Latest from us

Filter By

Clear filter

Taxes & compliance

TDS threshold limits for different sections in India

Taxes & compliance

The next generation of GST reforms: New GST rates and more!

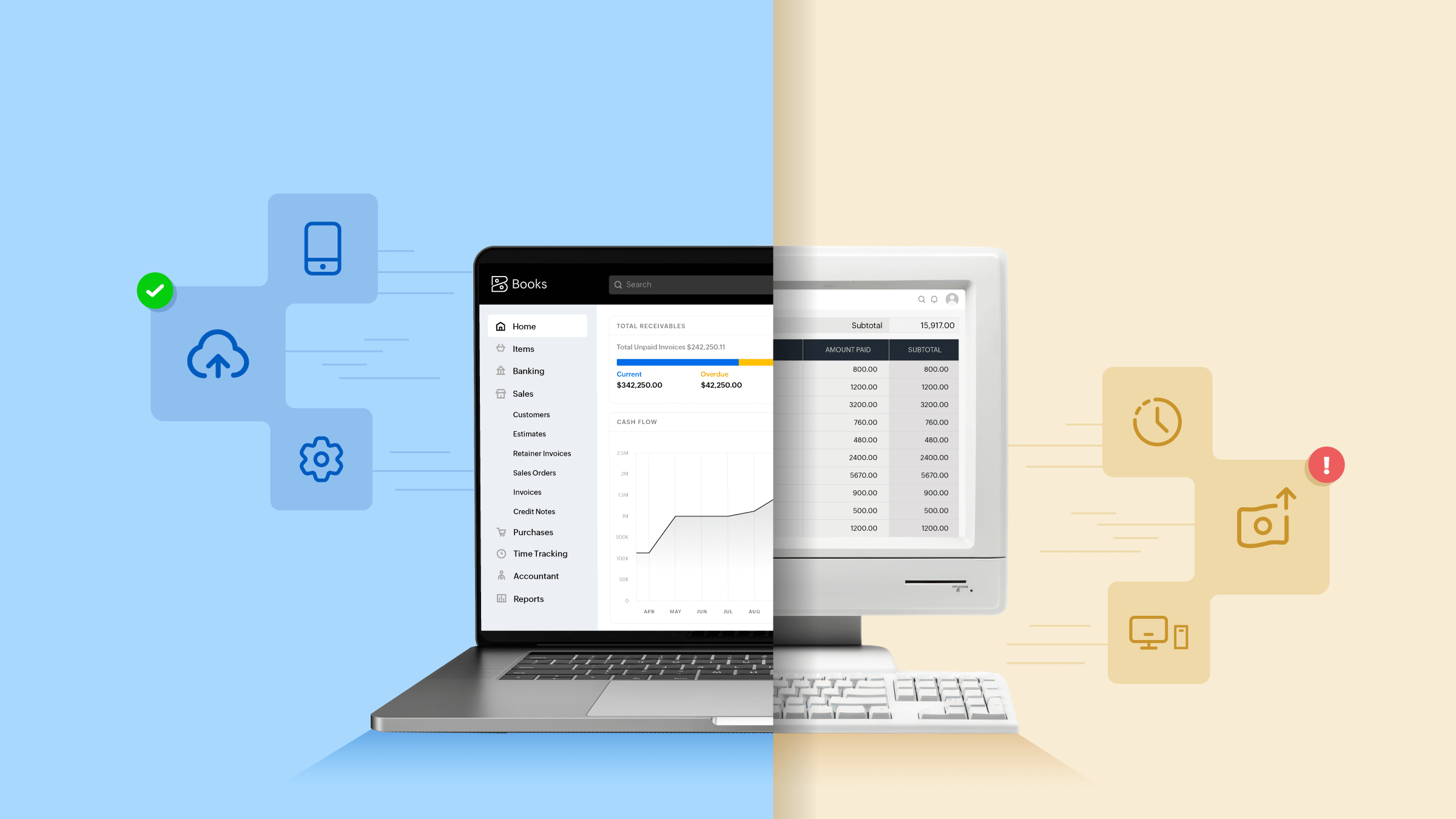

Accounting trends & insights

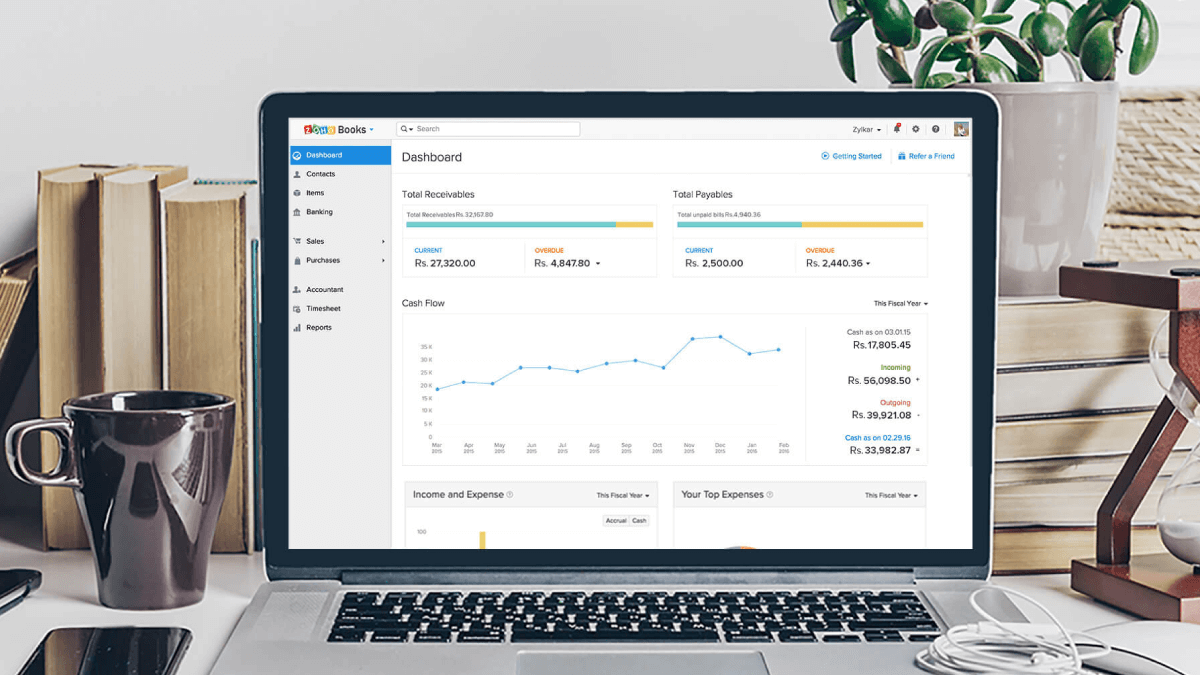

Unleash the true potential of your business with the right accounting software

