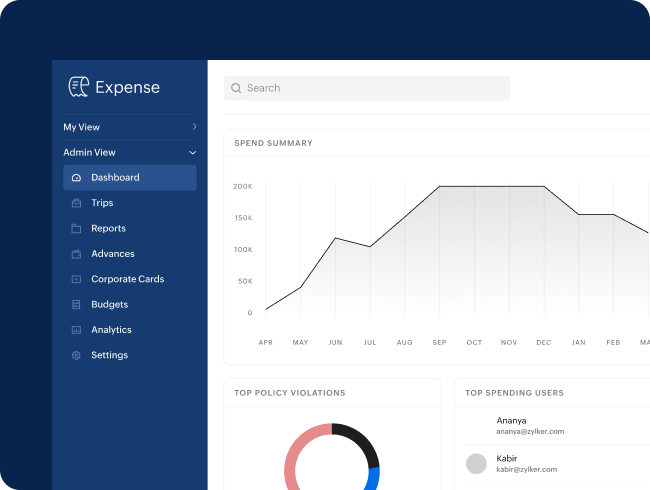

Expanding Financial Horizons

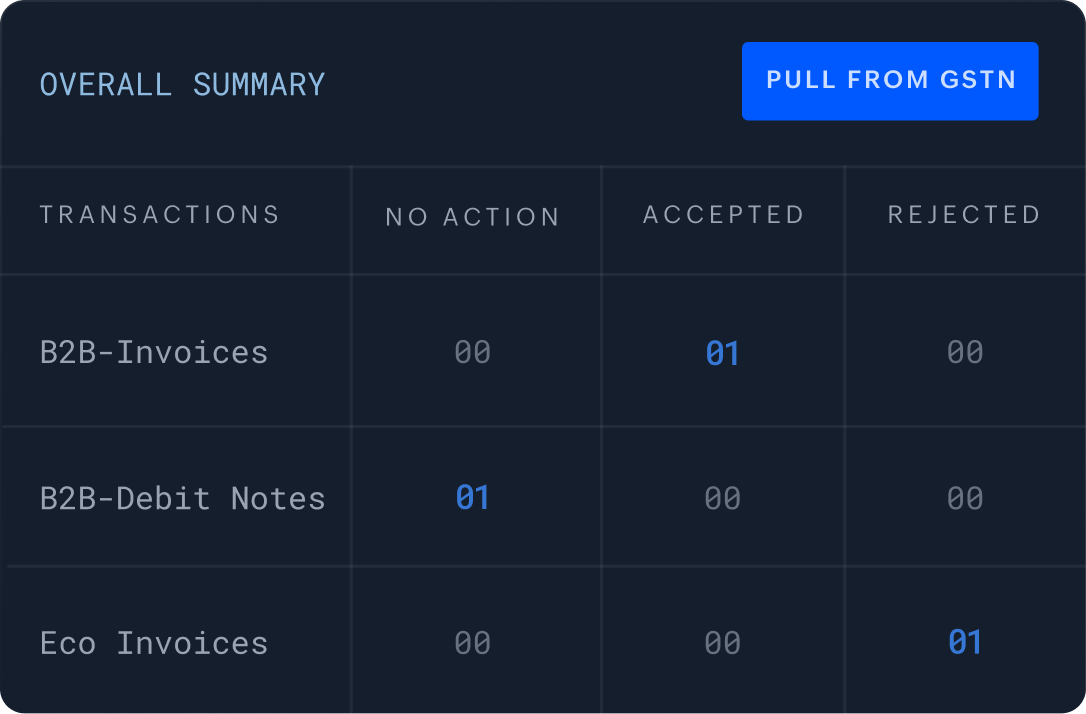

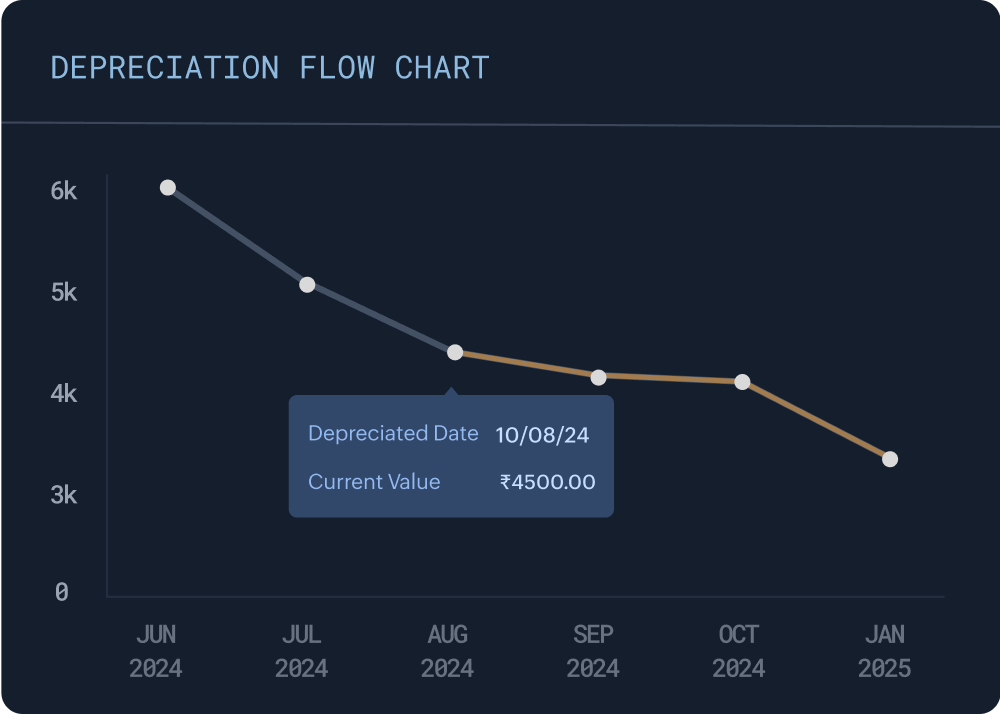

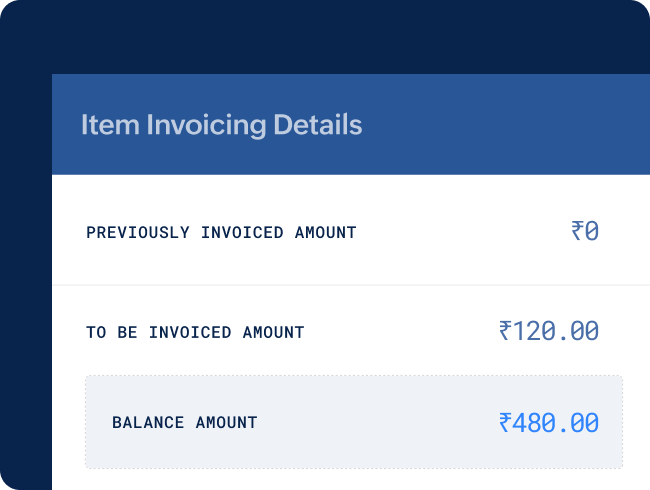

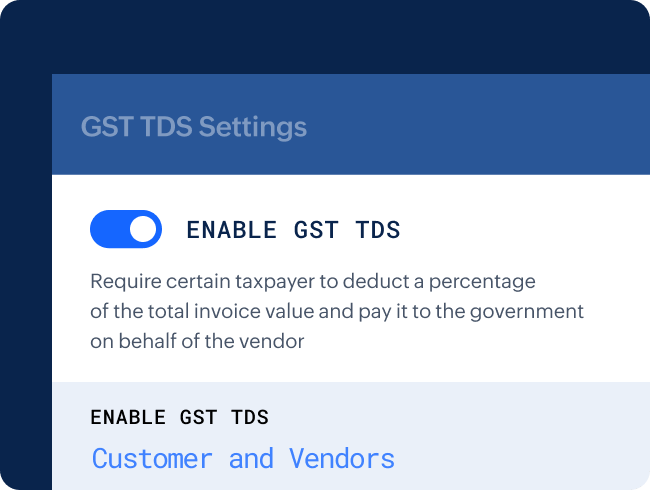

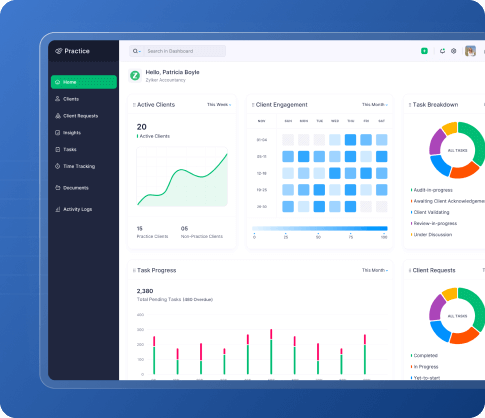

Zoho Books, a GST compliant powerful accounting platform trusted by CAs and businesses pan India, now offers enhanced capabilities to support your business growth. With added features to streamline tax management and optimize finances, we’re committed to supporting your growth as you reach new financial horizons with confidence.