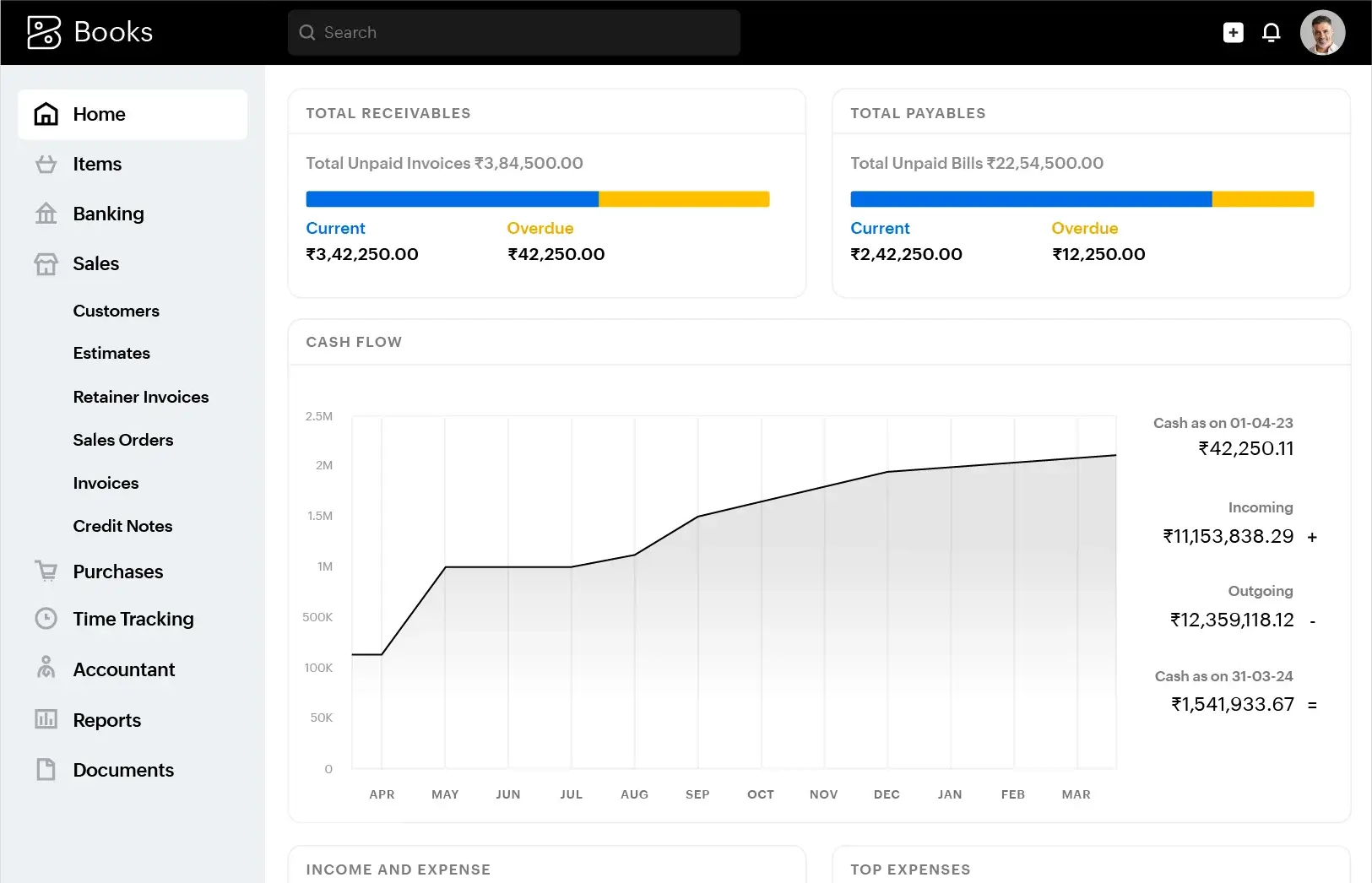

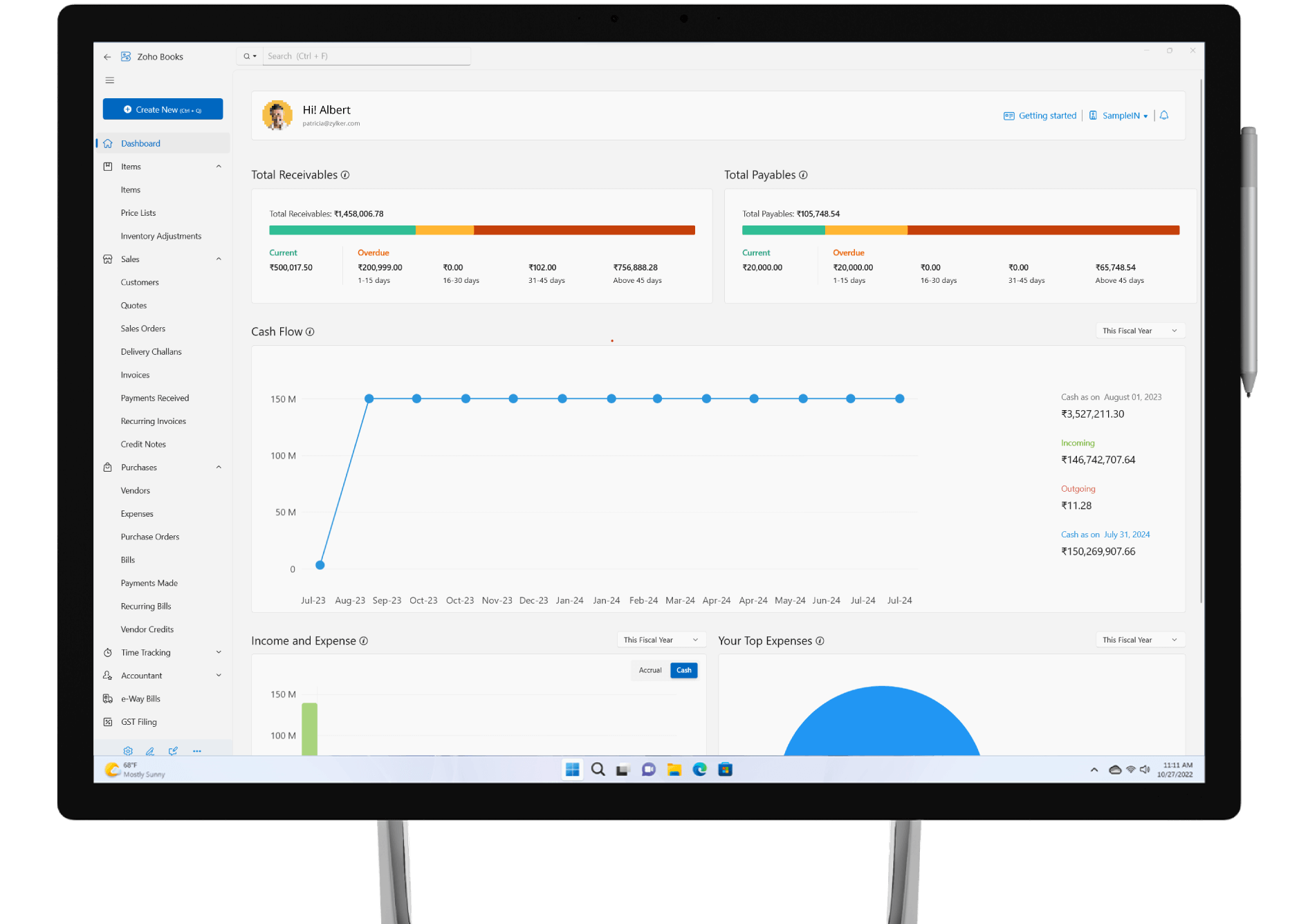

accounting platform for growing businesses

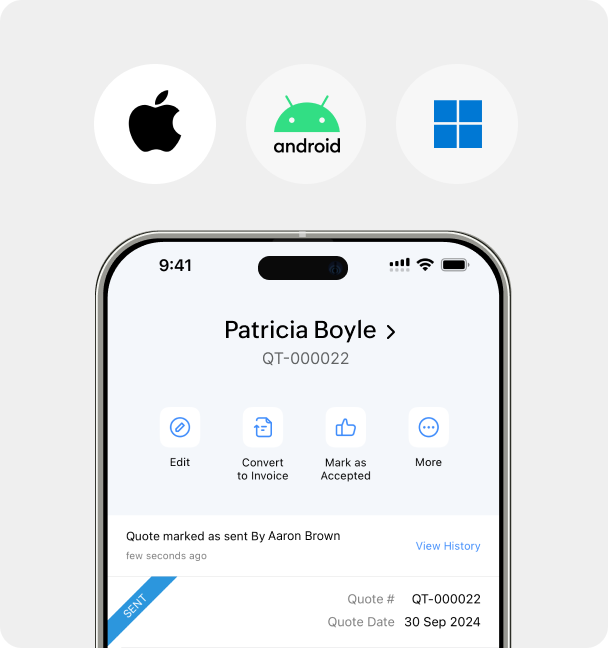

Manage end-to-end accounting—from banking & e-invoicing to inventory & payroll with the best accounting software in India.

Migrate to Zoho Books

Now you can easily move from other accounting solutions to Zoho Books!