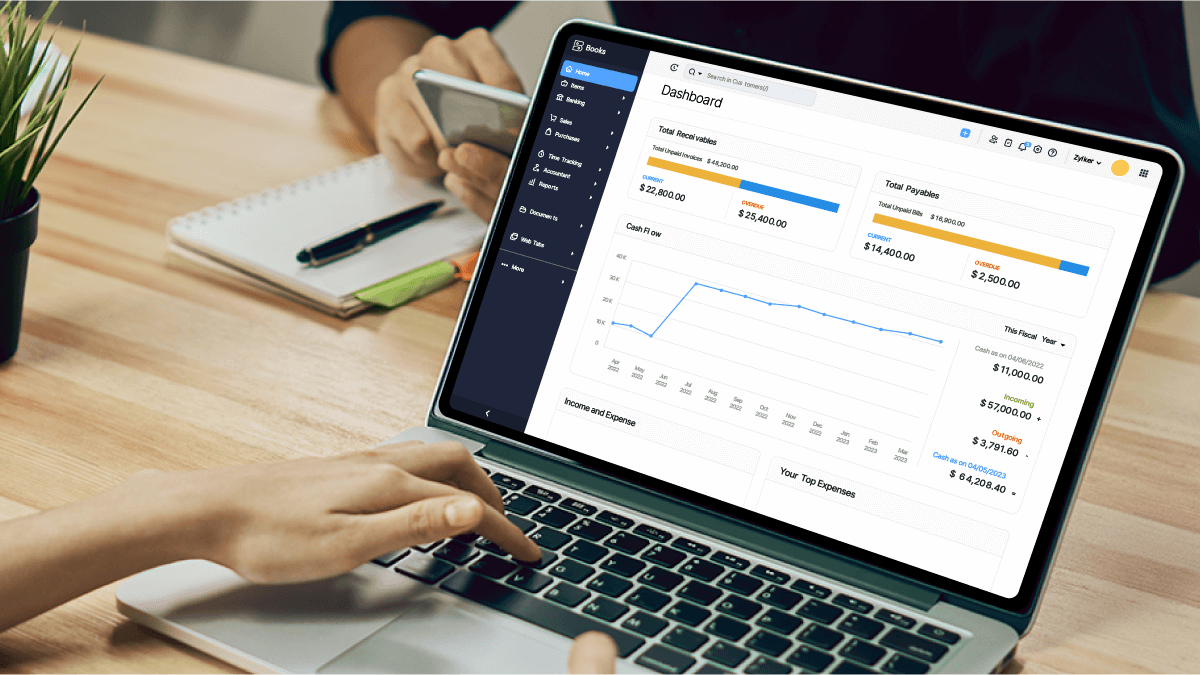

Taxes & compliance

Understanding the MSME 45-day payment rule in India: How Zoho Books can help

Financial Management

Accounts Payable Process: Common Challenges and Solutions

Financial Management

Choosing the right financial metrics for your business

Accounting Principles

Importance, Benefits, & Advantages of Using Accounting Software for Small Business

