- HOME

- Expense Management

- Receipts made simple: Everything businesses need to know

Receipts made simple: Everything businesses need to know

Receipts are not just pieces of paper collected after purchases; they are a vital part of running a business, staying compliant, managing expenses, and keeping cash flow healthy. Learn what receipts are, why they're important, and how the smartest teams simplify receipt management to stay ahead.

What is a receipt?

A receipt is a document provided by the seller to their buyer as proof of purchase for goods or services. It includes all purchase-related information like the date and time, items bought, amount paid, payment method, and seller information. Receipts are key both for customers and for businesses. While customers validate purchases or process returns, businesses require receipts to support accurate accounting, tax compliance, and make smarter financial decisions.

Why are receipts important for businesses?

Receipts are more than routine paperwork—they are an essential business tool. Here’s why:

- Proof of transaction - Vital for tax filing and resolving disputes.

- Compliance - Required documentation for reimbursing employees, claiming tax deductions, or passing audits.

- Expense tracking - Help monitor company spending and reimburse staff properly.

- Customer experience - Enable hassle-free returns and warranty claims.

- Fraud prevention - Provide a clear record that reduces the risk of bogus claims.

- Business insights - Support inventory tracking and reveal purchasing patterns.

Types of receipts

Different business transactions generate distinct types of receipts. Here are a few types of receipts that are commonly used.

- Retail receipts: Traditional or digital receipts for product sales at the point of sale.

- Service receipts: For services rendered (consulting, repairs, or medical visits).

- Business-to-business receipts: More detailed and usually include purchase order numbers, terms, supplier information, and more.

- Electronic receipts: Also known as e-receipts, these are digitally sent by email, SMS, or generated through apps.

- Expense receipts: Used by employees or contractors for business reimbursements.

What needs to be on a receipt?

For compliance and clarity, your receipts should always include:

- Date and time of purchase

- Description of products or services

- Total paid (including taxes/fees)

- Payment method

- Seller’s name and contact

- Any unique reference number (such as order ID or invoice ID)

These elements make receipts useful for audits, tax claims, disputes, and customer service.

Receipts and tax compliance: What the IRS requires

If your business claims tax deductions, the IRS expects you to keep receipts for:

- Income - Proof of all sales (cash register tapes, deposit slips, invoices).

- Purchase of goods for resale or use - Maintain vendor receipts, bills, or proof of payment.

- Expenses - Hold onto receipts for office rent, utilities, employee expenses, travel, and more.

How long should you keep receipts?

It’s recommended to keep receipts for at least three years from the date you filed your return, but longer if the receipts are for significant assets or property.