Make the switch to the future of business accounting

I TRUST FOR MY BUSINESS

I TRUST FOR MY BUSINESSEngineered to Unlock Business Growth

The perfect balance of features and affordability

FREE

Get started with free accounting software for solopreneurs and micro businesses

STANDARD

Efficiently organize your transactions, accounts, reports, and books

PROFESSIONAL

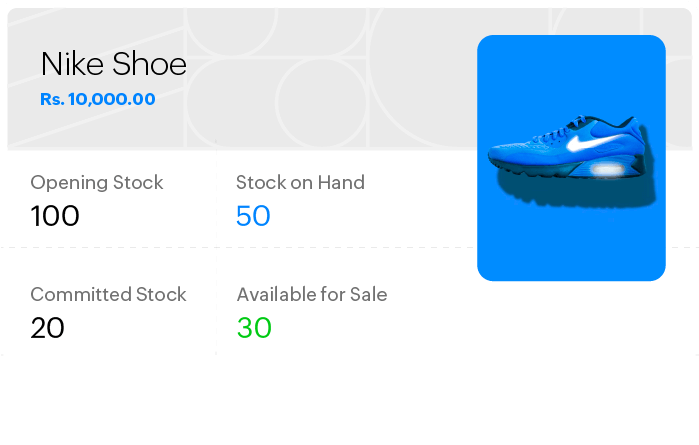

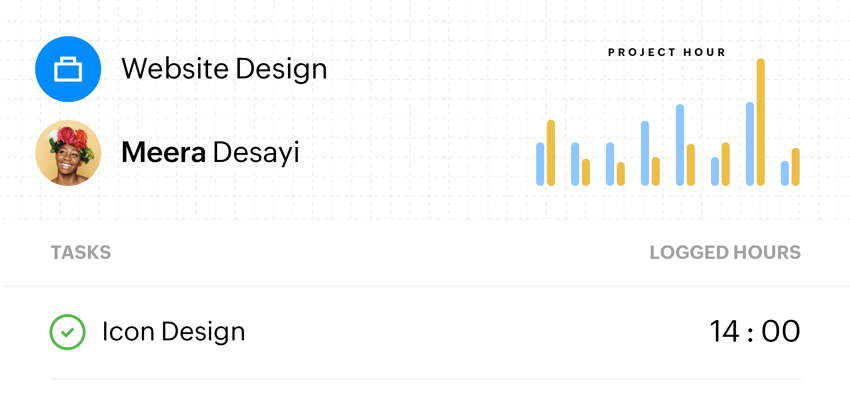

Confidently take on projects, track your inventory, and handle purchases

PREMIUM

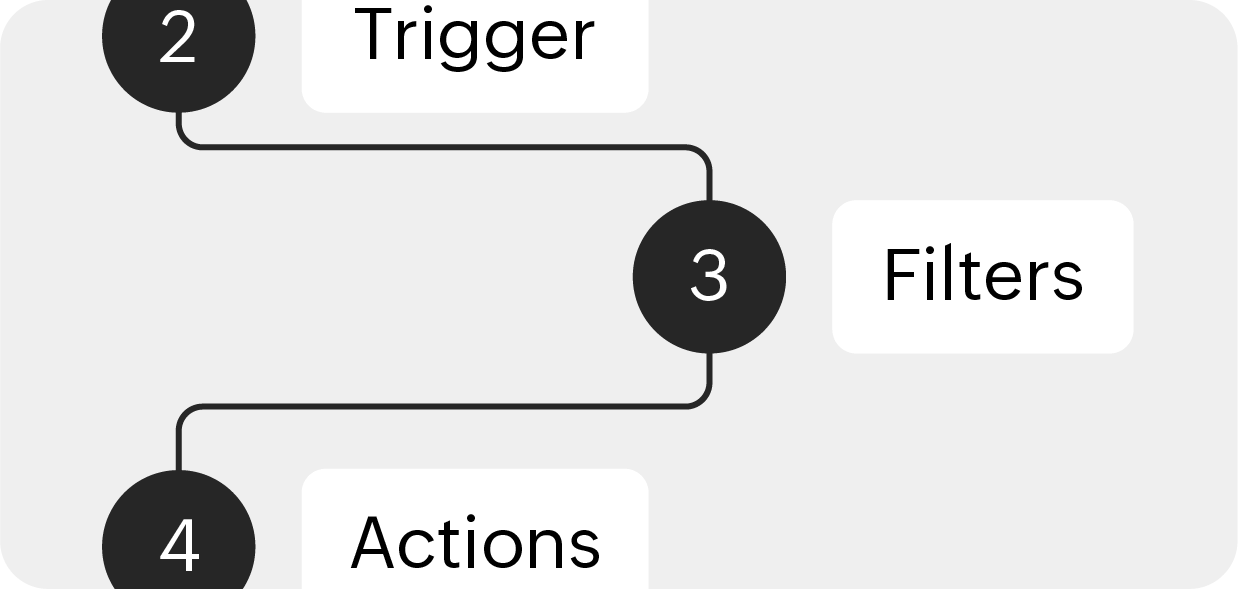

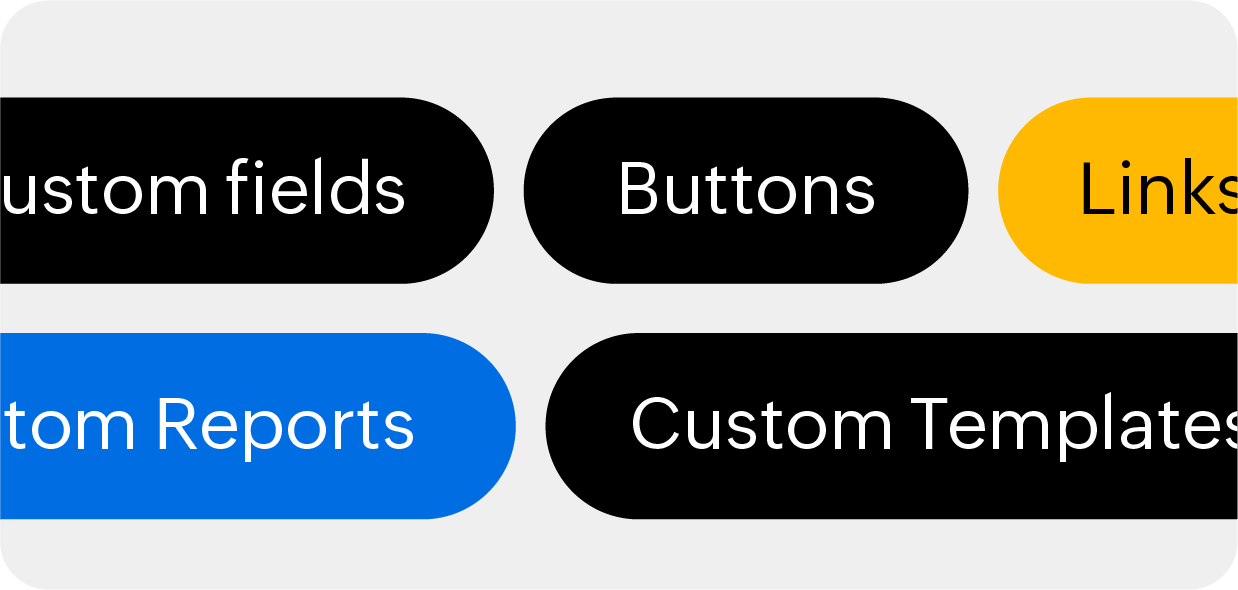

Enhanced customization and automation to streamline business processes

ELITE

Advanced accounting bundled with full-fledged inventory management

