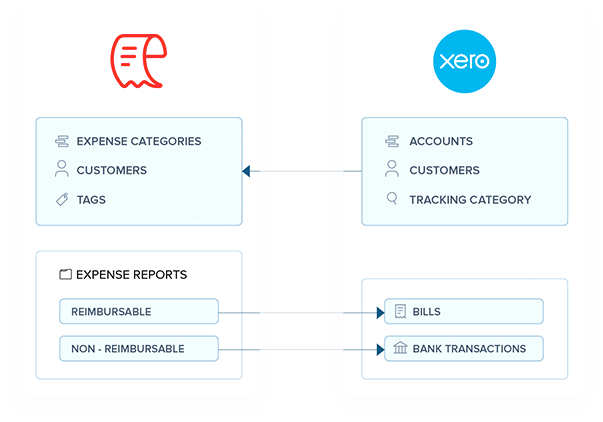

How the integration works

The integration ensures that all your accounts, customers, and tracking categories from Xero are synced with Zoho Expense, while the expense reports are exported to Xero.

To set up the integration, all you have to do is open your Zoho Expense account, go to Xero in your integrations section, and click Connect to Xero.