- HOME

- Accounting Principles

- Statement of Accounts – Definition & Sample Format

Statement of Accounts – Definition & Sample Format

What is a statement of accounts?

A statement of accounts is a document that reflects all transactions that took place between you and a particular customer for a given period of time. Generally business owners send statements of accounts to their customers to let them know how much they owe for sales that took place on credit during that period. The guide walks you through the contents of statement of accounts and shows how to file this document for customers.

Importance of statements of accounts

A statement of accounts is a great way to provide your customers with a recap of the products and services that were billed to them. statement also helps the business owners confirm the payments that the customer has already made for a statement period, which is generally a month.

The statement comes in handy when you have recurring customers for whom you have to create invoices on a monthly, quarterly, or annual basis. Statement of account is usually in addition to the individual invoices sent to the customer for each and every purchase that he makes. Since the payments are automatically generated on a periodic basis, it is easier to view all invoices sent and payments received in the same place for one particular customer. It can also be used as a tool for payment reminders as it gives the business owner an idea about the customer’s recurring expenses. In that case, the business owner can send reminder for payments in advance.

Whenever a business faces inconsistency in records, the summary report of the statement enables a business owner to check if the customer has paid his dues. This way they can detect the inconsistency in data. The statement can also help the business owner check whether the declared amount due includes the payments made by the customer so far. It can even help catch transactions that have accidentally been run twice.

The statement of accounts also provides business owners an accurate price record for each item that they sold to their customers. This enables them to track information associated to a customer (like the purchases made by the customer) for any time span and aids in identifying errors.

