GSTR 1A - Amendment to sales & outward supplies return

GSTR 1A allows taxpayers to update the sales details that were earlier filed under GSTR 1. In this guide, you will find the following information:

- What is GSTR 1A?

- When do we file GSTR-1A?

- When to file GSTR 1A?

- What happens if a seller makes changes to the previous month’s invoices after all 3 monthly returns have been filed?

- How to file GSTR 1A?

What is GSTR 1A?

The GSTR-1A is a document that will allow a registered taxpayer to update the details of sales and outward supplies on a previously-filed GSTR-1.

When do we file GSTR-1A?

Let’s assume that you have filed your monthly sales return, the GSTR-1, for a particular month. This return will contain the details of both B to C and B to B sales (along with the GSTIN of customers who are registered under GST). Your customers can access the details from your sales return on form GSTR-2A and use them to file their purchase return (GSTR-2).

Because your customer files their purchase return after you’ve filed your sales return, if there’s been a refund or cancellation, they may need to make changes to the invoices or credit notes on their return. This will cause a mismatch between their return and yours, so if this happens, the GSTN portal will notify you. You can review the changes and either accept or reject them.

If you choose to accept the changes made by your customer, then you are required to file an amendment to your monthly sales return called the GSTR-1A.

When to file GSTR 1A?

The GSTR-1A should be filed between the 10th and 17th of the following month, before filing the GSTR-3 for the same month.

What happens if a seller makes changes to the previous month’s invoices after all 3 monthly returns have been filed?

If you change any of your sales records pertaining to a particular month after the 20th of the following month, you will not be able to update them using a GSTR-1A. That said, you can still capture them under sections 9, 10 and 11 of the next GSTR-1 return.

How to file GSTR 1A?

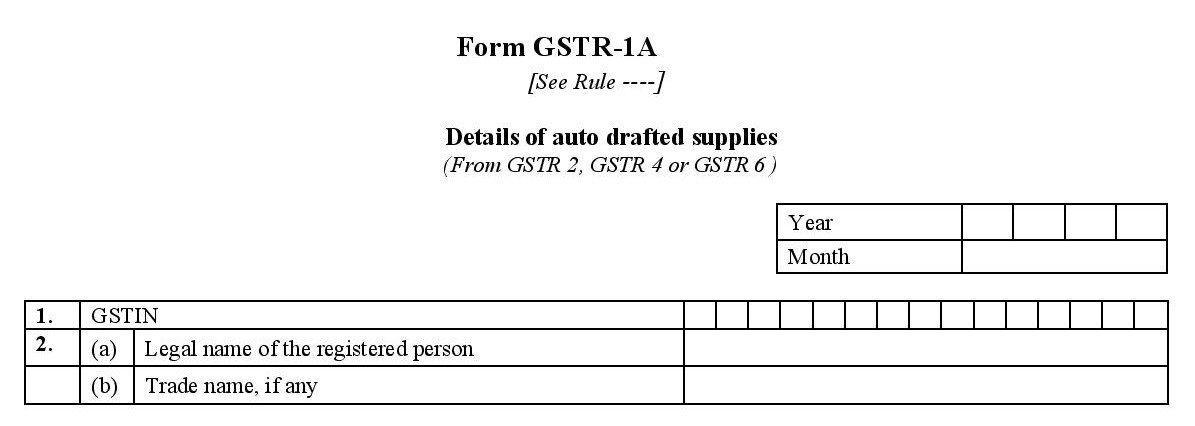

- 1. GSTIN: your unique PAN-based 15-digit Goods and Services Taxpayer Identification Number (GSTIN).

- 2. Name of the Taxpayer

- Legal name of the registered person

- Trade name (if any)

