What is HSN Code or SAC? How do I configure it in Zoho Books?

HSN Code (Harmonised System of Nomenclature) is a six-digit code that classifies more than 5000 products according to well-established rules that are accepted worldwide. This code has been developed by the World Customs Organisation (WCO) to enable efficient international trade. Similarly, SAC (Services Accounting Code) is a six-digit code used to classify the different services that are rendered.

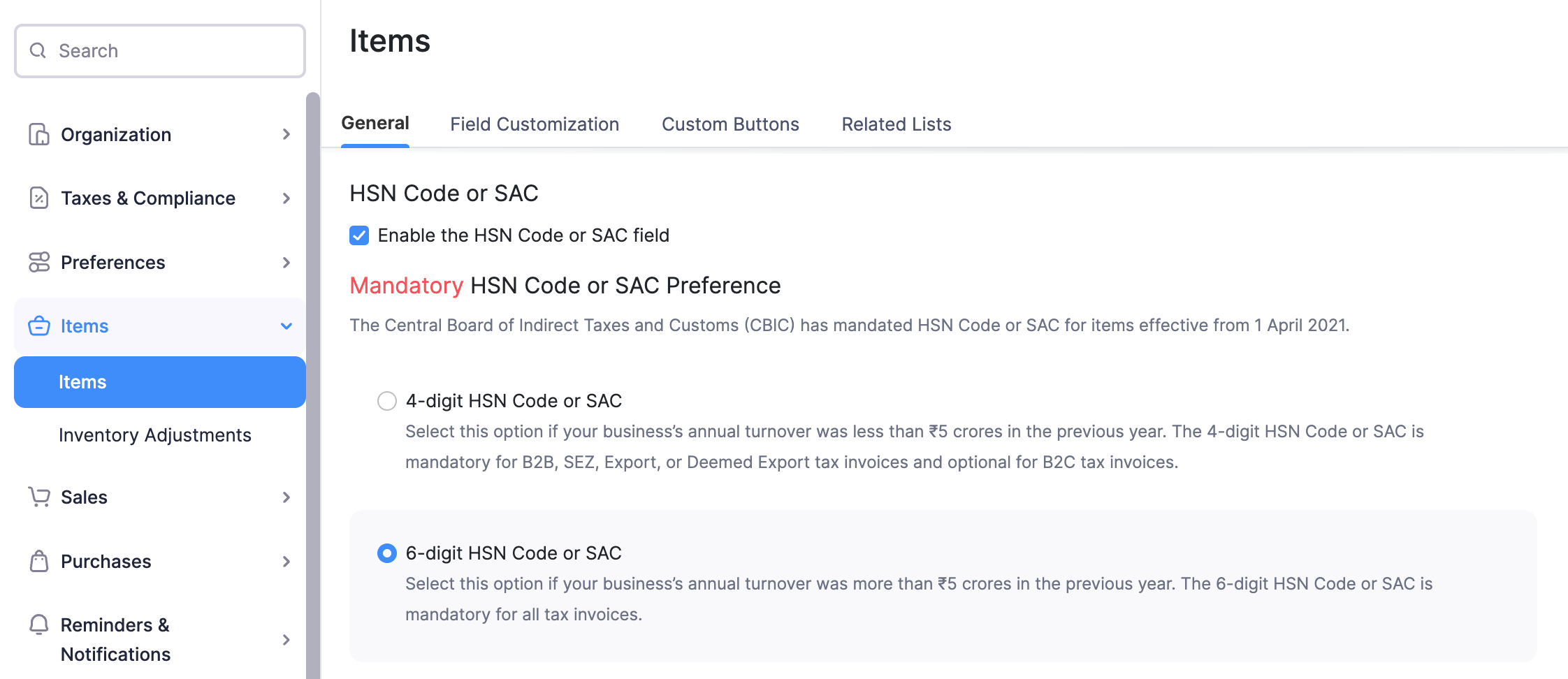

The Central Board of Indirect Taxes and Customs (CBIC) mandated the use of HSN Codes or SAC for goods, effective from 1 April 2021. This means that when you create sales transactions and add items that require tax, those added items must have the HSN Code or SAC associated with them.

According to CBIC, if your previous year’s annual turnover is less than ₹5 crores, you will have to use a 4-digit HSN Code or SAC, and if it is more than ₹5 crores, you will have to use a 6-digit HSN Code or SAC.

