What is TCS on Sale of Goods (Section 206C-1H) and how do I configure it in Zoho Inventory?

TCS or Tax Collected at Source is the tax that vendors collect from their customers at the time of sale. The government has introduced a new provision under Section 206C (1H) of the Income Tax Act for collecting TCS on the Sale of Goods after October 1, 2020.

Who should collect TCS on sale of goods?

The new provision requires you to collect TCS if your turnover has exceeded Rs.10 crore in the last financial year and the invoice value of sale to a customer exceeds ₹50 lakhs in the current financial year.

What are the tax rates?

The TCS rate to be collected is 0.1% but currently due to the COVID-19 pandemic, the rate has been reduced to 0.075% till 31 March 2021.

If the customer or buyer does not have a PAN card, then the applicable TCS will be 1%.

How do I configure and apply the TCS rates in Zoho Inventory?

To configure TCS rates in Zoho Inventory:

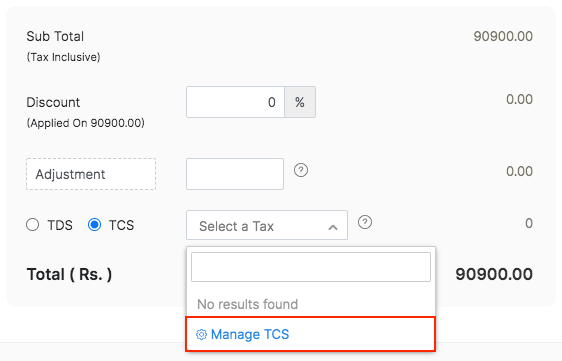

Open a new invoice/bill page and enter the necessary details.

In the Total section, click the dropdown field near TCS.

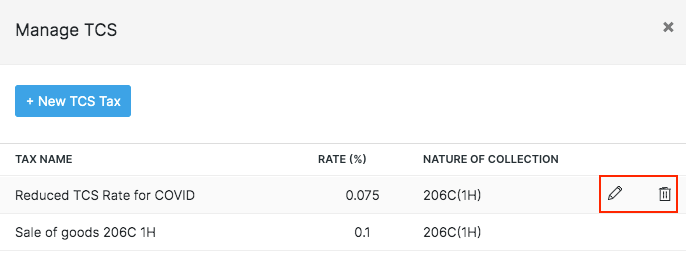

Select the Manage TCS option.

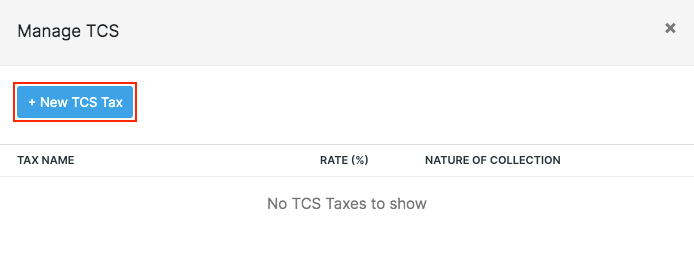

Click the + New TCS Tax button.

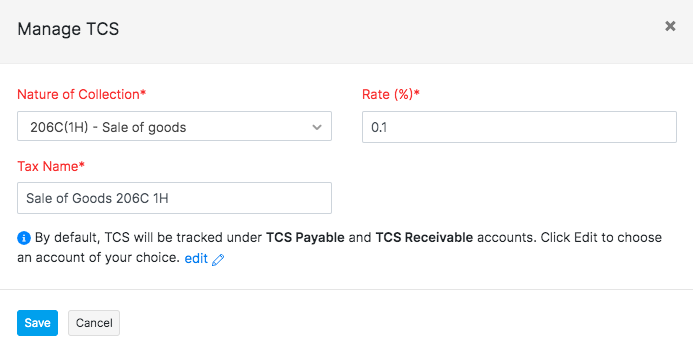

Select the Nature of Collection and enter the Tax Name and Rate.

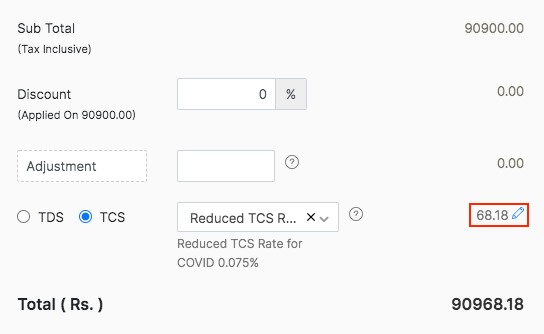

Save and apply the tax rate. If you want to override the calculated value, click the Pencil icon near the amount and type the TCS rate.

To edit or delete a TCS rate, click the Manage TCS option from the dropdown and click the pencil icon or the trash icon respectively.

Insight: TCS is calculated on the Total amount which is inclusive of taxes, shipping charges, discounts and adjustments.