- HOME

- Financial Management

- How to Create a Business Budget for Your Small Business

How to Create a Business Budget for Your Small Business

According to a study done by CBinsights, a few of the top reasons why small businesses fail include include pricing and cost issues, losing focus and running out of cash. These issues can be prevented by having a realistic budget in place.

Before you can focus on the budget, however, you need to identify what aspects of your business you’d like to improve. This will allow you to decide what can be done with your funds. Based on that list, you can set up short-term and long-term goals.

These goals will be directly affected by your incoming and outgoing cash. A short-term goal can be paying off a debt or purchasing new equipment. Long-term goals, like keeping aside marketing expenses, are crucial because they are connected to the overall growth of your business.

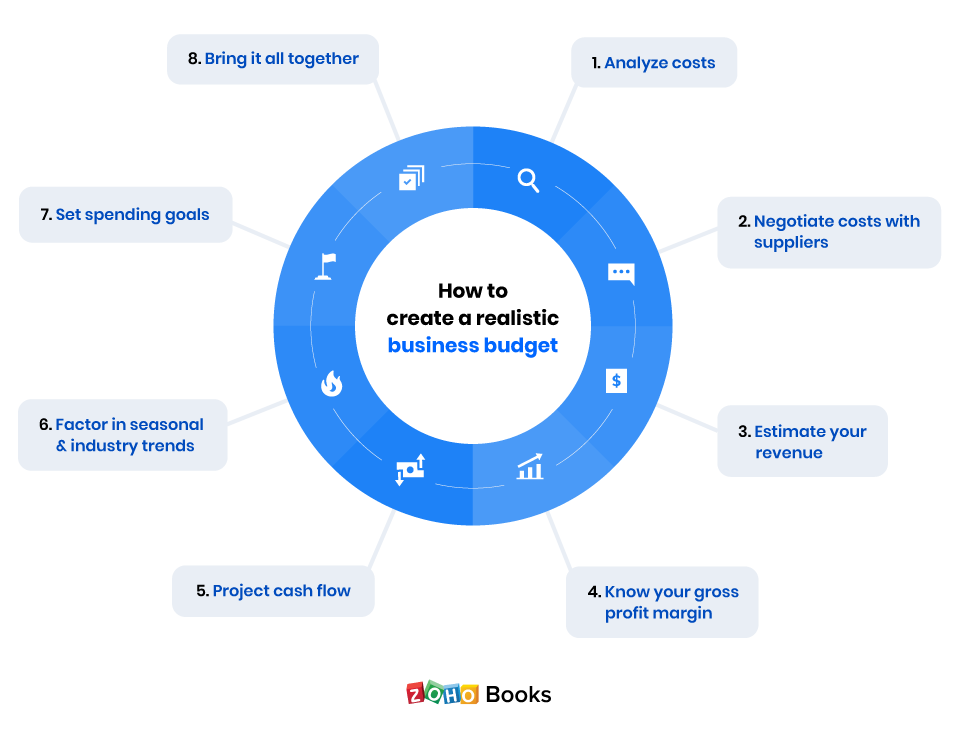

You should be practical about the goals you set. They should be purely based on your business’ capacity to spend and save. Once you have your goals in place, you can create an effective, foolproof budget by following these steps.

1. Analyze costs

Before you start drafting a budget, you must research the operating costs involved in your business. Knowing your costs inside and out gives you the baseline knowledge needed to craft an effective spending plan.

If you create a rough budget and later discover that you need more money for your business activities, this will jeopardize your goals. Your budget should be such that you can increase your revenue and profit enough as your business expands to handle your growing expenses.

Your budget should factor in fixed, variable, one-time, and unexpected costs. Some examples of a fixed expense are rent, mortgages, salaries, internet, accounting services, and insurance. Examples of variable costs include cost of goods sold and commissions for labor.

There is not much harm in overestimating the costs involved since you will need enough cash to handle your future expenditures. If your business is new, then you must include start-up costs as well. Planning the budget this way will help you make informed decisions and tackle any unwanted financial surprises.

2. Negotiate costs with suppliers

This step will be useful for those businesses which have been functional for more than a year and are dependent on suppliers to sell products. Before you get started on your yearly budget, have a chat with your suppliers and try getting discounted rates for the materials, products, or services you need before you make your payments.