ULTIMATE

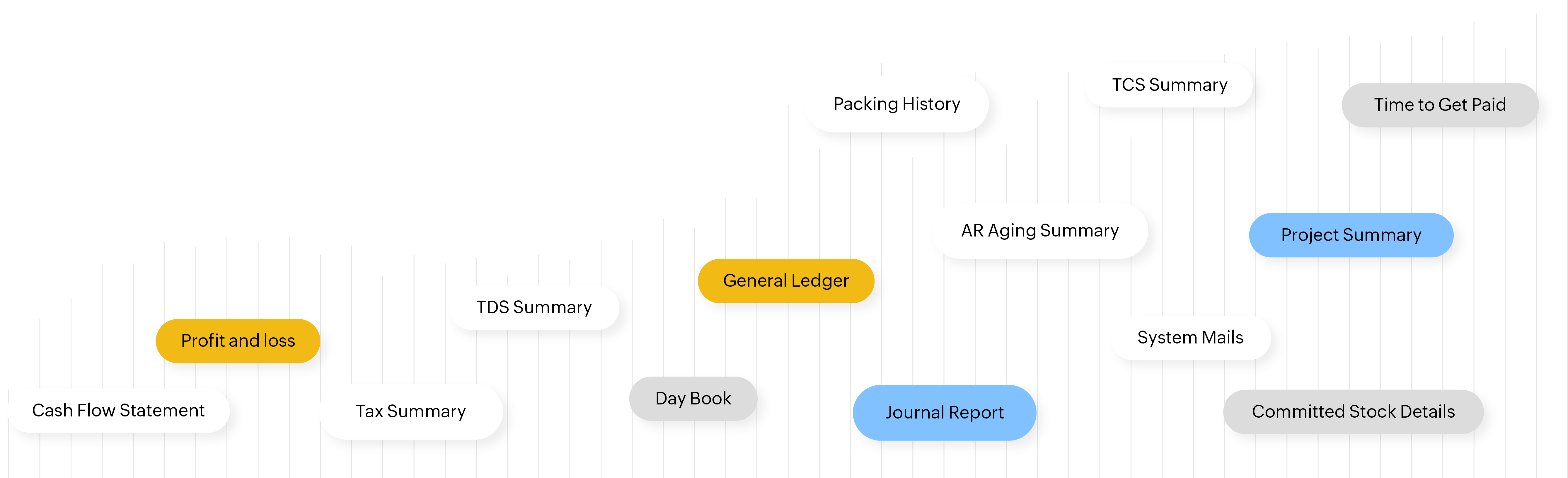

Gain deeper insights with advanced business intelligence capabilities

*Prices are exclusive of local taxes.

An accounting solution for every need and every business

Small-scale business

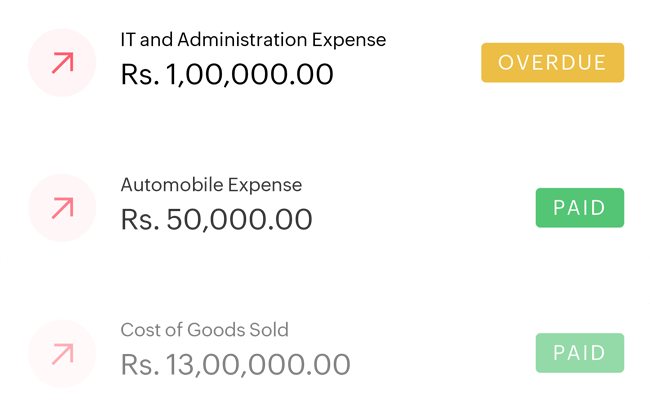

Get paid on time, track expenses, automate tasks, and make informed financial decisions.

