Back

What is a default tax and how does it work?

The Default Tax will be used in transactions when tax preference (Taxable/Tax Exempt) is not set for the involved customers.

The first tax you create will be marked as the Default Tax initially. However, you can mark a different sales tax as default as well.

Default Tax can be useful for the following scenarios.

- When customers are imported into Zoho Inventory, their tax preference is not set.

- When these customers are involved in transactions, the Default Tax will be applied in those transactions.

- The tax preference will also not be set for customers who were created before sales tax was enabled.

- Here again, the Default Tax will be used in transactions where these customers are involved.

Default Tax is not automatically associated with a customer. It is only used when tax preference (Taxable/Tax Exempt) is not set for the involved customers. You can set the Tax Preference of a customer at anytime.

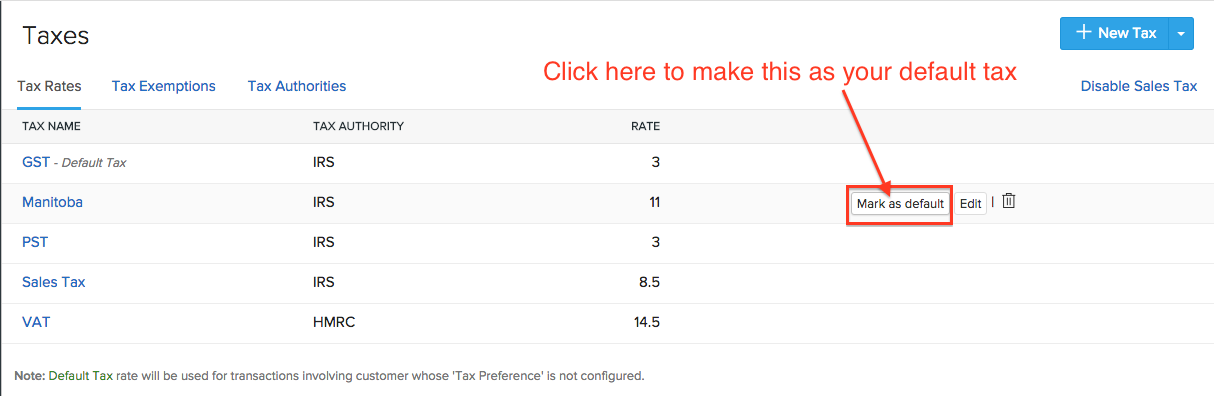

To mark a different tax as default:

- Click the gear icon on the top right corner.

- Select Taxes from the drop down.

- Hover your mouse over the tax to be marked as default.

- Click “Mark as default” button that becomes available.

- Doing this, will update this tax as the default tax.