Flexible Benefit Plans

Flexible benefit plans help you to plan your expenses and personalise your salary structure to suit your planned expenses for the financial year. FBP is a part of the CTC.

Ways to declare your Flexible benefit plans in Zoho Payroll

Once your payroll admin has enabled the Flexible Benefit Plan declaration window, you can access the FBP declaration section in three ways:

- An email will be sent to your registered email address, through which you can open the FBP declaration window.

- A notification will be published inside the employee portal, under the Home tab you can click View and Submit FBP declaration.

- A notification will also be published inside the employee portal under the Salary details tab in the Salary structure section.

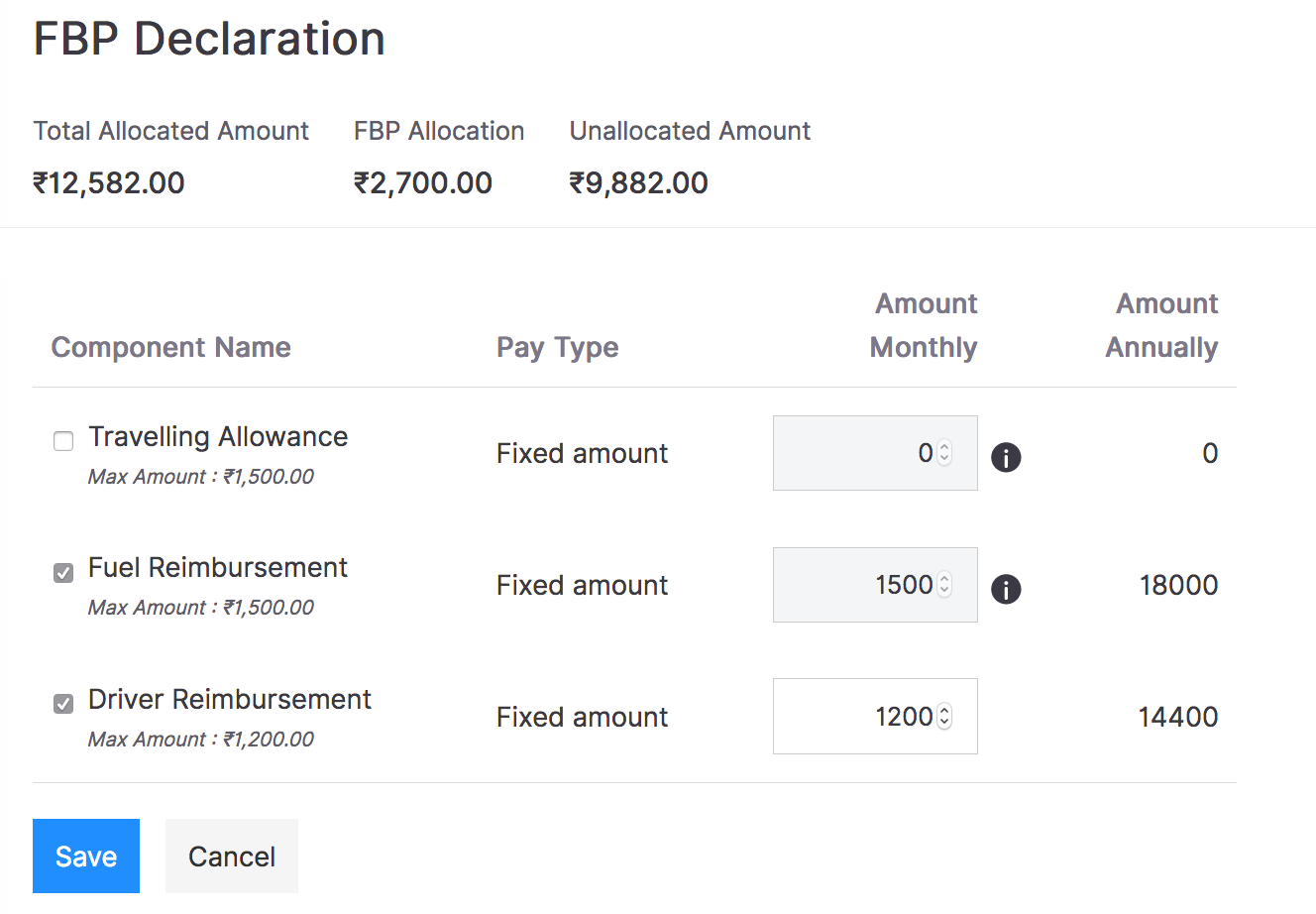

How to declare Flexible Benefit Plans in Zoho Payroll

Once you open the Flexible Benefit Plan declaration window,

- Enter your planned expenses under each eligible category.

- If a component is marked as restricted, then, you can either claim the maximum FBP amount (specified by the employer) or exclude the FBP component itself.

- Check the box next to the component to claim the maximum amount and uncheck the box to exclude it. The unclaimed FBP amount will be considered taxable.

- Click Save.

If you would like to re-allocate your FBP expense category later, you can do it when your payroll admin reopens the FBP declaration window.

Zoho Payroll's support is always there to lend a hand. A well-deserved five-star rating!

Zoho Payroll's support is always there to lend a hand. A well-deserved five-star rating!