Summary

Zoho Books is online accounting software that helps manage your finances, stay GST compliant, and take care for all the accounting needs in your business. Integrating Zoho POS and Zoho Books helps you manage your point of sale, inventory, and accounting together.

Once Zoho Books is integrated with Zoho POS, all the items, sales orders, vendors, purchase orders, customers, and payments made will be synchronized on both applications. This helps you keep track of your GST liability, file returns, and make payments from Zoho Books.

Benefits of integration

Create invoices and get paid by your customer through various online payment platform,s such as Eazypay, Razorpay, Paytm, PayPal, 2Checkout.

Record ing expenses helps you track of where you spend; such as fuel, office supplies, electricity, telephone, broadband, and maintenance.

Generate bills and track all the payments that you owe the vendor. You an also pay the vendors via various online payment integrations available.

Integrate your bank account to synchronize all the bank transactions in Zoho Books.

View detailed reports on TAX, TDS, Outward and Inward supplies, and Annual Tax summary, along with numerous others that help you get real-time data and optimize your business.

Setup the Integration

Integrating Zoho POS with Zoho Books lets you synchronize the data between the two applications. Any record added in Zoho POS will be available in Zoho Books and vice versa.

To setup the integration

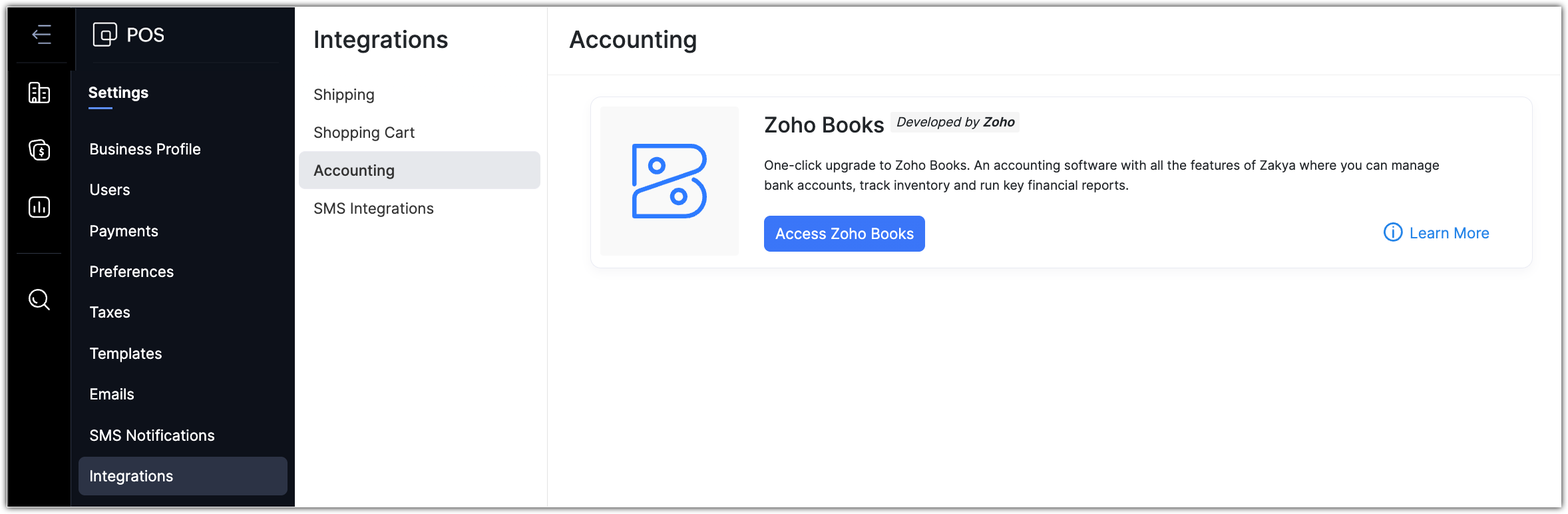

Go to Settings > Integrations > Accounting > Zoho Books.

Click Access Zoho Books.

In the GST Settings page, do the following:

Click Yes if your business is registered for GST.

Enter the GSTIN.

Select Composite Scheme, Reverse Charge, Import/Export, Digital Services checkboxes if applicable.

Click Next.

Specify Default Tax Preference by selecting the Inter and Intra state tax rates from the drop down list.

Click Next.

Select all the modules required for your business, specify the Inventory Start Date, and click Get Started.