A simplified GST-compliant accounting software

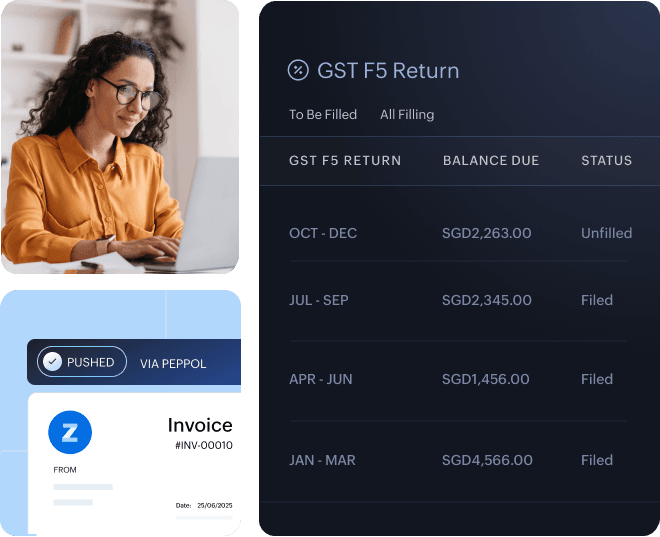

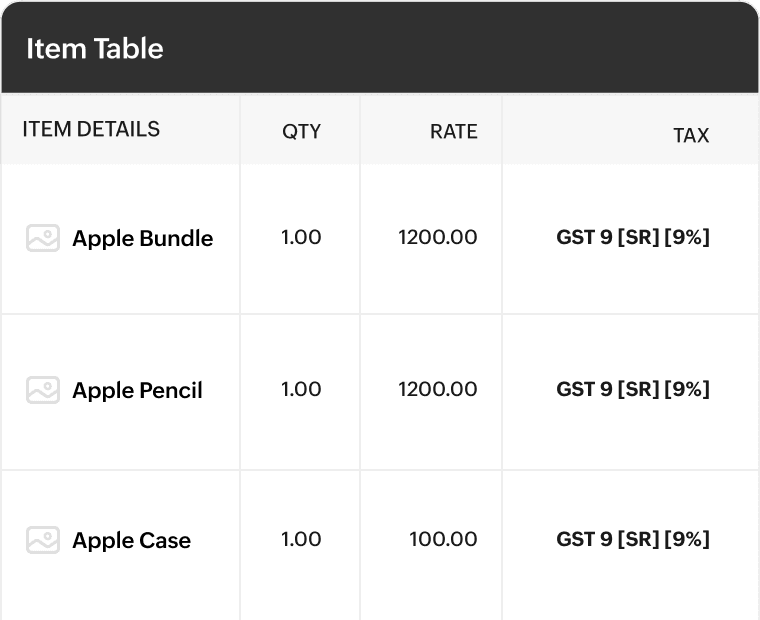

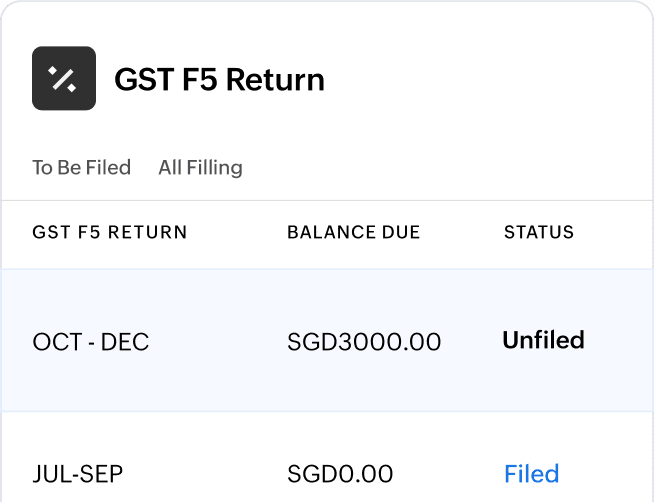

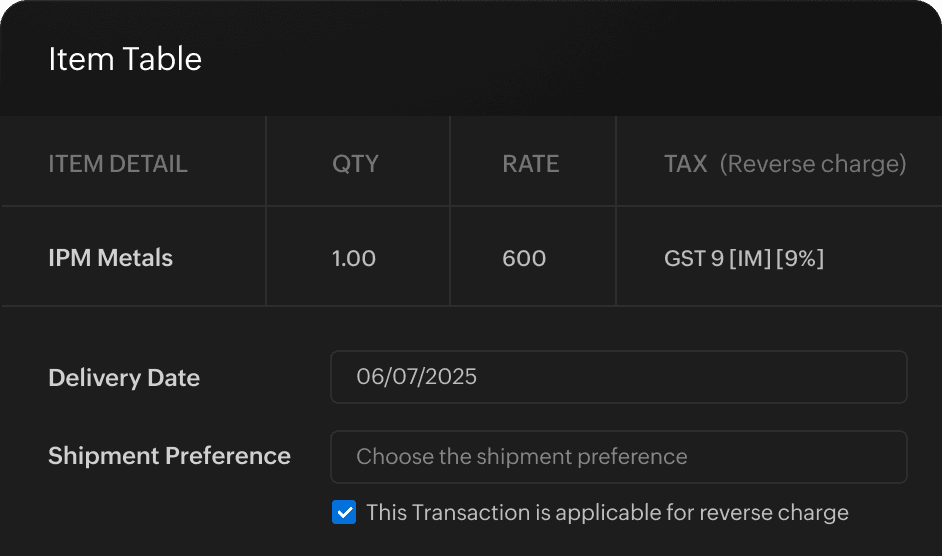

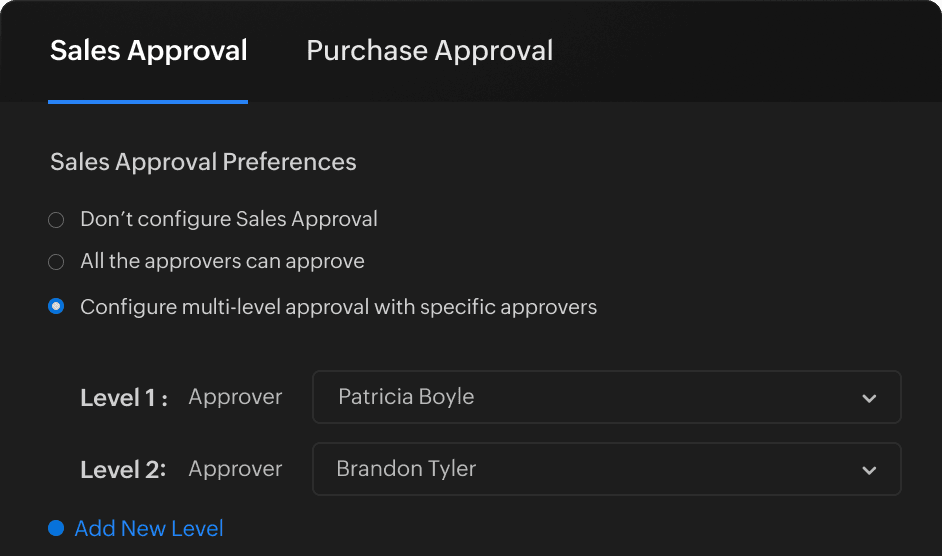

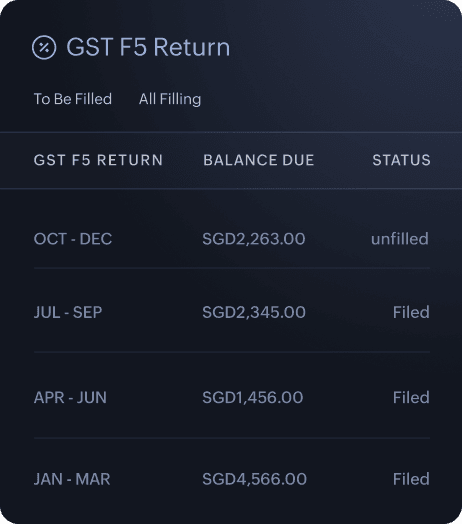

Staying compliant and computing taxes is made simpler than ever with Zoho Books. Automatically apply appropriate GST tax rates for different transactions. Generate F5 tax returns seamlessly within the software for easy filing with the IRAS.

Zoho Books simplifies GST accounting

Additional features for hassle-free GST compliance

FAQs on GST

Any business whose taxable turnover exceeds 1 million USD has to register for GST. Also, businesses with turnover less than 1 million USD can register for GST on a voluntary basis.

Businesses in Singapore are required to file their GST return within one month from the end of the accounting period. Generally, the accounting period is one quarter. However, businesses can opt for a different accounting period while registering for GST.

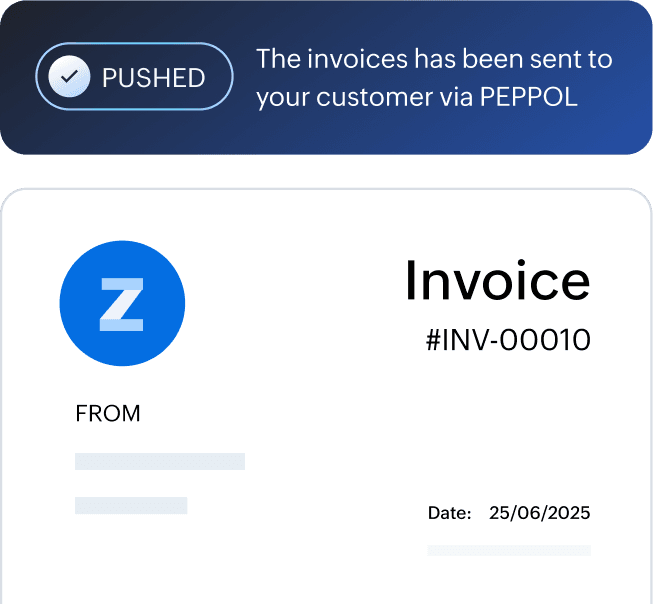

E-invoicing is the process of creating, sending, and receiving invoices in electronic format. This saves businesses significant resources spent on paper invoicing. Also, it helps the tax authority track taxable transactions of a particular business, improving transparency and accountability.

The e-invoicing mandate will be applied to the businesses in a phased and progressive way.

- GST-registered businesses can adopt e-invoicing on a voluntary basis from 1 May 2025.

- Newly incorporated companies that apply for voluntary GST registration are required to adopt e-invoicing from 1 November 2025.

- From 1 April 2026, all new voluntary GST registrants are required to adopt e-invoicing.

The GST F8 return is also known as the final GST return used to cancel the GST registration of your business. The GST F8 return is filed to account for the final output tax payable on taxable assets held by your business on the last date of registration.

ou can't resubmit your GST F5 return once it is filed with IRAS. However, you can file Form GST 7 to correct the errors in the return filed if the value of the error breaches the prescribed threshold. If the value is within the prescribed threshold, you can make adjustments in the next GST return.