Negotiations allow you to create trustworthy relationships with your suppliers. This will be helpful when incoming cash is thin. For example, you might have a seasonal business. When you have enough cash saved, you can pay advance amounts to your suppliers as compensation for the times when you are unable to make payments. The main goal here is to find efficient ways to reduce cost of doing business.

3. Estimate your revenue

Many businesses have failed in the past by overestimating revenue and borrowing more cash to meet operational needs. This defeats the very purpose of creating a budget. To keep things realistic, it’s a good idea to analyze previously recorded revenue. Businesses must track revenue periodically on a monthly, quarterly and annual basis.

Your previous year’s revenue figures can act as a reference point for the upcoming year. It’s important to rely solely on this empirical data. This will help you set realistic goals for your team, leading to the eventual growth of your business.

4. Know your gross profit margin

The gross profit margin is the cash you are left with after your business has dealt with all the expenses at the end of the year. It gives insight into the financial health of your business. Here’s an example of why you need to understand this parameter while creating a budget.

Suppose your business made a revenue $5,000,000 and yet there are debts to be paid. At the end of the year, your expenses are more than your revenue, which is not a good sign for a growing business. This tells you that you must identify the expenses that are not benefiting the business in any way and eliminate them. The best way to do this would be to list out the cost of goods sold for all materials and deduct them from the overall sales revenue. This information is needed to get a real picture on how your business is faring, allowing you to increase profit and reduce costs.

5. Project cash flow

There are two components to cash flow: customer payments and vendor payments. You need to balance these two components to keep the cash flowing in your organization.

To do your best to ensure timely customer payments, it’s important to have flexible payment terms and the ability to receive payments through common payment channels. Unfortunately you will need to deal with customers who might not comply to the stated terms. This might affect your cash flow forecast due to missing payments.

You can encourage payment by giving customers a grace period and creating strict business policies for paying late. Beyond this, you must have some money allocated in your budget for ‘bad debt,’ in case the customer never pays.

When you know your incoming cash flow, you can fix an amount for your employee salaries and travel expenses. You can also allocate some money to pay off your fixed vendor expenses. If you are still left with cash, you can then spend on business initiatives such as professional development or new equipment.

6. Factor in seasonal and industry trends

It’s unrealistic to expect that you will achieve every business goal and reach your estimates every month. In an annual cycle, there will be months where your business will be booming, and there may be a few months where sales are slow. Due to seasonal inconsistency and industry trends, you will have to spend cash effectively so that the business isn’t at risk of shutting down during slower periods.

To overcome this challenge while creating a budget, gather insights as to when your business performs better. The aim should be to generate enough revenue during peak months to sustain the business during off seasons.

For example, let’s assume that you are a business owner of a winter clothing company. Your products are on demand only during that season, so most of your revenue comes during that period. For the rest of the year, you can use the earnings to keep the business going and market to specific target groups, like hikers or travelers. This will help you gauge how successful your products are during off seasons, what revenue to expect, and how much to save during your peak periods.

7. Set spending goals

Making a budget is more than just adding your costs and subtracting them from your earnings. How wisely you spend your money determines how well your business will fare. Goals provide a system to check if your money is being spent on the right areas to avoid unwanted expenses.

For example, if you are spending money on stationary that is going unused for operational or marketing efforts, it may be time to cut those costs. This money can be better applied to your marketing campaigns, bringing in more leads and revenue. Gauge and invest in those expenses that would benefit your business in the long run.

8. Bring it all together

Once you have gathered all the information from the previous steps, it’s time to create your budget. After you have subtracted your fixed and variable expenses from your income, you will get an idea of the amount that you can work with. Be prepared to tackle the unexpected one-time expenses that come your way. You can then find ways to use the money effectively to achieve your short-term and long-term goals.

