Get ready for the Singapore e-invoicing mandate

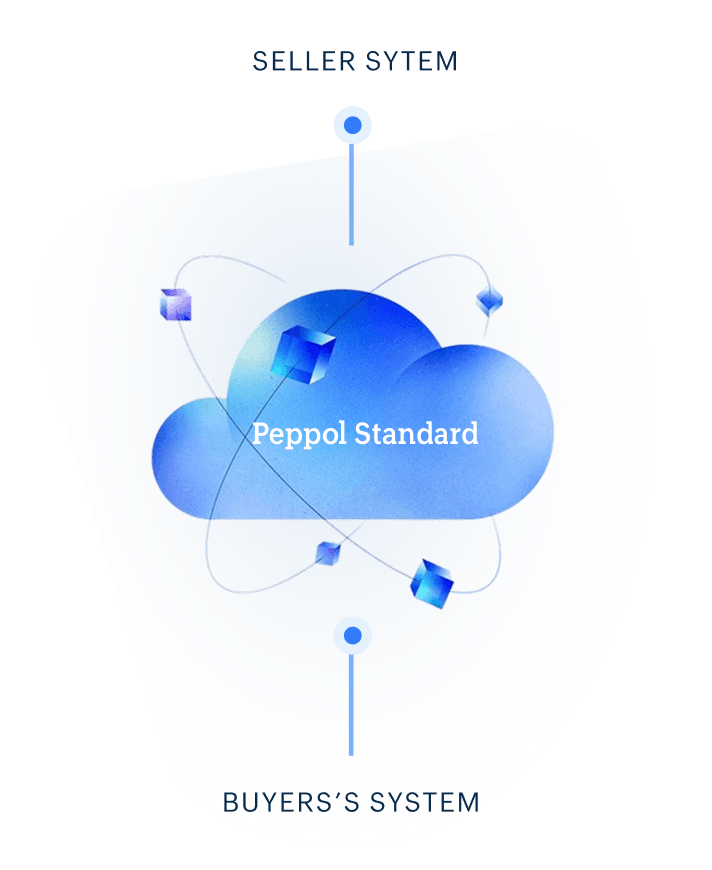

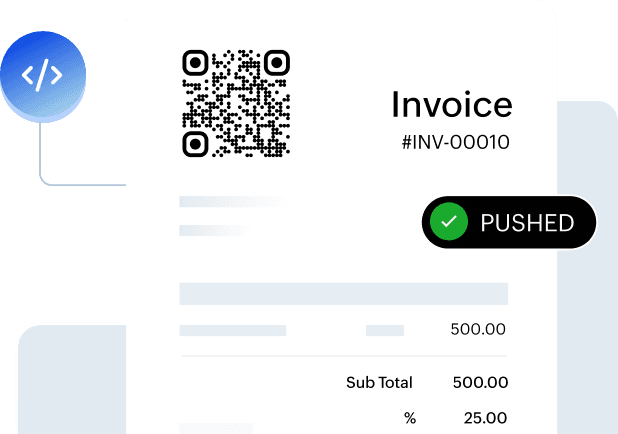

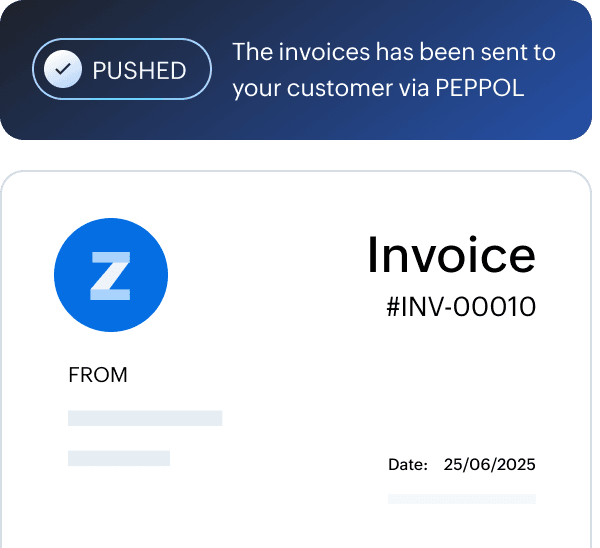

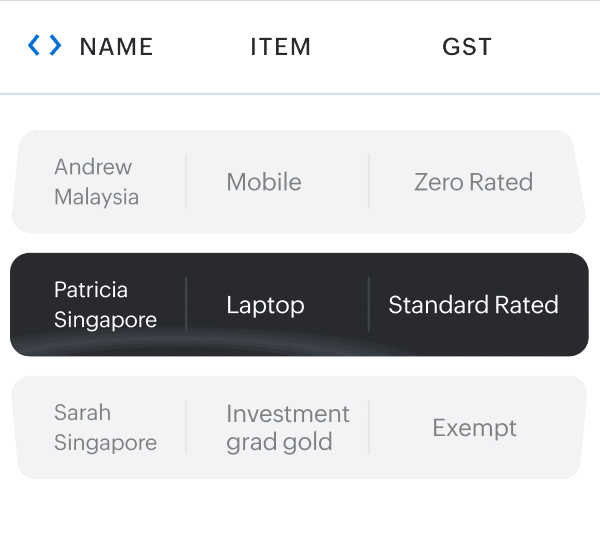

Send and receive e-invoices over the PEPPOL network. The electronic and direct transmission