Taxes & compliance

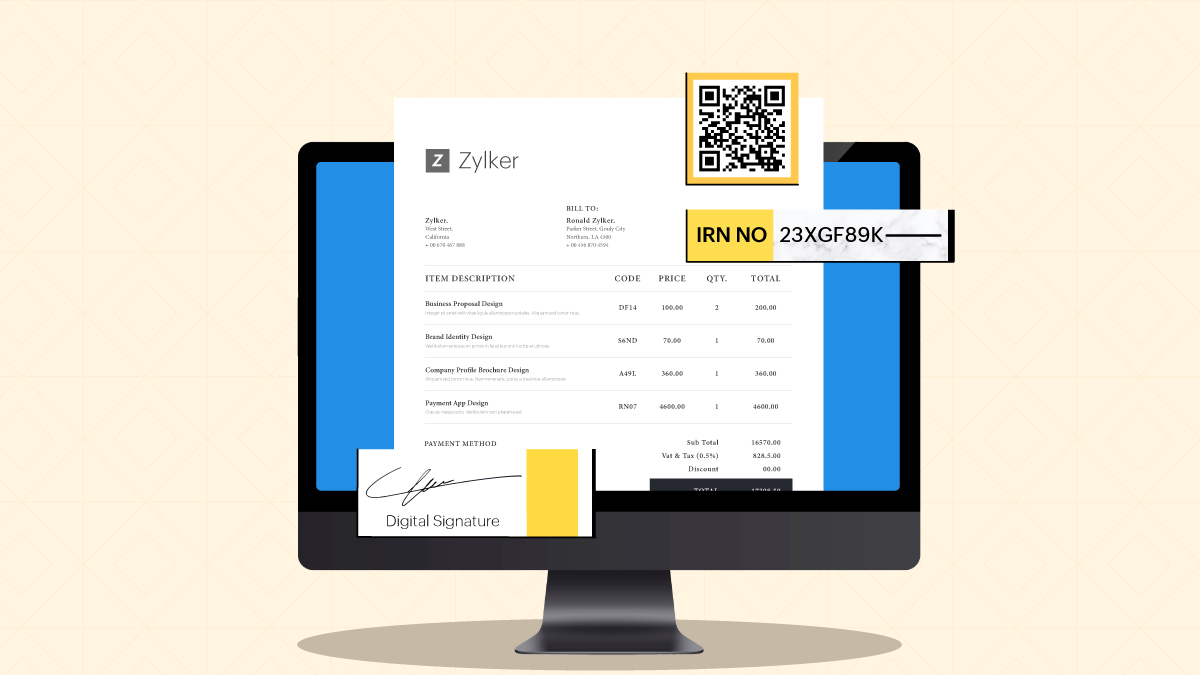

Streamline your transactions with these important e-invoicing features

Taxes & compliance

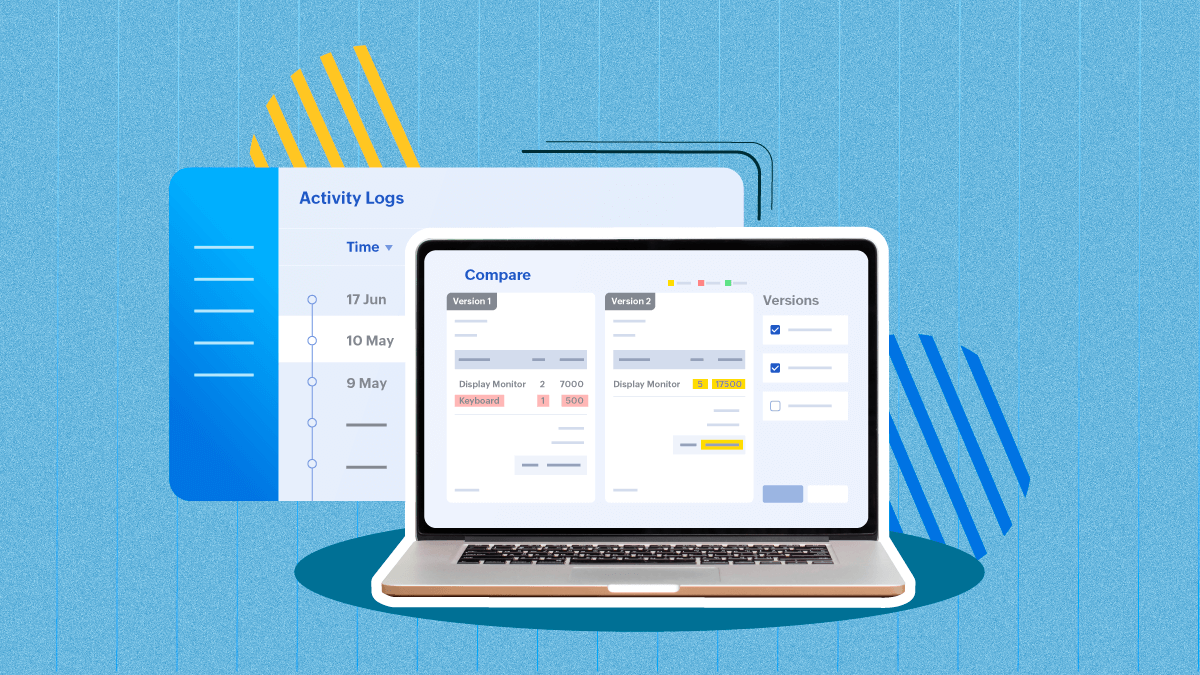

Staying audit ready: how to prepare your business for the audit trail mandate

Taxes & compliance

Basics of Invoice Furnishing Facility (IFF) in GST

Banking & payments

Managing Customer Payments with UPI and Zoho Books