Mid-market business

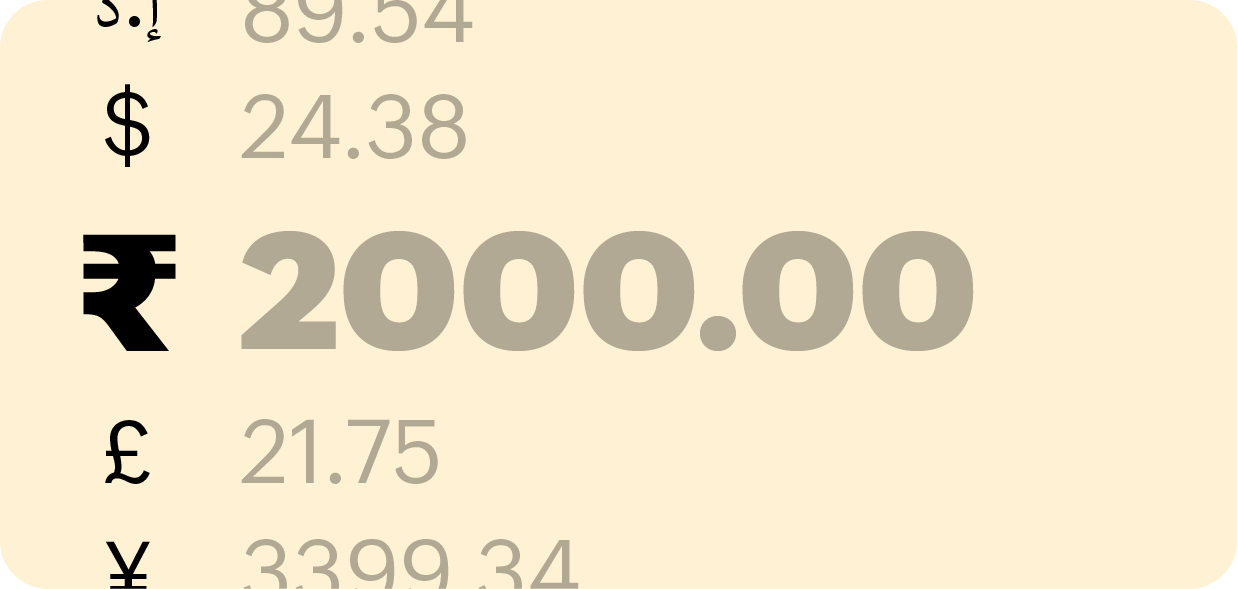

Go global! Use multi-currency feature, advanced integrations, analytics, and customization.

Connect and conquer

Orchestrate success connecting with the apps you love

Frequently Asked Questions

What is cloud accounting software and why should I choose it?

Cloud accounting software lets you access your financial records online from anywhere, on any device. It automates data entry, bank reconciliation, invoicing, and reporting. With automatic backups and secure access, it's a smarter, more efficient way to manage your books.

What features should I expect from top accounting software in India?

In India, a modern accounting software should support GST accounting (CGST, SGST, IGST), e-invoicing generation, e-way bill generation, compliance reporting, seamless bank integration, multi-user access, and mobile access. Also, support for input tax credit (ITC), HSN/SAC coding, and auto tax calculation will be helpful.

Does Zoho Books support GST accounting in India?

Zoho Books is a popular software for GST accounting in India, helping businesses manage GSTINs, apply HSN/SAC codes, and automatically calculate CGST, SGST, and IGST based on the place of supply. It compiles all taxable transactions, prepares return-ready data, and supports e-way bill generation. With built-in GST reports and direct integration with the GST portal, Zoho Books ensures that businesses stay compliant and file returns accurately.