Configure HSN Code or SAC in Zoho Books

To configure HSC Codes or SACs:

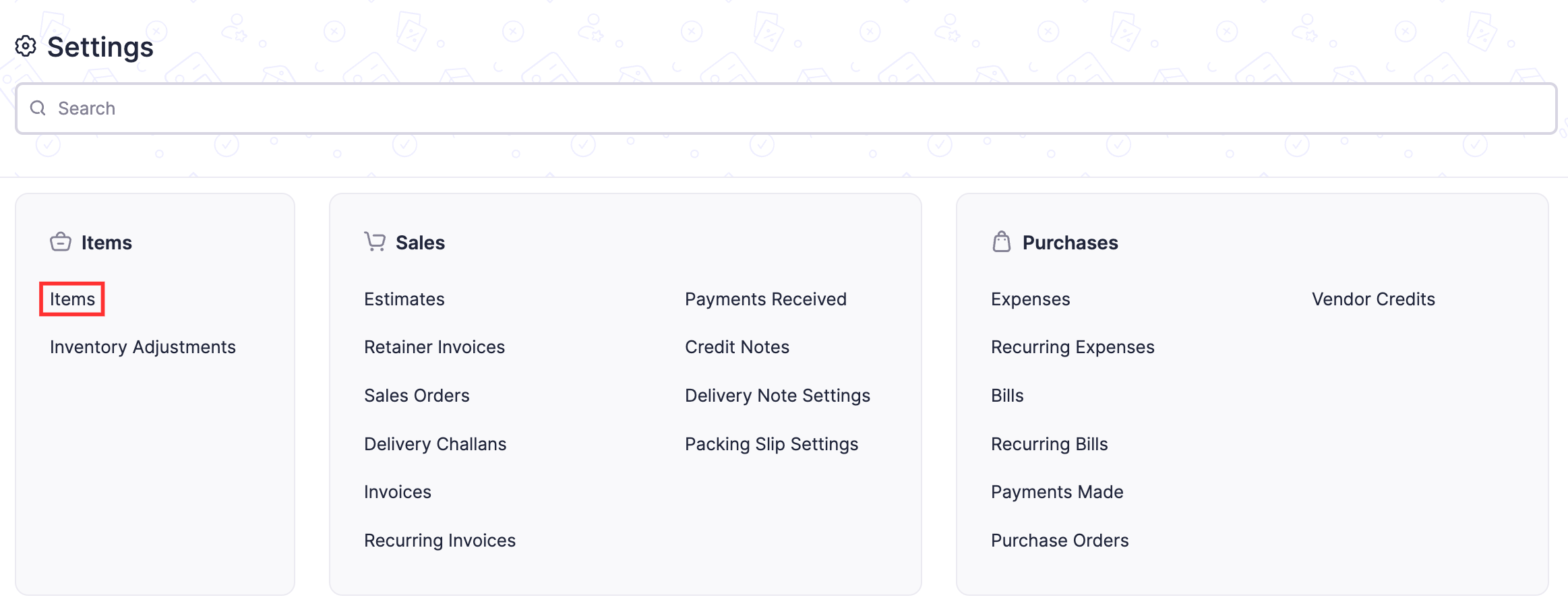

- Go to Settings on the top right corner of the page.

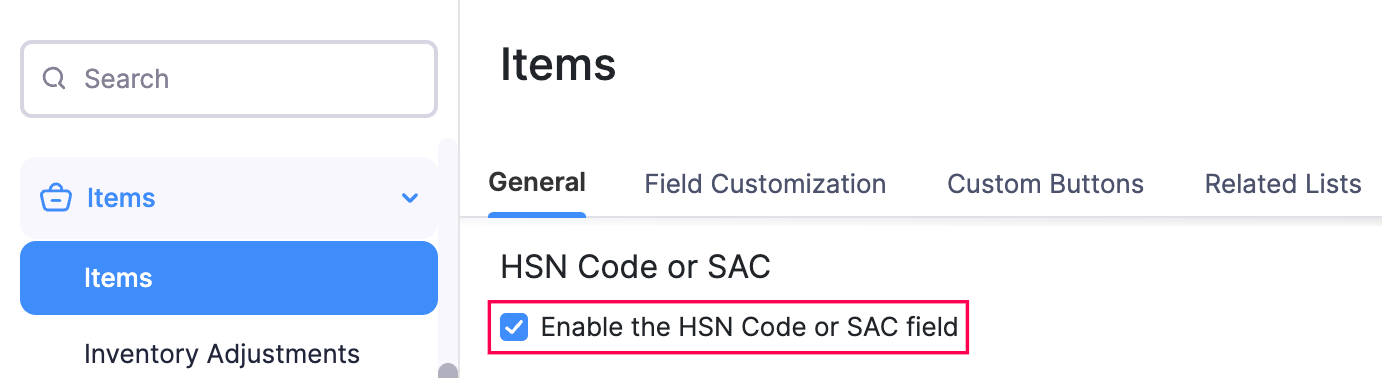

- Select Items under Items.

- In the General tab of the Items page, check the Enable HSN Code or SAC field option.

- If your business’s annual turnover was less than ₹5 crores in the previous year, select 4-digit HSN Code or SAC. The 4-digit HSN Code or SAC is mandatory for B2B, SEZ, Export, or Deemed Export tax invoices and optional for B2C tax invoices. (or)

If your business’s annual turnover was more than ₹5 crores in the previous year, select 6-digit HSN Code or SAC. The 6-digit HSN Code or SAC is mandatory for all tax invoices.

- Scroll down and click Save.

You can now add HSN Codes or SACs to your items in Zoho Books. Once the HSN Codes or SACs are added to the items, they will automatically populate when you create transactions.

Yes

Yes