Banking & payments

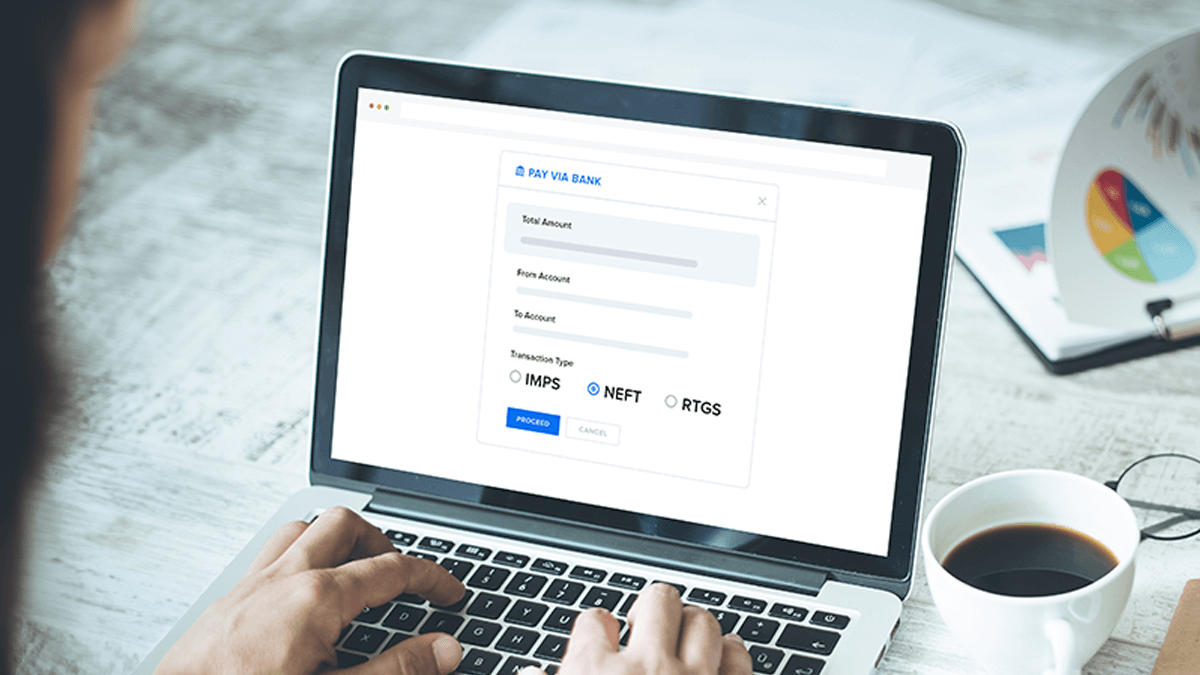

Benefits of making NEFT, RTGS, and IMPS payments with Zoho Books

Taxes & compliance

Zoho Books is the best tool for GST compliance, and here's why

Taxes & compliance

Composition scheme - A way to comply with GST if your business sells goods without invoices

Taxes & compliance

Impact of GST on Ecommerce Operators and Suppliers

Taxes & compliance