Why should I use accounting software like Zoho Books?

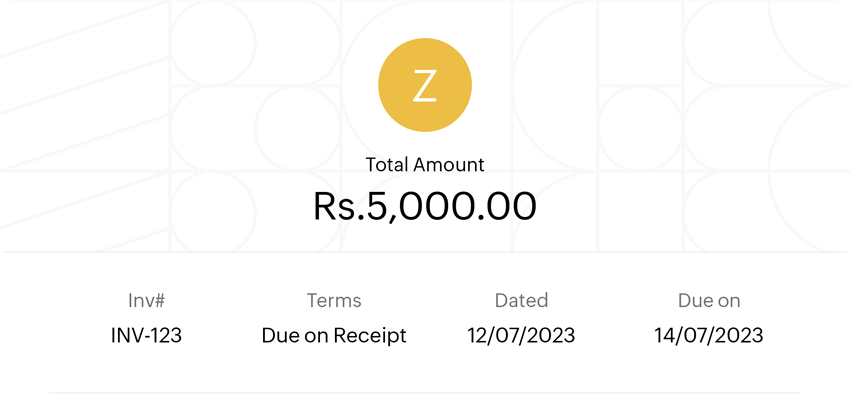

Accounting software allows you to streamline your end-to-end accounting process and run your business anytime, anywhere. Zoho Books, in this case, empowers you to manage your invoicing seamlessly, do bank reconciliation, tax management, and expense tracking, ensures you have clean financial records all the time. With automatic backups and secure access, it's a smarter, more efficient way to manage your books.

Does Zoho Books support e-invoicing in India?

Yes. Zoho Books supports e-invoicing for B2B transactions. You can generate IRN-validated e-invoices directly from the software, ensuring compliance with the e-invoice mandate and making your invoicing process more secure and streamlined.

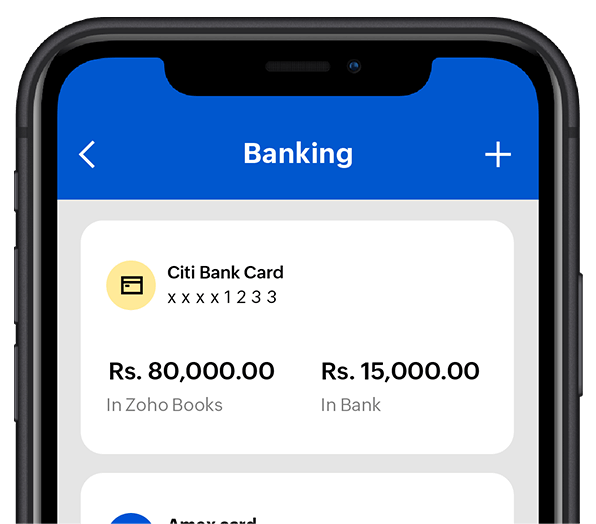

Can Zoho Books integrate with Indian banks and payment gateways?

Yes. Zoho Books supports bank feeds from major Indian banks, allowing automatic import of transactions for reconciliation. It also integrates with payment gateways available in India, enabling you to collect payments online and link them directly to invoices.

Is there a free version of Zoho Books for small businesses?

Yes, Zoho Books offers a forever free plan that includes essential features such as invoicing, expense tracking, and bank reconciliation. This is ideal for businesses that are just starting up, freelancers, and self-employed professionals.

Does Zoho Books provide onboarding, support, or help with migration?

Yes. Zoho Books offers onboarding support through detailed help guides, webinars, and support teams. If you're migrating from another accounting tool, Zoho support and partners can assist with data import to ensure a smooth transition.

How does Zoho Books handle updates to GST laws or slab changes?

Zoho Books proactively updates its tax engine to reflect changes in GST laws or slab revisions as and when they happen. The system then automatically updates tax rates for items and recurring transactions.

Choose privacy.

Choose Zoho.

At Zoho, we take pride in our perpetual efforts to surpass all expectations in providing security and privacy to our customers in this increasingly connected world.

₹70,000.00

₹70,000.00