of invoices and bills can help you speed up payments, reduce costs and errors, and get ready for the e-invoicing mandate.

Quick guide

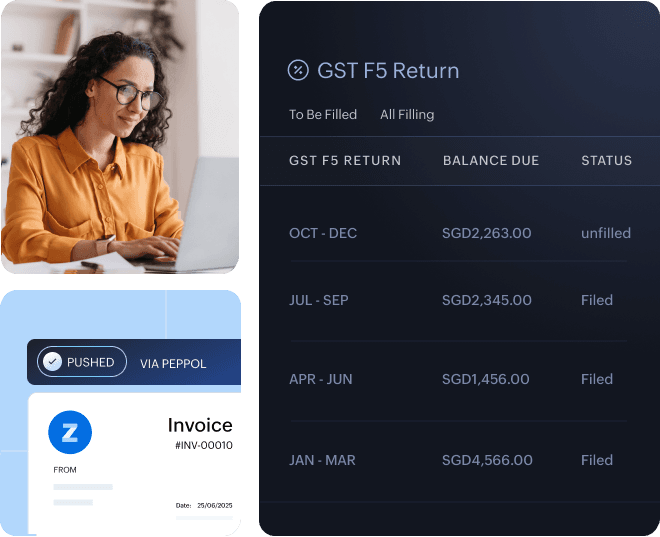

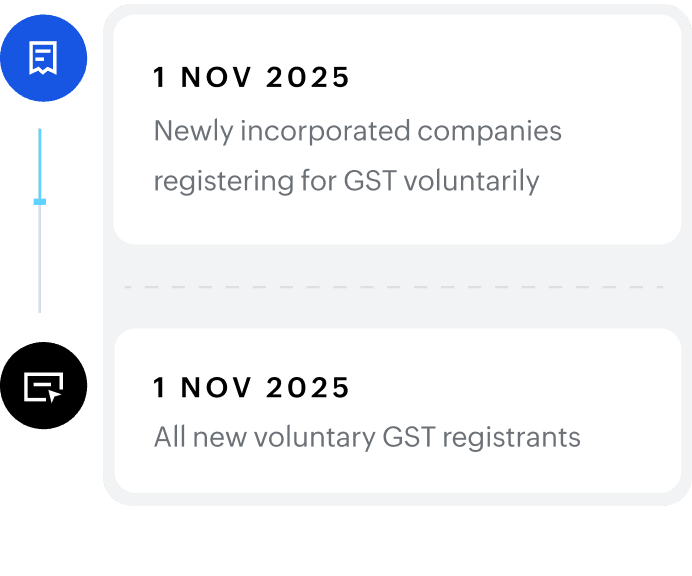

E-invoicing mandate in Singapore

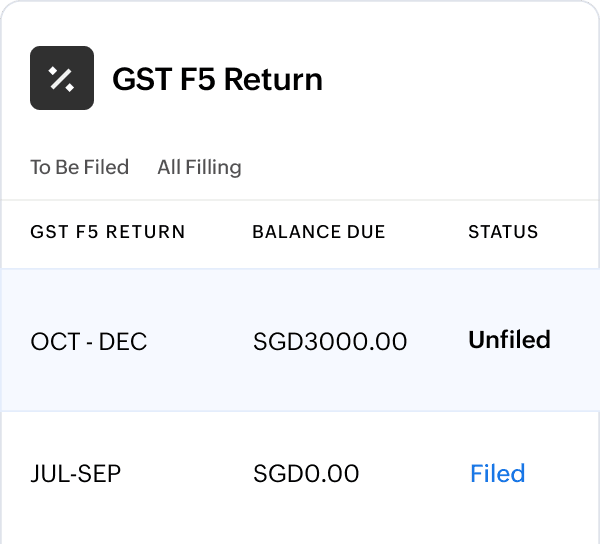

Stay compliant