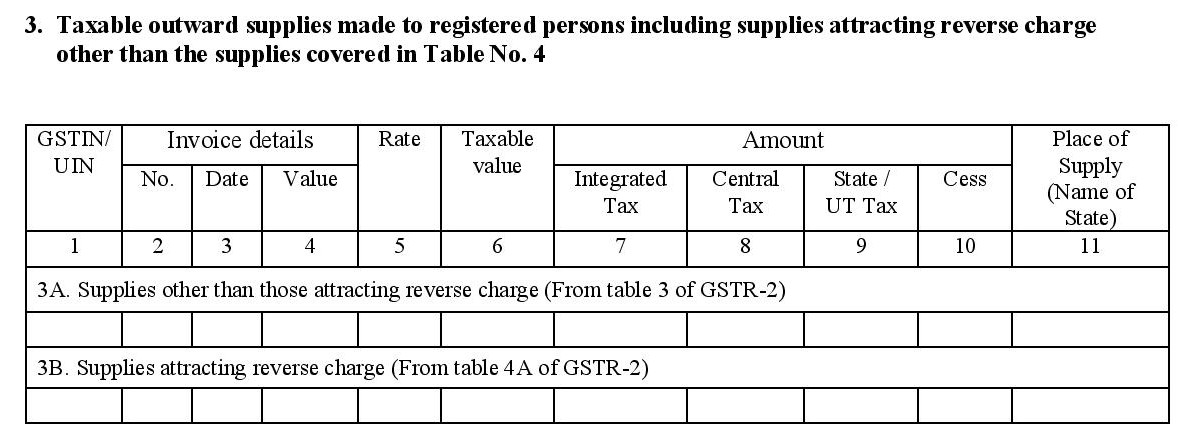

- 3. Taxable outward supplies made to registered persons, including supplies attracting reverse charge, other than the supplies covered in Table No. 4 of the original GSTR-1

- Changes made to invoices that do not attract reverse charge.

- Changes made to invoices that attract reverse charge.

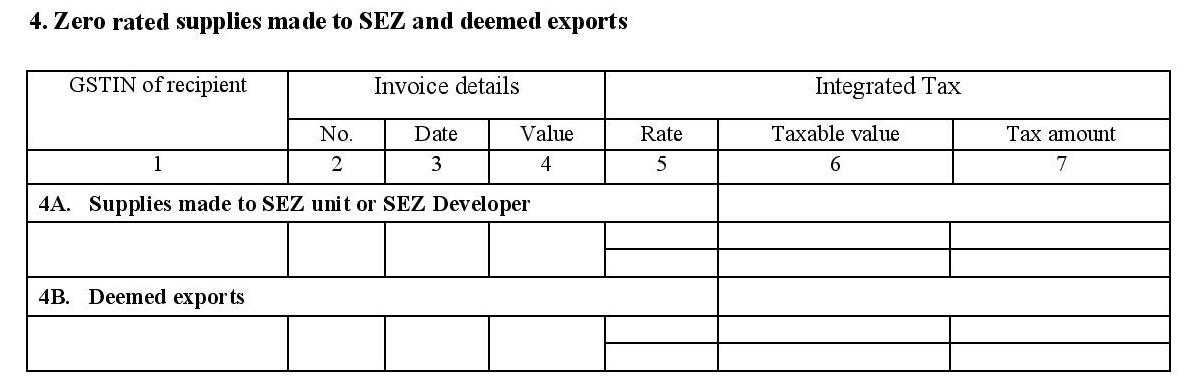

- 4. Zero rated supplies made to SEZ and deemed exports: This section captures the amendments/changes made to details you provided under table 6 of the original GSTR-1.

- Changes made to the details of supplies made to SEZ unit or SEZ developer.

- Changes made to supplies related to deemed exports.

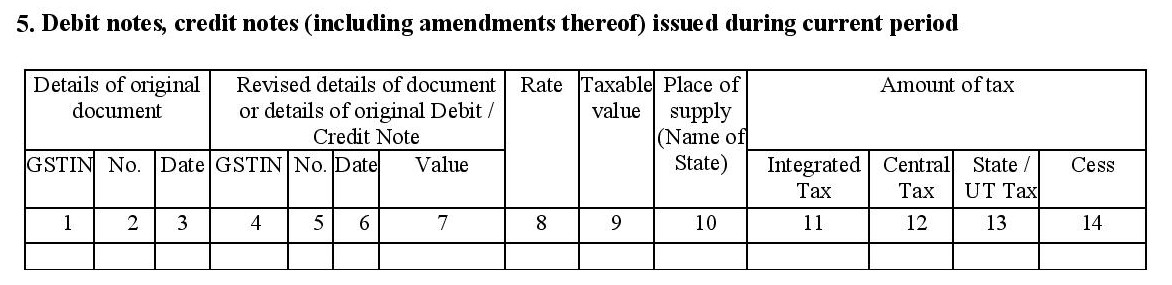

- 5. Debit notes and credit notes (including amendments) issued during current period: This section will capture any changes made to debit notes or credit notes for which you are yet to file the consolidated monthly return.

At the end of the document, there is a declaration of truth that needs to be signed by the authorized signatory of your company.