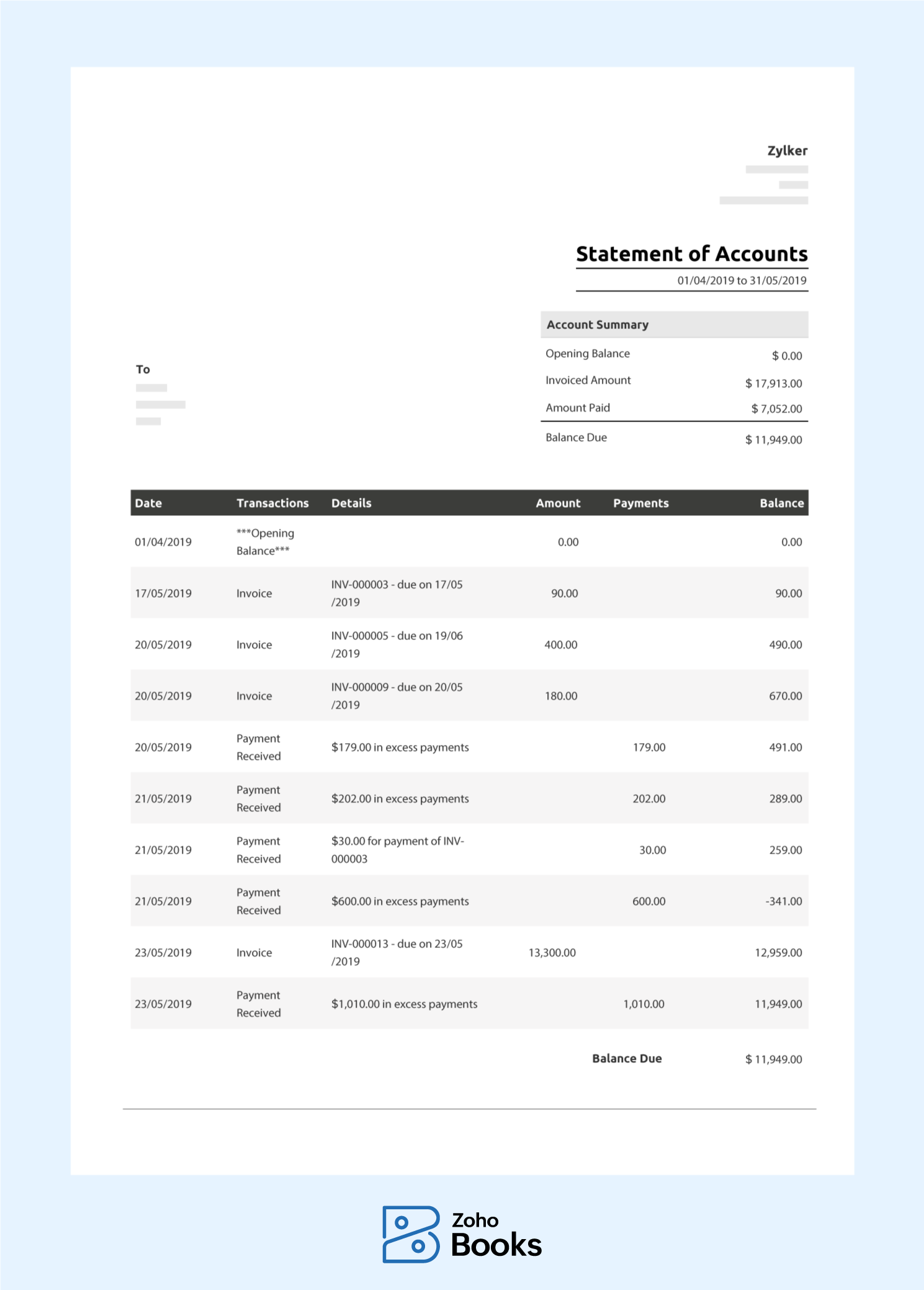

Statement of accounts – sample format

A statement of accounts is typically divided into two halves. The top half contains an overview of the customer’s accounts. The bottom half contains the details of each transaction.

Account overview

The top half of the statement shows the name and address of both the business owner and the customer.

It also contains the time interval for which the statement has been prepared. Some businesses use the last day of each month as a closing date. In that case, the statement will show invoices and credit notes for the month. However, there is no strict rule on what dates to use for the statements.

This part also includes the account summary, which contains the opening balance, invoiced amount, amount paid, and balance due.

The opening balance is the ‘total due’ amount from the statement which was sent out for the previous period. The period can be any time interval, whether it’s monthly, quarterly, or yearly.

The invoiced amount is the money that your customer is expected to pay for the goods or services that they received from your business during the current period.

The amount paid is the money which the customer has already paid. This is deducted from the total invoiced amount to get the current amount due.

The balance due is the money that the customer has yet to pay you.

Invoice details

Date: This is the date on which the invoice or credit note was sent.

Details: The numbers which refer to the invoice or credit note that were sent out in the given period. Even payments can be allocated to reference numbers which are mentioned in the cash register.

Transactions: It describes the type of transaction affecting the customer.

Amount: The currency amount of the sales invoice or credit note sent to the customer. Credit notes are usually represented as a negative value because they reduce the customer’s outstanding balance.

Payment: This column shows the payments the customer has already made during the month.

Balance due: A running tally of the amount the customer currently owes you.

Other sections

The format for a statement of accounts varies from business to business. Here are some other fields that may be included:

Remittance: Remittance is the amount of money the customer sends to the seller as a payment for the purchase made. Including the seller’s business name and address on a remittance coupon makes it easy for the customer to put it in an envelope and post it to the seller. The seller can also fill the customer’s details on the right side so that they will know which customer has sent the remittance.

Customer cut-off dates: Many sellers have a cut-off date for each month beyond which any invoices and credits will be counted as part of the next consecutive month. Ideally, all invoices and credit notes should be added and the statement of accounts should be sent to the customer before the cut-off date.

Run your business with ease

When your business expands, you will have customers for whom you would need to send and receive recurring invoices. Since payments would be automatically recorded for these customers, it will be easier to view all the transactions associated with a customer at one place. A statement of accounts is similar to a bank statement, except that it is issued by a seller to a customer. It helps identify mistakes in transaction records, track unwanted expenses, find fraudulent activities, and prevent small billing or payment mistakes from blowing up. Statement of accounts does not have a specific format and can vary based on the requirement of an enterprise and the types of information that they want to include in the invoice for the customer.

Using Zoho Books, you can easily generate and share the statement of accounts with your customers in a single click. Your clients can also access this as ‘Customer statement’ from the client portal easily and handle their outstanding payments. Check out how our free online accounting software can help you generate the statement directly from the customer profile.