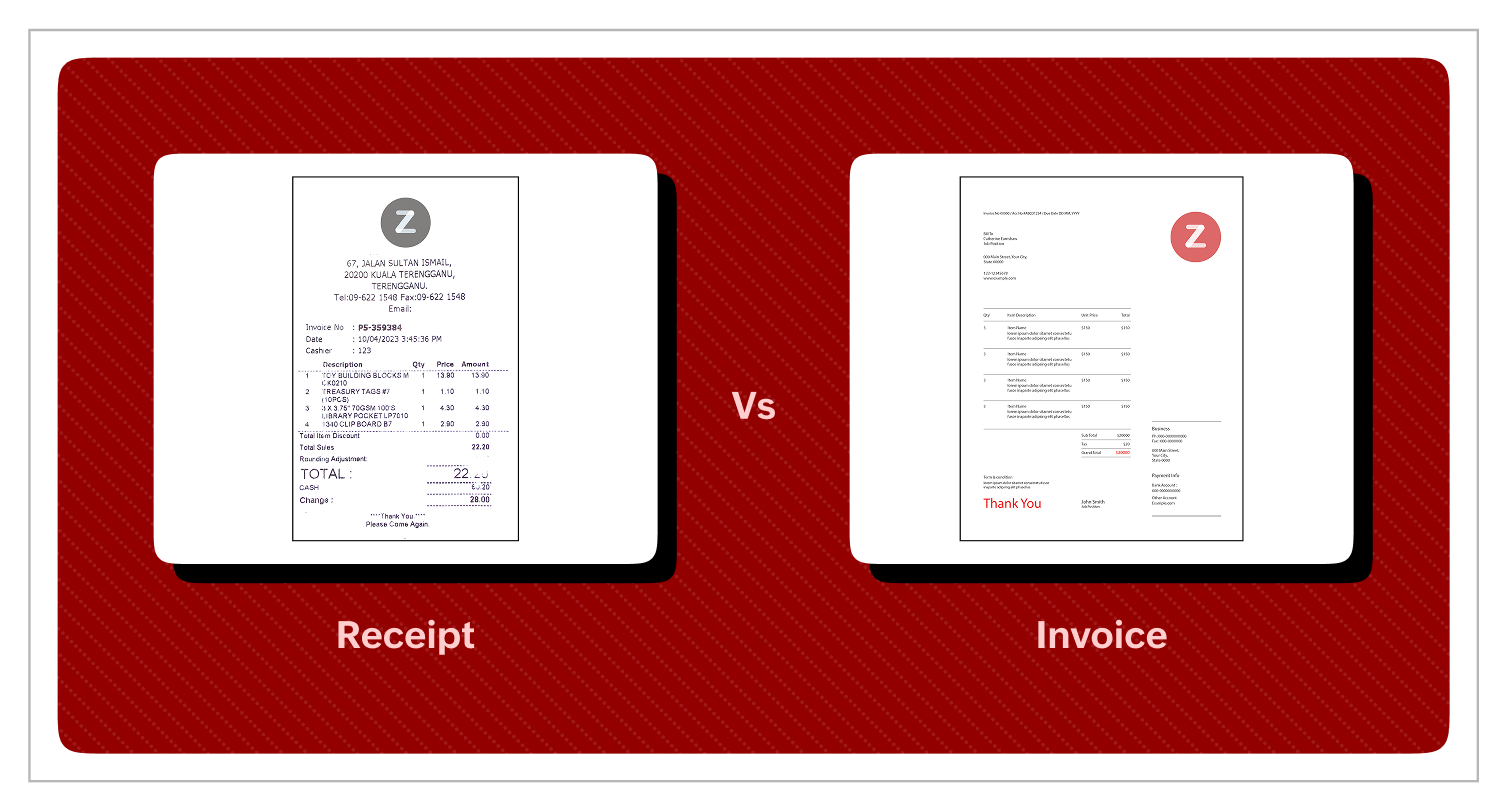

Invoice vs. Receipt: Know the difference

Invoice: A payment request sent to a buyer before payment is made.

Receipt: Confirmation that payment has been received and the transaction is complete.

Put simply, invoices ask for payment for dues, while receipts capture the transaction once a payment is received.

Challenges in managing physical receipts

- Paper receipts are easily lost, damaged, or faded, making it tough to prove expenses when needed.

- Storing stacks of receipts leads to cluttered workspaces and disorganization.

- Manual receipt sorting and data entry are time-consuming and increase the risk of mistakes.

- Finding a specific receipt later for audits or compliance can be frustrating and slow.

- Relying on paper makes it hard to keep everything accessible and safe, especially as your business grows.

AI powered receipt management with Zoho Expense

Digital receipt management helps overcome the above hurdles and also keeps your expense records organized, secure, and easy to access. Here’s howZoho Expensehelps digitize and manage receipts.

- Instant digitization: Snap a photo, upload proof by email, or automatically fetch receipts from apps. No need to store paper receipts.

- AI-powered data extraction: Effortlessly capture vendor, amount, tax, and categorization from scanned images.

- Seamless tax compliance: Easily access receipts for audits or deductions, and link them with expense claims.

- Mobile and cloud access: Manage receipts from anywhere, anytime.

- Integrated approval flows: Automate review, flag anomalies, and keep finance teams in control.

- Smart analytics: Spot spending trends and optimize policies.

Moving to end-to-end receipt management software improves compliance, accelerates reimbursement, and eliminates tedious paperwork.

Tips for hassle-free receipt management

- Digitally store all receipts as soon as you receive them and go paperless.

- Define what receipts are needed and by whom and enforce clear policies.

- Use AI tools to minimize manual entry errors.

- Keep all receipts and reports in one centralized searchable system.

- Connect receipt software to your financial tools, such as your accounting application, for seamless workflows.

Frequently asked questions (FAQ)

Are digital receipts acceptable for tax and audit purposes?

Yes, digital receipts are widely accepted by tax authorities if they are clear, authentic, and retrievable. Always verify local regulations to be sure.

Can I use my phone’s camera to capture receipts?

Absolutely. Modern expense systems let you snap receipts with your phone and attach them to expense claims instantly.

How should receipts be organized for business expenses?

Categorize them by expense type, date, or project. Use cloud-based systems for easy sorting and instant access.

Do I need to keep receipts for small purchases?

For businesses, it’s wise to keep receipts for all expenses you intend to claim—even small ones—to avoid audit risks.

What’s the fastest way to process receipts for multiple employees?

Enable mobile uploads, use AI-powered data extraction, and automate expense report approvals with solutions like Zoho Expense.

- Dhwani

Dhwani Parekh is a seasoned FinTech content writer with more than 7 years of experience in SaaS marketing. As a contributing expert at Academy by Zoho Expense, she focuses on uncovering trends that empower businesses to streamline their financial operations, especially business travel and expense management. With deep industry knowledge and a pulse on the rapidly evolving landscape of business spend, Dhwani’s content adds tremendous value to Academy by Zoho Expense.