Role of accounting software in budgeting

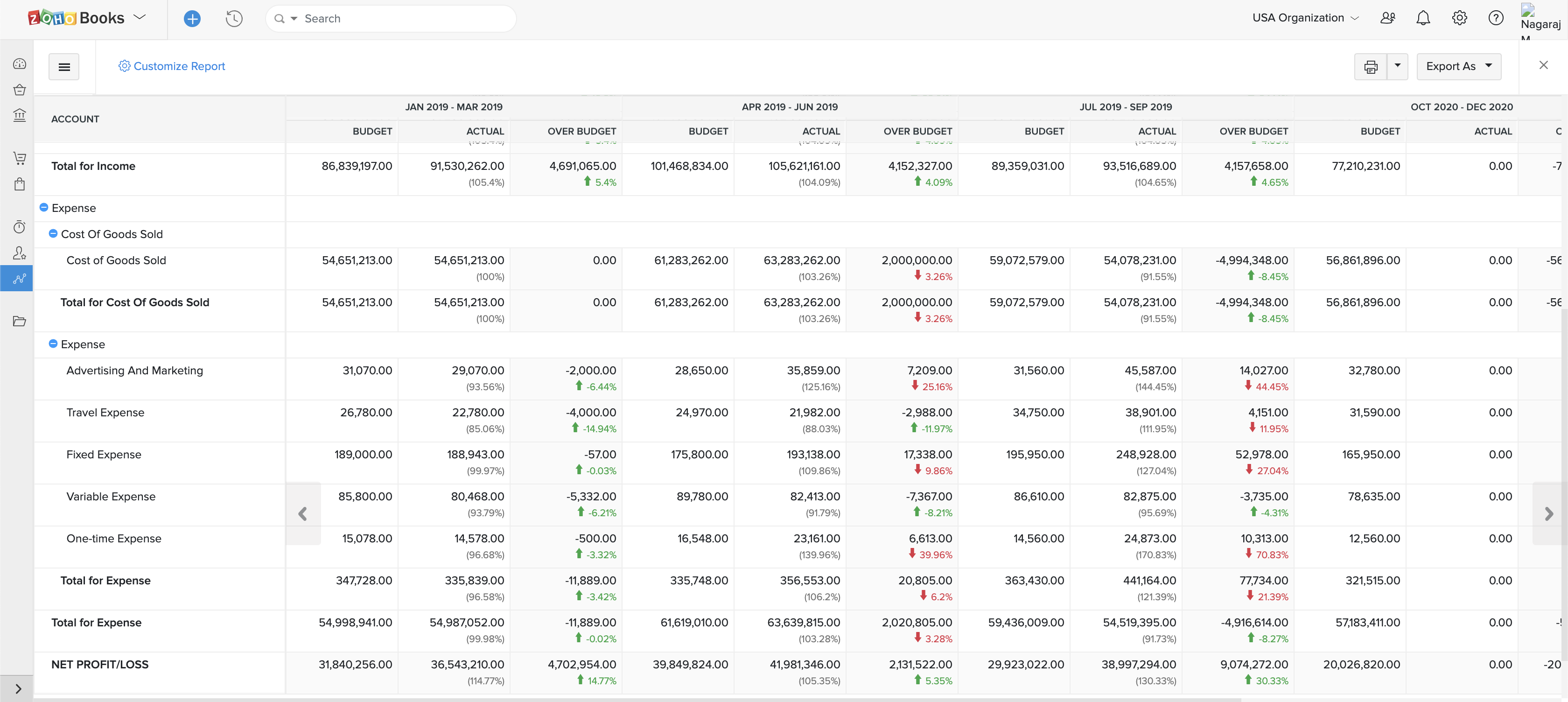

Budgeting for a business is a large task, which is why you might need assistance. Creating a budget will involve analyzing costs, estimating revenue, and projecting cash flow. Having an accounting system in place will give you real-time information about your finances, helping you to create a feasible budget.

The key to creating a good budget is to evaluate the previous years’ data and draw realistic projections. An accounting system can give you access to all this information in one place, no matter when you need it.

The effectiveness of a budget also depends on how well any projected goals have been achieved by your business. To check this, an accounting system generates financial reports that record your actuals, and those can then be compared with the budget. Comparing your budget with your actuals is an important step to gauge the effectiveness of a budget.

Conclusion

Budgeting is an essential process, especially for small businesses, as it allows business owners to estimate and allocate money for different business activities. Preparing a budget also gives you a clear idea of the money that can be used to achieve business goals and ensure that there is enough in hand to handle a crisis. For small businesses, it might get a bit difficult to make estimations for the whole year as the initial stages of growing an organization are often volatile. In such cases, you can create smaller budget estimates for a duration of two or three months and keep reviewing it for better results. When an accounting system is introduced, the process becomes even more manageable. You can easily handle tasks like projecting cash flow or estimating costs, and you can set realistic goals for your business.